- Home

- »

- Communication Services

- »

-

Telecom API Market Size And Share, Industry Report, 2030GVR Report cover

![Telecom API Market Size, Share & Trends Report]()

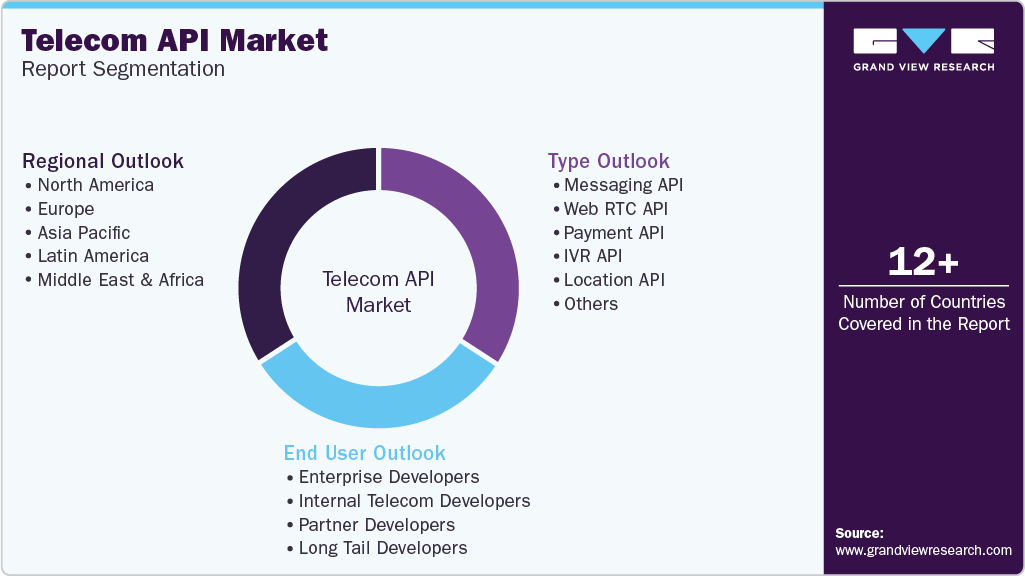

Telecom API Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Messaging API, Web RTC API, Payment API, IVR API, Location API), By End User (Enterprise Developers, Internal Telecom Developers), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-230-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Telecom API Market Summary

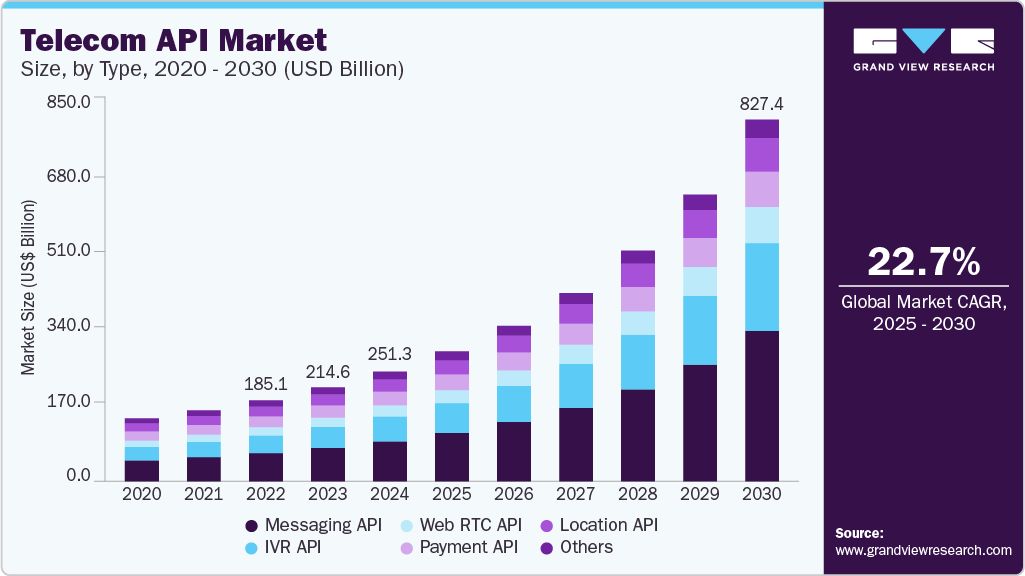

The global telecom api market size was estimated at USD 251,281.0 million in 2024 and is projected to reach USD 827,453.1 million by 2030, growing at a CAGR of 22.7% from 2025 to 2030. A telecom application programming interface (API) is used to manage web-based services such as cloud-based, banking, and identity management telecom software by arranging programming instructions and standard protocols.

Key Market Trends & Insights

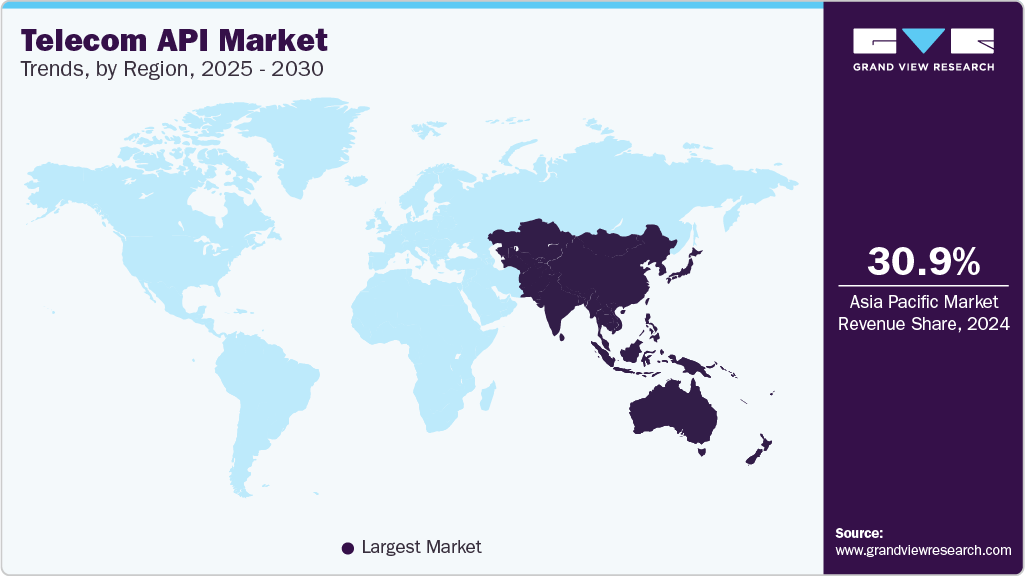

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, the location api accounted for a revenue of USD 103,519.0 million in 2024.

- Location API is the most lucrative type segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 251,281.0 Million

- 2030 Projected Market Size: USD 827,453.1 Million

- CAGR (2025-2030): 22.7%

- Asia Pacific: Largest market in 2024

The market provides cost-effective solutions by enhancing the system performance of existing web-based applications. These device and communication protocols facilitate agility in mobile application development as it enables the developers to focus on developing primary functions without the need to develop them from scratch.

Growing penetration of the Internet of Things (IoT), wearable, and device integration in the telecom sector is anticipated to positively impact the market over the forecast period. Telecom APIs allow end-to-end IoT solutions as they act as a singular point of interaction between several nodes within a network and hence reducing the multiple third-party service providers for system integration. With growing IoT penetration, the market for telecom API is anticipated to grow at a phenomenal rate.

Telecom API has prominent applications in all areas involving mobile applications and services such as location tracking apps, messaging apps, online mobile payments, and voice & video calls, among others. With the raising number of mobile service subscribers, the demand for mobile-based technologies has increased significantly in past years further increasing the demand for telecom APIs due to the scalability it offers. The recent increasing number of start-ups launched in the field of telecom API in emerging markets such as the Asia Pacific and Africa are expected to open new opportunities areas for the telecom API service providers during the forecast year. Industry giants such as Google, Vodafone, and communications service providers (CSPs) and technology suppliers Group have developed partnerships with start-ups from these emerging markets to create a nurturing ecosystem for the growth of telecom startups by offering their APIs for application developments thus, propelling the market growth.

Despite the phenomenal benefits offered by telecom API, data security concerns amongst the end-users are hindering the market growth. For instance, based on a recently published report on data security, it is observed that for enterprise and commercial web applications, API attacks will become the most-frequent attack resulting in data breaches. wherein malicious parties will get access to end-user data such as the name, contact details, and IMEI number of the device on which the application is operating.

The increasing adoption of machine-to-machine (M2M) devices is also estimated to propel the telecom API market from 2025 to 2030. APIs are critical for M2M communication as they identify the message format that can be used for device control. Moreover, increasing the adoption of mobile commerce is expected to increase the demand for telecom APIs in applications such as payment API and location API. Various mobile payment gateways such as Stripe, Zooz, PayPal, and Amazon Pay, among others allow the user to purchase products through cards using the payment API for processing the transactions.

Type Insights

Based on type, the telecom API market report is categorized into messaging API, webRTC API, payment API, IVR API, location API, and others. In 2024, the messaging API sub-segment held the largest market share contributing more than 36.42% to the total market. The high growth of messaging APIs is owing to the growing demand for SMS and RCS services that have the application of messaging APIs. The penetration of the SMS market is growing as an increasing number of companies are utilizing SMS services for personalized marketing efforts and enhancing customer engagement and experience. Thus, propelling the demand for messaging APIs.

Moreover, the IVR API sub-segment of the telecom API market is expected to witness significant growth over the forecast period. This growth in the market can be attributed to the increasing number of BPO service providers, specifically in developing markets such as South Africa, China, and India. Furthermore, the location API sub-segment held a considerable revenue share in 2024 owing to increasing demand for location-based web-application services.

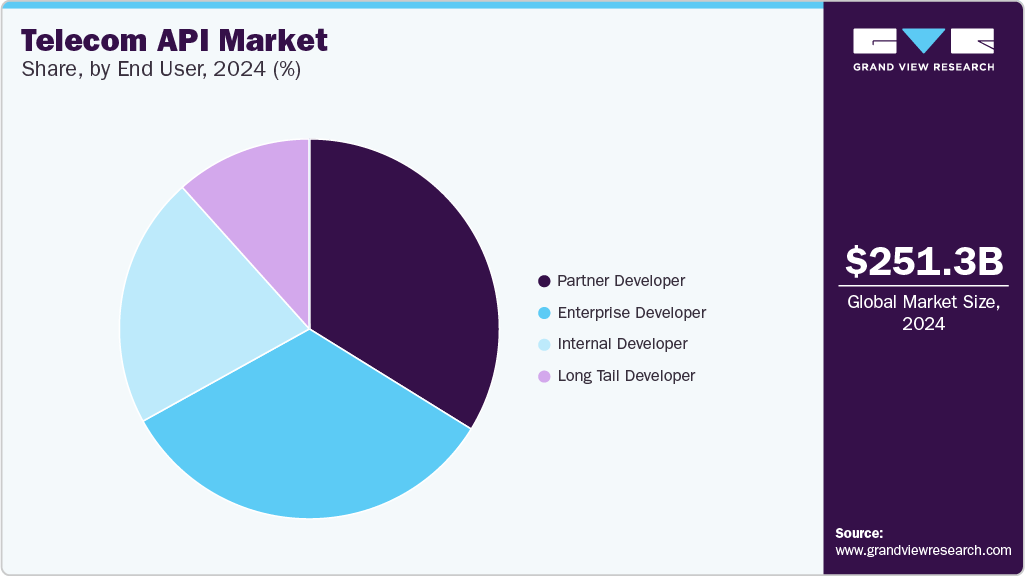

End User Insights

Based on end-user, the telecom API market is categorized into internal telecom developers, enterprise developers, partner developers, and long tail developers. The partner developer sub-segment holds the largest market share in 2024, Partner APIs help in creating a single-point data-sharing platform between CSPs and other developers to develop services such as payment services, and streaming services, among others. Developers can develop these services and get support from telecom organizations to manage service infrastructure. Furthermore, the customer base for partner developers is expanding rapidly as compared to enterprise developers resulting in their growth over the forecast period.

The enterprise developer sub-segment of the telecom API market is projected to expand at a significant CAGR during the forecast period, owing to the high penetration and adoption rate of large-scale enterprises. In large-scale organizations, A2P messages are majorly used in the announcement of offers, promotional activities, and changes in company policies, among others. The broadcast the above messages, organizations mostly use bulk messaging tools & software that drive the market growth for telecom APIs.

Regional Insights

Asia Pacific leads the Telecom API Market with a share of 30.96% in 2024. The telecom API market in Asia Pacific is projected to be one of the most attractive regions owing to the increasing number of mobile subscribers in the region and the increasing adoption of 5G technologies in the near future.

India’s telecom API market is witnessing rapid growth, driven by the surge in mobile internet users, increased digital transformation among enterprises, and the expansion of the 5G ecosystem. Telecom operators are increasingly partnering with third-party developers to monetize network capabilities through APIs, particularly in areas such as messaging, location, and payment services.

North America Telecom API Market Trends

The Telecom API market in North America witnessed the significant market share in 2024.This growth can be attributed to the significant presence of various large market players such as Broadcom, AT&T Intellectual Property, Google, and Oracle Corporation, among others in this region. Moreover, the adoption of technologies such as 4G and improvement in 5G technology is a major factor contributing to the high telecom API market growth in this region. With the integration of 4G or 5G technology and APIs, communication services such as voice & video calls, and video & speech integration services are delivered competently, and the productivity of businesses is improved to a greater extent.

U.S. Telecom API Market Trends

The U.S. telecom API market is highly mature and innovation-led, supported by strong investments in 5G infrastructure, edge computing, and IoT. Telecom providers are leveraging APIs to expose network services like authentication, number verification, and programmable messaging to enterprise clients, particularly in sectors such as finance, healthcare, and logistics. A large base of cloud-native enterprises and API-first developers in the U.S. drives robust demand for telecom APIs, especially those that enhance customer experience, streamline communications, and enable data monetization.

Europe Telecom API Market Trends

Europe’s telecom API market is characterized by regulatory harmonization, cross-border collaborations, and increasing investments in next-gen telecom infrastructure. The European Commission’s push for open and secure digital markets aligns with telecom operators' efforts to offer standardized APIs across the region, enabling pan-European service delivery.

Germany telecom API market represents a key growth within Europe, supported by its strong industrial base and digital transformation strategies like “Industrie 4.0.” German telecom operators are actively exploring API-based solutions to enhance machine-to-machine (M2M) communications, industrial IoT, and real-time data exchange. The integration of telecom APIs in automotive, manufacturing, and logistics sectors is gaining traction, particularly for location-based services, device management, and secure communications. Furthermore, ongoing 5G deployments and government initiatives to boost digital infrastructure are fostering a conducive environment for telecom API adoption across enterprises.

Key Telecom API Company Insights

Some of the key companies in the telecom API industry include AT&T, Inc., Twilio, Inc., Vodafone Group, and among others. The telecom API market is fragmented and characterized by high competition among the key players operating in a particular region. Each region or country is dominated by a few prominent players that mostly includes the CSPs of that particular region. These market players are focusing on adopting new organic & inorganic growth strategies such as mergers & acquisitions, partnerships, and joint ventures or collaborations in order to enhance their market presence.

-

AT&T Inc. is a provider of mobile and fixed telephone services. The company’s affiliates and subsidiaries operate worldwide in the technology, media, and telecommunications industries. The wireless broadband networks and high-speed fiber developed by the company offer connectivity services to businesses and people.

-

Huawei Technologies Co., Ltd. develops smart devices and information communications technology (ICT) infrastructure. The company offers integrated solutions across four key domains, namely cloud services, IT, smart devices, and telecom networks. The company provides solutions and network products for telecom carriers. The company offers ICT solutions to enterprise customers and government agencies and also provides them with intelligent and secure services and products.

Key Telecom API Companies:

The following are the leading companies in the telecom API market. These companies collectively hold the largest market share and dictate industry trends.

- AT&T, Inc.

- Twilio, Inc.

- Vodafone Group

- Verizon Communications, Inc.

- Huawei Technologies Co., Ltd.

- Telefonaktiebolaget LM Ericsson

- Telefónica S.A.

- Infobip ltd.

- Bharati Airtel Limited

- Deutsche Telekom AG

Recent Developments

-

In February 2025, Aduna, a collaborative venture by Ericsson and leading U.S. telecom operators AT&T, T-Mobile, and Verizon, has unveiled plans to launch the country’s first standardized network APIs for Number Verification and SIM Swap by 2025. This marks a milestone as it is the first instance where the three largest U.S. mobile carriers are jointly endorsing open, interoperable network APIs. The initiative aims to enhance cross-industry innovation-particularly in financial services, digital commerce, and identity verification-while strategically advancing the United States’ leadership position in the global telecom API economy.

Telecom API Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 297.25 billion

Revenue forecast in 2030

USD 827.45 billion

Growth rate

CAGR of 22.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

AT&T, Inc.; Twilio, Inc.; Vodafone Group; Verizon Communications, Inc.; Huawei Technologies Co., Ltd.; Telefonaktiebolaget LM Ericsson; Telefónica S.A.; Infobip ltd.; Bharati Airtel Limited; Deutsche Telekom AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Telecom API Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global telecom API market report based on type, end user, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Messaging API

-

Web RTC API

-

Payment API

-

IVR API

-

Location API

-

Others

-

-

End User Outlook (Revenue, USD Million, 2018 - 2030)

-

Enterprise Developers

-

Internal Telecom Developers

-

Partner Developers

-

Long Tail Developers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global telecom API market size was estimated at USD 251.28 billion in 2024 and is expected to reach USD 297.25 billion in 2025.

b. The global telecom API market is expected to grow at a compound annual growth rate of 22.7% from 2025 to 2030 to reach USD 827.45 billion by 2030.

b. Messaging API segment dominated the telecom API market with a share of 36.42% in 2024. This is attributable to the increasing adoption of SMS and RCS services that use messaging APIs.

b. Some key players operating in the telecom API market include AT&T, Inc.; Twilio, Inc.; Vodafone Group; Verizon Communications, Inc.; Huawei Technologies Co., Ltd.; Telefonaktiebolaget LM Ericsson; Telefónica S.A.; Infobip ltd.; Bharati Airtel Limited; and Deutsche Telekom AG.

b. Key factors that are driving the telecom API market growth include an increasing number of mobile service subscribers, growing adoption of the Internet of Things (IoT), and increasing number of mobile internet users.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.