- Home

- »

- Medical Devices

- »

-

Tendonitis Treatment Market Size, Industry Report, 2030GVR Report cover

![Tendonitis Treatment Market Size, Share & Trends Report]()

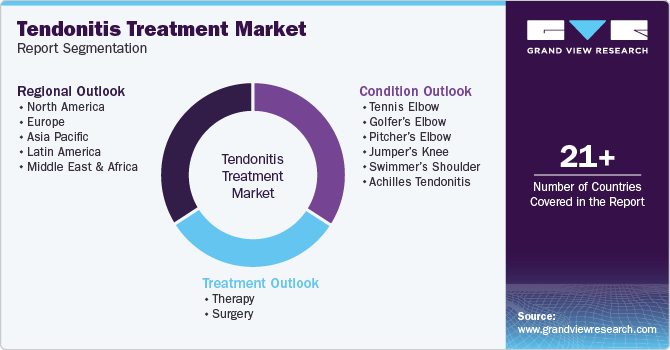

Tendonitis Treatment Market (2025 - 2030) Size, Share & Trends Analysis Report By Treatment (Therapy, Surgery), By Condition (Tennis Elbow, Golfer’s Elbow, Pitcher’s Elbow, Jumper’s Knee, Achilles Tendonitis), By Region (North America, Europe), And Segment Forecasts

- Report ID: GVR-4-68039-530-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Tendonitis Treatment Market Summary

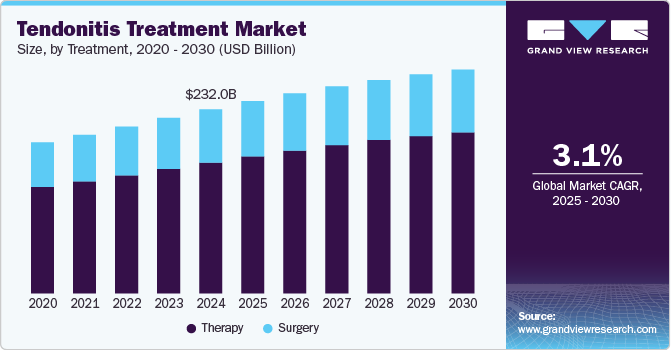

The global tendonitis treatment market size was estimated at USD 232.02 billion in 2024 and is projected to reach USD 281.8 billion by 2030, growing at a CAGR of 3.1% from 2025 to 2030. The increasing aging population, along with sports-related injuries, occupational injuries, and sudden traumas from physical work, are key factors contributing to the rise in tendonitis cases, thereby contributing to the growth of tendonitis treatment industry.

Key Market Trends & Insights

- North America tendonitis treatment market dominated with a revenue share of 42.2% in 2024.

- The Asia Pacific region is expected to witness the fastest growth in the tendonitis treatment market over the forecast period.

- Based on treatment, the therapy segment dominated the tendonitis treatment industry with the largest revenue share in 2024.

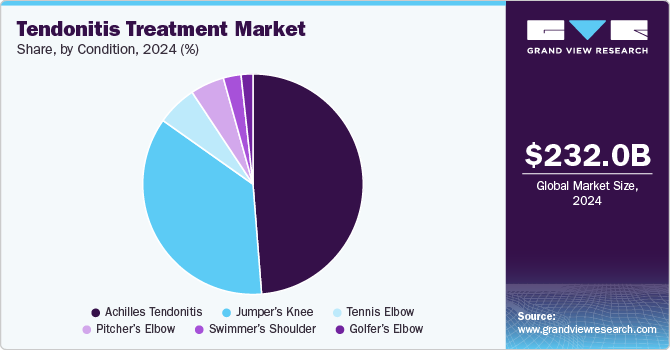

- By condition, the Achilles tendonitis segment dominated the market with a revenue share of 48.8% in 2024.

Market Size & Forecast

- 2023 Market Size: USD 232.02 Billion

- 2030 Projected Market Size: USD 281.8 Billion

- CAGR (2024-2030): 3.1%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Adolescents are becoming susceptible to arm-, wrist-, and hand-related injuries owing to the increasing usage of electronic devices, thereby making them more prone to developing tendonitis. The growing prevalence of bone disorders, osteoarthritis, rheumatoid arthritis, and osteoporosis makes the geriatric population group susceptible to tendonitis.

The increasing incidence of sports-related injuries due to the increased sports activities is contributing to market growth. As per reports from Sports Destination Management and SDM Blitz, 242 million individuals in the United States, nearly 80% of those aged 6 and older, engaged in at least one sports or fitness activity in 2023. This marks a 2.2% rise compared to the year before, achieving the highest participation rate documented in a single year. Moreover, the adoption of healthy habits is on the rise, with people around the world regularly engaging in some form of physical activity. This trend is expected to result in an increase in sports injuries, thereby contributing to the growth of the industry.

The growing prevalence of musculoskeletal conditions is another factor driving market growth. According to the CDC report, the age-adjusted prevalence of diagnosed arthritis among adults was 18.9% in 2022. Women were more prone to have arthritis (21.5%) compared to men (16.1%). Furthermore, the rising aging population is anticipated to increase the cases of arthritis, thereby supplementing the tendonitis treatment industry growth. The CDC report also indicates that arthritis prevalence increases with age, starting at 3.6% in adults aged 18-34 and reaching 53.9% in those aged 75 and older.

According to a report from the National Library of Medicine published in 2023, about 24% of athletes experience an injury to the Achilles tendon at some point in their lives. The occurrence of running-related injuries varies between 11% and 85%, translating to 2.5 to 59 injuries per 1,000 hours spent running. This rising incidence of Achilles tendon injuries among athletes is driving market growth. Various treatment options, such as OTC drugs, surgeries, and physical therapy have increased the number of individuals undergoing treatments, which will encourage the industry's growth.

In addition, increasing research and development activities coupled with the growing investment by government and non-government are supplementing market growth. For instance, in January 2023, the National Institutes of Health (NIH) granted nearly USD 8 million to establish the Penn Medicine Achilles Tendon Research Center. This funding, which is part of a new five-year grant from the National Institute of Arthritis and Musculoskeletal and Skin Diseases, will assist faculty at the Perelman School of Medicine at the University of Pennsylvania in initiating the Penn Achilles Tendinopathy Center of Research Translation (PAT-CORT). The main goal of this center is to discover more efficient and less invasive treatment options, as well as preventive strategies, for various types of Achilles tendon injuries.

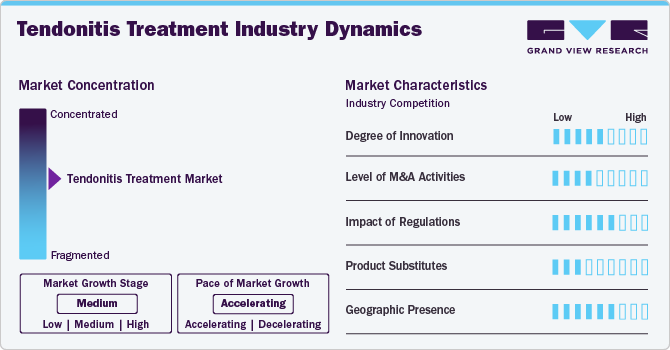

Market Concentration & Characteristics

Treatment for tendonitis focused on rest, ice, compression, and elevation (R.I.C.E.), combined with nonsteroidal anti-inflammatory drugs (NSAIDs) and physical therapy. However, the increasing demand for more effective, quicker, and less invasive solutions has driven innovation in several areas. For instance, the development of biologic therapies, such as platelet-rich plasma (PRP) injections and stem cell treatments, has gained attention for their ability to promote healing by harnessing the body’s own regenerative capabilities.

The tendonitis treatment industry is characterized by a medium level of merger and acquisition (M&A) activity, facilitating access to complementary technologies and distribution channels to capture a larger market share.

Regulatory bodies such as the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), and other national health agencies play a crucial role in overseeing the approval and monitoring of treatments for tendonitis. For instance, therapies such as platelet-rich plasma (PRP) injections and stem cell treatments, which have gained popularity in recent years, face a more complex regulatory landscape due to their novel nature.

For hot and cold therapy, alternatives such as contrast baths (which involve alternating immersion in hot and cold water), or infrared therapy can effectively reduce inflammation and improve circulation. These methods provide pain relief and promote tissue recovery. In physical therapy, options such as self-myofascial release (using foam rollers or massage tools), resistance band exercises, and yoga can help strengthen the affected muscles, enhance flexibility, and reduce strain on the tendons.

Companies are implementing various strategies, such as distribution agreements, geographic expansion, and new product development, to improve their market penetration.

Treatment Insights

By treatment, the therapy segment dominated the tendonitis treatment industry with the largest revenue share in 2024. The increasing preference of patients with tendonitis for non-invasive treatments contributes to segment growth. The physical therapy sub-segment accounted for the largest market share in the therapy segment because it is the first line of treatment for tendonitis as it helps relieve patients with chronic tendon cases. The effectiveness and outcomes of physical therapies, such as quicker relief to patients, are expected to boost the growth of the sub-segment. The therapy segment is also expected to witness the fastest growth with a CAGR of 3.3% over the forecast period

The surgery segment is anticipated to experience substantial growth in the tendonitis treatment industry, driven by the increasing prevalence of severe or chronic tendonitis cases that do not respond to conservative treatments. As tendonitis can lead to significant pain and limited mobility, surgical interventions such as tendon debridement, repair, or grafting are becoming more common for patients with advanced conditions. The growing demand for minimally invasive surgical techniques and advancements in surgical tools are also contributing to the expansion of this segment, offering faster recovery times and improved outcomes for patients.

Condition Insights

By condition, the Achilles tendonitis segment dominated the market with a revenue share of 48.8% in 2024. The segment dominated the market due to the high incidence of Achilles tendonitis condition, particularly among athletes and individuals engaged in repetitive physical activities. The Achilles tendon, being the largest and strongest tendon in the body, is highly susceptible to overuse, leading to inflammation and pain. Achilles tendonitis affects 5 to 10 per 100,000 people with 80% of the ruptures occurring during recreational sports. The incidence of Achilles tendinitis is 24% in athletes with 18% sustained by athletes before the age of 45 years. As a result, there is a growing demand for effective treatment options such as physical therapy, anti-inflammatory medications, and surgical interventions in severe cases. The increasing awareness of Achilles tendonitis and its potential long-term impact on mobility has further fueled the market's growth in this segment.

The Golfer’s elbow segment in the tendonitis treatment industry is anticipated to witness the fastest CAGR growth over the forecast period, driven by the rising incidence of this condition among both athletes and individuals engaged in repetitive hand and arm movements. Golfer’s elbow, or medial epicondylitis, affects the tendons on the inside of the elbow, causing pain and discomfort. As awareness of the condition increases, there is a growing demand for targeted treatment options such as physical therapy, corticosteroid injections, and minimally invasive surgical procedures. Additionally, the increasing popularity of recreational sports and fitness activities is expected to further propel growth in this segment.

Regional Insights

North America tendonitis treatment market dominated with a revenue share of 42.2% in 2024. A growing number of surgeries performed for tendonitis in the region and increasing consumer disposable income levels are among the few factors that contribute to the region’s growth. The emergence of local manufacturers of medical devices and collaborations amidst established & renowned players is creating significant growth opportunities for the industry in this region. Research activities undertaken by the key players in this region to expand product portfolios and business geographies are also attributed to accelerating the regional market growth over the forecast period.

U.S. Tendonitis Treatment Market Trends

The U.S. tendonitis treatment industry is experiencing significant growth, driven by the rising prevalence of tendon-related injuries due to factors such as aging populations, increased physical activity, and sports participation. The market is fueled by a variety of treatment options, including physical therapy, anti-inflammatory medications, injections, and advanced surgical techniques for severe cases. Additionally, the adoption of minimally invasive procedures and the growing focus on early intervention to prevent long-term damage are further contributing to market expansion.

Europe Tendonitis Treatment Market Trends

The Europe tendonitis treatment market is experiencing steady growth, driven by an aging population, increasing participation in sports, and rising awareness about musculoskeletal health. The high prevalence of tendonitis in countries such as Germany, UK, and France, among older adults and athletes, is a major factor contributing to this growth. The demand for effective treatments, including physical therapy, non-invasive therapies, and minimally invasive surgeries, is rising as individuals seek quicker recovery times and better long-term outcomes. With an increasing number of healthcare initiatives focused on musculoskeletal disorders, the European tendonitis treatment industry is poised for continued expansion in the coming years.

The Germany tendonitis treatment market is experiencing notable growth, driven by the country’s aging population, rising participation in sports, and the increasing prevalence of work-related repetitive motion injuries. Germany, with its advanced healthcare infrastructure, offers a wide range of treatment options for tendonitis, including physical therapy. The country's emphasis on rehabilitation and recovery, combined with the growing use of minimally invasive surgical techniques, is propelling market growth. Additionally, awareness campaigns regarding tendonitis prevention and treatment are contributing to greater demand for specialized care and faster recovery solutions.

Tendonitis treatment market in the UK is expected to experience significant growth due to the increasing awareness of musculoskeletal disorders, advancements in medical technologies, and a growing aging population prone to tendon-related issues. As lifestyle changes and sports-related injuries become more prevalent, the demand for effective and innovative treatments, including physical therapy, orthotics, biologics such as platelet-rich plasma (PRP), and minimally invasive surgeries, is rising. Additionally, the expansion of healthcare facilities and the adoption of personalized medicine are anticipated to further boost the market. This growth is also fueled by the increasing availability of rehabilitation programs and the growing focus on preventive care.

Asia Pacific Tendonitis Treatment Market Trends

The Asia Pacific region is expected to witness the fastest growth in the tendonitis treatment market over the forecast period, driven by a combination of factors such as a large and rapidly aging population, increased awareness about musculoskeletal health, and rising healthcare investments. Additionally, the growing prevalence of tendon-related injuries due to changing lifestyles, increased participation in sports, and occupational factors are contributing to the demand for effective tendonitis treatments.

The tendonitis treatment market in Japan is expected to experience steady growth, driven by a combination of factors such as an aging population, increasing awareness of musculoskeletal disorders, and advancements in medical treatments. Japan has one of the highest proportions of elderly people, leading to a higher incidence of tendon-related conditions, especially in older adults. As a result, there is growing demand for both conservative and advanced treatment options, including physical therapy and surgical interventions.

Latin America Tendonitis Treatment Market Trends

Latin America is witnessing steady growth in the tendonitis treatment market, driven by factors such as an increasing prevalence of musculoskeletal disorders, greater awareness of sports-related injuries, and improvements in healthcare infrastructure. The market is benefiting from the expansion of both conservative therapies, such as physical therapy and anti-inflammatory medications, as well as advanced options such as biologics, cortisone injections, and minimally invasive surgeries. Additionally, rising disposable incomes, along with the strengthening of healthcare access and insurance coverage in key markets are contributing to the market’s growth.

The tendonitis treatment market in Brazil is experiencing steady growth, fueled by a combination of factors including the country's large and diverse population, rising healthcare awareness, and increasing participation in sports and physical activities. Brazil’s healthcare system, which is a mix of public and private care, is expanding access to both traditional and advanced tendonitis treatments, contributing to market growth. Additionally, improvements in the availability of modern medical technologies, along with an increase in health insurance coverage and better access to specialized care, are expected to further boost the demand for tendonitis treatment solutions in the country.

MEA Tendonitis Treatment Market Trends

The tendonitis treatment market in the Middle East and Africa (MEA) is poised for gradual growth, driven by rising healthcare awareness, an increase in sports-related injuries, and the region's expanding healthcare infrastructure. Additionally, the region's young, active population is becoming more engaged in sports and fitness activities, leading to a higher incidence of tendon injuries and thus driving the demand for effective treatment options. As healthcare systems improve and disposable incomes rise, particularly in the Middle East, the tendonitis treatment market in the MEA region is expected to expand steadily in the coming years.

The tendonitis treatment market in South Africa is experiencing steady growth, supported by an increasing awareness of musculoskeletal health and rising cases of tendon-related injuries due to an active population and sports participation. With a growing focus on wellness and rehabilitation, many individuals seek preventive care and tendonitis treatment, further driving demand.

Key Tendonitis Treatment Company Insights

Key participants in the tendonitis treatment market are focusing on developing innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key Tendonitis Treatment Companies:

The following are the leading companies in the tendonitis treatment market. These companies collectively hold the largest market share and dictate industry trends.

- Merck and Co., Inc.

- Bayer AG

- AstraZeneca

- Boehringer Ingelheim Pharmaceuticals, Inc.

- Abbott

- Pfizer

- GlaxoSmithKline PLC

- Almatica Pharma, Inc.

- Teva Pharmaceuticals Industries

Recent Developments

-

In November 2024, Johnson & Johnson MedTech, a global leader in orthopedic technologies, announced that it will present its extensive range of products and data-driven solutions at the American Association of Hip and Knee Surgeons (AAHKS) 2024 Annual Meeting in Dallas.

-

In July 2024, Anika Therapeutics, Inc., a company in joint preservation focused on early intervention in orthopedics, announced the launch of its Integrity Implant System, which is widely available across the U.S. The Integrity System includes a hyaluronic acid-based implant, bone and tendon fixation components, and specialized single-use arthroscopic delivery instruments.

-

In January 2024, Arthrex, a leader in minimally invasive surgery and surgical education, launched TheNanoExperience.com, a new resource focused on the benefits of Nano arthroscopy. This advanced, minimally invasive orthopedic procedure facilitates quicker recovery and reduces pain, allowing patients to return to activity sooner. The platform aims to educate patients on the science behind the procedure and its potential advantages.

Tendonitis Treatment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 242.3 billion

Revenue forecast in 2030

USD 281.8 billion

Growth rate

CAGR of 3.1% from 2025 to 2030

Historical data

2018 - 2024

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Treatment, condition, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Merck and Co. Inc.; Bayer AG; AstraZeneca; Boehringer Ingelheim Pharmaceuticals, Inc.; Abbott; Pfizer; GlaxoSmithKline PLC; Almatica Pharma, Inc.;Teva Pharmaceuticals Industries

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Tendonitis Treatment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country level and provides an analysis on industry trends in each of the sub segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the global tendonitis treatment market report based on treatment, condition, and region:

-

Treatment Outlook (Revenue, USD Million, 2018 - 2030)

-

Therapy

-

Hot and Cold Therapy

-

Physical Therapy

-

Shockwave Therapy

-

-

Surgery

-

-

Condition Outlook (Revenue, USD Million, 2018 - 2030)

-

Tennis Elbow

-

Golfer’s Elbow

-

Pitcher’s Elbow

-

Jumper’s Knee

-

Swimmer’s Shoulder

-

Achilles Tendonitis

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global tendonitis treatment market size was estimated at USD 232.02 billion in 2024 and is expected to reach USD 242.3 billion in 2025.

b. The global tendonitis treatment market is expected to grow at a compound annual growth rate of 3.1% from 2025 to 2030 to reach USD 281.8 billion by 2030.

b. North America dominated the tendonitis treatment market with a share of 42.2% in 2024. This is attributable to the growing number of tendonitis surgeries performed in the region and rising disposable income.

b. Some key players operating in the tendonitis treatment market include Merck and Co. Inc.; Bayer AG; AstraZeneca; Boehringer Ingelheim Pharmaceuticals, Inc.; Abbott; Pfizer; GlaxoSmithKline PLC; Almatica Pharma, Inc.

b. Key factors that are driving the tendonitis treatment market growth include increasing incidence of tendonitis due to growth in the aging population, sports & occupational work injuries, and sudden injuries caused due to physical exercise and trauma.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.