- Home

- »

- Consumer F&B

- »

-

THC Water Market Size, Share, Growth Analysis Report 2030GVR Report cover

![THC Water Market Size, Share & Trends Report]()

THC Water Market Size, Share & Trends Analysis Report By Flavor (Citrus, Berry, Tropical, Herbal), By Distribution Channel (Hypermarkets & Supermarkets, Specialty Stores, Online), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-417-1

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

THC Water Market Size & Trends

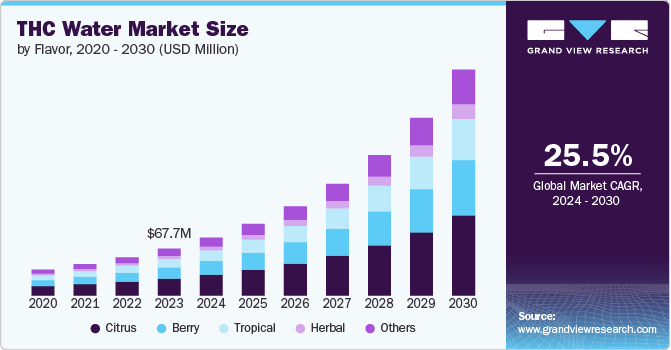

The global THC water market size was estimated at USD 67.7 million in 2023 and is expected to grow at a CAGR of 25.5% from 2024 to 2030. Increasing legalization and decriminalization of cannabis in various regions across the globe. As more states in the U.S. and countries worldwide loosen their cannabis regulations, the demand for THC-infused types, including THC water, is on the rise. Consumers are seeking alternative methods to consume cannabis that do not involve smoking, and tetrahydrocannabinol (THC) water offers a discreet and health-conscious option. In addition, the wellness trend that emphasizes natural and holistic health solutions is boosting the appeal of THC water, which is perceived as a healthier alternative to sugary edibles and high-calorie cannabis-infused beverages.

The shift in consumer preferences towards low-calorie, non-alcoholic beverages. With growing health consciousness, consumers are increasingly seeking alternatives to traditional alcoholic drinks, and THC water provides a novel option that aligns with their lifestyle choices. Another significant driver is the technological advancements in cannabis extraction and infusion techniques. These advancements have made it possible to create THC water with consistent dosing and improved bioavailability, ensuring a more predictable and effective consumer experience.

A notable trend in the tetrahydrocannabinol water market is the increasing popularity of microdosing. Consumers are looking for ways to enjoy the benefits of THC without the intense psychoactive effects, and microdosed THC water allows for precise control over intake. This trend is particularly appealing to new users who are cautious about trying cannabis types. In addition, the rise of e-commerce platforms dedicated to cannabis types is transforming the market. Online sales channels offer consumers a convenient and discreet way to purchase THC water, expanding the market reach and making it easier for brands to connect with their target audience.

Flavor Insights

The citrus-flavored THC water market accounted for a revenue share of 36.1% in 2023. Citrus-flavored THC water is dominating the global market due to a combination of consumer preferences, sensory appeal, and market trends that favor such flavors. Citrus-flavored THC water is dominating the global market due to a combination of consumer preferences, sensory appeal, and market trends that favor such flavors.

The berry-flavored THC water market is expected to grow at a CAGR of 25.9% from 2024 to 2030. Berry flavors are often associated with freshness, cleanliness, and a revitalizing effect. These attributes align well with the health-conscious image of THC water, which is marketed as a healthier alternative to traditional cannabis consumption methods and other THC-infused types. The perception of freshness and the natural essence of citrus make it a popular flavor choice for consumers looking for a refreshing beverage.

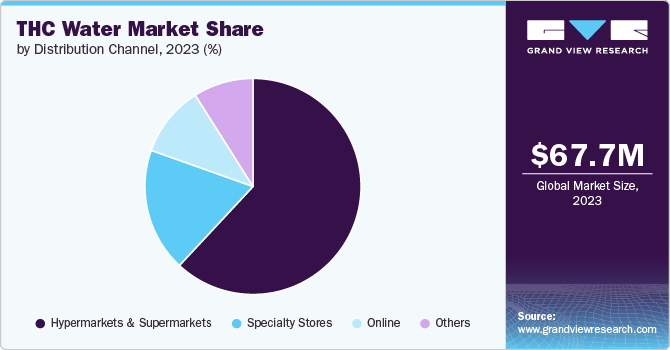

Distribution Channel Insights

Sales of THC water through hypermarkets & supermarkets accounted for a revenue share of 61.9% in 2023. Hypermarkets and supermarkets offer unmatched specialty for consumers. Shoppers can purchase THC water while doing their regular grocery shopping, eliminating the need for separate trips to specialized dispensaries or niche stores. This specialty encourages impulse buying and makes it easier for consumers to incorporate THC water into their routine shopping habits.

The demand for THC water through online retail channels is expected to grow with a CAGR of 34.2% from 2024 to 2030. Online retailers often offer competitive pricing and exclusive promotions that are not available in physical stores. Discounts, bundle deals, and loyalty programs can incentivize consumers to purchase THC water online. In addition, online platforms frequently provide detailed type descriptions, reviews, and ratings, helping consumers make informed decisions and feel confident in their purchases.

Regional Insights

North America THC water market accounted for a revenue share of 87.31% in 2023. The ongoing expansion of cannabis legalization across North America is a significant trend influencing the THC water market. As more states and provinces legalize both medical and recreational cannabis, the market for THC-infused types, including THC water, is growing rapidly. This legal expansion not only increases consumer access but also boosts market opportunities for new and established brands.

U.S. THC Water Market Trends

The THC water market in the U.S. is expected to grow at a CAGR of 23.3% from 2024 to 2030. There is a strong trend towards innovation in THC water formulations. Companies are experimenting with different flavors, including exotic and health-enhancing options such as citrus, berry blends, and herbal infusions. In addition, there is growing interest in combining THC with other beneficial ingredients, such as CBD, adaptogens, and vitamins, to create multifunctional beverages that cater to diverse consumer needs.

Europe THC Water Market Trends

Europe THC water market is expected to grow at a CAGR of 43.2% from 2024 to 2030. European consumers are increasingly drawn to wellness-oriented and functional beverages. THC water, which is often marketed as a health-conscious alternative to traditional cannabis consumption, aligns with this trend. The emphasis on natural ingredients, stress relief, and relaxation appeals to health-conscious consumers seeking holistic solutions.

Key THC Water Company Insights

Manufacturers in the THC water market are leveraging a variety of strategies to capitalize on the burgeoning demand for cannabis-infused beverages. These strategies are multifaceted, focusing on product innovation, strategic partnerships, marketing initiatives, and regulatory compliance to ensure a competitive edge in the evolving landscape.

Key THC Water Companies:

The following are the leading companies in the THC water market. These companies collectively hold the largest market share and dictate industry trends.

- CannaCraft Inc.

- Cann Social Tonics

- Keef Brands

- Bent Paddle Brewing Co.

- Drink Delta

- Sensi Co.

- Calexo

- Snapdragon Hemp

- WLD WTR

- Climbing Kites

Recent Developments

-

In May 2022, Los Angeles-based Calexo introduced Watercolors, a new line of cannabis-infused sparkling waters, along with a streetwear apparel collection. Watercolors are made with sparkling water, natural flavors, and nano-emulsified THC (5 mg per 12-ounce can). The precise dosing provides an uplifting and easy-to-control experience.

THC Water Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 83.4 million

Revenue forecast in 2030

USD 326.3 million

Growth rate (Revenue)

CAGR of 25.5% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Flavor, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S., Canada, Germany, UK, Netherlands

Key companies profiled

CannaCraft Inc.; Cann Social Tonics; Keef Brands; Bent Paddle Brewing Co; Drink Delta; Sensi Co.; Calexo; Snapdragon Hemp; WLD WTR; Climbing Kites.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global THC Water Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global THC water market report on the basis of type, flavor, distribution channel, and region.

-

Flavor Outlook (Revenue, USD Million, 2018 - 2030)

-

Citrus

-

Berry

-

Tropical

-

Herbal

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Specialty Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

Netherlands

-

-

Rest of the World

-

Frequently Asked Questions About This Report

b. The global THC water market size was estimated at USD 67.7 million in 2023 and is expected to reach USD 83.4 million in 2024.

b. The global THC water market is expected to grow at a compounded growth rate of 25.5% from 2024 to 2030 to reach USD 326.3 million by 2030.

b. The citrus-flavored THC water market accounted for a revenue share of 36.1% in 2023. Citrus-flavored THC water is dominating the global market due to a combination of consumer preferences, sensory appeal, and market trends that favor such flavors.

b. The global THC water market is characterized by the presence of numerous well-established players such as CannaCraft Inc., Cann Social Tonics, Keef Brands, Bent Paddle Brewing Co, Drink Delta, Sensi Co., Calexo, Snapdragon Hemp, WLD WTR, Climbing Kites, and others.

b. Increasing legalization and decriminalization of cannabis in various regions across the globe. As more states in the U.S. and countries worldwide loosen their cannabis regulations, the demand for THC-infused types, including THC water, is on the rise.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."