- Home

- »

- Next Generation Technologies

- »

-

Set Top Box Market Size, Share And Growth Report, 2030GVR Report cover

![Set Top Box Market Size, Share & Trends Report]()

Set Top Box Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (IPTV, OTT), By Content Quality (HD & Full HD, 4K & Above), By Distribution Channel, By Application, By Operating System, By Region, And Segment Forecasts

- Report ID: 978-1-68038-752-0

- Number of Report Pages: 164

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Set Top Box Market Summary

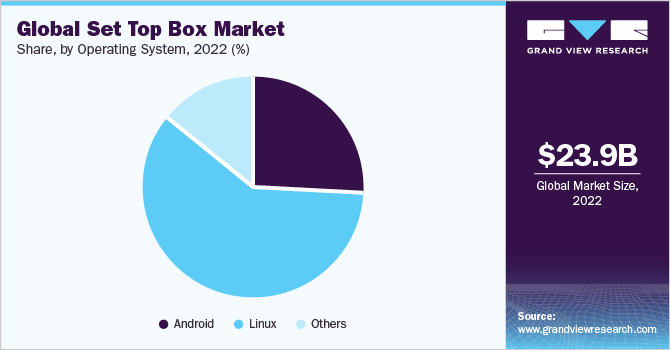

The global set top box market size was estimated at USD 23.98 billion in 2022 and is projected to reach USD 30.52 billion by 2030, growing at a CAGR of 3.0% from 2023 to 2030. Changing consumer behavior patterns toward the consumption of media content over television and internet amidst ongoing transitions in digital TV domain is a major factor in enhancing market outlook.

Key Market Trends & Insights

- Asia Pacific set top box market dominated with a revenue share of 32.94% in 2022.

- North America set top box market is anticipated to grow steadily from 2023 to 2030.

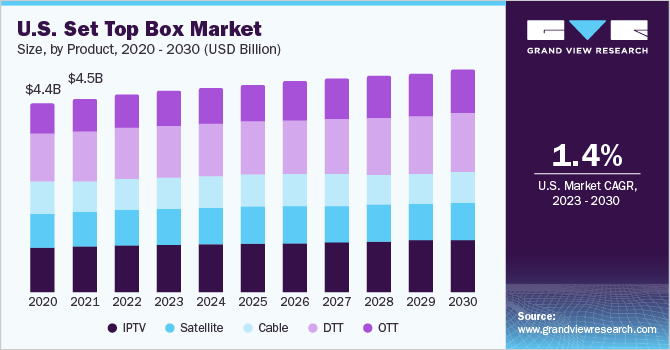

- By product, OTT segment is anticipated to exhibit a CAGR of around 6.0% from 2023 to 2030

- By content quality, 4K and above segment is projected to grow substantially between 2023 and 2030.

- By distribution channel, Offline segment captured a significant revenue share of over 75.0% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 23.98 Billion

- 2030 Projected Market Size: USD 30.52 Billion

- CAGR (2023–2030): 3.0%

- Asia Pacific: Largest market in 2022

Moreover, rising internet and broadband penetration coupled with increased preference for HD channels and on-demand video services is positively influencing the set top box market.

Global outbreak of COVID-19 pandemic transformed the media landscape amid technology proliferation and integration of digital technologies. This, in turn, urged market participants to adopt the latest technologies to replace the conventional settings. In 2022, KAONMEDIA and 3 Screen Solutions (3SS) launched next-generation TV services for Scandinavia on a hybrid KAON BCM72180 PVR (set-top box), an Android TV STB that supports DTH satellite, OTT, and IPTV, which was offered to over 1 million subscribers of Allente, a prominent TV distribution company in the Nordic region. Similarly, in November 2022, DISH Network L.L.C. unveiled a new offer that locks in subscription prices on 3-year plans and guarantees no increase in prices to attract new long-term customers.

Android STBs are gaining significant popularity as they offer enhanced and personalized experiences, featuring a robust app ecosystem, voice recognition, TV Input Framework (TVIF), and video conferencing. Multiple connectivity options, such as Wi-Fi, Ethernet, HDMI, and Bluetooth, are also playing a vital role in driving the demand for the latest STB models. Integration of advanced technologies, such as Bluetooth Low Energy (BLE), voice-enabled remote, and Full HD and 4K/8K resolution support, in the latest STB models to make them stand out against the conventional set top boxes, thereby contributing towards the growth of the industry.

Market Dynamics

GROWING ADOPTION OF SMART TVS AND SMART SET TOP BOX

On account of significant technological advancements in the OTT industry, the demand for higher-resolution pictures and improved-quality sound has increased. OTT services allow users to access HD-quality video content on their HD-ready TV sets and portable devices. With the emergence of innovative products, such as OLED TVs, 8K UHD TVs, and 3D smart interactive TVs, the global OTT devices and services market is expected to present significant opportunities for the market players over the forecast period. In March 2022, Technicolor Connected Home partnered with Bouygues Telecom, one of France’s prominent network service providers with over 26.2 million fixed and mobile subscribers, to develop and deploy a futureproof and premium Android 4K ultra-high-definition (UHD) STB integrated with the best-in-class Wi-Fi that delivers video experiences to consumers throughout the French market.

TV manufacturers are increasingly installing 8K into TVs throughout their product verticals. For instance, in 2019, Samsung Electronics launched QLED 8K TV in four sizes of 98, 82, 75, and 65 inches. These wide ranges of 8K sets are available at a price range between USD 1,500 to USD 8,500. Moreover, many smartphone manufacturing companies, such as Xiaomi Corporation and OnePlus Technology (Shenzhen) Co., Ltd., are entering the market with their low-cost and technologically advanced products.

Product Insights

OTT segment, based on product, is anticipated to exhibit CAGR of around 6.0% from 2023 to 2030, owing to ongoing technological advancements, allowing broadcasters to deliver improved sound quality and high-resolution picture quality. OTT platforms offer several enhanced features, including simplified payment methods, reduced time-to-content, and accessible time-shifted viewing. A significant surge in viewership across OTT platforms, such as Amazon Prime Video, Hulu, Disney+ Hotstar, and Netflix, is further contributing to segment’s growth.

Cable STBs segment is expected to capture a share of more than 23% in terms of volume by 2030 owing to increased adoption across emerging economies across Asia Pacific. Government mandates for cable digitization and benefits, such as increased channel carrying capacity, offered by cable TV are further driving the product demand. Having realized that cable TV remains the most popular platform, several cable service providers are improving their technology and service offerings. However, the adoption of cable TV has been dwindling over the past few years in line with the shifting consumer preference toward technologically advanced content viewing platforms.

Content Quality Insights

HD and Full HD segment is anticipated to capture a market share of around 91.0%, in terms of volume, by 2030 owing to increased demand driven by accessibility to a wider variety of channels than 4K counterpart. These STBs are gradually replacing conventional SD boxes as they offer improved sound and picture quality and exclusive channels. Besides, increased sales of smart TVs has also increased the demand for these set top boxes, thereby increasing segmental growth.

4K and above segment is projected to grow substantially between 2023 and 2030 owing to increased demand for high-resolution content and sharp picture quality offered by these STBs. Moreover, a favorable regulatory scenario encouraging the installation of set top boxes and large-scale digitization programs across various countries is expected to drive segmental growth. In the U.S., government authorities, such as the Federal Communications Commission (FCC), are pursuing favorable initiatives to support third-party STB manufacturers, thereby creating new growth opportunities for manufacturers of 4K STBs.

Distribution Channel Insights

Offline segment captured a significant revenue share of over 75.0% in 2022 owing to increasing sales through electronics retailers, independent TV dealers, stores, and distributors. Several consumers prefer to buy electronic products from brick-and-mortar stores as they can immediately check product quality and compare with other similar offerings, which leads to faster purchase decisions.

Online segment is estimated to record a CAGR of over 4.0% from 2023 to 2030 with increasing consumer preference for ecommerce platforms to buy electronic products. These platforms offer greater convenience, offers, discounts, and coupons, attracting a larger customer base. As a result, several companies offer STBs through other e-commerce platforms or their independent online sales channel.

Application Insights

Residential segment, by application, accounted for the largest market share of 88.1% in 2022. The segment’s growth can be accredited to high penetration of television sets in residential homes. Moreover, trend of entertainment via movies and TV shows can be met by set top boxes, thereby adding to segment demand in set top box market. In addition, the pandemic is anticipated to have increased this segment share as a number of people began installing set top boxes to keep themselves entertained during government-issued lockdowns.

Commercial segment is estimated to record a CAGR of 2.0% between 2023 and 2030 owing to an increasing adoption of set top boxes in restaurants, bars, and other establishments to host sports and movie screenings. Moreover, a cost-effective factor of using set-top boxes in commercial entities is expected to increase product demand further. Similarly, as set-top boxes offer multiple output ports, they can connect to multiple TVs, which in turn is expected to drive segmental demand as it offers scalability options to commercial business owners.

Operating System Insights

On basis of operating system, Linux accounted for a revenue share of nearly 60.0% in 2022. This can be attributed to open-source nature of Linux operating system that allows manufacturers to cut costs by easy implementation. Moreover, as Linux is highly customizable, manufacturers are compelled to use it to develop set top boxes with custom smart features to attract users.

Android segment is expected to observe a CAGR of over 4.0% from 2023 to 2030.This can be attributed to trend of OTT and video sharing platforms whose applications can be downloaded and run on Android-based set top boxes. Besides, trend of smart TVs is also expected to drive segmental growth as Android-based set top boxes offer smart features and options without needing a smart TV.

Regional Insights

Asia Pacific region accounted for a considerable revenue share of over 44.0% in 2022, owing to rising consumption of media and entertainment content, especially among the middle-class population in this region. Rising consumer demand for technologically advanced solutions providing high quality, functionality, and affordable pricing is creating lucrative opportunities for set top box market. As a result, several prominent players, including Kaonmedia Co. Ltd. and Huawei Technologies Co., Ltd are aggressively integrating latest technologies, such as Bluetooth, motion sensors, and Virtual Reality into their products.

North America set top box market is expected to record a CAGR of nearly 3.0% in terms of demand, from 2023 to 2030. Set top box market in North America is relatively saturated as number of households have already installed such devices. It serves as a prominent hub for emerging Internet-based set top boxes, such as IPTV and OTT, featuring customizable configurations and high-quality video and sound content transmission. Moreover, growing prominence of global OTT service providers, such as Netflix, Star TV Network, and Amazon Prime Video, is also favoring the market expansion.

Key Companies & Market Share Insights

Several major players in set top box market are focusing on technological developments, new product launches and strategic collaborations to strengthen their market position. They are introducing Artificial Intelligence (AI) in set top boxes to provide personalized services, cut the backend server costs, reduce human interference, and utilize available bandwidth effectively.

They are also integrating voice recognition technology for channel control, issuing other commands for services, including weather and music, and enhancing digital signal strength. For instance, in February 2023, ADB launched Cheetah, a multi-gigabit XGS-PON Wi-Fi 7 gateway equipped with all the key benefits of Wi-Fi 7, including 4k-QAM modulation, 320MHz ultra-wide channel, Preamble Puncturing, and Multi-Link Operation. This latest solution provides Wi-Fi with ultra-low latency, extremely high throughput of up to 19 Gbps, and increased capacity through the most efficient use of spectrum. Some of the prominent players in global set top box market include:

-

Advance Digital Broadcast (ADB)

-

Commscope (ARRIS International, plc)

-

Coship Electronics Co.Ltd.

-

Echostar Corporation

-

Huawei Technologies Co., Ltd

-

KaonMedia

-

Sagemcom SAS

-

Samsung Electronics Co. Ltd.

-

Technicolor SA

-

LG CNS Co., Ltd

Recent Developments

-

In August 2023, Reliance Jio announced launch of Jio set top box (STB) along with introduction of Jio Smart Home Services and Jio Router at Reliance Jio 46th Annual General Meeting (AGM). Jio STB is anticipated to offer various services including TV channel streaming, games, streaming platforms, and applications like JioCinema and JioTV+ among others.

-

In September 2022, a European set top box manufacturer - Vestel, announced the launch of its 4K ultra-high definition (UHD) 97XX series STB product. The STB product is expected to enhance consumer’s entrainment experience and features a compact minimalist design.

Set Top Box Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 24.79 billion

Revenue forecast in 2030

USD 30.52 billion

Growth rate

CAGR of 3.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

June 2023

Quantitative units

Volume in thousand units, Revenue in USD billion, and CAGR from 2023 to 2030

Report coverage

Revenue and demand forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, content quality, distribution channel, application, operating system, region.

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Benelux; Nordic Countries; Russia; China; India; Japan; South Korea; Australia; Indonesia; Thailand; Mexico; Brazil; Argentina; Saudi Arabia; UAE; Egypt; South Africa; Nigeria

Key companies profiled

Commscope; Kaonmedia Co., Ltd.; Coship Electronics Co. Ltd.; Huawei Technologies Co., Ltd; Technicolor SA; Sagemcom SAS; Advanced Digital Broadcast (ADB); Samsung Electronics Co. Ltd.; Echostar Corporation; LG CNS Co., Ltd.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Set Top Box Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global set top box market report based on product, content quality, distribution channel, application, operating system, and region:

-

Product Outlook (Volume, Thousand Units; Revenue, USD Billion, 2018 - 2030)

-

IPTV

-

Satellite

-

Cable

-

DTT

-

OTT

-

-

Content Quality Outlook (Volume, Thousand Units; Revenue, USD Billion, 2018 - 2030)

-

HD & Full HD

-

4K and Above

-

-

Distribution Channel Outlook (Volume, Thousand Units; Revenue, USD Billion, 2018 - 2030)

-

Offline

-

Online

-

-

Application Outlook (Volume, Thousand Units; Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Commercial

-

-

Operating System Outlook (Volume, Thousand Units; Revenue, USD Billion, 2018 - 2030)

-

Android

-

Linux

-

Others

-

-

Regional Outlook (Volume, Thousand Units; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Benelux

-

Nordic Countries

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Thailand

-

-

Latin America

-

Mexico

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

Egypt

-

South Africa

-

Nigeria

-

-

Frequently Asked Questions About This Report

b. The global set top box market size was valued at USD 23.98 billion in 2022 and expected to reach USD 24.79 billion in 2023.

b. The global set top box market is expected to grow at a compound annual growth rate of 3.0% from 2023 to 2030 to reach USD 30.54 billion by 2030.

b. The DTT STBs dominated the set-top box market in 2022, accounting for over 24.0% of the demand that year, and are expected to retain their dominance till 2030 as well.

b. Some key players operating in the STB market include Commscope; Kaonmedia Co., Ltd.; Coship Electronics Co. Ltd.; Huawei Technologies Co., Ltd; Technicolor SA; Sagemcom SAS; Advanced Digital Broadcast (ADB) and Samsung Electronics Co. Ltd.

b. Key factors that are driving the STB market growth include the rising adoption of internet and broadband services coupled with the widespread availability of on-demand video services and HD channels.

b. The HD and Full HD segment is anticipated to dominate the STB market with a volume and revenue share of more than 90% over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.