- Home

- »

- Sensors & Controls

- »

-

Tension Control Market Size, Share & Trends Report, 2030GVR Report cover

![Tension Control Market Size, Share & Trends Report]()

Tension Control Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Automated, Manual), By Component (Load Cell, Controller, Diameter Sensor, Clutch, Brake, Dance Roller), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-388-2

- Number of Report Pages: 250

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Tension Control Market Size & Trends

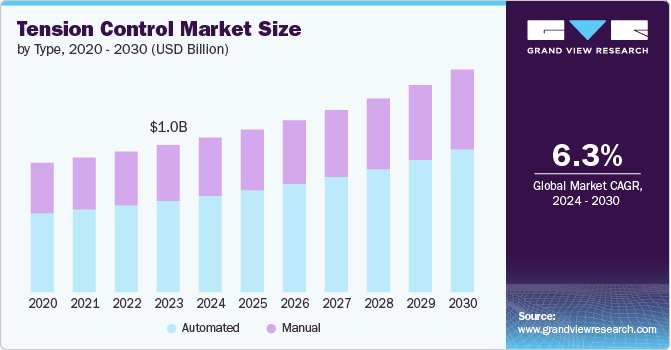

The global tension control market size was estimated at USD 1.01 billion in 2023 and is expected to expand at a CAGR of 6.3% from 2024 to 2030. This growth can be attributed to the increasing demand for precision and efficiency across various industrial sectors. Manufacturing processes, particularly in industries such as packaging, paper and pulp, metal processing, and textiles, require sophisticated tension control systems to maintain product quality and operational efficiency. As these industries continue to evolve and adopt more advanced technologies, the need for robust tension control solutions is expected to intensify.

Technological advancements play a crucial role in shaping the market landscape. The integration of digital technologies, such as IoT and AI, into tension control systems is enhancing their capabilities, allowing for more accurate tension measurement, real-time adjustments, and predictive maintenance. These innovations are not only improving product performance but also contributing to reduced downtime and increased productivity, factors that are highly valued in industrial settings.

The growing emphasis on automation and Industry 4.0 initiatives is another significant driver for the tension control market. As manufacturers seek to streamline their operations and reduce labor costs, automated tension control systems are becoming increasingly essential. These systems enable consistent product quality, minimize material waste, and optimize production speeds, aligning with the broader industry trends toward greater efficiency and sustainability.

Emerging economies, particularly in Asia Pacific and Latin America, are expected to present substantial growth opportunities for the tension control market. The rapid industrialization and increasing adoption of advanced manufacturing technologies in these regions are likely to fuel demand for tension control solutions. Additionally, the expansion of end-user industries such as automotive, electronics, and consumer goods in these markets is anticipated to further drive market growth.

However, the market also faces certain challenges that may impact its growth trajectory. The high initial investment required for advanced tension control systems could potentially limit adoption, particularly among small and medium-sized enterprises. Moreover, the complexity of integrating these systems into existing production lines may pose implementation challenges for some manufacturers.

Type Insights

The automated segment held the largest revenue share of 62.1% in 2023 in the tension control market and is expected to maintain its dominance from 2024-2030, due to its ability to offer superior precision, consistency, and efficiency compared to manual alternatives. Automated tension control systems integrate advanced sensors, actuators, and control algorithms to maintain optimal tension across various materials and production speeds.

The segment's growth is further propelled by the increasing adoption of Industry 4.0 principles across manufacturing sectors. These automated systems often feature connectivity capabilities, allowing for real-time monitoring, data analysis, and remote adjustments. This aligns well with the broader industrial trends towards digital transformation and smart factories.

Industries such as packaging, printing, and web processing have been particularly instrumental in driving the demand for automated tension control solutions. These sectors require high-speed, continuous operations where even minor tension fluctuations can lead to significant quality issues or material waste. Automated systems address these challenges effectively, offering consistent performance over extended production runs.

Component Insights

The load cell segment's dominant position, capturing 24.2% of the revenue share in 2023, in the tension control market's component segment, can be attributed to several key factors. Load cells are fundamental components in tension measurement systems, offering high accuracy and reliability in force sensing applications. Their widespread adoption stems from their versatility across various industries, including manufacturing, aerospace, and material handling.

Load cells excel in providing precise tension measurements even in challenging industrial environments, contributing to their preferred status. Their durability and ability to withstand harsh conditions make them suitable for long-term use in continuous production settings. The increasing demand for real-time data and process optimization has further bolstered the adoption of load cell-based tension control systems.

Moreover, the ongoing technological advancements in load cell design, including the integration of digital signal processing and wireless communication capabilities, have enhanced their functionality and ease of integration into modern control systems. This has expanded their applicability in automated and smart manufacturing environments, aligning with Industry 4.0 initiatives.

The brake segment is expected to register the fastest CAGR of 6.9% from 2024 to 2030 attributed to its crucial role in tension control systems by providing precise and responsive tension adjustment capabilities. The increasing need for accurate tension management in high-speed production processes, particularly in industries such as packaging, printing, and converting, is fueling the demand for advanced brake systems.

Technological advancements in brake design, including the development of electromagnetic and pneumatic brakes with enhanced performance characteristics, are contributing to their growing adoption. These innovations offer improved response times, smoother operation, and better heat dissipation, addressing the evolving requirements of modern manufacturing processes.

The trend towards energy efficiency and sustainability in industrial operations is also boosting the brake segment's growth. Modern brake systems are designed to minimize energy consumption while maintaining optimal tension control, aligning with the industry's focus on reducing operational costs and environmental impact.

Furthermore, the integration of smart features such as self-diagnostics and predictive maintenance capabilities in brake systems is enhancing their appeal to manufacturers seeking to improve overall equipment effectiveness and reduce downtime. This aligns with the broader industry shift towards predictive and preventive maintenance strategies.

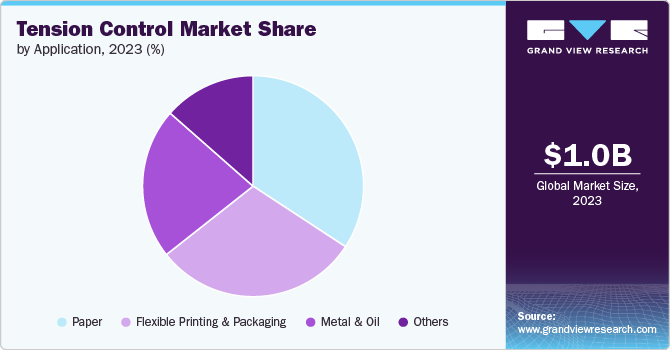

Application Insights

The paper segment held the largest revenue share, 34.2%, in 2023 in the tension control market, which is mainly attributed to several key factors inherent to the paper industry's operations and market dynamics.

The paper manufacturing process requires precise tension control at multiple stages, from pulp processing to finished product winding, making it a significant consumer of tension control solutions. The industry's continuous production nature and high-speed operations necessitate advanced tension control systems to maintain product quality and prevent web breaks.

Increasing demand for high-quality paper products, particularly in packaging and specialty paper segments, has driven investments in advanced manufacturing technologies, including sophisticated tension control systems. These systems are crucial for achieving consistent quality and reducing waste in paper production.

The paper industry's ongoing efforts to improve operational efficiency and reduce production costs have led to increased adoption of automated tension control solutions. These systems help optimize material usage, reduce downtime, and improve overall equipment effectiveness.

Environmental regulations and sustainability initiatives in the paper industry have also contributed to the adoption of advanced tension control systems. These solutions help in reducing material waste and energy consumption, aligning with the industry's sustainability goals.

The flexible printing & packaging segment is expected to register the fastest CAGR of 7.1% from 2024 to 2030, attributed to the rapid expansion of the e-commerce industry and changing consumer preferences are fueling the demand for flexible packaging solutions, consequently increasing the need for advanced tension control systems in production processes. These systems are crucial for maintaining consistent quality and efficiency in high-speed, flexible packaging operations.

Technological advancements in flexible printing techniques, such as digital printing and high-speed flexography, require precise tension control to ensure print quality and registration accuracy. This is driving the adoption of sophisticated tension control solutions in the segment.

The trend towards sustainable packaging is influencing manufacturing processes, with tension control playing a vital role in optimizing material usage and reducing waste. This aligns with both environmental concerns and cost-reduction initiatives in the industry.

Increasing automation in flexible printing and packaging facilities is boosting the demand for integrated tension control systems that can seamlessly interface with other production equipment and management systems.

The growing complexity of packaging designs and materials, including multi-layer films and smart packaging, necessitates more advanced tension control capabilities to handle diverse substrate properties and ensure product integrity.

Regional Insights

The North American tension control market is experiencing growth driven primarily by technological advancements and the region's strong industrial base. The market benefits from the presence of established manufacturing sectors, particularly in the automotive, packaging, and aerospace industries, which demand high-precision tension control solutions. In addition, the region's focus on automation and Industry 4.0 initiatives is fueling the adoption of advanced tension control systems. The emphasis on operational efficiency, quality improvement, and waste reduction across various industries further contributes to the market's expansion in North America.

U.S. Tension Control Market Trends

The U.S. held the largest market share in the North American tension control market due to its robust industrial infrastructure and technological leadership. The country's diverse manufacturing sector, encompassing industries such as automotive, aerospace, packaging, and paper production, drives significant demand for advanced tension control solutions. The U.S. market benefits from a strong emphasis on automation and process optimization, with many companies investing in cutting-edge technologies to enhance productivity and product quality. In addition, the presence of major tension control system manufacturers and a culture of innovation contribute to the country's dominant position. The U.S. market is further bolstered by ongoing research and development activities, fostering the creation of more sophisticated and efficient tension control technologies.

Asia Pacific Tension Control Market Trends

The Asia Pacific region's dominant 32.4% revenue share in the 2023 tension control market can be attributed to several key factors. Rapid industrialization and economic growth in countries such as China, India, and Southeast Asian nations have driven significant demand for tension control solutions across various manufacturing sectors. The region's expanding packaging, textile, and electronics industries, which require precise tension management, have been major contributors to market growth. In addition, the increasing adoption of automation and Industry 4.0 technologies in Asia Pacific has spurred investments in advanced tension control systems. The presence of a large and cost-effective manufacturing base has also attracted global players, further boosting market development. Government initiatives promoting industrial upgrades and technological advancements have provided additional impetus to the tension control market in the region. Moreover, the growing focus on quality improvement and waste reduction in manufacturing processes has heightened the need for sophisticated tension control solutions across the Asia Pacific.

Europe Tension Control Market Trends

The European tension control market's growth is primarily driven by the region's strong emphasis on manufacturing excellence and technological innovation. The market benefits from Europe's well-established industrial sectors, particularly in automotive, aerospace, and high-end consumer goods production, which demand precision tension control solutions. The region's stringent quality standards and focus on sustainability are propelling the adoption of advanced tension control systems that enhance efficiency and reduce waste. In addition, Europe's commitment to Industry 4.0 initiatives and smart manufacturing practices is fostering increased integration of sophisticated tension control technologies across various industries.

Key Tension Control Company Insights

Some of the key companies operating in the Tension control market include Montalvo Corporation, and Siemens, among others.

-

Montalvo Corporation is a global provider of web tension control solutions. Specializing in advanced brakes, load cells, controllers, sensors, and rollers, Montalvo enhances machine performance and efficiency across various industrial sectors. With a presence of over 70 years, the company combines deep industry expertise with innovative technology to deliver precision control systems and support services.

-

Nireco Corporation is a key player in the tension control market, specializing in advanced control, measurement, and inspection equipment. The company’s web control segment focuses on providing precise tension management solutions for thin sheets like film and paper, ensuring consistent quality and optimal production efficiency. The company’s product lineup includes sophisticated tension control systems, measurement and inspection tools, and advanced optical and sensing technologies. With a commitment to innovation, The company invests heavily in R&D to refine its technologies and meet the evolving demands of various industries. Its solutions are integral to sectors requiring exacting standards in tension control, including steel, film, and paper manufacturing.

Comptrol and Nexen Group, Inc Technologies are some of the emerging market companies in the target market.

- Comptrol, the provider in the tension control market, specializes in manufacturing a comprehensive range of tension measurement solutions, including load cells, tension indicators, and control systems. The company is equipped with in-house capabilities for engineering, machining, manufacturing, and assembly, ensuring high-quality and reliable products. The company also offers services to rebuild or repair older tension control products and can replace transducers or load cells on existing machinery. Additionally, the company provides web tension control calculators to assist in selecting appropriate load cells for various applications. The company's expertise extends to linear motion products and connecting rod weighing systems, supporting both small and large production facilities with customized solutions.

Key Tension Control Companies:

The following are the leading companies in the tension control market. These companies collectively hold the largest market share and dictate industry trends.

- Montalvo Corporation

- Maxcess

- Erhardt+Leimer

- NIRECO

- Double E Group

- Federatie Medisch Specialisten

- Re Controlli Industriali

- Carolina Commerce Parkway

- OWECON APS

- Nexen Group, Inc

- Dover Flexo Electronics, Inc.

- Comptrol

Recent Developments

-

In February 2024, Double E Group introduced the RollMover RX, a new roll pusher that combines increased power with a compact design. This model is 20% smaller and lighter than previous versions while offering a 35% boost in torque. It can handle rolls up to 8,000 lbs. and features enhanced maneuverability, a wider diameter range, and a quick-charging Lithium Iron Phosphate battery, making it a highly efficient solution for material handling in the converting industry.

-

In September 2023, Erhardt+Leimer introduced advancements in tension control and inspection technologies at Labelexpo Europe. The new generation SmartScan system features enhanced speed, compact design, and improved defect detection capabilities, while the rotary actuating drives (AD 11 and AD 12) offer integrated control for position, speed, and torque with decentralized drive topology. These updates aim to improve efficiency and accuracy in web guiding, tension control, and print monitoring applications.

Tension Control Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.06 billion

Revenue forecast in 2030

USD 1.52 billion

Growth rate

CAGR of 6.3% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million/Billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, component, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Montalvo Corporation; Maxcess; Erhardt+Leimer; NIRECO; Double E Group; Federatie Medisch Specialisten; Re Controlli Industriali; Carolina Commerce Parkway; OWECON APS; Nexen Group, Inc; Dover Flexo Electronics, Inc.; Comptrol

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Tension Control Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global tension control market report based on type, component, application and region.

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Automated

-

Manual

-

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Load Cell

-

Controller

-

Diameter Sensor

-

Clutch

-

Brake

-

Dancer Roller

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Paper

-

Flexible Printing & Packaging

-

Metal & Oil

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global tension control market size was estimated at USD 1.01 billion in 2023 and is expected to reach USD 1.06 billion in 2024.

b. The global tension control market is expected to grow at a compound annual growth rate of 6.3% from 2024 to 2030 to reach USD 1.52 billion by 2030.

b. Asia Pacific dominated the tension control market with a share of over 32.4% in 2023. This is attributable to the rapid industrialization and economic growth in countries like China, India, and Southeast Asian nations have driven significant demand for tension control solutions across various manufacturing sectors. The region's expanding packaging, textile, and electronics industries, which require precise tension management, have been major contributors to market growth

b. Some key players operating in the tension control market include Montalvo Corporation, Maxcess, Erhardt+Leimer, NIRECO, Double E Group, Federatie Medisch Specialisten, Re Controlli Industriali, Carolina Commerce Parkway, OWECON APS, Nexen Group, Inc, Dover Flexo Electronics, Inc., and Comptrol.

b. Key factors driving market growth include the automation in manufacturing, advancements in material science, growth in the packaging industry, and expansion of the e-commerce sector.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.