- Home

- »

- Clothing, Footwear & Accessories

- »

-

Tennis Racquet Market Size, Share & Growth Report, 2030GVR Report cover

![Tennis Racquet Market Size, Share & Trends Report]()

Tennis Racquet Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Carbon Fiber, Aluminum, Others), By Distribution Channel, By String Pattern, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-955-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Tennis Racquet Market Summary

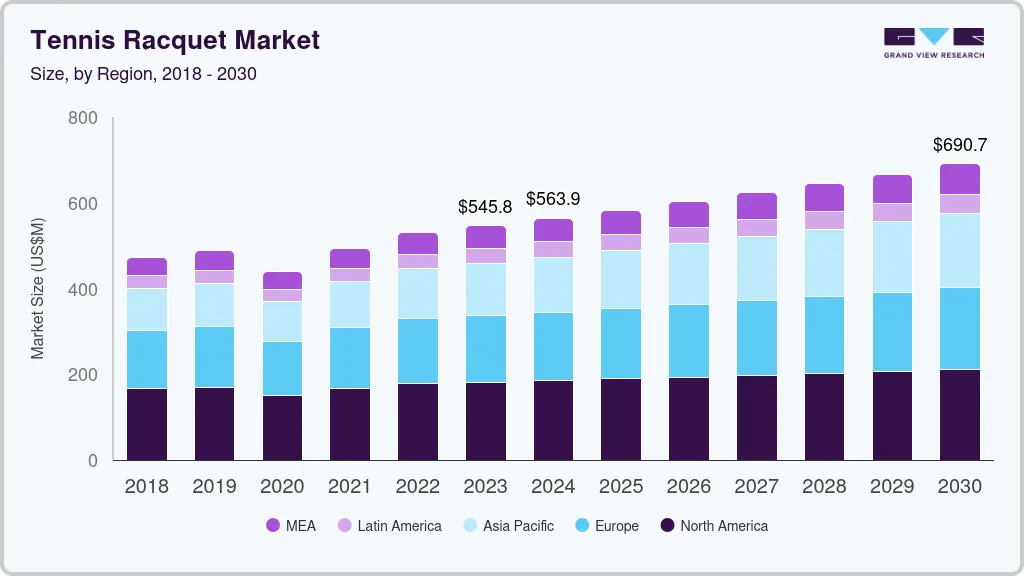

The global tennis racquet market size was estimated at USD 545.8 million in 2023 and is projected to reach USD 690.7 million by 2030, growing at a CAGR of 3.4% from 2024 to 2030. Influencers, professional players, and brands use these platforms to showcase tennis gear, share tips, and promote the sport.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

- In terms of segment, carbon fiber accounted for a revenue of USD 545.8 million in 2023.

- Carbon fiber is the most lucrative material segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 545.8 Million

- 2030 Projected Market Size: USD 690.7 Million

- CAGR (2024-2030): 3.4%

- North America: Largest market in 2023

Online reviews, tutorials, and endorsements contribute to informed purchasing decisions, increasing sales of tennis racquets. Social media encourages more people to try it, and digital marketing campaigns by racquet manufacturers target potential customers directly.

Tennis is an effective way to maintain physical fitness. The sport offers cardiovascular benefits, improves coordination, and is a full-body workout. As more people prioritize healthy lifestyles and seek engaging ways to stay fit, tennis gains popularity as a preferred activity. This trend drives the demand for tennis racquets as new players and fitness enthusiasts purchase equipment to participate in the sport. Additionally, tennis clubs and recreational centers are seeing increased memberships, further fueling the need for quality racquets. Many fitness influencers and trainers now recommend tennis as part of a balanced fitness exercise.

Manufacturers continually invest in research and development to create racquets that enhance player performance through improved power, control, and comfort. Advanced materials such as graphite composites, titanium, and other high-tech substances have revolutionized racquet construction, making them lighter, stronger, and more durable. Features such as better grip, vibration dampening, and customizable string tension also attract consumers seeking to optimize their playing experience. For instance, in July 2023, Yonex announced the launch of PERCEPT, a tennis racquet series for intermediate and advanced players. These racquets are developed to act as an extension of the player's arm, allowing for greater control and accuracy in ball placement. The racquets' enhanced frame stability, achieved through multiple layers of graphite, results in better ball control.

Material Insights

The carbon fiber segment dominated the market and accounted for a market revenue share of 78.2% in 2023. Carbon fiber offers remarkable strength and stiffness and is significantly lighter. This allows manufacturers to produce strong and lightweight racquets, enhancing player's performance. The reduced weight enables faster swing speeds and improved maneuverability, while the increased strength provides better durability and power. This combination makes carbon fiber ideal for tennis racquets, attracting professional players.

The aluminum segment is expected to witness significant growth over the forecast period. Aluminum racquets are less expensive, making them an attractive option for budget-conscious consumers. This cost-effectiveness enables manufacturers to produce high-quality racquets at lower prices, making them more accessible to a broader audience, including beginners, recreational players, and those who play tennis occasionally. This affordability and accessibility drive the demand in the market.

Distribution Channel insights

The sporting goods stores segment accounted for the largest market revenue share in 2023. Stores that provide personalized services such as racquet customization, stringing services, and expert advice tend to attract more tennis enthusiasts. Testing racquets in-store, with dedicated spaces or courts for demonstrations, also enhances the shopping experience. Personalized service aids customers in choosing the racquet based on their skill level, playing style, and specific needs.

The online segment is anticipated to register a significant CAGR over the forecast period. Online shopping allows consumers to browse and purchase products from the comfort of their homes, eliminating the need for physical store visits. This is particularly advantageous for those with busy schedules or living in remote areas without easy access to sporting goods stores. The ability to shop 24/7 and deliver products directly to their doorstep enhances the consumer experience, driving the demand for online channels.

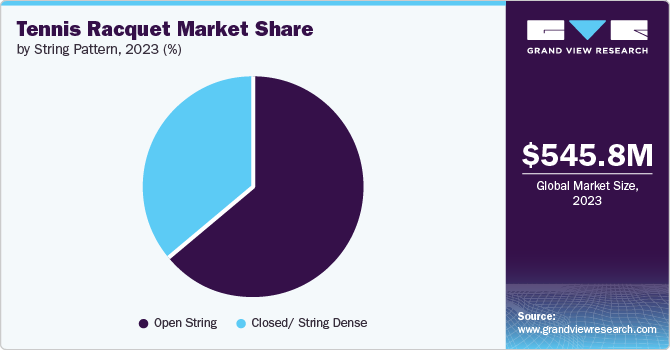

String Pattern Insights

The open string segment accounted for the largest market revenue share in 2023. Open string patterns have fewer strings, which creates larger gaps between them. This design allows the strings to grip the ball more effectively, resulting in greater spin. Players who prioritize topspin or slice shots often prefer racquets with open string patterns, as the added spin enables them to achieve higher bounce rates and more challenging ball trajectories for their opponents.

Closed/string dense is expected to witness a significant CAGR over the forecast period. With more strings packed closely together, dense string patterns provide a more uniform and consistent response across the string bed. This results in greater accuracy and control over ball placement, allowing players to hit precise shots confidently. Additionally, the increased number of strings creates a more solid and connected feel when striking the ball. This improved feedback allows players to sense the ball on the racquet better, leading to more controlled and confident strokes.

End Use Insights

Professional players segment accounted for the largest market revenue share in 2023. Professional players require racquets that enhance their natural abilities and complement their playing style. Factors such as racquet weight, balance, string tension, and stiffness play crucial roles in maximizing power, control, spin, and comfort. Manufacturers invest heavily in research and development to create racquets that offer superior performance for professional players pursuing the best equipment to gain a competitive edge on the court. For instance, in December 2022, Yonex launched the 7th-generation VCORE tennis racquet. It features a spin ball that drops and bounces more widely. It is available for professional players, junior players, and others.

The recreational players segment is anticipated to register the fastest CAGR over the forecast period. Recreational players often seek racquets that balance cost and performance well. Manufacturers cater to this segment by offering a range of budget-friendly racquets that provide essential performance for cost-conscious consumers. Additionally, they require equipment that performs well across various aspects of the game, including power, control, and spin, without specializing in any one area. This versatility allows recreational players to improve their skills and adapt to different playing styles.

Regional Insights

The North America dominated the tennis racquet market in 2023 with a revenue share of 33.2%. Tennis is a prevalent recreational activity in schools, colleges, and community clubs. The availability of public tennis courts and programs that promote the sport to youth and adults ensure a steady inflow of new players. These participation rates translate into ongoing demand for tennis racquets as new players enter the market and existing players upgrade their equipment. The high participation rates in tennis across North America significantly drive the tennis racquet market.

U.S. Tennis Racquet Market Trends

The U.S. dominated the regional market and is expected to maintain its dominance over the forecast period. The U.S. hosts some tennis tournaments globally, such as the U.S. Open, which draws significant media attention and large audiences. These high-profile events increase the sport's interest, encouraging new and existing players to participate and improve their game. The visibility and excitement surrounding these tournaments drive sales of tennis racquets as fans and players improve their game.

Europe Tennis Racquet Market Trends

The Europe tennis racquet market is anticipated to witness significant growth in 2023. Tennis is perceived as a beneficial activity that combines physical exercise with social interaction. Health-conscious consumers are increasingly participating in tennis to maintain their fitness, driving demand for tennis racquets. Marketing campaigns highlight the health benefits of tennis and promote it as a fun, lifelong sport. This growing emphasis on fitness and healthy lifestyles significantly drives the Europe tennis racquet market.

The UK tennis racquet market is anticipated to witness significant growth in 2023. Tennis is played competitively and casually, making it suitable for social gatherings, family activities, and friendly matches. This versatility increases its popularity as a sport that people of all ages and skill levels enjoy. The communal aspect of tennis, often promoted by local clubs and community centers, aids in sustaining interest and demand for tennis equipment. Additionally, the development of weather-resilient tennis facilities, such as indoor courts and covered arenas, has increased year-round participation in the UK. These facilities mitigate the impact of the UK’s variable weather conditions, ensuring that players continue practicing and playing regardless of the season. The availability of such facilities supports continuous engagement with the sport, driving significant demand for tennis racquets.

Asia Pacific Tennis Racquet Market Trends

The Asia Pacific region is expected to witness the fastest CAGR over the forecast period. Governments and sports institutions in Asia Pacific are increasingly promoting tennis as part of broader sports development programs. Investments in sports infrastructure, including the construction of tennis courts and training centers, make the sport more accessible. Government initiatives encourage youth participation and talent development aid in nurturing a new generation of players. This institutional support boosts participation rates, driving demand for tennis racquets. For instance, in January 2024, the Maharashtra Government collaborated with the Juan Carlos Ferrero Academy in Spain to launch the Lakshyavedh tennis program. This collaboration aims to provide high-quality training to players, coaches, and physical trainers in Maharashtra. The government initiated the project to increase Maharashtra's representation in international competitions such as the Asian Games and Olympics.

The China tennis racquet market is anticipated to witness significant growth in 2023. The influence of professional tennis players significantly impacts the racquet market. Their success and endorsement of specific racquet brands and models often increase demand for those products. Manufacturers in China leverage these endorsements in their marketing strategies to increase sales and brand recognition. Additionally, well-developed retail and e-commerce infrastructure supports tennis racquets' widespread availability. Sporting goods stores, specialized tennis shops, and online platforms offer extensive selections catering to diverse preferences and budgets. The convenience of online shopping, with detailed product descriptions and customer reviews, makes it easy for consumers to find and purchase the right racquet, contributing to market growth.

Key Tennis Racquet Company Insights

Some of the key industries participants include YONEX Co., Ltd., Wilson Sporting Goods, HEAD, Dunlop Sports and others.

-

YONEX Co., Ltd. is a Japanese sports equipment manufacturing company that offers a comprehensive range of products, including badminton racquets, tennis racquets, golf clubs, shuttlecocks, strings, footwear, apparel, and accessories. Its tennis racquet lineup includes popular series such as EZONE, VCORE, ASTREL, and others.

-

Wilson Sporting Goods is a leading American manufacturer of sports equipment. The company offers products across various sports, including tennis, basketball, baseball, football, soccer, and golf. It provides an extensive lineup of racquets, including popular models such as the Pro Staff, Blade, Clash series, and others.

Key Tennis Racquet Companies:

The following are the leading companies in the tennis racquet market. These companies collectively hold the largest market share and dictate industry trends.

- YONEX Co., Ltd.

- Wilson Sporting Goods

- HEAD

- Dunlop Sports

- Babolat

- PRINCE SPORTS

- Völkl - Global

- Tecnifibre

- Gamma Sports

- PACIFIC Europe GmbH

Recent Developments

-

In April 2023, Wilson launched the Roland Garros collection of products. The collection features design elements and traditions associated with the French Open. This limited-edition collection includes new rackets, such as the Blade 98 (16x19) V9 Roland-Garros 2024, balls, and bags.

-

In August 2022, Head introduced a new version of their Extreme tennis racket incorporating fresh technology. The new Extreme racket features Auxetic technology, located on the bottom of the frame. This technology allows the carbon fiber yoke piece to enlarge when a pull force is applied and contract when squeezed. The racket comes in different models with varying specifications.

Tennis Racquet Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 563.9 million

Revenue forecast in 2030

USD 690.7 million

Growth Rate

CAGR of 3.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, distribution channel, string pattern, end use, region

Regional scope

North America, Europe, Asia Pacific, MEA, Central & South America

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, India, Japan, South Korea, Australia & New Zealand, Saudi Arabia, Brazil

Key companies profiled

YONEX Co., Ltd., Wilson Sporting Goods, HEAD, Dunlop Sports, Babolat, PRINCE SPORTS, Völkl - Global, Tecnifibre, Gamma Sports, PACIFIC Europe GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Tennis RacquetMarket Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global tennis racquet market report based on material, distribution channel, string pattern, end use, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Carbon Fiber

-

Aluminum

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Sporting goods stores

-

Hypermarkets & Supermarkets

-

Online

-

Others

-

-

String Pattern Outlook (Revenue, USD Million, 2018 - 2030)

-

Open String

-

Closed/ String Dense

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Professional Players

-

Recreational Players

-

-

Regional Outlook ( Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

-

Middle East & Africa

-

South Africa

-

-

Central & South America

-

Brazil

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.