- Home

- »

- Alcohol & Tobacco

- »

-

THC Seltzers Market Size & Share, Industry Report, 2033GVR Report cover

![THC Seltzers Market Size, Share & Trends Report]()

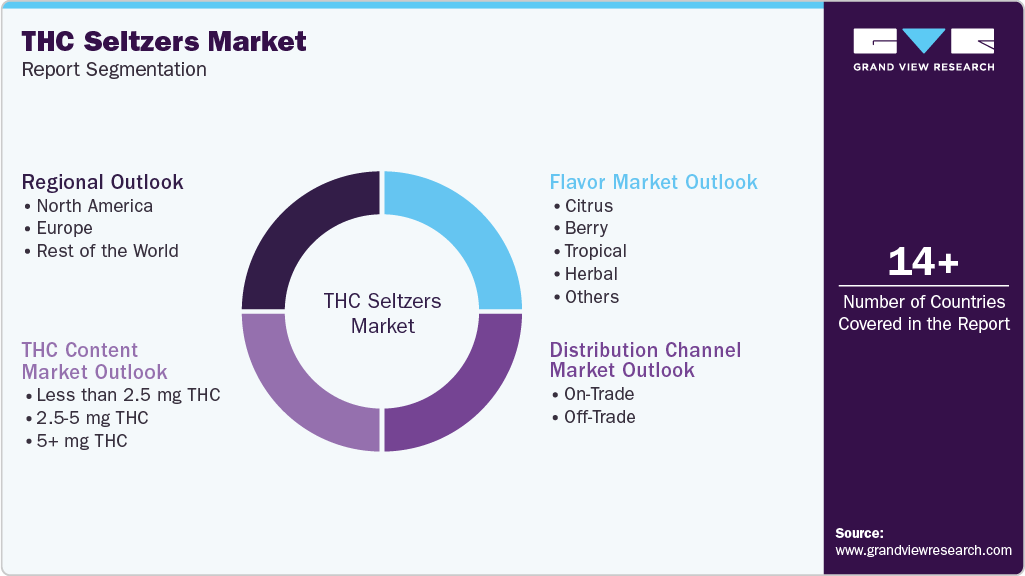

THC Seltzers Market (2025 - 2033) Size, Share & Trends Analysis Report By THC Content (Less than 2.5 mg THC, 2.5-5 mg THC, and 5+ mg THC), By Flavor (Citrus, Berry, Tropical, Herbal), By Distribution Channel (On-Trade, Off-Trade), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-425-3

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

THC Seltzers Market Summary

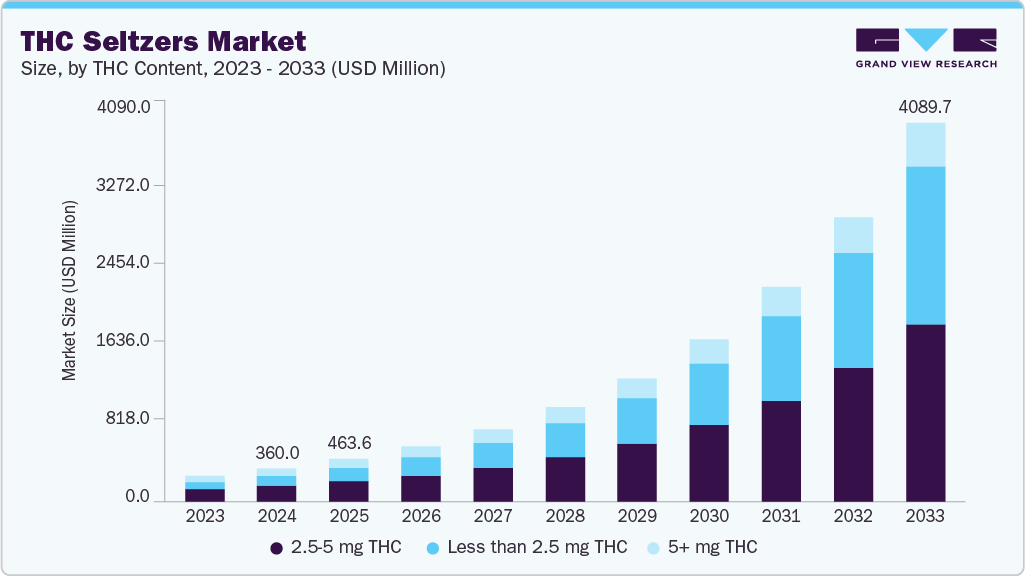

The global THC seltzers market size was valued at USD 360.0 million in 2024 and is projected to reach USD 4,089.7 million in 2033, growing at a CAGR of 31.3% from 2025 to 2033. As more jurisdictions decriminalize and regulate the sale and consumption of cannabis, the market for THC-infused products, including seltzers, expands significantly.

Key Market Trends & Insights

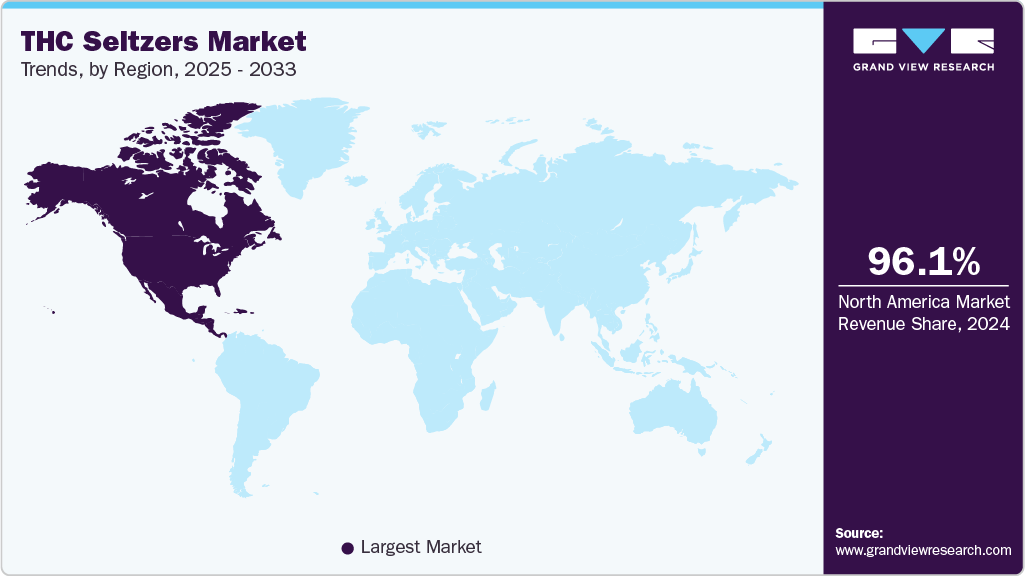

- North America dominated the global THC seltzers market in 2024 with a revenue share of 96.1%

- Europe is growing at the fastest CAGR of 41.6% in the forecast period.

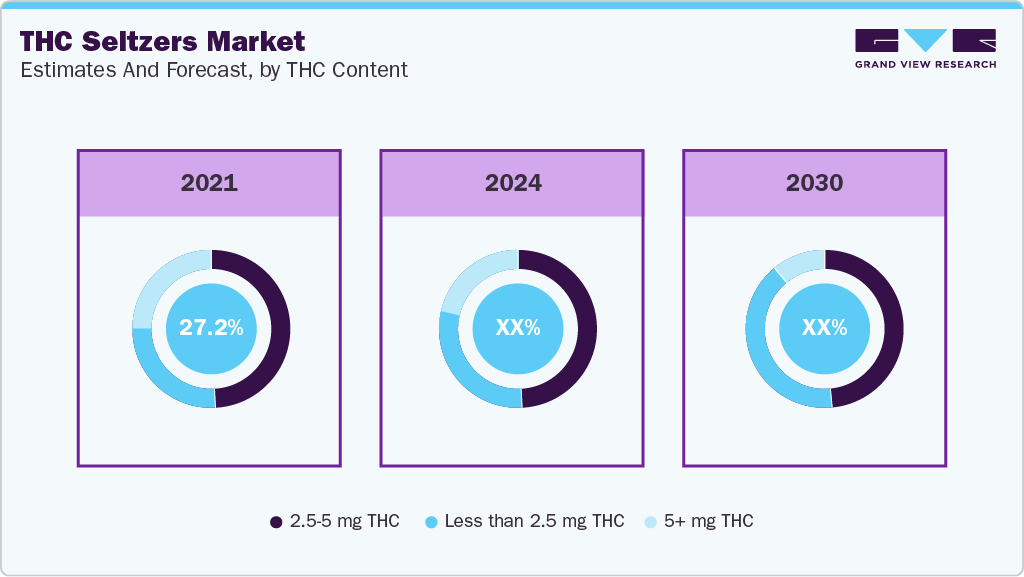

- Based on THC content, the 2.5-5 mg THC segment accounted for a share of 47.8% in 2024.

- Based on flavor, the citrus segment held a share of 35.7% in 2024.

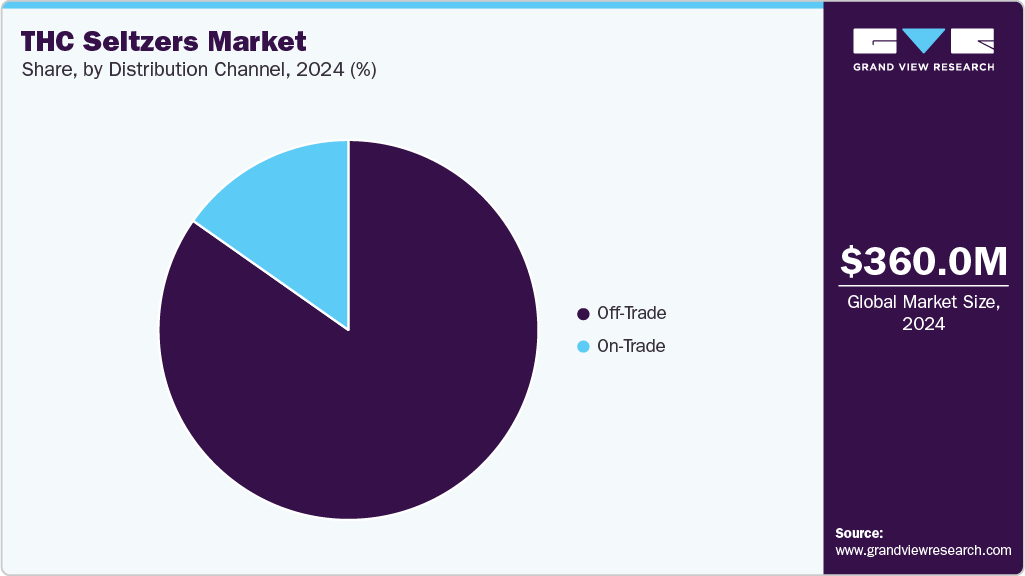

- By distribution channel, the off-trade segment dominated the market with a revenue share of 84.8% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 360.0 Million

- 2033 Projected Market Size: USD 4,089.70 Million

- CAGR (2025-2033): 31.3%

- North America: Largest market in 2024

This regulatory shift not only opens new markets but also normalizes cannabis consumption, reducing stigma and increasing consumer acceptance. Another critical driver is the growing consumer preference for healthier, low-calorie beverage alternatives. Traditional alcoholic beverages and sugary sodas are being shunned by health-conscious consumers who are increasingly seeking out drinks that align with their lifestyle choices. THC seltzers, which are typically low in calories and free from alcohol and added sugars, provide a healthier alternative that appeals to this demographic. A notable trend in the THC seltzer market is the emphasis on flavor innovation. Brands are continuously experimenting with a wide range of flavors to cater to diverse consumer preferences, from classic citrus and berry flavors to more exotic combinations like hibiscus and ginger. This focus on flavor variety not only attracts a broader audience but also keeps the product offerings fresh and exciting, encouraging repeat purchases.

For instance, in March 2025, NoDa Brewing Company, a Charlotte-based brewery, ventured into the cannabis industry with the launch of "Happy Bird," a line of hemp-derived THC-infused seltzers. These beverages are crafted using full-spectrum THC combined with natural ingredients, offering a refreshing alternative to traditional alcoholic drinks. Available in three flavors-Lavender Lemon, Grapefruit Hibiscus, and Tropical Lime-each can contain either 5mg or 10mg of THC. Notably, Happy Bird seltzers are free from alcohol, sugar, calories, gluten, and GMOs, catering to health-conscious consumers and those seeking non-alcoholic options.

Another significant trend is the rise of microdosing. Consumers are increasingly interested in consuming small, controlled amounts of THC to enjoy the benefits without the intense psychoactive effects. THC seltzers, with their precise dosing capabilities, provide an excellent medium for microdosing, making them appealing to both new users and those who prefer milder effects.

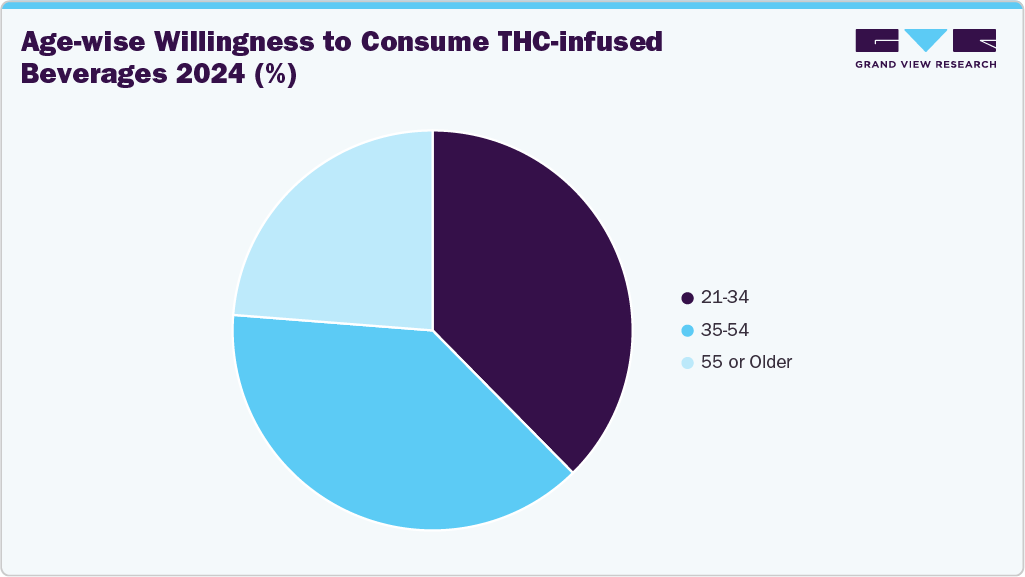

Consumer Insights for the THC Seltzers Market

In 2024, interest in THC-infused beverages spans across age groups, with the highest willingness to consume found among adults aged 35-54, who make up 38.7% of consumers. Close behind are younger adults aged 21-34 at 37.7%, highlighting strong demand among Millennials and older Gen Z. Notably, 23.6% of respondents aged 55 and older also expressed willingness to try THC beverages, indicating growing acceptance even among older demographics. This age distribution reflects a broadening appeal of THC drinks across generations, driven by an interest in wellness, relaxation, and alternatives to alcohol.

The THC seltzer market is rapidly evolving, driven by consumer preferences for low-dose, controlled cannabis experiences. Many consumers are opting for beverages that offer a mild and manageable dose of THC, with a preference for microdosing (2.5-5 mg per serving). This reflects a desire for relaxation and mild euphoria without intense psychoactive effects, particularly appealing to first-time users or those seeking a more balanced experience. As a result, THC seltzers are seen as an attractive alternative to alcohol, offering a way to unwind while staying in control of the experience.

Flavor innovation plays a central role in attracting consumers to THC seltzers. As taste remains a top priority, brands are expanding their flavor profiles beyond basic offerings, introducing a range of refreshing and exotic options such as hibiscus, ginger, and tropical fruits. This flavor experimentation caters to diverse palates and keeps consumers engaged.

The rise of influencer marketing and the increasing availability of THC seltzers through retail and online platforms have contributed to the product's mainstream acceptance. Social media influencers are playing a key role in normalizing cannabis consumption and broadening the appeal of THC seltzers, especially among younger audiences. THC-infused beverages, sometimes referred to as "gardening drinks" on social media, are catching the eyes of consumers looking for alternatives to alcoholic beverages.

THC Content Insights

2.5-5 mg THC content held the largest share, accounting for 47.8% of the global revenues in 2024. This dosage range offers a manageable experience that allows novices to explore THC without feeling overwhelmed, while providing seasoned users with a controlled, sessionable buzz suitable for social or daytime use. For instance, Curaleaf’s introduction of 2.5 mg hemp THC seltzers with fast-acting, low-calorie formulations and diverse flavors like Black Cherry and Grapefruit directly responds to consumer demand for light, refreshing THC beverages that fit into active lifestyles and wellness routines. Strategically, the 2.5-5 mg THC seltzers segment plays a pivotal role in expanding the market’s consumer base and fostering repeat purchases through sessionability and flavor variety. Consumers favoring this dosage can enjoy multiple servings over time without adverse effects, encouraging longer social occasions and brand loyalty.

Seltzers with less than 2.5 mg THC content are anticipated to grow at a CAGR of 35.6% from 2025 to 2033. The less than 2.5 mg THC seltzers segment benefits from the convergence of health-conscious consumer trends and regulatory normalization of cannabis. These seltzers offer a low-calorie, non-alcoholic alternative that fits within wellness lifestyles, providing relaxation without hangover risks or excessive intoxication. The segment's growth is also propelled by technological advances such as nanoemulsion, which improves THC bioavailability and ensures consistent dosing in beverages, making low-dose products more reliable and attractive to cautious consumers. This precision dosing is crucial in building consumer trust and expanding the market beyond traditional cannabis users to include those seeking functional, mild psychoactive experiences.

Flavor Insights

Citrus-flavored THC seltzers held the share of 35.7% in 2024. The dominance of citrus flavors is driven by the alignment of these tastes with broader beverage industry trends favoring light, low-calorie, and natural flavor profiles. Consumers increasingly prioritize health-conscious choices, and citrus flavors are often associated with freshness and vitality, reinforcing the perception of THC seltzers as a clean-label, functional alternative to sugary or alcoholic drinks. In addition, citrus flavors facilitate microdosing by providing a pleasant, subtle taste that does not overpower the mild THC effects, making them ideal for consumers who want to control psychoactive experiences without harsh flavor interference. This synergy between flavor appeal and dosing precision supports the segment’s strong market performance and projected growth.

Herbal THC seltzers are anticipated to grow at a CAGR of 35.2% in the forecast period, driven by the increasing consumer demand for products that blend cannabis with holistic wellness trends. Herbal flavors resonate with health-conscious users who associate these botanicals with stress relief, anti-inflammatory properties, and natural remedies, reinforcing THC seltzers as part of a self-care routine rather than just recreational use. This segment benefits from flavor innovation that leverages traditional herbal medicine and aromatherapy, creating a unique sensory experience that elevates the product beyond simple taste masking to functional beverage status.

Distribution Channel Insights

The sale of THC seltzers through the off-trade channel accounted for a share of over 84.8% of the global revenues in 2024. The off-trade segment benefits from a robust distribution network and competitive pricing strategies that appeal to a diverse consumer base. Online platforms provide detailed product information, customer reviews, and exclusive promotions such as bundle deals and loyalty programs, which enhance consumer confidence and incentivize repeat purchases. This digital accessibility complements physical retail presence, enabling consumers to shop based on convenience, price, and product variety. The combination of these factors supports the off-trade channel’s dominance and its projected sustained growth alongside the expanding legalization and normalization of cannabis products globally.

Sale of THC seltzers through the on-trade channel is anticipated to grow at a CAGR of 35.9% from 2025 to 2033. The on-trade segment’s growth is propelled by regulatory relaxation and evolving social attitudes that encourage cannabis consumption in public and semi-public settings. As cannabis normalization progresses, more hospitality venues are licensed or willing to serve THC-infused beverages, creating new distribution opportunities beyond traditional retail. This channel also benefits from direct consumer interaction, allowing brands to educate users on dosing, effects, and flavor profiles, which is critical for a relatively novel product category like THC seltzers.

Regional Insights

The North America THC seltzers market held a market share of 96.1% of the global revenue in 2024. North America’s dominance is driven by the strong health and wellness trend among consumers, who increasingly prefer low-calorie, non-alcoholic alternatives that deliver functional benefits without the negative effects of smoking or sugary edibles. THC seltzers, often marketed as low-calorie and free from artificial additives, resonate with younger, health-conscious demographics seeking discreet, manageable cannabis experiences. This alignment with lifestyle preferences fuels rapid growth in the U.S. market, supported by continuous flavor innovation and product diversification tailored to evolving consumer tastes. The combination of regulatory support, consumer trends, and distribution sophistication makes North America the pivotal growth engine in the global THC seltzers market.

U.S. THC Seltzers Market Trends

The U.S. THC seltzers market is expected to grow at a CAGR of 30.3% from 2025 to 2033, due to the early legalization framework, strong consumer awareness, and expanding retail infrastructure across key states such as California, Colorado, and Michigan. The U.S. market benefits from a well-developed cannabis ecosystem, enabling rapid product innovation, flavor diversification, and branding. Additionally, rising demand for low-sugar, alcohol-free alternatives among millennials and Gen Z consumers, along with the growing acceptance of cannabis-infused beverages for social and wellness use, has reinforced the country’s dominance in regional THC seltzer sales.

Europe THC Seltzers Market Trends

Europe THC seltzers market is expected to grow at a CAGR of 41.6% from 2025 to 2033. The region is witnessing a surge in legalization efforts and policy shifts that facilitate easier market entry and product distribution, particularly in countries like Germany and the Netherlands. This regulatory momentum is complemented by a growing middle class and heightened consumer awareness about cannabis’s therapeutic benefits, which together create fertile ground for THC seltzers to thrive. For instance, the rise of cannabis-friendly bars, cafes, and lounges across major European cities promotes communal consumption, normalizing THC use in social settings and driving revenue growth.

The THC seltzers market in Germany held a market share of 14.1% of the European market in 2024 due to the country’s progressive stance on cannabis regulation and growing consumer openness toward functional and wellness-oriented beverages. The partial legalization of recreational cannabis and increasing demand for alcohol alternatives have accelerated interest in THC-infused drinks. German consumers, particularly younger adults, are drawn to the category’s mild psychoactive effects, controlled dosing, and low-calorie appeal. Moreover, the expansion of retail partnerships and local production capabilities has strengthened Germany’s position as a leading European market for THC seltzers.

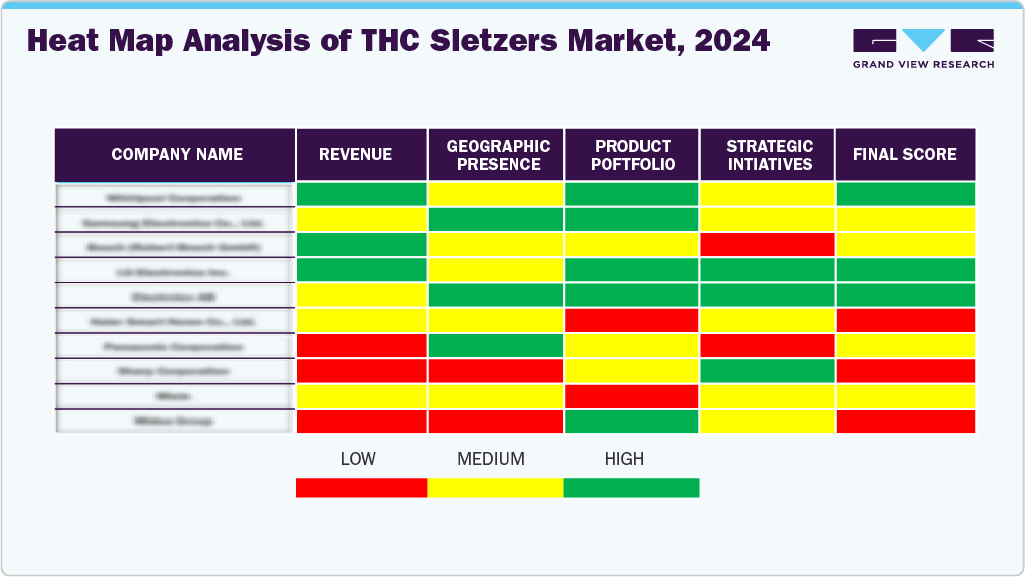

Key THC Seltzers Company Insights

Key companies in the THC seltzers industry primarily focus on innovation, flavor diversity, and health-centric offerings. They are investing in product development, strategic partnerships, and sustainable packaging to cater to evolving consumer preferences, expand their footprint, and strengthen competitiveness across regions.

Key THC Seltzers Companies:

The following are the leading companies in the THC seltzers market. Collectively, they hold the largest market share and dictate industry trends.

- Cann

- Pabst Brewing Company

- Crescent Distributions NC, LLC

- the drinkable company

- The Hi Collection

- WYNK

- Sacred Bloom

- Cheech & Chong’s Global Holdings

- 8TH Wonder

- Cantrip

Recent Developments

-

In April 2025, WYNK introduced THC-infused Seltzers in 4 new markets, including Kentucky, Wisconsin, Alabama, and Arkansas. The company partnered with various regional distributors to expand its product offerings.

-

In April 2025, Crosstown Brewing Co. introduced THC-infused, non-alcoholic seltzers under the brand name Orbit. These seltzers come in several THC strengths: 10 mg, 25 mg, and 50 mg per 12 oz. can, and are available in a variety of flavors, including Peach Tea and Blueberry Lemonade.

-

In February 2025, Curaleaf introduced THC Seltzers with a THC content of 2.5mg in delicious new flavors: Black Cherry, Grapefruit, and Watermelon, alongside the Original Berry flavors. The newly introduced THC Seltzers are available across major retailers and on-delivery services in selected states.

THC Seltzers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 463.6 million

Revenue Forecast in 2033

USD 4,089.7 million

Growth rate

CAGR of 31.3% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

THC content, flavor, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Netherlands; Germany; Rest of the World

Key companies profiled

Cann; Pabst Brewing Company; Crescent Distributions NC, LLC; the drinkable company; The Hi Collection; WYNK; Sacred Bloom; Cheech & Chong’s Global Holdings; 8TH Wonder; Cantrip

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global THC Seltzers Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segment from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global THC seltzers market on the basis of THC content, flavor, distribution channel, and region:

-

THC Content Market Outlook (Revenue: USD Million, 2021 - 2033)

-

Less than 2.5 mg THC

-

2.5-5 mg THC

-

5+ mg THC

-

-

Flavor Market Outlook (Revenue: USD Million, 2021 - 2033)

-

Citrus

-

Berry

-

Tropical

-

Herbal

-

Others

-

-

Distribution Channel Market Outlook (Revenue: USD Million, 2021 - 2033)

-

On-Trade

-

Off-Trade

-

Specialty Stores

-

Online

-

Others

-

-

-

Regional Market Outlook (Revenue: USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

Netherlands

-

-

Rest of the World

-

Frequently Asked Questions About This Report

b. The global THC seltzers market size was estimated at USD 360.0 million in 2024 and is expected to reach USD 463.6 million in 2025.

b. The global THC seltzers market is expected to grow at a compounded growth rate of 31.3% from 2025 to 2033 to reach USD 4,089.7 million by 2033.

b. The 2.5-5 mg THC seltzers market accounted for a revenue share of 47.8% in 2024. consumer preference for higher potency products. Consumers who have some experience with THC and are looking for a noticeable psychoactive effect tend to prefer beverages that contain a higher dosage

b. The global THC seltzers market is characterized by the presence of numerous well-established players such as Cann Social Tonics, Pabst Blue Ribbon (PBR) High Seltzer, Crescent Distributions, LLC, Power Biopharms, The Hi Collection, WYNK, Sacred Bloom, Cheech & Chong’s Global Holdings, 8TH Wonder, Cantrip and Others.

b. Increasing legalization of cannabis across various states in the U.S. and other regions globally. As more jurisdictions decriminalize and regulate the sale and consumption of cannabis, the market for THC-infused products, including seltzers, expands significantly

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.