- Home

- »

- Healthcare IT

- »

-

Telemedicine Market Size, Share And Growth Report, 2030GVR Report cover

![Telemedicine Market Size, Share & Trends Report]()

Telemedicine Market Size, Share & Trends Analysis Report By Component (Products, Services), By Modality, By Application (Teleradiology, Telepsychiatry), By Delivery Mode, By Facility, By End User, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-313-3

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Telemedicine Market Size & Trends

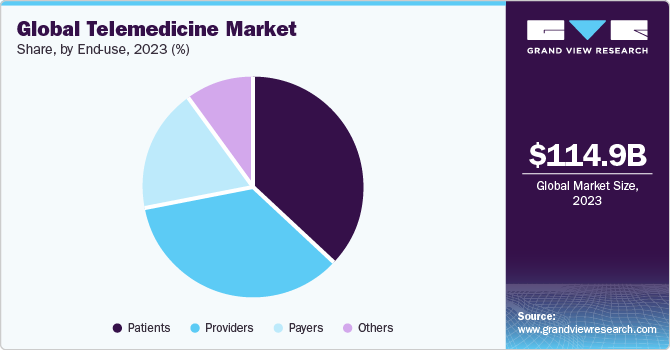

The global telemedicine market size was valued at USD 114.98 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 17.96% from 2024 to 2030. The telemedicine market growth is being driven by factors such as consolidation across industry, strategic initiatives by key companies, and increasing healthcare consumerism. Furthermore, rising adoption of telemedicine by providers, increasing patient acceptance and consumer demand, and delivery of improved quality of care are expected to contribute to the growth of the telemedicine market over the forecast period. For instance, in May 2021, Walmart Inc. acquired a telehealth company, MeMD. This acquisition is expected to enable Walmart to expand its offerings and provide virtual access to primary, urgent, and behavioral healthcare services nationwide.

COVID-19 pandemic has resulted in a significant increase in adoption of telemedicine to reduce the risk of infection by minimizing contact between patients, healthcare facilities, and staff. Health authorities and mental health professionals in China have utilized online mental health surveys and communication programs, including Weibo, TikTok, and WeChat, to provide effective and safe mental health services during the pandemic, leading to expansion of telemedicine market. In March 2020, SOC Telemed, witnessed a surge in requests for on-demand acute care delivered through telemedicine. This emphasizes rising need for its services during the pandemic and capability of telemedicine to provide remote care in urgent situations. In addition, in October 2022, the Union Ministry of Health & Family Welfare of India launched the National Tele Mental Health Programme (Tele MANAS) to strengthen mental health service delivery in the country.

According to statistics published by the GSM Association report, The Mobile Economy 2022, in 2021, number of people mobile users was 5.3 billion, and number of unique mobile subscribers is expected to reach 5.7 billion by 2025 (70% of the global population). In addition, penetration of smartphones is rising significantly. As per The Mobile Economy 2022, smartphone penetration was 75% in 2021 and is expected to reach 84% by 2025. Rising adoption of smartphones by consumers is driving growth of telemedicine market. Furthermore, growing network coverage and continuous advancement in network infrastructure are boosting the demand for telemedicine services.

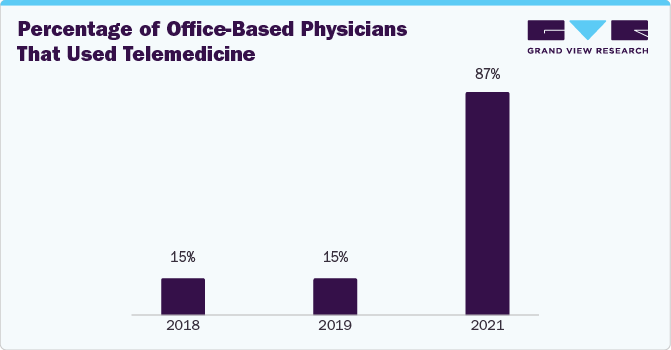

Percentage of Office-Based Physicians Using Telemedicine

Telemedicine solutions have goal of enhancing accessibility to fundamental healthcare, elevating the quality of healthcare services, and bolstering patient safety. As indicated in a report published by the Agency for Healthcare Research and Quality (AHRQ), introduction of telemedicine solutions has been shown to improve the delivery of patient care by diminishing likelihood of unnoticed adverse effects or symptoms. For instance, in July 2023, Faye (Zenner, Inc.), a travel insurer company, announced the launch of telemedicine services in collaboration with Air Doctor. The services are available to all those individuals traveling with Faye internationally to 75 countries across the globe. This telemedicine service covers both in-patient and out-patient visits as part of the emergency medical coverage.

Technologies such as e-ICU and eCare offer appropriate care, reducing risk of adverse effects or symptoms slipping under the radar. Demand for such systems is expected to increase due to their ability to provide patients with high safety and quality standards, thereby driving market growth. Telemedicine is also considered an exceptionally versatile technology for delivering health education, information, and care remotely, enabling advanced patient-centered care and improving access to remote areas. Moreover, it could decrease emergency room visits and hospitalization rates, further fueling market expansion.

Market Concentration & Characteristics

Market growth stage is high, and pace of the market growth is accelerating. The telemedicine market is characterized by a high degree of growth owing to improved internet connectivity and smartphone adoption, which contribute to telemedicine expansion by making healthcare services more accessible and convenient for patients. In addition, growth is driven by the increasing prevalence of target diseases and rising demand for teleradiology for second opinions and emergencies.

Telemedicine market is characterized by a high degree of innovation owing to rapid technological advancements driven by factors such as advancements in artificial intelligence (AI) functionalities, machine learning, and the availability of strong networks. For instance, in April 2023, Oracle and Zoom Video Communications, Inc. are expanding their collaboration to offer improved telehealth services that are faster, more efficient, and easier. Subsequently, innovative AI applications are constantly emerging and creating new opportunities for market players.

Telemedicine market is characterized by a moderate level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to gain access to new technologies and advancements and the need to consolidate in a rapidly growing market. For instance, in February 2023, MediBuddy, a Virtual health company, acquired Aetna's telehealth business in India.

The eased regulations and formation of a robust framework for the practice of telemedicine have positively impacted the market growth. These guidelines comprehensively prescribe norms and protocols covering all aspects of telemedicine practice, such as physician-patient relationship, management and treatment, issues of liability and negligence, continuity of care, informed consent, privacy and security of the patient records, medical records, and exchange of information.

Key market players are adopting various strategies, such as new product launches, partnerships, collaborations, and geographical expansions. Market players adopt geographical expansion strategies to expand their reach. For instance, in December 2021, AT&T and Samsung collaborated with Qure4u, a digital health solutions developer. Under this partnership, the three companies would focus on co-developing remote patient monitoring solutions for individuals suffering from high blood pressure in rural & underserved localities.

Component Insights

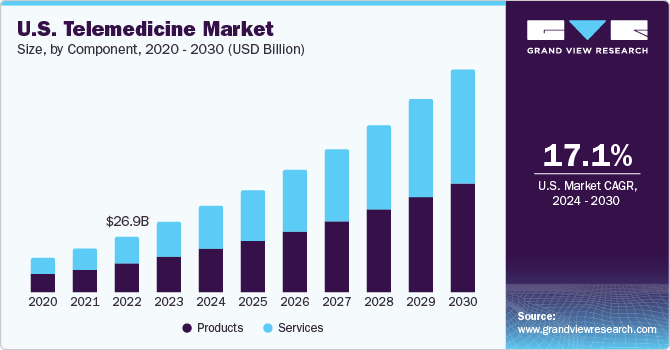

Product segment dominated the market and is further divided into software, hardware, and others. Product segment accounted for the largest market share of 51.97% in 2023. This can be attributed to the widespread adoption of various medical peripheral devices, audio equipment, microphones, display screens, and videoconferencing devices used to facilitate virtual visits. For instance, Teladoc Health, Inc. provides several devices, including Xpress & Xpress Cart, TV Pro & TV Pro+, Lite with Boom Camera, and Viewpoint Cart, to facilitate clinical collaboration and point-of-care visits. Similarly, NVIDIA CLARA is a powerful combination of software and hardware that brings advanced data analytics to medical imaging systems to advance disease diagnosis, detection, and treatment.

Service segment is expected to witness fastest CAGR growth, over the forecast period, owing to expanding field of remote patient monitoring, widespread use of teleconsulting between patients and clinicians, between physicians, and between surgeons and students is estimated to propel the segment growth. For instance, in December 2021, the Common Services Centre of the Ministry of Electronics and Information Technology in India launched CSC Health Services Helpdesk chatbot-based helpline on WhatsApp. This solution provides teleconsultation services for people living in rural parts of India.

Modality Insights

Modality segment is divided into real-time (synchronous), store and forward (asynchronous), and other technologies such as remote patient monitoring. Real-time segment dominated the market in terms of revenue share in 2023. This growth can be attributed to increasing demand for on-demand medical consultations, adoption of mHealth and virtual video visits, and availability of services from major market players.

Others segments, including patient monitoring from remote locations such as homes or hospitals, are expected to experience significant growth over the forecast period. For instance, in February 2022, Teladoc Health, Inc., a provider of whole-person virtual care, introduced Chronic Care Complete, a chronic condition management solution to improve healthcare outcomes for patients with multiple chronic conditions. Moreover, in October 2020, Fitbit (now a subsidiary of Google) announced its intention to expand the premium health and fitness subscription service line by venturing into virtual care over the forecast period.

Application Insights

By application, market is segmented intoteleradiology, telepsychiatry, telepathology, teledermatology, telecardiology, and others. Teleradiology segment held largest revenue share of in 2023. As healthcare providers adopt teleradiology workflows, service offerings within radiology sub-segments expand, introduction of new teleradiology services, and teleradiology practices are regulated, this segment is expected to grow. For instance, in November 2021, Agfa Healthcare introduced a true remote diagnostic imaging workflow. Key growth drivers for this segment include integrating Artificial Intelligence (AI) into teleradiology, implementing a Picture Archiving and Communication System (PACS), and increasing R&D activities in eHealth. For instance, telemedicine service provider Heidelberg Medical Consultancy & Health Tourism Pvt. Ltd. specializes in providing customized, affordable, high-quality radiology reporting solutions for dental specialists and practices.

Telepsychiatry is projected to grow fastest at CAGR due to increasing prevalence of mental and behavioral health disorders, growing awareness, and adoption of telepsychiatry services. For instance, MD Live provides counseling and psychiatric sessions for a range of conditions such as anxiety, depression, trauma & PTSD, panic disorders, and more. In addition, in December 2021, American Well launched Mind Your Mind, a mental health initiative designed to raise awareness about mental health issues.

Delivery Model Insights

By delivery mode, market is segmented into web/mobile and call centers. Web/mobile segment accounted for largest revenue share in 2023 and is predicted to grow at fastest rate during the forecast period, owing to increasing prevalence of smartphone usage, mHealth adoption, and healthcare consumerism. This segment is further subdivided into audio/text-based and visualized access to care. Tech companies that provide mobile and web-based solutions are the key players in this segment. Rising adoption of visualized care delivery solutions and different strategies by market players, increasing user awareness, introducing technologically advanced solutions, and penetrating cloud-based solutions are expected to drive market growth. For instance, in January 2021, Koninklijke Philips N.V. signed an agreement to acquire Capsule Technologies, Inc. to expand its connected care segment portfolio and cloud based HealthSuite digital platform.

The growth of the call centers segment is evident from establishing a COVID-19 telemedicine consultation call center by the Hyderabad Police in Telangana, India, in April 2021. A call center was launched to provide prompt responses to COVID-related queries from citizens.

Facility Insights

By facility, market is divided into tele-hospitals and tele-home. Tele-hospitals segment accounted for largest revenue share in 2023. This growth can be attributed to government initiatives, rising patient awareness of health concerns, and widespread access to internet-based solutions. For instance, Koninklijke Philips N.V. has a Tele-ICU program allowing doctors to remotely monitor ICU beds. These beds have cameras and special tools to help predict what might happen to patients.

Telehome care solutions segment is anticipated to experience fastest growth rate as adoption of remote patient monitoring devices increases. Furthermore, the growing geriatric population, increased prevalence of chronic diseases, and awareness of telehealth solutions fuel the market growth. For instance, according to American Health Rankings (United Health Foundation), in 2022, 58 million adults ages 65 and older live in the U.S., which accounted for 17.3% of the country's population.

End Use Insights

By end use, market is divided into patients,payers,providers and others. In 2023, patients segment held largest market share. This can be attributed to patients using telemedicine services for various health issues, from mild to emergency situations. To cater to diverse needs of patients, market players such as VSee offer a range of solutions, including telemedicine software, remote patient monitoring dashboards, and API & SDKs across various clinical specialties. In addition, in March 2023, Koninklijke Philips N.V. launched Virtual Care Management, offering various flexible solutions and services to help health systems, payers, providers, patients, and employer groups connect with patients virtually anywhere.

Provider segment is expected to grow at fastest CAGR, driven by ability of telemedicine solutions to improve the quality of healthcare services and provide healthcare providers with convenient access to patient records, improved decision support, workflows, and analytics. For instance, eHealth solutions offer healthcare professionals the convenience of patient scheduling and data management, which is expected to drive providers' adoption of telemedicine solutions over the forecast period.

Regional Insights

North America dominated the market with a revenue share of 33.53% in 2023. This can be attributed to region's advanced healthcare facilities, and a strong presence of key market players. Companies such as Teladoc Health, American Well Corporation, and Zoom Video Communications are based in the U.S., implementing strategic initiatives to increase their market share. Increasing home care adoption by patients, growing demand for mobile technologies, and increased healthcare expenditure are expected to drive the market's growth over the forecast period. For instance, according to the National Health Expenditure (NHE) Fact Sheet, the U.S. spent USD 4.5 trillion on healthcare in 2022.

Asia Pacific is expected to experience fastest CAGR growth during the forecast period. This is due to a large patient population, growing internet usage, and high demand for healthcare assistance, particularly in rural areas. India and China are predicted to lead the regional growth, with India's telemedicine service, eSanjeevani, already completing around 3 billion consultations across the country, according to a report from the India Brand Equity Foundation in March 2021. The telemedicine market in India, is growing significantly owing to improving internet coverage and increasing health-tech expenditure. Furthermore, telehealth and telemedicine services are expected to revolutionize medical tourism in India. The Union Government has launched the Heal In India campaign to promote India's medical facilities and infrastructure globally campaign aims to boost Indian healthcare globally and increase the size of Medical Value Travel (MVT) to 13 billion by 2026.

Key Companies & Market Share Insights

Renowned market players across the globe are adopting numerous marketing strategies to expand their clientele. The telemedicine marketplace is fragmented and accommodates some renowned players such as MDlive, Inc. (Evernorth), American Well Corporation, and Teladoc Health, Inc. and numerous other small-scale & local players.

-

MDLive Inc. is a telehealth and on-demand healthcare provider with services that cater to patients, hospitals, healthcare providers, employers, etc. The virtual care cloud-based platform of the company allows easy collaboration between providers and patients, bridging the gap in care delivery.

-

American Well Corporation is a major telehealth solutions company providing accessible, affordable, quality care to individuals through its innovative platform and services. The company develops innovative solutions for individuals, insurers, and healthcare providers to create access to better healthcare solutions.

-

Teladoc Health, Inc. has more than 12,000 clients across the globe and provides virtual care, such as mental health, primary care, and chronic condition management.

-

Doctor On Demand, Inc. (Included Health), NXGN Management, LLC, and Zoom Video Communications, Inc. are some of the emerging market players in telemedicine market.

-

Doctor On Demand, Inc. provides virtual healthcare solutions to patients in remote locations. The solutions provide guidance, advocacy, and access to personalized care through virtual & in-person medical assistance for primary care, urgent care, specialty care, chronic disease care, preventive health, and behavioral health.

-

NXGN Management, LLC provides advanced healthcare technology and data solutions that empower providers to deliver comprehensive care and value-based services to patients.

Key Telemedicine Companies:

- MDlive, Inc. (Evernorth)

- American Well Corporation

- Twilio Inc.

- Teladoc Health, Inc.

- Doctor On Demand, Inc. (Included Health)

- Zoom Video Communications, Inc.

- SOC Telemed, Inc.

- NXGN Management, LLC

- Plantronics, Inc.

- Practo

- VSee

Recent Developments

-

In June 2023, Twilio Inc. declared a partnership with Frame AI to leverage AI for the enhancement of customer engagement. The partnership resulted in the strengthening of AI-powered insights for sharing recommendations, and summarizing health cases.

-

In April 2023, Teladoc Health Inc. launched a provider-based care service with the use of telemedicine as a technology for prediabetes and weight management programs.

-

In March 2023, American Well Corporation expanded its digital clinical program service for the inclusion of a cardiometabolic program. The purpose is to enable clinicians and health plans to patients remotely through telemedicine.

-

In January 2023, Sesame Inc. partnered with Lucira Health for providing telemedicine services to access affordable, convenient, and high quality COVID-19 test and treatment.

-

In November 2022, MDLIVE announced its rapid expansion in providing primary virtual care program for enhancing support for patients suffering from chronic illness. The purpose is to provide patients with convenient and seamless access to medical care through telemedicine.

-

In September 2022, Doxy.me Inc. extended its telemedicine service reach to 88% of the global population wherein patients can get access to remote health facilities in more than 100 languages.

-

In March 2022, Plantronics Inc., renamed as Poly, announced its partnership with Raydiant for making advancements in telemedicine services. The purpose was to optimize remote, hybrid, and in-office team communication for facilitating health communication.

Telemedicine Market Report Scope

Report Attribute

Details

The market size value in 2024

USD 141.19 billion

The revenue forecast in 2030

USD 380.33 billion

Growth rate

CAGR of 17.96% from 2024 to 2030

Actual data

2018 - 2023

Forecast data

2024 - 2030

Quantitative units

Revenue in USD Billion/Million & CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, Modality, Application, Delivery Model, Facility, and End User

Regions covered

North America, Europe, Asia Pacific, Latin America, MEA

Country Scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway;; Japan; China; India; South Korea; Australia; Thailand;; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Israel

Key companies profiled

MDlive, Inc. (Evernorth); American Well Corporation; Twilio Inc.; Teladoc Health, Inc.; Doctor On Demand, Inc. (Included Health); Zoom Video Communications, Inc.; SOC Telemed, Inc.; NXGN Management, LLC; Plantronics, Inc.; Practo; VSee

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Telemedicine Market Report Segmentation

This report forecasts revenue growth at the regional & country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the telemedicine market on the basis of component, modality, application, delivery model, facility, end user, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Product

-

Hardware

-

Software

-

Others

-

-

Services

-

Tele-consulting

-

Tele-monitoring

- Tele-education

-

-

-

Modality Outlook (Revenue, USD Billion, 2018 - 2030)

-

Store and forward

-

Real time

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Teleradiology

-

Telepsychiatry

-

Telepathology

-

Teledermatology

-

Telecardiology

-

Others

-

-

Delivery Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

Web/Mobile

-

Audio/Text-based

-

Visualized

-

-

Call Centers

-

-

Facility Outlook (Revenue, USD Billion, 2018 - 2030)

-

Tele-hospital

-

Tele-home

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Providers

-

Payers

-

Patients

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global telemedicine market size was estimated at USD 114.98 billion in 2023 and is expected to reach USD 169.45 billion in 2024.

b. The global telemedicine market is expected to grow at a compound annual growth rate of 17.96% from 2024 to 2030 to reach USD 380.3 billion by 2030.

b. North America dominated the telemedicine market in 2023 with a share of over 33.53%. This is owing to rising digitalization across healthcare, advanced healthcare facilities, and the adoption of telemedicine solutions.

b. Some key players operating in the telemedicine market include MDlive, Inc. (Evernorth); American Well Corporation; Twilio Inc.; Teladoc Health, Inc.; Doctor On Demand, Inc. (Included Health); Zoom Video Communications, Inc.; SOC Telemed, Inc.; NXGN Management, LLC; Plantronics, Inc.; Practo; and VSee.

b. Key factors driving the telemedicine market include the growing need to reduce the cost of care, consolidation across the industry, and other strategic initiatives by key companies, as well as healthcare consumerism.

Table of Contents

Chapter 1. Telemedicine Market: Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Segment Definitions

1.3. Research Methodology

1.4. Information Procurement

1.4.1. Purchased database

1.4.2. GVR’s internal database

1.4.3. Secondary sources

1.4.4. Primary research

1.5. Information or Data Analysis

1.5.1. Data analysis models

1.6. Market Formulation & Validation

1.7. Model Details

1.7.1. Commodity flow analysis (Model 1)

1.7.2. Approach 1: Commodity flow approach

1.7.3. Volume price analysis (Model 2)

1.7.4. Approach 2: Volume price analysis

1.8. List of Secondary Sources

1.9. List of Primary Sources

1.10. Objectives

Chapter 2. Telemedicine Market: Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Telemedicine Market: Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.1.2. Related/ancillary market outlook

3.2. Market Dynamics

3.2.1. Market driver analysis

3.2.2. Market restraint analysis

3.3. Case Study Analysis

3.4. Telemedicine Market Analysis Tools

3.4.1. Industry Analysis - Porter’s

3.4.1.1. Supplier power

3.4.1.2. Buyer power

3.4.1.3. Substitution threat

3.4.1.4. Threat of new entrant

3.4.1.5. Competitive rivalry

3.4.2. PESTEL Analysis

3.4.2.1. Political landscape

3.4.2.2. Technological landscape

3.4.2.3. Economic landscape

Chapter 4. Telemedicine Market: Component Estimates & Trend Analysis

4.1. Technology Market Share, 2023 & 2030

4.2. Segment Dashboard

4.3. Global Telemedicine Market by Technology Outlook

4.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

4.4.1. Product

4.4.1.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.2. Hardware

4.4.1.2.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.3. Software

4.4.1.3.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.1.4. Others

4.4.1.4.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.2. Services

4.4.2.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.2.2. Tele-consulting

4.4.2.2.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.2.3. Tele-education

4.4.2.3.1. Market estimates and forecasts 2018 to 2030 (USD Million)

4.4.2.4. Tele-monitoring

4.4.2.4.1. Market estimates and forecasts 2018 to 2030 (USD Million)

Chapter 5. Telemedicine Market: Modality Estimates & Trend Analysis

5.1. Modality Market Share, 2023 & 2030

5.2. Segment Dashboard

5.3. Global Telemedicine Market by Modality Outlook

5.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

5.4.1. Store and forward

5.4.1.1. Market estimates and forecasts 2018 to 2030 (USD Million)

5.4.2. Real time

5.4.2.1. Market estimates and forecasts 2018 to 2030 (USD Million)

5.4.3. Others

5.4.3.1. Market estimates and forecasts 2018 to 2030 (USD Million)

Chapter 6. Telemedicine Market: Application Estimates & Trend Analysis

6.1. Application Market Share, 2023 & 2030

6.2. Segment Dashboard

6.3. Global Telemedicine Market by Application Outlook

6.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

6.4.1. Teleradiology

6.4.1.1. Market estimates and forecasts 2018 to 2030 (USD million)

6.4.2. Telepsychiatry

6.4.2.1. Market estimates and forecasts 2018 to 2030 (USD Million)

6.4.3. Telepathology

6.4.3.1. Market estimates and forecasts 2018 to 2030 (USD Million)

6.4.4. Teledermatology

6.4.4.1. Market estimates and forecasts 2018 to 2030 (USD Million)

6.4.5. Telecardiology

6.4.5.1. Market estimates and forecasts 2018 to 2030 (USD Million)

6.4.6. Others

6.4.6.1. Market estimates and forecasts 2018 to 2030 (USD Million)

Chapter 7. Telemedicine Market: Delivery Mode Estimates & Trend Analysis

7.1. Delivery Mode Market Share, 2023 & 2030

7.2. Segment Dashboard

7.3. Global Telemedicine Market by Delivery Mode Outlook

7.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

7.4.1. Web/Mobile

7.4.1.1. Market estimates and forecasts 2018 to 2030 (USD million)

7.4.1.2. Audio/Text-based

7.4.1.2.1. Market estimates and forecasts 2018 to 2030 (USD million)

7.4.1.3. Visualized

7.4.1.3.1. Market estimates and forecasts 2018 to 2030 (USD million)

7.4.2. Call Centers

7.4.2.1. Market estimates and forecasts 2018 to 2030 (USD Million)

Chapter 8. Telemedicine Market: Facility Estimates & Trend Analysis

8.1. Facility Market Share, 2023 & 2030

8.2. Segment Dashboard

8.3. Global Telemedicine Market by Facility Outlook

8.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

8.4.1. Tele-hospital

8.4.1.1. Market estimates and forecasts 2018 to 2030 (USD million)

8.4.2. Tele-home

8.4.2.1. Market estimates and forecasts 2018 to 2030 (USD million)

Chapter 9. Telemedicine Market: End Use Estimates & Trend Analysis

9.1. End Use Market Share, 2023 & 2030

9.2. Segment Dashboard

9.3. Global Telemedicine Market by End Use Outlook

9.4. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

9.4.1. Providers

9.4.1.1. Market estimates and forecasts 2018 to 2030 (USD million)

9.4.2. Payers

9.4.2.1. Market estimates and forecasts 2018 to 2030 (USD million)

9.4.3. Patients

9.4.3.1. Market estimates and forecasts 2018 to 2030 (USD million)

9.4.4. Others

9.4.4.1. Market estimates and forecasts 2018 to 2030 (USD million)

Chapter 10. Telemedicine Market: Regional Estimates & Trend Analysis

10.1. Regional Market Share Analysis, 2023 & 2030

10.2. Regional Market Dashboard

10.3. Global Regional Market Snapshot

10.4. Market Size, & Forecasts Trend Analysis, 2018 to 2030:

10.5. North America

10.5.1. U.S.

10.5.1.1. Key country dynamics

10.5.1.2. Regulatory framework/ reimbursement structure

10.5.1.3. Competitive scenario

10.5.1.4. U.S. market estimates and forecasts 2018 to 2030 (USD Million)

10.5.2. Canada

10.5.2.1. Key country dynamics

10.5.2.2. Regulatory framework/ reimbursement structure

10.5.2.3. Competitive scenario

10.5.2.4. Canada market estimates and forecasts 2018 to 2030 (USD Million)

10.6. Europe

10.6.1. UK

10.6.1.1. Key country dynamics

10.6.1.2. Regulatory framework/ reimbursement structure

10.6.1.3. Competitive scenario

10.6.1.4. UK market estimates and forecasts 2018 to 2030 (USD Million)

10.6.2. Germany

10.6.2.1. Key country dynamics

10.6.2.2. Regulatory framework/ reimbursement structure

10.6.2.3. Competitive scenario

10.6.2.4. Germany market estimates and forecasts 2018 to 2030 (USD Million)

10.6.3. France

10.6.3.1. Key country dynamics

10.6.3.2. Regulatory framework/ reimbursement structure

10.6.3.3. Competitive scenario

10.6.3.4. France market estimates and forecasts 2018 to 2030 (USD Million)

10.6.4. Italy

10.6.4.1. Key country dynamics

10.6.4.2. Regulatory framework/ reimbursement structure

10.6.4.3. Competitive scenario

10.6.4.4. Italy market estimates and forecasts 2018 to 2030 (USD Million)

10.6.5. Spain

10.6.5.1. Key country dynamics

10.6.5.2. Regulatory framework/ reimbursement structure

10.6.5.3. Competitive scenario

10.6.5.4. Spain market estimates and forecasts 2018 to 2030 (USD Million)

10.6.6. Norway

10.6.6.1. Key country dynamics

10.6.6.2. Regulatory framework/ reimbursement structure

10.6.6.3. Competitive scenario

10.6.6.4. Norway market estimates and forecasts 2018 to 2030 (USD Million)

10.6.7. Sweden

10.6.7.1. Key country dynamics

10.6.7.2. Regulatory framework/ reimbursement structure

10.6.7.3. Competitive scenario

10.6.7.4. Sweden market estimates and forecasts 2018 to 2030 (USD Million)

10.6.8. Denmark

10.6.8.1. Key country dynamics

10.6.8.2. Regulatory framework/ reimbursement structure

10.6.8.3. Competitive scenario

10.6.8.4. Denmark market estimates and forecasts 2018 to 2030 (USD Million)

10.7. Asia Pacific

10.7.1. Japan

10.7.1.1. Key country dynamics

10.7.1.2. Regulatory framework/ reimbursement structure

10.7.1.3. Competitive scenario

10.7.1.4. Japan market estimates and forecasts 2018 to 2030 (USD Million)

10.7.2. China

10.7.2.1. Key country dynamics

10.7.2.2. Regulatory framework/ reimbursement structure

10.7.2.3. Competitive scenario

10.7.2.4. China market estimates and forecasts 2018 to 2030 (USD Million)

10.7.3. India

10.7.3.1. Key country dynamics

10.7.3.2. Regulatory framework/ reimbursement structure

10.7.3.3. Competitive scenario

10.7.3.4. India market estimates and forecasts 2018 to 2030 (USD Million)

10.7.4. Australia

10.7.4.1. Key country dynamics

10.7.4.2. Regulatory framework/ reimbursement structure

10.7.4.3. Competitive scenario

10.7.4.4. Australia market estimates and forecasts 2018 to 2030 (USD Million)

10.7.5. South Korea

10.7.5.1. Key country dynamics

10.7.5.2. Regulatory framework/ reimbursement structure

10.7.5.3. Competitive scenario

10.7.5.4. South Korea market estimates and forecasts 2018 to 2030 (USD Million)

10.7.6. Thailand

10.7.6.1. Key country dynamics

10.7.6.2. Regulatory framework/ reimbursement structure

10.7.6.3. Competitive scenario

10.7.6.4. Thailand market estimates and forecasts 2018 to 2030 (USD Million)

10.8. Latin America

10.8.1. Brazil

10.8.1.1. Key country dynamics

10.8.1.2. Regulatory framework/ reimbursement structure

10.8.1.3. Competitive scenario

10.8.1.4. Brazil market estimates and forecasts 2018 to 2030 (USD Million)

10.8.2. Mexico

10.8.2.1. Key country dynamics

10.8.2.2. Regulatory framework/ reimbursement structure

10.8.2.3. Competitive scenario

10.8.2.4. Mexico market estimates and forecasts 2018 to 2030 (USD Million)

10.8.3. Argentina

10.8.3.1. Key country dynamics

10.8.3.2. Regulatory framework/ reimbursement structure

10.8.3.3. Competitive scenario

10.8.3.4. Argentina market estimates and forecasts 2018 to 2030 (USD Million)

10.9. MEA

10.9.1. South Africa

10.9.1.1. Key country dynamics

10.9.1.2. Regulatory framework/ reimbursement structure

10.9.1.3. Competitive scenario

10.9.1.4. South Africa market estimates and forecasts 2018 to 2030 (USD Million)

10.9.2. Saudi Arabia

10.9.2.1. Key country dynamics

10.9.2.2. Regulatory framework/ reimbursement structure

10.9.2.3. Competitive scenario

10.9.2.4. Saudi Arabia market estimates and forecasts 2018 to 2030 (USD Million)

10.9.3. UAE

10.9.3.1. Key country dynamics

10.9.3.2. Regulatory framework/ reimbursement structure

10.9.3.3. Competitive scenario

10.9.3.4. UAE market estimates and forecasts 2018 to 2030 (USD Million)

10.9.4. Kuwait

10.9.4.1. Key country dynamics

10.9.4.2. Regulatory framework/ reimbursement structure

10.9.4.3. Competitive scenario

10.9.4.4. Kuwait market estimates and forecasts 2018 to 2030 (USD Million)

Chapter 11. Competitive Landscape

11.1. Recent Developments & Impact Analysis, By Key Market Participants

11.2. Company/Competition Categorization

11.3. Vendor Landscape

11.3.1. MDlive, Inc. (Evernorth)

11.3.1.1. Company overview

11.3.1.2. Financial performance

11.3.1.3. Product benchmarking

11.3.1.4. Strategic initiatives

11.3.2. American Well Corporation

11.3.2.1. Company overview

11.3.2.2. Financial performance

11.3.2.3. Product benchmarking

11.3.2.4. Strategic initiatives

11.3.3. Twilio Inc.

11.3.3.1. Company overview

11.3.3.2. Financial performance

11.3.3.3. Product benchmarking

11.3.3.4. Strategic initiatives

11.3.4. Teladoc Health, Inc.

11.3.4.1. Company overview

11.3.4.2. Financial performance

11.3.4.3. Product benchmarking

11.3.4.4. Strategic initiatives

11.3.5. Doctor On Demand, Inc. (Included Health)

11.3.5.1. Company overview

11.3.5.2. Financial performance

11.3.5.3. Product benchmarking

11.3.5.4. Strategic initiatives

11.3.6. Zoom Video Communications, Inc.

11.3.6.1. Company overview

11.3.6.2. Financial performance

11.3.6.3. Product benchmarking

11.3.6.4. Strategic initiatives

11.3.7. SOC Telemed, Inc.

11.3.7.1. Company overview

11.3.7.2. Financial performance

11.3.7.3. Product benchmarking

11.3.7.4. Strategic initiatives

11.3.8. NXGN Management, LLC

11.3.8.1. Company overview

11.3.8.2. Financial performance

11.3.8.3. Product benchmarking

11.3.8.4. Strategic initiatives

11.3.9. Plantronics, Inc.

11.3.9.1. Company overview

11.3.9.2. Financial performance

11.3.9.3. Product benchmarking

11.3.9.4. Strategic initiatives

11.3.10. Practo

11.3.10.1. Company overview

11.3.10.2. Financial performance

11.3.10.3. Product benchmarking

11.3.10.4. Strategic initiatives

11.3.11. VSee

11.3.11.1. Company overview

11.3.11.2. Financial performance

11.3.11.3. Product benchmarking

11.3.11.4. Strategic initiatives

List of Tables

Table 1 List of abbreviation

Table 2 North America telemedicine market, by region, 2018 - 2030 (USD Million)

Table 3 North America telemedicine market, by component, 2018 - 2030 (USD Million)

Table 4 North America telemedicine market, by modality, 2018 - 2030 (USD Million)

Table 5 North America telemedicine market, by application, 2018 - 2030 (USD Million)

Table 6 North America telemedicine market, by delivery mode, 2018 - 2030 (USD Million)

Table 7 North America telemedicine market, by facility, 2018 - 2030 (USD Million)

Table 8 North America telemedicine market, by end use, 2018 - 2030 (USD Million)

Table 9 U.S. telemedicine market, by component, 2018 - 2030 (USD Million)

Table 10 U.S. telemedicine market, by modality, 2018 - 2030 (USD Million)

Table 11 U.S. telemedicine market, by application, 2018 - 2030 (USD Million)

Table 12 U.S. telemedicine market, by delivery mode, 2018 - 2030 (USD Million)

Table 13 U.S. telemedicine market, by facility, 2018 - 2030 (USD Million)

Table 14 U.S. telemedicine market, by end use, 2018 - 2030 (USD Million)

Table 15 Canada telemedicine market, by component, 2018 - 2030 (USD Million)

Table 16 Canada telemedicine market, by modality, 2018 - 2030 (USD Million)

Table 17 Canada telemedicine market, by application, 2018 - 2030 (USD Million)

Table 18 Canada telemedicine market, by delivery mode, 2018 - 2030 (USD Million)

Table 19 Canada telemedicine market, by facility, 2018 - 2030 (USD Million)

Table 20 Canada telemedicine market, by end use, 2018 - 2030 (USD Million)

Table 21 Europe telemedicine market, by region, 2018 - 2030 (USD Million)

Table 22 Europe telemedicine market, by component, 2018 - 2030 (USD Million)

Table 23 Europe telemedicine market, by modality, 2018 - 2030 (USD Million)

Table 24 Europe telemedicine market, by application, 2018 - 2030 (USD Million)

Table 25 Europe telemedicine market, by delivery mode, 2018 - 2030 (USD Million)

Table 26 Europe telemedicine market, by facility, 2018 - 2030 (USD Million)

Table 27 Europe telemedicine market, by end use, 2018 - 2030 (USD Million)

Table 28 Germany telemedicine market, by component, 2018 - 2030 (USD Million)

Table 29 Germany telemedicine market, by modality, 2018 - 2030 (USD Million)

Table 30 Germany telemedicine market, by application, 2018 - 2030 (USD Million)

Table 31 Germany telemedicine market, by delivery mode, 2018 - 2030 (USD Million)

Table 32 Germany telemedicine market, by facility, 2018 - 2030 (USD Million)

Table 33 Germany telemedicine market, by end use, 2018 - 2030 (USD Million)

Table 34 UK telemedicine market, by component, 2018 - 2030 (USD Million)

Table 35 UK telemedicine market, by modality, 2018 - 2030 (USD Million)

Table 36 UK telemedicine market, by application, 2018 - 2030 (USD Million)

Table 37 UK telemedicine market, by delivery mode, 2018 - 2030 (USD Million)

Table 38 UK telemedicine market, by facility, 2018 - 2030 (USD Million)

Table 39 UK telemedicine market, by end use, 2018 - 2030 (USD Million)

Table 40 France telemedicine market, by component, 2018 - 2030 (USD Million)

Table 41 France telemedicine market, by modality, 2018 - 2030 (USD Million)

Table 42 France telemedicine market, by application, 2018 - 2030 (USD Million)

Table 43 France telemedicine market, by delivery mode, 2018 - 2030 (USD Million)

Table 44 France telemedicine market, by facility, 2018 - 2030 (USD Million)

Table 45 France telemedicine market, by end use, 2018 - 2030 (USD Million)

Table 46 Italy telemedicine market, by component, 2018 - 2030 (USD Million)

Table 47 Italy telemedicine market, by modality, 2018 - 2030 (USD Million)

Table 48 Italy telemedicine market, by application, 2018 - 2030 (USD Million)

Table 49 Italy telemedicine market, by delivery mode, 2018 - 2030 (USD Million)

Table 50 Italy telemedicine market, by facility, 2018 - 2030 (USD Million)

Table 51 Italy telemedicine market, by end use, 2018 - 2030 (USD Million)

Table 52 Spain telemedicine market, by component, 2018 - 2030 (USD Million)

Table 53 Spain telemedicine market, by modality, 2018 - 2030 (USD Million)

Table 54 Spain telemedicine market, by application, 2018 - 2030 (USD Million)

Table 55 Spain telemedicine market, by delivery mode, 2018 - 2030 (USD Million)

Table 56 Spain telemedicine market, by facility, 2018 - 2030 (USD Million)

Table 57 Spain telemedicine market, by end use, 2018 - 2030 (USD Million)

Table 58 Denmark telemedicine market, by component, 2018 - 2030 (USD Million)

Table 59 Denmark telemedicine market, by modality, 2018 - 2030 (USD Million)

Table 60 Denmark telemedicine market, by application, 2018 - 2030 (USD Million)

Table 61 Denmark telemedicine market, by delivery mode, 2018 - 2030 (USD Million)

Table 62 Denmark telemedicine market, by facility, 2018 - 2030 (USD Million)

Table 63 Denmark telemedicine market, by end use, 2018 - 2030 (USD Million)

Table 64 Sweden telemedicine market, by component, 2018 - 2030 (USD Million)

Table 65 Sweden telemedicine market, by modality, 2018 - 2030 (USD Million)

Table 66 Sweden telemedicine market, by application, 2018 - 2030 (USD Million)

Table 67 Sweden telemedicine market, by delivery mode, 2018 - 2030 (USD Million)

Table 68 Sweden telemedicine market, by facility, 2018 - 2030 (USD Million)

Table 69 Sweden telemedicine market, by end use, 2018 - 2030 (USD Million)

Table 70 Norway telemedicine market, by component, 2018 - 2030 (USD Million)

Table 71 Norway telemedicine market, by modality, 2018 - 2030 (USD Million)

Table 72 Norway telemedicine market, by application, 2018 - 2030 (USD Million)

Table 73 Norway telemedicine market, by delivery mode, 2018 - 2030 (USD Million)

Table 74 Norway telemedicine market, by facility, 2018 - 2030 (USD Million)

Table 75 Norway telemedicine market, by end use, 2018 - 2030 (USD Million)

Table 76 Asia Pacific telemedicine market, by region, 2018 - 2030 (USD Million)

Table 77 Asia Pacific telemedicine market, by component, 2018 - 2030 (USD Million)

Table 78 Asia Pacific telemedicine market, by modality, 2018 - 2030 (USD Million)

Table 79 Asia Pacific telemedicine market, by application, 2018 - 2030 (USD Million)

Table 80 Asia Pacific telemedicine market, by delivery mode, 2018 - 2030 (USD Million)

Table 81 Asia Pacific telemedicine market, by facility, 2018 - 2030 (USD Million)

Table 82 Asia Pacific telemedicine market, by end use, 2018 - 2030 (USD Million)

Table 83 China telemedicine market, by component, 2018 - 2030 (USD Million)

Table 84 China telemedicine market, by modality, 2018 - 2030 (USD Million)

Table 85 China telemedicine market, by application, 2018 - 2030 (USD Million)

Table 86 China telemedicine market, by delivery mode, 2018 - 2030 (USD Million)

Table 87 China telemedicine market, by facility, 2018 - 2030 (USD Million)

Table 88 China telemedicine market, by end use, 2018 - 2030 (USD Million)

Table 89 Japan telemedicine market, by component, 2018 - 2030 (USD Million)

Table 90 Japan telemedicine market, by modality, 2018 - 2030 (USD Million)

Table 91 Japan telemedicine market, by application, 2018 - 2030 (USD Million)

Table 92 Japan telemedicine market, by delivery mode, 2018 - 2030 (USD Million)

Table 93 Japan telemedicine market, by facility, 2018 - 2030 (USD Million)

Table 94 Japan telemedicine market, by end use, 2018 - 2030 (USD Million)

Table 95 India telemedicine market, by component, 2018 - 2030 (USD Million)

Table 96 India telemedicine market, by modality, 2018 - 2030 (USD Million)

Table 97 India telemedicine market, by application, 2018 - 2030 (USD Million)

Table 98 India telemedicine market, by delivery mode, 2018 - 2030 (USD Million)

Table 99 India telemedicine market, by facility, 2018 - 2030 (USD Million)

Table 100 India telemedicine market, by end use, 2018 - 2030 (USD Million)

Table 101 South Korea telemedicine market, by component, 2018 - 2030 (USD Million)

Table 102 South Korea telemedicine market, by modality, 2018 - 2030 (USD Million)

Table 103 South Korea telemedicine market, by application, 2018 - 2030 (USD Million)

Table 104 South Korea telemedicine market, by delivery mode, 2018 - 2030 (USD Million)

Table 105 South Korea telemedicine market, by facility, 2018 - 2030 (USD Million)

Table 106 South Korea telemedicine market, by end use, 2018 - 2030 (USD Million)

Table 107 Australia telemedicine market, by component, 2018 - 2030 (USD Million)

Table 108 Australia telemedicine market, by modality, 2018 - 2030 (USD Million)

Table 109 Australia telemedicine market, by application, 2018 - 2030 (USD Million)

Table 110 Australia telemedicine market, by delivery mode, 2018 - 2030 (USD Million)

Table 111 Australia telemedicine market, by facility, 2018 - 2030 (USD Million)

Table 112 Australia telemedicine market, by end use, 2018 - 2030 (USD Million)

Table 113 Thailand telemedicine market, by component, 2018 - 2030 (USD Million)

Table 114 Thailand telemedicine market, by modality, 2018 - 2030 (USD Million)

Table 115 Thailand telemedicine market, by application, 2018 - 2030 (USD Million)

Table 116 Thailand telemedicine market, by delivery mode, 2018 - 2030 (USD Million)

Table 117 Thailand telemedicine market, by facility, 2018 - 2030 (USD Million)

Table 118 Thailand telemedicine market, by end use, 2018 - 2030 (USD Million)

Table 119 Latin America telemedicine market, by region, 2018 - 2030 (USD Million)

Table 120 Latin America telemedicine market, by component, 2018 - 2030 (USD Million)

Table 121 Latin America telemedicine market, by modality, 2018 - 2030 (USD Million)

Table 122 Latin America telemedicine market, by application, 2018 - 2030 (USD Million)

Table 123 Latin America telemedicine market, by delivery mode, 2018 - 2030 (USD Million)

Table 124 Latin America telemedicine market, by facility, 2018 - 2030 (USD Million)

Table 125 Latin America telemedicine market, by end use, 2018 - 2030 (USD Million)

Table 126 Brazil telemedicine market, by component, 2018 - 2030 (USD Million)

Table 127 Brazil telemedicine market, by modality, 2018 - 2030 (USD Million)

Table 128 Brazil telemedicine market, by application, 2018 - 2030 (USD Million)

Table 129 Brazil telemedicine market, by delivery mode, 2018 - 2030 (USD Million)

Table 130 Brazil telemedicine market, by facility, 2018 - 2030 (USD Million)

Table 131 Brazil telemedicine market, by end use, 2018 - 2030 (USD Million)

Table 132 Mexico telemedicine market, by component, 2018 - 2030 (USD Million)

Table 133 Mexico telemedicine market, by modality, 2018 - 2030 (USD Million)

Table 134 Mexico telemedicine market, by application, 2018 - 2030 (USD Million)

Table 135 Mexico telemedicine market, by delivery mode, 2018 - 2030 (USD Million)

Table 136 Mexico telemedicine market, by facility, 2018 - 2030 (USD Million)

Table 137 Mexico telemedicine market, by end use, 2018 - 2030 (USD Million)

Table 138 Argentina telemedicine market, by component, 2018 - 2030 (USD Million)

Table 139 Argentina telemedicine market, by modality, 2018 - 2030 (USD Million)

Table 140 Argentina telemedicine market, by application, 2018 - 2030 (USD Million)

Table 141 Argentina telemedicine market, by delivery mode, 2018 - 2030 (USD Million)

Table 142 Argentina telemedicine market, by facility, 2018 - 2030 (USD Million)

Table 143 Argentina telemedicine market, by end use, 2018 - 2030 (USD Million)

Table 144 MEA telemedicine market, by region, 2018 - 2030 (USD Million)

Table 145 MEA telemedicine market, by component, 2018 - 2030 (USD Million)

Table 146 MEA telemedicine market, by modality, 2018 - 2030 (USD Million)

Table 147 MEA telemedicine market, by application, 2018 - 2030 (USD Million)

Table 148 MEA telemedicine market, by delivery mode, 2018 - 2030 (USD Million)

Table 149 MEA telemedicine market, by facility, 2018 - 2030 (USD Million)

Table 150 MEA telemedicine market, by end use, 2018 - 2030 (USD Million)

Table 151 South Africa telemedicine market, by component, 2018 - 2030 (USD Million)

Table 152 South Africa telemedicine market, by modality, 2018 - 2030 (USD Million)

Table 153 South Africa telemedicine market, by application, 2018 - 2030 (USD Million)

Table 154 South Africa telemedicine market, by delivery mode, 2018 - 2030 (USD Million)

Table 155 South Africa telemedicine market, by facility, 2018 - 2030 (USD Million)

Table 156 South Africa telemedicine market, by end use, 2018 - 2030 (USD Million)

Table 157 Saudi Arabia telemedicine market, by component, 2018 - 2030 (USD Million)

Table 158 Saudi Arabia telemedicine market, by modality, 2018 - 2030 (USD Million)

Table 159 Saudi Arabia telemedicine market, by application, 2018 - 2030 (USD Million)

Table 160 Saudi Arabia telemedicine market, by delivery mode, 2018 - 2030 (USD Million)

Table 161 Saudi Arabia telemedicine market, by facility, 2018 - 2030 (USD Million)

Table 162 Saudi Arabia telemedicine market, by end use, 2018 - 2030 (USD Million)

Table 163 UAE telemedicine market, by component, 2018 - 2030 (USD Million)

Table 164 UAE telemedicine market, by modality, 2018 - 2030 (USD Million)

Table 165 UAE telemedicine market, by application, 2018 - 2030 (USD Million)

Table 166 UAE telemedicine market, by delivery mode, 2018 - 2030 (USD Million)

Table 167 UAE telemedicine market, by facility, 2018 - 2030 (USD Million)

Table 168 UAE telemedicine market, by end use, 2018 - 2030 (USD Million)

Table 169 Kuwait telemedicine market, by component, 2018 - 2030 (USD Million)

Table 170 Kuwait telemedicine market, by modality, 2018 - 2030 (USD Million)

Table 171 Kuwait telemedicine market, by application, 2018 - 2030 (USD Million)

Table 172 Kuwait telemedicine market, by delivery mode, 2018 - 2030 (USD Million)

Table 173 Kuwait telemedicine market, by facility, 2018 - 2030 (USD Million)

Table 174 Kuwait telemedicine market, by end use, 2018 - 2030 (USD Million)

List of Figures

Fig. 1 Market research process

Fig. 2 Data triangulation techniques

Fig. 3 Primary research pattern

Fig. 4 Market research approaches

Fig. 5 Value-chain-based sizing & forecasting

Fig. 6 QFD modeling for market share assessment

Fig. 7 Market formulation & validation

Fig. 8 Telemedicine market: market outlook

Fig. 9 Telemedicine competitive insights

Fig. 10 Parent market outlook

Fig. 11 Related/ancillary market outlook

Fig. 12 Penetration and growth prospect mapping

Fig. 13 Industry value chain analysis

Fig. 14 Telemedicine market driver impact

Fig. 15 Telemedicine market restraint impact

Fig. 16 Telemedicine market strategic initiatives analysis

Fig. 17 Telemedicine market: Component movement analysis

Fig. 18 Telemedicine market: Component outlook and key takeaways

Fig. 19 Product market estimates and forecast, 2018 - 2030

Fig. 20 Hardware market estimates and forecast, 2018 - 2030

Fig. 21 Software market estimates and forecast, 2018 - 2030

Fig. 22 Others market estimates and forecast, 2018 - 2030

Fig. 23 Services market estimates and forecast, 2018 - 2030

Fig. 24 Tele-consulting estimates and forecast, 2018 - 2030

Fig. 25 Tele-monitoring estimates and forecast, 2018 - 2030

Fig. 26 Tele-education estimates and forecast, 2018 - 2030

Fig. 27 Telemedicine Market: Modality movement Analysis

Fig. 28 Telemedicine market: Modality outlook and key takeaways

Fig. 29 Store and forward market estimates and forecasts, 2018 - 2030

Fig. 30 Real time market estimates and forecasts,2018 - 2030

Fig. 31 Others market estimates and forecasts,2018 - 2030

Fig. 32 Telemedicine market: Application movement analysis

Fig. 33 Telemedicine market: Application outlook and key takeaways

Fig. 34 Teleradiology market estimates and forecasts, 2018 - 2030

Fig. 35 Telepsychiatry market estimates and forecasts,2018 - 2030

Fig. 36 Telepathology market estimates and forecasts, 2018 - 2030

Fig. 37 Teledermatology market estimates and forecasts,2018 - 2030

Fig. 38 Telecardiology market estimates and forecasts, 2018 - 2030

Fig. 39 Others application market estimates and forecasts,2018 - 2030

Fig. 40 Telemedicine Market: Delivery Mode movement Analysis

Fig. 41 Telemedicine market: Delivery Mode outlook and key takeaways

Fig. 42 Store and forward market estimates and forecasts, 2018 - 2030

Fig. 43 Web/Mobile market estimates and forecasts,2018 - 2030

Fig. 44 Audio/Text-based market estimates and forecasts,2018 - 2030

Fig. 45 Visualized market estimates and forecasts,2018 - 2030

Fig. 46 Call Centers market estimates and forecasts,2018 - 2030

Fig. 47 Telemedicine Market: Facility movement Analysis

Fig. 48 Telemedicine market: Facility outlook and key takeaways

Fig. 49 Tele-hospital market estimates and forecasts, 2018 - 2030

Fig. 50 Tele-home market estimates and forecasts,2018 - 2030

Fig. 51 Telemedicine Market: End Use movement Analysis

Fig. 52 Telemedicine market: End Use outlook and key takeaways

Fig. 53 Providers market estimates and forecasts, 2018 - 2030

Fig. 54 Payers market estimates and forecasts,2018 - 2030

Fig. 55 Patients market estimates and forecasts, 2018 - 2030

Fig. 56 Others market estimates and forecasts,2018 - 2030

Fig. 57 Global Telemedicine market: Regional movement analysis

Fig. 58 Global Telemedicine market: Regional outlook and key takeaways

Fig. 59 Global Telemedicine market share and leading players

Fig. 61 North America market estimates and forecasts, 2018 - 2030

Fig. 62 U.S. market estimates and forecasts, 2018 - 2030

Fig. 63 Canada market estimates and forecasts, 2018 - 2030

Fig. 64 Europe market estimates and forecasts, 2018 - 2030

Fig. 65 UK market estimates and forecasts, 2018 - 2030

Fig. 66 Germany market estimates and forecasts, 2018 - 2030

Fig. 69 France market estimates and forecasts, 2018 - 2030

Fig. 70 Italy market estimates and forecasts, 2018 - 2030

Fig. 71 Spain market estimates and forecasts, 2018 - 2030

Fig. 72 Denmark market estimates and forecasts, 2018 - 2030

Fig. 73 Sweden market estimates and forecasts, 2018 - 2030

Fig. 74 Norway market estimates and forecasts, 2018 - 2030

Fig. 75 Asia Pacific market estimates and forecasts, 2018 - 2030

Fig. 76 China market estimates and forecasts, 2018 - 2030

Fig. 77 Japan market estimates and forecasts, 2018 - 2030

Fig. 78 India market estimates and forecasts, 2018 - 2030

Fig. 79 Thailand market estimates and forecasts, 2018 - 2030

Fig. 80 South Korea market estimates and forecasts, 2018 - 2030

Fig. 81 Australia market estimates and forecasts, 2018 - 2030

Fig. 82 Latin America market estimates and forecasts, 2018 - 2030

Fig. 83 Brazil market estimates and forecasts, 2018 - 2030

Fig. 84 Mexico market estimates and forecasts, 2018 - 2030

Fig. 85 Argentina market estimates and forecasts, 2018 - 2030

Fig. 86 Middle East and Africa market estimates and forecasts, 2018 - 2030

Fig. 87 South Africa market estimates and forecasts, 2018 - 2030

Fig. 88 Saudi Arabia market estimates and forecasts, 2018 - 2030

Fig. 89 UAE market estimates and forecasts, 2018 - 2030

Fig. 90 Kuwait market estimates and forecasts, 2018 - 2030What questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Telemedicine Component Outlook (Revenue, USD Billion, 2018 - 2030)

- Product

- Hardware

- Software

- Others

- Services

- Tele-consultingTele-monitoring

- Tele-education

- Product

- Telemedicine Modality Outlook (Revenue, USD Billion, 2018 - 2030)

- Store and forward

- Real time

- Others

- Telemedicine Application Outlook (Revenue, USD Billion, 2018 - 2030)

- Teleradiology

- Telepsychiatry

- Telepathology

- Teledermatology

- Telecardiology

- Others

- Telemedicine Delivery Mode Outlook (Revenue, USD Billion, 2018 - 2030)

- Web/Mobile

- Audio/Text-based

- Visualized

- Call Centers

- Web/Mobile

- Telemedicine Facility Outlook (Revenue, USD Billion, 2018 - 2030)

- Tele-hospital

- Tele-home

- Telemedicine End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- Providers

- Payers

- Patients

- Others

- Telemedicine Regional Outlook (Revenue, USD Billion, 2018 - 2030)

- North America

- North America Telemedicine Market, by Component

- Product

- Hardware

- Software

- Others

- Services

- Tele-consulting

- Tele-monitoring

- Tele-education

- Product

- North America Telemedicine Market, by Modality

- Store and forward

- Real time

- Others

- North America Telemedicine Market, by Application

- Teleradiology

- Telepsychiatry

- Telepathology

- Teledermatology

- Telecardiology

- Others

- North America Telemedicine Market, by Delivery Mode

- Web/Mobile

- Audio/Text-based

- Visualized

- Call Centers

- Web/Mobile

- North America Telemedicine Market, by Facility

- Tele-hospital

- Tele-home

- North America Telemedicine Market, by End-use

- Providers

- Payers

- Patients

- Others

- U.S.

- U.S. Telemedicine Market, by Component

- Product

- Hardware

- Software

- Others

- Services

- Tele-consulting

- Tele-monitoring

- Tele-education

- Product

- U.S. Telemedicine Market, by Modality

- Store and forward

- Real time

- Others

- U.S. Telemedicine Market, by Application

- Teleradiology

- Telepsychiatry

- Telepathology

- Teledermatology

- Telecardiology

- Others

- U.S. Telemedicine Market, by Delivery Mode

- Web/Mobile

- Audio/Text-based

- Visualized

- Call Centers

- Web/Mobile

- U.S. Telemedicine Market, by Facility

- Tele-hospital

- Tele-home

- U.S. Telemedicine Market, by End-use

- Providers

- Payers

- Patients

- Others

- U.S. Telemedicine Market, by Component

- Canada

- Canada Telemedicine Market, by Component

- Product

- Hardware

- Software

- Others

- Services

- Tele-consulting

- Tele-monitoring

- Tele-education

- Product

- Canada Telemedicine Market, by Modality

- Store and forward

- Real time

- Others

- Canada Telemedicine Market, by Application

- Teleradiology

- Telepsychiatry

- Telepathology

- Teledermatology

- Telecardiology

- Others

- Canada Telemedicine Market, by Delivery Mode

- Web/Mobile

- Audio/Text-based

- Visualized

- Call Centers

- Web/Mobile

- Canada Telemedicine Market, by Facility

- Tele-hospital

- Tele-home

- Canada Telemedicine Market, by End-use

- Providers

- Payers

- Patients

- Others

- Canada Telemedicine Market, by Component

- North America Telemedicine Market, by Component

- Europe

- Europe Telemedicine Market, by Component

- Product

- Hardware

- Software

- Others

- Services

- Tele-consulting

- Tele-monitoring

- Tele-education

- Product

- Europe Telemedicine Market, by Modality

- Store and forward

- Real time

- Others

- Europe Telemedicine Market, by Application

- Teleradiology

- Telepsychiatry

- Telepathology

- Teledermatology

- Telecardiology

- Others

- Europe Telemedicine Market, by Delivery Mode

- Web/Mobile

- Audio/Text-based

- Visualized

- Call Centers

- Web/Mobile

- Europe Telemedicine Market, by Facility

- Tele-hospital

- Tele-home

- Europe Telemedicine Market, by End-use

- Providers

- Payers

- Patients

- Others

- Germany

- Germany Telemedicine Market, by Component

- Product

- Hardware

- Software

- Others

- Services

- Tele-consulting

- Tele-monitoring

- Tele-education

- Product

- Germany Telemedicine Market, by Modality

- Store and forward

- Real time

- Others

- Germany Telemedicine Market, by Application

- Teleradiology

- Telepsychiatry

- Telepathology

- Teledermatology

- Telecardiology

- Others

- Germany Telemedicine Market, by Delivery Mode

- Web/Mobile

- Audio/Text-based

- Visualized

- Call Centers

- Web/Mobile

- Germany Telemedicine Market, by Facility

- Tele-hospital

- Tele-home

- Germany Telemedicine Market, by End-use

- Providers

- Payers

- Patients

- Others

- Germany Telemedicine Market, by Component

- UK

- UK Telemedicine Market, by Component

- Product

- Hardware

- Software

- Others

- Services

- Tele-consulting

- Tele-monitoring

- Tele-education

- Product

- UK Telemedicine Market, by Modality

- Store and forward

- Real time

- Others

- UK Telemedicine Market, by Application

- Teleradiology

- Telepsychiatry

- Telepathology

- Teledermatology

- Telecardiology

- Others

- UK Telemedicine Market, by Delivery Mode

- Web/Mobile

- Audio/Text-based

- Visualized

- Call Centers

- Web/Mobile

- UK Telemedicine Market, by Facility

- Tele-hospital

- Tele-home

- UK Telemedicine Market, by End-use

- Providers

- Payers

- Patients

- Others

- UK Telemedicine Market, by Component

- France

- France Telemedicine Market, by Component

- Product

- Hardware

- Software

- Others

- Services

- Tele-consulting

- Tele-monitoring

- Tele-education

- Product

- France Telemedicine Market, by Modality

- Store and forward

- Real time

- Others

- France Telemedicine Market, by Application

- Teleradiology

- Telepsychiatry

- Telepathology

- Teledermatology

- Telecardiology

- Others

- France Telemedicine Market, by Delivery Mode

- Web/Mobile

- Audio/Text-based

- Visualized

- Call Centers

- Web/Mobile

- France Telemedicine Market, by Facility

- Tele-hospital

- Tele-home

- France Telemedicine Market, by End-use

- Providers

- Payers

- Patients

- Others

- France Telemedicine Market, by Component

- Italy

- Italy Telemedicine Market, by Component

- Product

- Hardware

- Software

- Others

- Services

- Tele-consulting

- Tele-monitoring

- Tele-education

- Product

- Italy Telemedicine Market, by Modality

- Store and forward

- Real time

- Others

- Italy Telemedicine Market, by Application

- Teleradiology

- Telepsychiatry

- Telepathology

- Teledermatology

- Telecardiology

- Others

- Italy Telemedicine Market, by Delivery Mode

- Web/Mobile

- Audio/Text-based

- Visualized

- Call Centers

- Web/Mobile

- Italy Telemedicine Market, by Facility

- Tele-hospital

- Tele-home

- Italy Telemedicine Market, by End-use

- Providers

- Payers

- Patients

- Others

- Italy Telemedicine Market, by Component

- Spain

- Spain Telemedicine Market, by Component

- Product

- Hardware

- Software

- Others

- Services

- Tele-consulting

- Tele-monitoring

- Tele-education

- Product

- Spain Telemedicine Market, by Modality

- Store and forward

- Real time

- Others

- Spain Telemedicine Market, by Application

- Teleradiology

- Telepsychiatry

- Telepathology

- Teledermatology

- Telecardiology

- Others

- Spain Telemedicine Market, by Delivery Mode

- Web/Mobile

- Audio/Text-based

- Visualized

- Call Centers

- Web/Mobile

- Spain Telemedicine Market, by Facility

- Tele-hospital

- Tele-home

- Spain Telemedicine Market, by End-use

- Providers

- Payers

- Patients

- Others

- Spain Telemedicine Market, by Component

- Sweden

- Sweden Telemedicine Market, by Component

- Product

- Hardware

- Software

- Others

- Services

- Tele-consulting

- Tele-monitoring

- Tele-education

- Product

- Sweden Telemedicine Market, by Modality

- Store and forward

- Real time

- Others

- Sweden Telemedicine Market, by Application

- Teleradiology

- Telepsychiatry

- Telepathology

- Teledermatology

- Telecardiology

- Others

- Sweden Telemedicine Market, by Delivery Mode

- Web/Mobile

- Audio/Text-based

- Visualized

- Call Centers

- Web/Mobile

- Canada Telemedicine Market, by Facility

- Tele-hospital

- Tele-home

- Canada Telemedicine Market, by End-use

- Providers

- Payers

- Patients

- Others

- Sweden Telemedicine Market, by Component

- Denmark

- Denmark Telemedicine Market, by Component

- Product

- Hardware

- Software

- Others

- Services

- Tele-consulting

- Tele-monitoring

- Tele-education

- Product

- Denmark Telemedicine Market, by Modality

- Store and forward

- Real time

- Others

- Denmark Telemedicine Market, by Application

- Teleradiology

- Telepsychiatry

- Telepathology

- Teledermatology

- Telecardiology

- Others

- Denmark Telemedicine Market, by Delivery Mode

- Web/Mobile

- Audio/Text-based

- Visualized

- Call Centers

- Web/Mobile

- Denmark Telemedicine Market, by Facility

- Tele-hospital

- Tele-home

- Denmark Telemedicine Market, by End-use

- Providers

- Payers

- Patients

- Others

- Denmark Telemedicine Market, by Component

- Norway

- Norway Telemedicine Market, by Component

- Product

- Hardware

- Software

- Others

- Services

- Tele-consulting

- Tele-monitoring

- Tele-education

- Product

- Norway Telemedicine Market, by Modality

- Store and forward

- Real time

- Others

- Norway Telemedicine Market, by Application

- Teleradiology

- Telepsychiatry

- Telepathology

- Teledermatology

- Telecardiology

- Others

- Norway Telemedicine Market, by Delivery Mode

- Web/Mobile

- Audio/Text-based

- Visualized

- Call Centers

- Web/Mobile

- Norway Telemedicine Market, by Facility

- Tele-hospital

- Tele-home

- Norway Telemedicine Market, by End-use

- Providers

- Payers

- Patients

- Others

- Norway Telemedicine Market, by Component

- Europe Telemedicine Market, by Component

- Asia Pacific

- Asia Pacific Telemedicine Market, by Component

- Product

- Hardware

- Software

- Others

- Services

- Tele-consulting

- Tele-monitoring

- Tele-education

- Product

- Asia Pacific Telemedicine Market, by Modality

- Store and forward

- Real time

- Others

- Asia Pacific Telemedicine Market, by Application

- Teleradiology

- Telepsychiatry

- Telepathology

- Teledermatology

- Telecardiology

- Others

- Asia Pacific Telemedicine Market, by Delivery Mode

- Web/Mobile

- Audio/Text-based

- Visualized

- Call Centers

- Web/Mobile

- Asia Pacific Telemedicine Market, by Facility

- Tele-hospital

- Tele-home

- Asia Pacific Telemedicine Market, by End-use

- Providers

- Payers

- Patients

- Others

- China

- China Telemedicine Market, by Component

- Product

- Hardware

- Software

- Others

- Services

- Tele-consulting

- Tele-monitoring

- Tele-education

- Product

- China Telemedicine Market, by Modality

- Store and forward

- Real time

- Others

- China Telemedicine Market, by Application

- Teleradiology

- Telepsychiatry

- Telepathology

- Teledermatology

- Telecardiology

- Others

- China Telemedicine Market, by Delivery Mode

- Web/Mobile

- Audio/Text-based

- Visualized

- Call Centers

- Web/Mobile

- China Telemedicine Market, by Facility

- Tele-hospital

- Tele-home

- China Telemedicine Market, by End-use

- Providers

- Payers

- Patients

- Others

- China Telemedicine Market, by Component

- India

- India Telemedicine Market, by Component

- Product

- Hardware

- Software

- Others

- Services

- Tele-consulting

- Tele-monitoring

- Tele-education

- Product

- India Telemedicine Market, by Modality

- Store and forward

- Real time

- Others

- India Telemedicine Market, by Application

- Teleradiology

- Telepsychiatry

- Telepathology

- Teledermatology

- Telecardiology

- Others

- India Telemedicine Market, by Delivery Mode

- Web/Mobile

- Audio/Text-based

- Visualized

- Call Centers

- Web/Mobile

- India Telemedicine Market, by Facility

- Tele-hospital

- Tele-home

- India Telemedicine Market, by End-use

- Providers

- Payers

- Patients

- Others

- India Telemedicine Market, by Component

- Japan

- Japan Telemedicine Market, by Component

- Product

- Hardware

- Software

- Others

- Services

- Tele-consulting

- Tele-monitoring

- Tele-education

- Product

- Japan Telemedicine Market, by Modality

- Store and forward

- Real time

- Others

- Japan Telemedicine Market, by Application

- Teleradiology

- Telepsychiatry

- Telepathology

- Teledermatology

- Telecardiology

- Others

- Japan Telemedicine Market, by Delivery Mode

- Web/Mobile

- Audio/Text-based

- Visualized

- Call Centers

- Web/Mobile

- Japan Telemedicine Market, by Facility

- Tele-hospital

- Tele-home

- Japan Telemedicine Market, by End-use

- Providers

- Payers

- Patients

- Others

- Japan Telemedicine Market, by Component

- Australia

- Australia Telemedicine Market, by Component

- Product

- Hardware

- Software

- Others

- Services

- Tele-consulting

- Tele-monitoring

- Tele-education

- Product

- Australia Telemedicine Market, by Modality

- Store and forward

- Real time

- Others

- Australia Telemedicine Market, by Application

- Teleradiology

- Telepsychiatry

- Telepathology

- Teledermatology

- Telecardiology

- Others

- Australia Telemedicine Market, by Delivery Mode

- Web/Mobile

- Audio/Text-based

- Visualized

- Call Centers

- Web/Mobile

- Australia Telemedicine Market, by Facility

- Tele-hospital

- Tele-home

- Australia Telemedicine Market, by End-use

- Providers

- Payers

- Patients

- Others

- Australia Telemedicine Market, by Component

- South Korea

- South Korea Telemedicine Market, by Component

- Product

- Hardware

- Software

- Others

- Services

- Tele-consulting

- Tele-monitoring

- Tele-education

- Product

- South Korea Telemedicine Market, by Modality

- Store and forward

- Real time

- Others

- South Korea Telemedicine Market, by Application

- Teleradiology

- Telepsychiatry

- Telepathology

- Teledermatology

- Telecardiology

- Others

- South Korea Telemedicine Market, by Delivery Mode

- Web/Mobile

- Audio/Text-based

- Visualized

- Call Centers

- Web/Mobile

- South Korea Telemedicine Market, by Facility

- Tele-hospital

- Tele-home

- South Korea Telemedicine Market, by End-use

- Providers

- Payers

- Patients

- Others

- South Korea Telemedicine Market, by Component

- Thailand

- Thailand Telemedicine Market, by Component

- Product

- Hardware

- Software

- Others

- Services

- Tele-consulting

- Tele-monitoring

- Tele-education

- Product

- Thailand Telemedicine Market, by Modality

- Store and forward

- Real time

- Others

- Thailand Telemedicine Market, by Application

- Teleradiology

- Telepsychiatry

- Telepathology

- Teledermatology

- Telecardiology

- Others

- Thailand Telemedicine Market, by Delivery Mode

- Web/Mobile

- Audio/Text-based

- Visualized

- Call Centers

- Web/Mobile

- Thailand Telemedicine Market, by Facility

- Tele-hospital

- Tele-home

- Thailand Telemedicine Market, by End-use

- Providers

- Payers

- Patients

- Others

- Thailand Telemedicine Market, by Component

- Asia Pacific Telemedicine Market, by Component

- Latin America

- Latin America Telemedicine Market, by Component

- Product

- Hardware

- Software

- Others

- Services

- Tele-consulting

- Tele-monitoring

- Tele-education

- Product

- Latin America Telemedicine Market, by Modality

- Store and forward

- Real time

- Others

- Latin America Telemedicine Market, by Application

- Teleradiology

- Telepsychiatry

- Telepathology

- Teledermatology

- Telecardiology

- Others

- Latin America Telemedicine Market, by Delivery Mode

- Web/Mobile

- Audio/Text-based

- Visualized

- Call Centers

- Web/Mobile

- Latin America Telemedicine Market, by Facility

- Tele-hospital

- Tele-home

- Latin America Telemedicine Market, by End-use