- Home

- »

- Communications Infrastructure

- »

-

Telecom Cloud Market Size & Share, Industry Report, 2033GVR Report cover

![Telecom Cloud Market Size, Share & Trends Report]()

Telecom Cloud Market (2026 - 2033) Size, Share & Trends Analysis Report By Component (Solution, Services), By Deployment Type, By Service Model, By Enterprise Size, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-968-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Telecom Cloud Market Summary

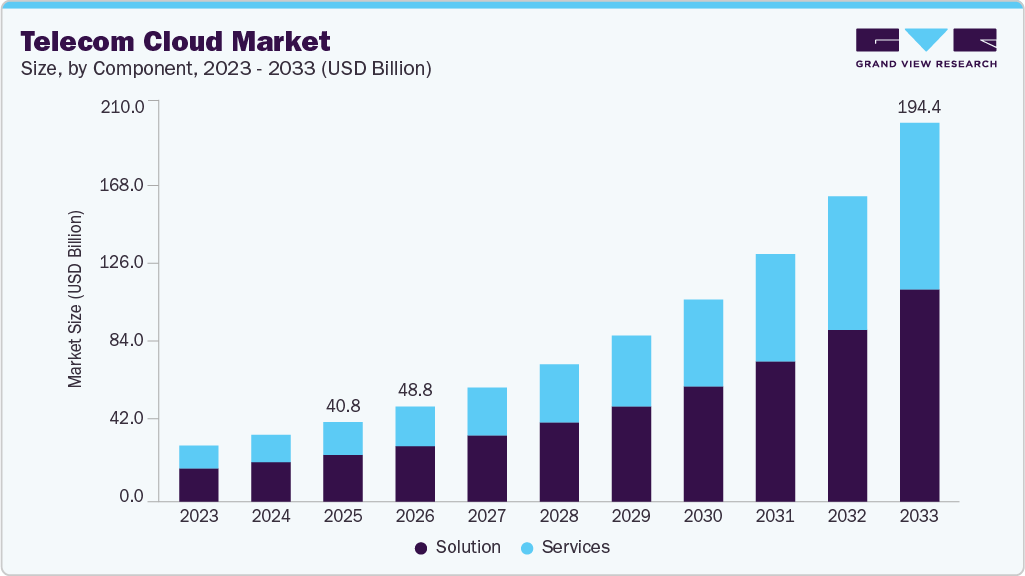

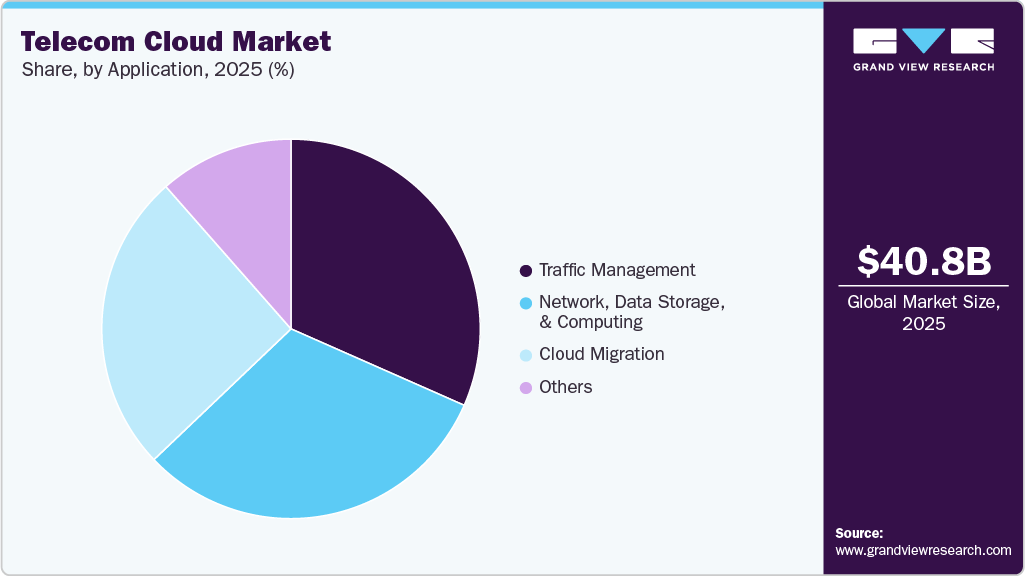

The global telecom cloud market size was estimated at USD 40.81 billion in 2025 and is projected to reach USD 194.42 billion by 2033, growing at a CAGR of 21.8% from 2026 to 2033. Telecommunication cloud is a next-generation network architecture that integrates software-defined networking, network function virtualization, and cloud-native technologies into a distributed computing network.

Key Market Trends & Insights

- Asia Pacific dominated the global telecom cloud market with the largest revenue share of 35.8% in 2025.

- By component, the solution segment led the market with the largest revenue share of 58.8% in 2025.

- By deployment type, the private segment accounted for the largest market revenue share in 2025.

- By service model, the software as a service (SaaS) segment accounted for the largest market revenue share in 2025.

- By enterprise size, the large enterprises segment accounted for the largest market revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 40.81 Billion

- 2033 Projected Market Size: USD 194.42 Biillion

- CAGR (2026-2033): 21.8%

- Asia Pacific: Largest market in 2025

Telecom operators are increasingly migrating from legacy, hardware-centric networks to cloud-native architecture built on Network Function Virtualization (NFV) and containerized network functions. This transition enables operators to decouple network services from physical infrastructure, significantly reducing capital expenditure while improving scalability and service agility. Cloud-native designs also support faster deployment of new services, automated lifecycle management, and improved network resilience. Competition is intensifying, and service innovation has become critical, making NFV adoption a major growth driver for telecom cloud platforms.

The global rollout of 5G networks is accelerating demand for distributed cloud and edge computing solutions within telecom environments. 5G use cases such as ultra-low latency communications, massive IoT connectivity, and real-time analytics require processing capabilities closer to end users, driving investment in edge cloud infrastructure. Telecom cloud platforms enable operators to dynamically allocate resources across centralized and edge locations, ensuring efficient network performance. 5G coverage is expanding, and new enterprise applications are emerging, driving the integration of edge cloud capabilities as a critical growth trend.

Enterprises are increasingly turning to telecom operators for cloud services that combine connectivity, security, and localized data hosting. Telecom cloud offerings such as unified communications, private 5G networks, and industry-specific cloud solutions provide enterprises with end-to-end service reliability and regulatory compliance. Operators are leveraging their existing customer relationships and network assets to position themselves as trusted cloud service providers. This growing enterprise adoption is expanding revenue streams beyond traditional connectivity services, fueling sustained market growth.

Telecom cloud platforms are increasingly incorporating artificial intelligence and advanced analytics to automate network operations and improve service quality. AI-driven cloud systems enable predictive maintenance, intelligent traffic management, and real-time fault detection, reducing operational costs and minimizing service disruptions. Automation also supports self-optimizing networks, enabling operators to scale resources efficiently in response to demand fluctuations. Telecom networks are growing more complex, driving demand for AI-enabled cloud orchestration as a significant trend supporting market expansion.

The telecom cloud industry faces several constraints, including high implementation complexity, security concerns, and integration challenges with legacy network infrastructure. Migrating mission-critical telecom operations to cloud environments requires significant upfront investment, a skilled workforce, and careful network re-architecture, which can slow adoption, particularly for smaller operators. Data security, privacy risks, and compliance with stringent regulatory requirements further increase operational complexity and limit the use of public cloud models. In addition, interoperability issues between multi-vendor cloud platforms and existing telecom systems can delay deployments and reduce return on investment, restraining overall market growth.

Component Insights

The solution segment led the market with the largest revenue share of 58.8% in 2025.The solution segment includes unified communication and collaboration solutions, content delivery networks, network function virtualization, and other related offerings. Growing internet penetration and widespread adoption of mobile devices are accelerating demand for these solutions, as organizations seek to enhance agility and improve operational efficiency through advanced technologies. Enterprises are increasingly deploying applications such as telephony, email, voicemail, instant messaging and presence, unified messaging, audio, web, and video conferencing, file sharing and white boarding, social networking, and mobility solutions. In addition, the rapid growth of digital media content, rising demand for high-quality video among internet users, and increasing digitalization across end-user industries are driving strong adoption of content delivery network solutions.

The services segment is expected to grow at the fastest CAGR over the forecast period. The growth of this segment is driven by the increasing integration and deployment of telecom cloud services, which support efficient operations and enhanced performance across network environments. The services segment is categorized into professional services and managed services. Professional services, including business analysis and consulting, design and architecture, integration, and deployment, assist organizations in assessing business requirements and developing cost-effective solutions while ensuring operational efficiency, security, and quality of service (QoS). Managed services encompass network and infrastructure management, data center operations, backup and recovery, maintenance, and ongoing support. This service model enables organizations to outsource day-to-day operations, resulting in proactive network management, reduced total cost of ownership (TCO), and optimized service delivery through intelligent bundling.

Deployment Insights

The private segment accounted for the largest market revenue share in 2025. Private infrastructure is fully operated by an organization and hosted within its own data center, either on-premise or off-premise, and managed by a third party. This deployment model provides telecom operators with greater control, enhanced security and data privacy, and access to specialized computing resources such as radio access networks (RAN), virtual network functions (VNF), and edge applications and services. It also improves cost efficiency by enabling better utilization of underused capacity within existing data centers. Unused resources can be exposed through cloud interfaces, allowing organizations to leverage cloud management tools such as automated orchestration, self-service provisioning, and the ability to monetize excess capacity by offering it to partner companies. In addition, private infrastructure supports virtualized services that reduce operational complexity, maximize hardware utilization at a lower cost, and provide end-to-end control over infrastructure and computing resources.

The hybrid segment is expected to grow at the fastest CAGR of 24.7% during the forecast period. A hybrid cloud combines two or more distinct cloud environments, typically integrating at least one public cloud with a private cloud. These environments are connected through proprietary or standardized technologies, enabling seamless data portability and workload mobility. Growth of this segment is driven by its cost efficiency, scalability, and enhanced security and data privacy. Hybrid cloud models allow telecom operators to optimize operations by flexibly managing workloads across environments based on performance, compliance, and cost requirements. This approach improves resource utilization, optimizes infrastructure spending, enhances organizational agility, and enables scalable expansion through public cloud resources while retaining control and security within private cloud deployments.

Service Model Insights

The Software as a Service (SaaS) segment accounted for the largest market revenue share in 2025.SaaS delivers defined business outcomes through subscription-based, cloud-native software and supports a fully digitalized business experience with an automated service lifecycle suitable for carrier-grade networks. By adopting SaaS solutions, telecommunications companies can develop agile application frameworks that optimize resource utilization and reduce operational complexity. This enhances organizational agility and allows telecom operators to adapt more effectively to continuous technological change.

The Infrastructure as a service (IaaS) segment is expected to grow at the fastest CAGR during the forecast period. IaaS provides cost-effective, easily accessible computing resources, enabling enterprises to test and deploy new business services and concepts with greater flexibility. This model reduces the risks typically associated with innovation and supports faster business growth. A key advantage of IaaS is its ability to lower infrastructure costs by shifting spending from capital expenditure (CAPEX) to operational expenditure (OPEX). The IaaS model is particularly attractive because it enables infrastructure migration with real-time business insights, reduces the maintenance burden of on-premises data centers, and allows IT resources to scale independently based on demand. Furthermore, rising investments in data center infrastructure across the Asia-Pacific region are expected to increase the availability and adoption of IaaS, encouraging enterprises to move from ad hoc use to more structured, strategic deployments.

Enterprise Size Insights

The large enterprises segment accounted for the largest market revenue share in 2025. The large enterprise segment growth is driven by the need to manage complex, large-scale network operations while improving operational efficiency and service reliability. Large organizations generate high volumes of data and require robust, scalable cloud infrastructure to support advanced use cases such as 5G deployment, network virtualization, edge computing, and real-time analytics. Telecom cloud solutions enable large enterprises to centralize network management, automate operations, and optimize resource utilization across distributed environments. In addition, growing requirements for data security, regulatory compliance, and business continuity encourage large enterprises to adopt telecom cloud platforms that offer greater control, resilience, and integration with existing IT and telecom systems.

The SMEs segment is expected to witness at the fastest CAGR over the forecast period. Small and medium-sized enterprises (SMEs) are increasingly adopting cloud technologies, particularly cloud-based unified communications, to streamline business operations and improve efficiency. Telecom cloud services offer SMEs significant advantages through subscription-based, cloud-managed solutions that include end-to-end Wi-Fi services, automated system upgrades, access points, and cloud-native management and control platforms. These solutions enable SMEs to collect and analyze customer interaction and preference data, supporting real-time, data-driven decision-making. The availability of affordable cloud-based communication solutions is accelerating adoption and implementation, helping SMEs enhance agility and compete more effectively in global markets.

Application Insights

The traffic management segment accounted for the largest market revenue share in 2025. Segment growth is driven by rapid growth in mobile data traffic, the increasing adoption of bandwidth-intensive applications, and the rising complexity of telecom networks. Expanding 4G and 5G deployments, along with the proliferation of video streaming, cloud applications, and IoT devices, require intelligent traffic control to maintain network performance and service quality. Telecom cloud-based traffic management solutions enable real-time monitoring, dynamic traffic prioritization, and automated optimization of network resources, helping operators ensure consistent quality of service while reducing congestion. In addition, the growing focus on service differentiation, regulatory compliance, and improved customer experience is encouraging telecom operators to invest in advanced cloud-based traffic management applications, supporting the sustained growth of this segment.

The cloud migration segment is expected to witness the fastest CAGR over the forecast period. Cloud migration enables organizations to move their data and applications from one telecom cloud provider to another, offering enhanced security, improved performance, and flexible pricing options. It supports a pay-per-use model, self-service provisioning, high elasticity, and redundancy, while encompassing various service models, including IaaS, PaaS, and SaaS. Key benefits of cloud migration include enhanced cloud security, streamlined operations, increased enterprise productivity, greater operational flexibility, and scalability. In addition, it improves quality of service (quality of service), facilitates agile application deployment, and allows organizations to shift from capital-intensive investments to an operational expenditure (OPEX) model.

Regional Insights

The telecom cloud market in North America is expected to grow at a moderate CAGR during the forecast period. The early adoption of cloud technologies, substantial investments in 5G and edge computing, and the presence of leading telecom and hyperscale cloud service providers can be attributed to the growth of the market in the region.

U.S. Telecom Cloud Market Trends

The telecom cloud market in the U.S. accounted for the largest market revenue share in North America in 2025. Early and extensive 5G deployments, strong enterprise adoption of cloud and edge technologies, and strategic alliances between telecom operators and hyperscale cloud providers are key drivers of the market’s growth.

Asia Pacific Telecom Cloud Market Trends

Asia Pacific dominated the global telecom cloud market with the largest revenue share of 35.8% in 2025, driven by rapid digital transformation initiatives, widespread 5G rollouts, and increasing mobile and broadband penetration across the region. Major economies, including China, India, Japan, and South Korea, are investing heavily in cloud‑native telecom platforms to support network modernization, IoT deployment, and smart city infrastructure.

The telecom cloud market in India is expected to grow at the fastest CAGR during the forecast period. India’s telecom cloud industry is expanding rapidly amid strong demand for cloud‑native services, 5G network deployments, and enterprise digitization. Telecom operators are launching integrated cloud and AI‑driven platforms to support enterprise customers and modernize network functions, reflecting a shift toward digital service delivery and enhanced operational efficiency.

The China telecom cloud market held a significant market share in Asia Pacific in 2025, supported by aggressive 5G infrastructure expansion, strong domestic cloud service ecosystems, and significant investments in data center capacity.

Europe Telecom Cloud Market Trends

The telecom cloud market in Europe is expected to register at a moderate CAGR from 2026 to 2033. The region’s growth is propelled by regulatory emphasis on data privacy, digital sovereignty, and network modernization. Telecom operators across the region are transitioning to cloud‑native network architectures to support 5G services, improve operational efficiencies, and meet compliance requirements.

The France telecom cloud market is expected to grow at a significant CAGR during the forecast period. France is a key country within the European telecom cloud landscape, benefiting from strong enterprise and telecom demand for cloud‑based network services and digital transformation. French operators are investing in cloud platforms that prioritize security, compliance with data protection regulations, and scalable network functions.

The telecom cloud market in Germany held a substantial market share in Europe in 2025, driven by advanced industrial digitization, robust network infrastructure, and early deployment of 5G services. German telecom operators and enterprises are leveraging cloud solutions to support digital transformation, IoT integration, and efficient network management.

Key Telecom Cloud Company Insight

Some of the key companies in the telecom cloud industry include Microsoft Corporation, Google LLC, and IBM, among others. These companies are focusing on cloud-native network transformation, 5G and edge computing integration, and AI-driven network optimization to gain a competitive edge. They are also emphasizing strategic partnerships with telecom operators, hybrid/multi-cloud solutions, and industry-specific offerings to expand market share and enhance service differentiation.

-

Microsoft Corporation is a major global provider of cloud services, offering a broad portfolio of telecom cloud solutions through its Azure platform. The company enables telecom operators to deploy cloud-native network functions, support 5G and edge computing services, and leverage AI-driven network analytics.

-

Google LLC offers Google Cloud, a robust telecom cloud platform that combines high-performance computing, AI, machine learning, and network orchestration capabilities. Its solutions help operators optimize network operations, deliver low-latency edge services, and implement scalable SaaS, PaaS, and IaaS offerings.

Key Telecom Cloud Companies:

The following key companies have been profiled for this study on the telecom cloud market

- Microsoft Corporation

- Hewlett Packard Enterprise

- Google LLC

- Intellias

- Metaswitch Network

- IBM Corporation

- Mavenir

- Virtusa

- Oracle

- VMware

Recent Developments

- In August 2025, Bharti Airtel’s newly launched digital unit, Xtelify, introduced a cloud platform along with AI-powered software solutions tailored for businesses and telecom operators, supported by partnerships with Singtel, Globe Telecom, and Airtel Africa. Airtel Cloud provides a comprehensive suite of services, including infrastructure-as-a-service (IaaS) and platform-as-a-service (PaaS), with secure migration and scalable deployment capabilities, the company stated.

Telecom Cloud Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 48.78 billion

Revenue forecast in 2033

USD 194.42 billion

Growth rate

CAGR of 21.8% from 2026 to 2033

Base year for estimation

2025

Historical data

2021- 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment type, service model, application, enterprise size, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Microsoft Corporation; Hewlett Packard Enterprise; Google LLC; Intellias; Metaswitch Network; IBM Corporation; Mavenir; Virtusa; Oracle; VMware

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Telecom Cloud Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global telecom cloud market report based on component, deployment type, service model, application, enterprise size, and region.

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Solution

-

Services

-

Professional Services

-

Managed Services

-

-

-

Deployment Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Private

-

Public

-

Hybrid

-

-

Service Model Outlook (Revenue, USD Million, 2021 - 2033)

-

Software as a Service (SaaS)

-

Platform as a Service (PaaS)

-

Infrastructure as a Service (IaaS)

-

-

Applications Outlook (Revenue, USD Million, 2021 - 2033)

-

Network, Data Storage, and Computing

-

Traffic Management

-

Cloud Migration

-

Others

-

-

Enterprise Size Outlook (Revenue, USD Million, 2021 - 2033)

-

Large Enterprises

-

SMEs

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the telecom cloud market growth include rapid digital transformation between industries increased significant data consumption, and increased internet & mobile device penetration.

b. The global telecom cloud market size was estimated at USD 40.81 billion in 2025 and is expected to reach USD 48.78 billion in 2026.

b. The global telecom cloud market is expected to grow at a compound annual growth rate of 21.8% from 2026 to 2033 to reach 194.42 billion by 2033.

b. Asia Pacific dominated the telecom cloud industry and accounted for a share of 35.8% in 2025, driven by rapid digital transformation initiatives, widespread 5G rollouts, and increasing mobile and broadband penetration across the region.

b. Some of the key players operating in the telecom cloud market include Microsoft Corporation, Hewlett Packard Enterprise, Google LLC, Intellias, Metaswitch Network, IBM Corporation, Mavenir, Virtusa, Oracle, and VMware

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.