- Home

- »

- Healthcare IT

- »

-

Telerehabilitation Market Size & Share, Industry Report, 2030GVR Report cover

![Telerehabilitation Market Size, Share & Trends Report]()

Telerehabilitation Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software), By Services (Assessment, Therapy), By Therapy, By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-029-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

<

Telerehabilitation Market Summary

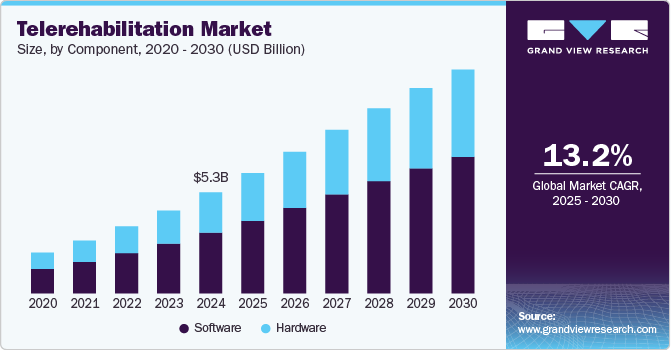

The global telerehabilitation market size was estimated at USD 5.32 billion in 2024 and is projected to reach USD 11.81 billion by 2030, growing at a CAGR of 13.2% from 2025 to 2030. Increased instances of various disorders such as traumatic brain injury, cerebrovascular accidents, and developmental delays in the pediatric population are some of the factors expected to increase the demand for telerehabilitation services globally.

Key Market Trends & Insights

- North America dominated the telerehabilitation market with a revenue share of 41.5% in 2024.

- By application, the orthopedic segment dominated the market with a share of 31.9% in 2024 and is anticipated to witness the fastest CAGR growth over the forecast period.

- By component, software segment dominated the market with the largest revenue share in 2024 and is anticipated to witness the fastest CAGR of 13.5% over the forecast period.

- By services, the clinical therapy segment dominated the market with the largest revenue share in 2024 and is anticipated to witness the fastest CAGR of 13.3% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 5.32 Billion

- 2030 Projected Market Size: USD 11.81 Billion

- CAGR (2025-2030): 13.2%

- North America: Largest market in 2024

These conditions hamper the patient's physical movement, increasing the demand for these services. For instance, according to an article published by JAMA Network Open in November 2024, pediatric traumatic brain injury accounts for nearly 500,000 emergency department visits and more than 7000 fatalities annually in the U.S.

Telerehabilitation, or e-rehabilitation, provides rehabilitation services through a telecommunication network and the Internet. Medical professionals remotely communicate with patients using telerehabilitation services and diagnose the patients & administer therapy. Physical therapy, speech-language, occupational therapy, audiology, audiology, and psychology are medical specialties that use telerehabilitation. For instance, Bio-sensing Solutions SL. (DyCare), a Spain-based telerehabilitation platform offering ReHub, a telerehabilitation tool for physiotherapists, hospitals, and clinics.

Furthermore, telerehabilitation allows patients to receive rehabilitation services from the comfort of their homes, overcoming geographical barriers and enabling continuous care for those with limited access. For instance, NeoRehab introduced a new eHAB platform to meet the demand of patients with chronic pain who reside in remote locations.

Moreover, the rising adoption of digital technologies in the healthcare industry and the increasing penetration of smartphones and the internet globally are expected to drive the market. In addition, various initiatives are undertaken by both public and private institutions. For instance, the American Telemedicine Association's Telemedicine Special Interest Group Special is a key resource for rehabilitation professionals who want to incorporate information and communication technologies into clinical best practices, advocacy, and the delivery of rehabilitation services. These initiatives are credited with increasing awareness of telerehabilitation services, which is expected to drive market growth.

With the advancement of telecommunication technologies, patients can now access rehabilitation services remotely, reducing the need for in-person visits and making therapy more convenient and accessible. This shift particularly benefits individuals in rural or underserved areas, allowing them to receive high-quality rehabilitation care without geographical constraints. The proliferation of telerehabilitation platforms and tools reflects the broader trend towards digital health solutions, enhancing the overall accessibility and efficiency of rehabilitation services. As technology advances, these innovations are set to drive further growth in the rehabilitation equipment market, offering new possibilities for improving patient care and recovery.

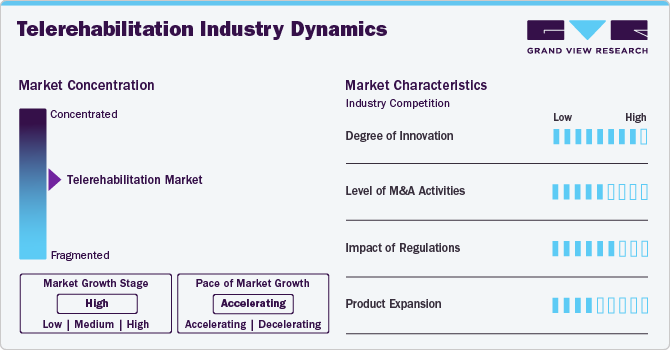

Market Concentration & Characteristics

The telerehabilitation industry is characterized by a high degree of innovation owing to dynamic market trends and technological advancements, such as integrating AI and ML in software and hardware. Real-time telerehabilitation may positively affect treatment session attendance and exercise program compliance.

The telerehabilitation industry is characterized by a medium level of merger and acquisition (M&A) activity, facilitating access to complementary technologies and expertise to capture a larger market share. Furthermore, companies desire to expand their business to cater to the growing demand for orthopedic implants and maintain a competitive edge.

Regulations, such as the 1996 Health Insurance Portability and Accountability Act (HIPAA) and its amendments under the Health Information Technology for Economic and Clinical Health (HITECH) Act, positively impact market growth. These regulations play a crucial role in safeguarding digital health information's secure management and privacy, shaping telemedicine services' operational framework and compliance standards, particularly in the U.S.

Key market players are adopting various strategies, such as new partnerships, collaborations, and geographical expansions.Several market players are expanding their business by launching new solutions to expand their product portfolio.

Component Insights

By component, software dominated the market with the largest revenue share in 2024 and is anticipated to witness the fastest growth with a CAGR of 13.5% over the forecast period. The adoption of various software has significantly increased due to assistance from healthcare systems. Furthermore, market players are developing software applications to help physicians diagnose and treat patients more efficiently. For instance, in 2021, HI launched Open Tele Rehab software in Vietnam to provide rehabilitation services to isolated populations. Similarly, Rehametrics digital rehabilitation software is designed to improve the outcomes obtained from rehabilitation and facilitate rehabilitation professionals' daily work. Such an initiative is expected to propel the segment’s growth over the forecast period.

Hardware is anticipated to witness significant CAGR growth over the forecast period. The growth is attributed to the widespread adoption of various medical peripheral devices, microphones, audio equipment, video conferencing, and display screen devices used to facilitate telerehabilitation. Moreover, a study published by NIH reported that a telerehabilitation program using virtual reality video games improves postural control and balance in multiple sclerosis patients. For instance, the Oculus is a virtual reality (VR) system used for telerehabilitation services.

Services Insights

By services, the clinical therapy segment dominated the market with the largest revenue share in 2024 and is anticipated to witness the fastest growth with a CAGR of 13.3% over the forecast period. Physical, speech, occupational, behavioral, neurological, and cognitive rehabilitation therapies are among the clinical therapies provided by telerehabilitation. Moreover, the demand for drug and alcohol addiction treatment is anticipated to rise over the forecast period, thereby driving segment growth. For instance, according to the 2023 National Survey on Drug Use and Health (NSDUH) conducted by the National Institute on Alcohol Abuse and Alcoholism (NIAAA), 28.9 million individuals ages 12 and above had alcohol use disorder.

Clinical assessment is anticipated to witness a significant CAGR over the forecast period. The primary purpose of clinical assessment in telerehabilitation is to help the rehabilitation counselor, and consumers obtain essential and relevant information. Telerehabilitation eliminates the need for patients to travel, which is beneficial for people with mobility issues, chronic conditions, or those residing in rural or remote areas. This leads to improved patient engagement and treatment adherence. Moreover, this segment offers evidence to support the development of a rehabilitation plan tailored to the client's needs, circumstances, and goals and enables accurate assessment. Such beneficial factors are anticipated to boost the market growth over the forecast period.

Therapy Insights

By therapy, the physical therapy segment dominated the market with a revenue share of 43.0% in 2024. The increasing number of people participating in fitness programs and the rising number of outdoor or sports endeavors drive demand for physical therapy. With the help of telerehabilitation, physical therapists discuss with patients online and specify their physical activities. Moreover, the growing acceptance of telerehabilitation among physiotherapists is further propelling segment growth. For instance, Ambitions, a therapy center in the U.S., reported that more than 50 million Americans seek physical therapy services.

Occupational therapy is anticipated to witness the fastest CAGR over the forecast period. Occupational therapy helps patients suffering from cognitive, physical, and sensory problems regain independence in all aspects of their daily activities. The rise in the prevalence of people suffering from various disorders, such as dementia, Alzheimer's disease, amputations, etc., is expected to drive demand for these software solutions during the forecast period. In addition, occupational therapists are adopting electronic information and telecommunication technologies to offer services to patients remotely. Thus, such factors are expected to boost segment growth. For instance, according to the Alzheimer's Society, currently, an estimated 982,000 individuals live with dementia in the UK, and is anticipated to rise to 1.4 million by 2040.

Application Insights

By application, the orthopedic segment dominated the market with a share of 31.9% in 2024 and is anticipated to witness the fastest CAGR growth over the forecast period. The rising number of people suffering from osteoarthritis, bone fractures due to road accidents, and sports injuries are driving the demand for telerehabilitation. For instance, according to Stanford University, in the U.S., annually, more than 3.5 million children suffer from sports injuries. Thus, sports-induced injury is anticipated to drive the demand for telerehabilitation services in the orthopedic industry. Moreover, various software solutions are being developed that permit monitoring exercise time, local temperature, and the biomechanics of active movements of patients who underwent orthopedic surgery. This is expected to drive the market.

The cardiovascular segment is anticipated to witness the fastest CAGR over the forecast period. Moreover, various software solutions are being developed that permit monitoring exercise time, local temperature, and the biomechanics of active movements of patients who underwent orthopedic surgery. This is expected to drive the market. In addition, telephysiotherapy treatments modulate physiological signals such as pulse rate, oxygen levels, electrocardiograms (ECG), and joint motion frequency for individuals with cardiorespiratory disorders. Such factors boost the segment growth.

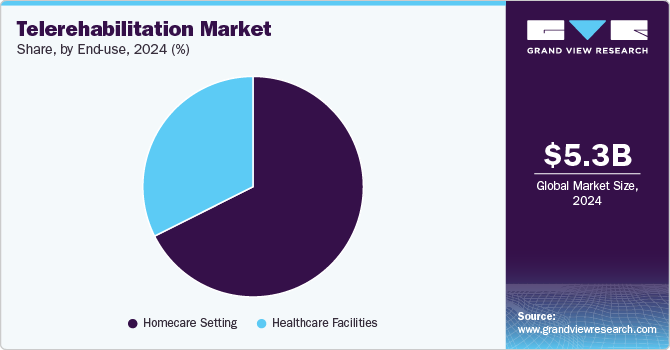

End-use Insights

By end use, the homecare setting segment dominated the market with the largest revenue share in 2024 and is anticipated to witness the fastest growth with a CAGR of 13.3% over the forecast period. One primary driver is the increasing preference for home-based care among patients, especially the elderly and those suffering from chronic diseases. Home care allows patients to maintain their independence and receive personalized care tailored to their specific needs, which is particularly important for those undergoing long-term rehabilitation. In addition, government initiatives and insurance providers increasingly support home care services, understanding the cost benefits and the positive impact on patient well-being.

The healthcare facilities segment is anticipated to witness significant CAGR over the forecast period, owing to an increasing focus on patient-centered care and the rise in chronic diseases and age-related conditions. Hospitals and clinics are investing in advanced telerehabilitation technologies to improve patient outcomes and enhance recovery processes. This trend is driven by the need for more effective treatments and rehabilitation solutions for conditions such as stroke, orthopedic injuries, and neurological disorders.

Regional Insights

North America dominated the telerehabilitation market with a revenue share of 41.5% in 2024. The rising prevalence of chronic diseases and well-developed healthcare infrastructure fuel the market growth in this region. In addition, technological advancements in rehabilitation and rising public awareness of remote patient monitoring contribute to the market expansion. Market players are focusing on improving the quality of telerehabilitation services to improve the overall patient experience.

U.S. Telerehabilitation Market Trends

The telerehabilitation market in the U.S. held the largest market share in 2024. Factors such as the growing need for remote patient consultation and the launch of virtual physiotherapist services boost market growth. For instance, in August 2022, Orbit Telehealth, a virtual care platform, introduced a platform enabling over 300,000 brick-and-mortar Physical Therapy providers to provide hybrid virtual care.

Europe Telerehabilitation Market Trends

The telerehabilitation market in Europe is anticipated to register a considerable growth rate during the forecast period. The rising prevalence of chronic diseases, such as heart disease, and obesity, is one of the primary market drivers in this region. For instance, according to the UK Government, approximately 63.8% of adults in England 18 years and above were living with obesity.

Spain telerehabilitation market is anticipated to register a considerable growth rate during the forecast period. Factors such as rising demand for telerehabilitation services among athletes and fitness enthusiasts, and a growing number of smartphone users fuel the telerehabilitation industry in the country. For instance, in October 2022, DyCare, a Spain-based provider of telerehabilitation services, launched telerehabilitation services for insurance companies.

Asia Pacific Telerehabilitation Market Trends

The telerehabilitation market in Asia Pacific is anticipated to register the fastest growth over the forecast period. There is huge investment potential in providing telerehabilitation services in emerging nations such as India and China, where healthcare infrastructure is expanding, and the physician-to-patient ratio is low. Moreover, various government initiatives are undertaken to promote digital health technologies, thereby boosting market growth in the region.

India telerehabilitation market is anticipated to register a considerable growth rate during the forecast period. Factors such as favorable government initiatives and growing investment drive the market growth. For instance, in October 2024, the Indian government launched a telerehabilitation center to offer crucial sound therapy for children post-cochlear implant surgery.

Latin America Telerehabilitation Market Trends

The telerehabilitation market in Latin America is witnessing steady growth. The market is driven by an increasing elderly population, rising prevalence of chronic diseases, and growing awareness of rehabilitation services. Market players are focusing on improving the quality of telerehabilitation services to improve the overall patient experience.

Argentina telerehabilitation market is anticipated to register considerable growth during the forecast period. Argentina's telerehabilitation equipment market is rapidly evolving, driven by increasing investments in healthcare and a growing awareness of the importance of rehabilitation in improving quality of life. The Argentine government has been focusing on expanding access to rehabilitation services through various public health programs and collaborations with private-sector players.

Middle East & Africa Telerehabilitation Market Trends

The telerehabilitation market in the Middle East and Africa is experiencing lucrative growth, owing to growth in the rehabilitation equipment sector. This growth is driven by an increasing prevalence of chronic diseases and an aging population, technological advancements, and rising awareness about the benefits of telerehabilitation.

Saudi Arabia telerehabilitation market is anticipated to register a considerable growth rate during the forecast period. The rising adoption of various strategies to improve the rehabilitation market, with substantial investments in healthcare facilities and rehabilitation centers, boosts the market growth. For example, the Saudi Vision 2030 plan emphasizes enhancing the quality of healthcare services, including rehabilitation, which has led to the establishment of new centers equipped with the latest rehabilitation technology.

Key Telerehabilitation Company Insights

Key participants in the telerehabilitation industry are focusing on developing innovative business growth strategies, such as expanding their product portfolios, partnerships and collaborations, mergers and acquisitions, and business footprints.

Key Telerehabilitation Companies:

The following are the leading companies in the telerehabilitation market. These companies collectively hold the largest market share and dictate industry trends.

- American Well

- Doctor On Demand, Inc.

- Koninklijke Philips N.V

- Hinge Health, Inc.

- Cisco Systems, Inc.

- NeoRehab

- C3O TelemedicineTM

- Bosch Healthcare Solutions GmbH

- Physio Cloud Software

- Ludica Health Inc. (Jintronix.com)

Recent Developments

- In July 2024, the Federation Physiotherapy Virtual Care Clinic(FPVCC) launched the first satellite hubs across the Latrobe Valley, which provides access to their physiotherapy telehealth appointments.

Telerehabilitation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.35 billion

Revenue forecast in 2030

USD 11.81 billion

Growth rate

CAGR of 13.2% from 2025 to 2030

Actual data

2018 - 2024

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, services, therapy, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

American Well; Doctor On Demand, Inc.; Koninklijke Philips N.V; Hinge Health, Inc.; Cisco Systems, Inc.; NeoRehab; C3O TelemedicineTM; Bosch Healthcare Solutions GmbH; Physio Cloud Software; Ludica Health Inc. (Jintronix.com)

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Telerehabilitation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the global telerehabilitation market report based component, services, therapy, application, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

-

Services Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinical Assessment

-

Clinical Therapy

-

-

Therapy Outlook (Revenue, USD Million, 2018 - 2030)

-

Physical Therapy

-

Occupational Therapy

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiovascular

-

Orthopedic

-

Neurology

-

Pediatric

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Healthcare Facilities

-

Homecare Setting

-

-

Regional Outlook Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Increased instances of various disorders such as traumatic brain injury, cerebrovascular accidents, and developmental delays in the pediatric population are some of the factors expected to increase the demand for telerehabilitation services globally.

b. The global telerehabilitation market was valued at USD 5.32 billion in 2024 and is expected to reach 6.35 billion in 2025.

b. The global telerehabilitation market is expected to grow at a compound annual growth rate (CAGR) of 13.2% from 2025 to 2030 to reach 11.81 billion by 2030.

b. Software segment dominated the global market with market share of 60.2% in 2024. The adoption of various software has significantly increased owing to the assistance provided to healthcare systems. In addition, the software helps to achieve greater engagement and improves the outcomes.

b. Some of the key market players of telerehabilitation market include American Well, Doctor On Demand, Inc., Koninklijke Philips N.V, Hinge Health, Inc., Cisco Systems, Inc., NeoRehab, C3O TelemedicineTM , Bosch Healthcare Solutions GmbH, Physio Cloud Software, Ludica Health Inc. (Jintronix.com).

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.