- Home

- »

- Medical Devices

- »

-

Therapeutic Respiratory Devices Market Size Report, 2030GVR Report cover

![Therapeutic Respiratory Devices Market Size, Share & Trends Report]()

Therapeutic Respiratory Devices Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Nebulizer, Humidifiers), By Technology (Electrostatic Filtration, HEPA Filter Technology), By Filter, By Region, And Segment Forecasts

- Report ID: 978-1-68038-488-8

- Number of Report Pages: 144

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Therapeutic Respiratory Devices Market Summary

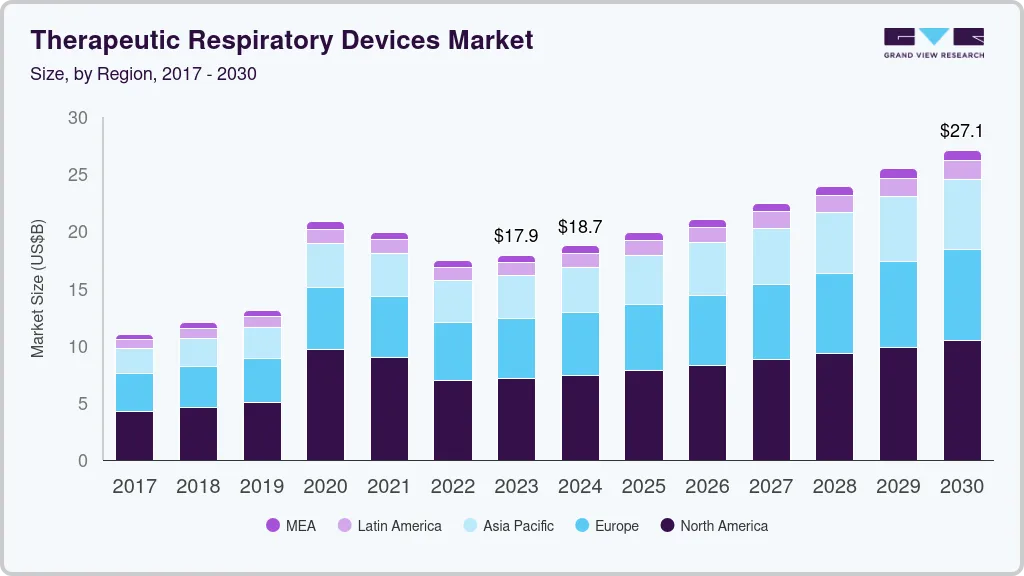

The global therapeutic respiratory devices market size was estimated at USD 12.5 billion in 2023 and is projected to reach USD 18.4 billion by 2030, growing at a CAGR of 5.8% from 2024 to 2030. The growth of the market is primarily driven by the rising prevalence of respiratory diseases, including cystic fibrosis, COPD, lung cancer, and asthma.

Key Market Trends & Insights

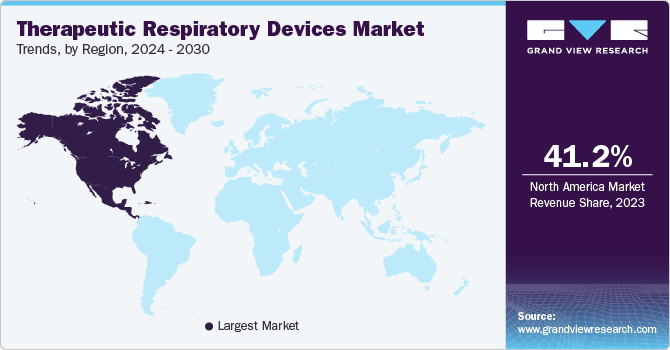

- North America dominated the market and accounted for a revenue share of 41.2% in 2023.

- The U.S. held a substantial share of the market in 2023.

- By product, the oxygen concentrators segment dominated the market with the largest share of 29.3% in 2023.

- By texhnology the, electrostatic filters segment dominated the market, with the largest share of 35.7% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 12.5 Billion

- 2030 Projected Market Size: USD 18.4 Billion

- CAGR (2024-2030): 5.8%

- North America: Largest market in 2023

In addition, government initiatives and the introduction of advanced products by market players further support market expansion. For instance, in July 2022, OMRON Healthcare launched a portable oxygen concentrator using Pressure Swing Adsorption (PSA) technology. This device delivers high-purity oxygen (>90%) at a rate of 5 liters per minute by filtering out unwanted molecules from the air, such as nitrogen and argon.The integration of AI with respiratory devices is also expected to contribute to the growing efficacy and demand of the therapeutic respiratory devices. For instance, in November 2023, the U.S. startup, Samay, presented clinical findings demonstrating the efficacy of its Sylvee wearable technology in accurately diagnosing COPD and forecasting critical exacerbations before onset. The company reported that its AI-supported device successfully identified "air trapping," a key early indicator of COPD exacerbations, with an accuracy of 83%. This performance was compared to traditional hospital-based Pulmonary Function Tests (PFTs), which utilize in-person spirometry, plethysmography, or CT scans.

The global COVID-19 pandemic had a favorable impact on the sales of therapeutic respiratory devices. While many non-essential operations, such as regular patient-doctor visits, elective surgeries, and screenings, were canceled or delayed due to regional and national shelter-in-place orders, connected care businesses saw a significant boost due to the unexpected surge in demand. This situation certainly benefited prominent market companies.

For instance, Philips N.V., a notable player in the industry, reported in its 2020 annual report that the pandemic impacted every aspect of its business in the first half of 2020. However, the connected care segment, including its ventilator portfolio, experienced exceptional growth driven by COVID-19-related demands. This surge led to Philips delivering a 3% comparable sales growth and generating a strong cash flow of EUR 1.9 billion.

Furthermore, a significant factor anticipated to drive the growth of the market in the near future is the rising demand for therapeutic respiratory devices in home healthcare applications. Home healthcare devices have been gaining popularity and market share in recent years. The convenience and efficiency of using these devices at home contribute to their increasing adoption.

The introduction of therapeutic respiratory devices specifically designed for home healthcare is another area of interest for both established global manufacturers and emerging vendors. For instance, in October 2021, Movair, a respiratory therapy corporation previously known as International Biophysics Corporation, announced the U.S. commercial introduction of Luisa-an innovative ventilator designed for use in homes, hospitals, and institutions, or for portable applications in both invasive and noninvasive ventilation. This product highlights the trend towards developing versatile, user-friendly devices that cater to the needs of patients outside traditional clinical settings.

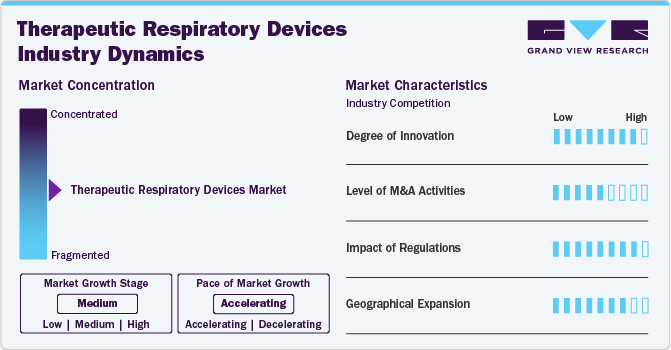

Market Concentration & Characteristics

The degree of innovation in the therapeutic respiratory devices market is high. Technological innovation in respiratory therapeutic devices includes advancements in portable ventilators, smart inhalers, and AI-driven monitoring systems. These innovations enhance patient compliance, provide real-time data for personalized treatment, and improve overall respiratory care outcomes. For instance, in February 2024, ResMed launched AirCurve 11 series of bilevel positive airway pressure devices in the U.S. The product designed with integrated digital technology, aim to support providers treat sleep apnea and help patients in starting and maintaining therapy.

The level of M&A activities in the market is high, enable companies to expand geographically, financially, and technologically. For instance,in April 2024, Clario announced the acquisition of a technology firm, ArtiQ. This move broadens the integration of AI within Clario's Respiratory Solutions offerings and strengthens the firm's capacity to innovate and incorporate AI throughout its services.

The impact of regulations is moderate to high in the industry. The industry involves several digital technologies, including AI and ML. It is regulated by different bodies in different countries. The U.S. FDA regulates the respiratory devices, along with other medical devices in the U.S.

Geographic expansion significantly drives the market by increasing market penetration and revenue, enabling access to diverse resources, and fostering regulatory compliance and standardization. For instance, in April 2022, CAIRE, Inc. planned to expand its oxygen portfolio in Brazil with Companion 5 and New Life Intensity 10 stationary oxygen concentrators. The COVID-19 pandemic created a shortage of oxygen across Latin America, providing an opportunity for the company to grow its oxygen therapy portfolio.

Product Insights

Oxygen concentrators segment dominated the market with the largest share of 29.3% in 2023. Growing demand for home oxygen therapy, rising incidence of respiratory diseases, rapid growth in the aging population, high tobacco consumption, and technological advancements in respiratory devices are some of the reasons driving the segment. In April 2023, OxyGo announced the launch of OxyHome 5L Stationary Concentrator, specifically designed to provide continuous oxygen flow of up to 5 liters per minute for use at home. The compact size and small footprint of the device make it a perfect fit for home environments, and the sleek design ensures that it is user-friendly. Moreover, OxyHome 5L operates quietly, allowing users to continue with their daily activities without any disruptions.

Capnographs segment is expected to grow at the fastest CAGR during the forecast period. The market growth of capnography is expected to be driven by technological advancements, increasing prevalence of respiratory diseases, and supportive government initiatives. The industry has also seen a rise in the number of startups seeking opportunities, leading to intense competition. As an example, in May 2020, Koninklijke Philips and Masimo entered into a licensing deal that allowed Philips to incorporate additional Masimo measurement technologies, such as NomoLine Capnography & O3 Regional Oximetry, into a subset of IntelliVue MX-series multi-parameter monitors. Furthermore, in March 2020, Masimo acquired TNI Medical AG, a German company.

Technology Insights

Electrostatic filters segment dominated the market, with the largest share of 35.7% in 2023. Electrostatic filters provide effective microbial removal and offer low airflow resistance. Regulatory bodies & healthcare organizations may recommend or mandate the use of respiratory devices with advanced filtration technologies, including electrostatic filtration. This has influenced the demand for such devices in healthcare facilities. In addition, the manufacturers are focusing on developing respiratory devices with advanced electrostatic filtration capabilities. They are investing in research & development to enhance filtration efficiency, durability, and user-friendliness, providing devices with superior air filtration performance. This is expected to drive the segment growth over the forecast period.

Microsphere separation segment is expected to grow at the fastest CAGR over the forecast period. The demand for microsphere separation in respiratory devices is driven by the need for clean & particle-free air or gas delivery to patients. It is crucial to ensure the safety of patients using respiratory devices. The removal of microspheres helps prevent the inhalation of potentially harmful particles, reducing the risk of respiratory complications and adverse health effects. In addition, it ensures that the therapeutic agents or medications delivered through the respiratory device are not contaminated or compromised by microspheres, thus optimizing treatment outcomes.

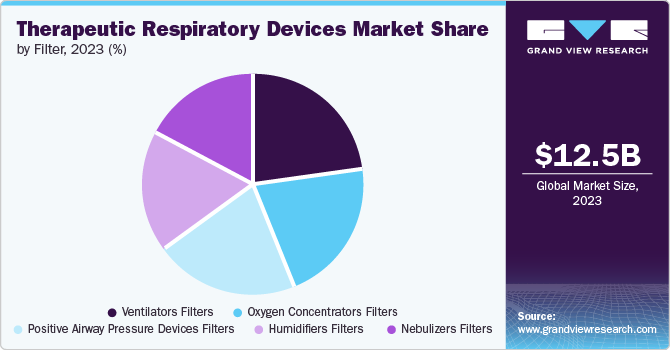

Filter Insights

Ventilator filters segment dominated the market with the largest share in 2023. Ventilator filters are crucial for preventing the spread of infectious diseases in healthcare settings. The COVID-19 pandemic has significantly increased the demand for these filters due to the heightened need for ventilators and respiratory support. In addition, the rise in respiratory disorders is expected to further drive market growth, creating new opportunities in the ventilator filters market.

Humidifier filters segment is expected to grow at the fastest CAGR over the forecast period. This growth is driven by the factors such as increased demand for humidifiers in hospitals, schools, homes, and healthcare facilities. These filters are essential to prevent the growth of molds, mildew, fungi, and bacteria in circulating air. The rising prevalence of airborne infections, such as tuberculosis, further boosts the need for filters in humidifiers. In addition, humidifiers help protect against environmental dryness, and growing awareness of conditions like asthma, sinusitis, and allergies is expected to increase demand for humidifier equipment, thereby driving the humidifier filters market.

Regional Insights

North America dominated the market and accounted for a revenue share of 41.2% in 2023. The increasing prevalence of respiratory conditions and technological advancements in respiratory devices, such as portable and compact models with enhanced features is driving the market in the region. According to an article published by the American Lung Association in February 2023, over 34 million U.S. individuals suffer from chronic lung diseases, including COPD, asthma, chronic bronchitis, and emphysema.

U.S. Therapeutic Respiratory Devices Market Trends

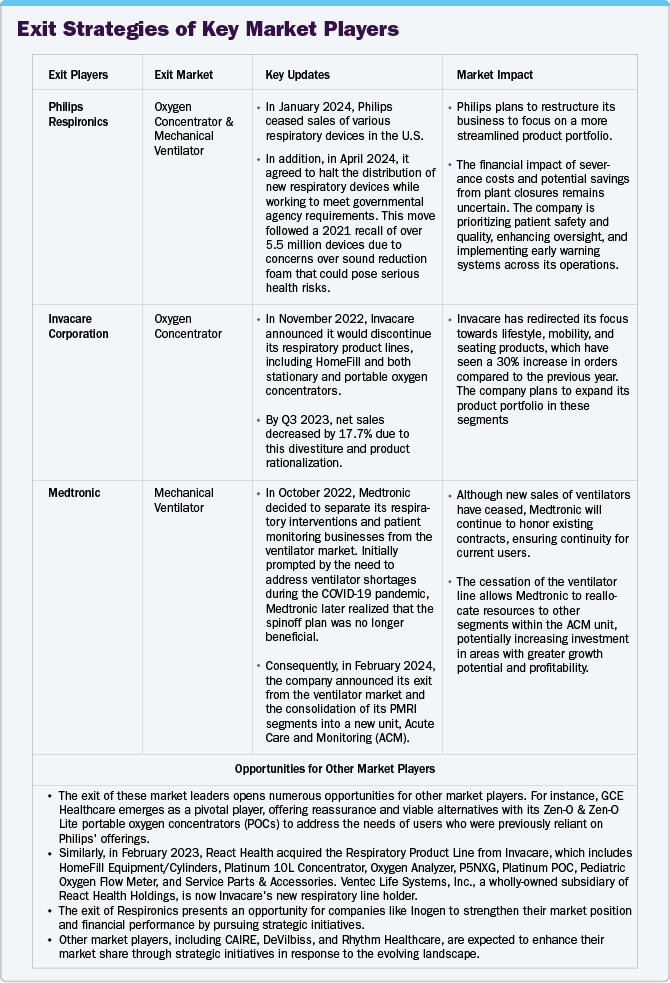

The U.S. held a substantial share of the market in 2023. Key market players, such as GE Healthcare; CAIRE, Inc.; Koninklijke Philips N.V.; Invacare, Medtronic, and React Health, are employing strategies, such as acquisitions, collaborations, expansions, & new product launches, to extend their product offerings and geographical reach. For instance, React Health’s acquisition of Invacare’s Respiratory line in February 2023 strengthened its market position, expanded its product portfolio, and enabled it to cater to a wider customer base.

Europe Therapeutic Respiratory Devices Market Trends

The market in Europe is expected to be driven by the speedy approval of medical oxygen concentrator reimbursement in the European region. For instance, in January 2023, Inogen, Inc. received European Medical Device Regulation (EU MDR) certification from the British Standards Institution (BSI), its Notified Body. This certification supports the company’s portable oxygen concentrator products in the U.S. and EU markets.

Therapeutic respiratory devices market in Switzerland is expected to be driven by the rising prevalence of chronic respiratory diseases in the country. For instance, as per the data published by WHO, in 2020, asthma-related deaths in Switzerland reached 95 or 0.16% of total deaths, and overall lung disease deaths in the country reached 2,902 or 5.01% of total deaths. Thus, the growing demand for respiratory devices in the country is expected to fuel the market over the forecast period.

Therapeutic respiratory devices market in Germany held a substantial market share in 2023. The rising number of sleep apnea patients and the availability of reimbursement coverage in Germany can be attributed to market growth in Germany. In addition, enhanced patient compliance and a high prevalence of respiratory diseases are expected to have a positive impact on the market. For instance, as per the National Institute of Health Research (NIHR), the prevalence of COPD in Germany was around 2.7 million in 2019. Thus, the presence of a large patient pool is expected to increase the demand for therapeutic respiratory devices and drive the market in Germany.

Asia Pacific Therapeutic Respiratory Devices Market Trends

The market in the Asia Pacific is expected to witness the fastest growth rate during the forecast period, owing to the rising demand for medical oxygen concentrators in ambulatory surgical centers, hospitals, and home healthcare settings. Moreover, some companies have launched cost-effective and reliable portable oxygen concentrators that can be easily carried by patients, enabling them to move around and perform daily activities while receiving oxygen therapy. For instance, in November 2022, the Bolivian government selected CANTA oxygen concentrators to supply La Paz, the highest capital city in the world. This decision was based on the quality and reliability of the CANTA oxygen concentrators. Canta Medical is a China-based manufacturer and provider of respiratory equipment, oxygen concentrators, & hyperbaric oxygen chambers. Its products have been exported to over 120 countries across Asia, Europe, the Americas, and Africa.

Therapeutic respiratory devices market in Japan held a substantial share in 2023. Japan has one of the world’s fastest-aging populations, which has led to increased investment in healthcare infrastructure, developing new technologies, and improving access to care. Furthermore, nebulizers, oxygen concentrators, ventilators, and other respiratory devices are in high demand due to the increasing prevalence of respiratory diseases. Hay fever is Japan’s most common respiratory allergy, caused by the spread of cedar pollen. According to an article published by Firstpost., in May 2023, hay fever affected an estimated 40% of the Japanese population. As a result, the market for therapeutic respiratory devices in Japan is anticipated to grow as the number of individuals with respiratory conditions increases.

Therapeutic respiratory devices market in India is expected to be driven by strategic pricing by the market players. Players adopt competitive pricing as one of their primary strategies in the market. In April 2021, Koninklijke Philips N.V. announced a 7% price reduction in its oxygen concentrators in India. This move passed the benefits of custom duty reduction by the government to customers, reducing the MRP of its products. As of April 2021, the MRP of the company’s oxygen concentrator was INR 68,120 (USD 940), decreasing from INR 73,311 (USD 1,012).

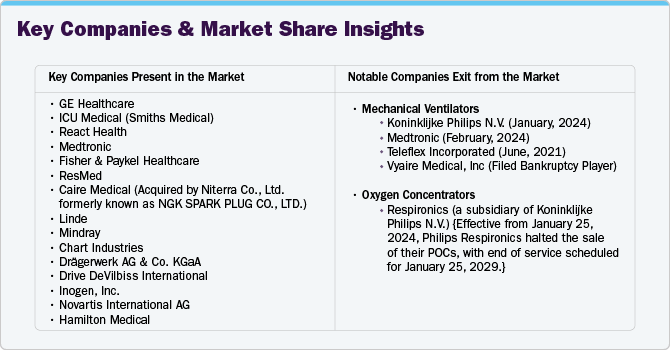

Key Therapeutic Respiratory Devices Company Insights

The market is dominated by prominent players, such as GE Healthcare, Medtronic, CAIRE, Inc. (NGK SPARK PLUG CO., LTD.), andMedtronic among others. These key players implement strategies such as mergers and acquisitions as well as new product launches to expand their market share. For instance, in June 2022, CAIRE launched a portable oxygen concentrator in the U.S.-LifeStyle-to significantly improve the quality of life of oxygen users across the country.

Recent Developments & Strategies:

-

In April 2024, Royal Philips, initiated the establishment of an additional R&D center within its Healthcare Innovation Center (HIC) in Maharashtra, underscoring India's increasing significance in global healthcare innovation. This new facility, set to be functional within two years, will house R&D units dedicated to Sleep & Respiratory Care, Precision Diagnosis, Image Guided Therapy, and Monitoring.

-

In February 2023, React Health successfully acquired Invacare's respiratory line. This strategic acquisition would enable React Health to further enhance its position in the market and expand its product portfolio to cater to a broader range of customers.

-

In January 2023, Inogen, Inc. announced that it achieved key regulatory milestones in the U.S. and Europe to strengthen its portable oxygen concentrator products. This accomplishment signifies Inogen's continued commitment to meeting regulatory requirements and underscores the company's focus on ensuring its products meet the highest standards of quality and safety.

-

In January 2023, Getinge launched its latest mechanical ventilator, the Servo-c, which provides lung-protective therapeutic capabilities for pediatric and adult patients. The Servo-c utilizes modular parts, facilitating intelligent fleet management. This ensures optimal uptime and reduces costs, eliminating the necessity for proprietary disposables. Moreover, the Servo-c is equipped with CO2 monitoring and Servo Compass technology.

-

In June 2022, GE Healthcareintroduced its new remote patient monitoring system, Portrait Mobile, which monitors respiration rate, oxygen saturation, and pulse rate. This new launch would help increase the company’s product portfolio.

Therapeutic Respiratory Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 13.2 billion

Revenue forecast in 2030

USD 18.4 billion

Growth rate

CAGR of 5.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, filter, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; Spain; France; Italy; Sweden; Denmark; Norway; China; India; Japan; Australia, South Korea, Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

GE Healthcare; Koninklijke Philips N.V.; ICU Medical (Smiths Medical); Invacare Corporation; React Health; Medtronic; Fisher & Paykel Healthcare; ResMed; CAIRE, Inc. (NGK SPARK PLUG CO., LTD.); Linde; Mindray; Chart Industries; Drägerwerk AG & Co. KGaA; Drive DeVilbiss International; Inogen, Inc., Novartis International AG; Hamilton Medical.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Therapeutic Respiratory Devices Market Report Segmentation

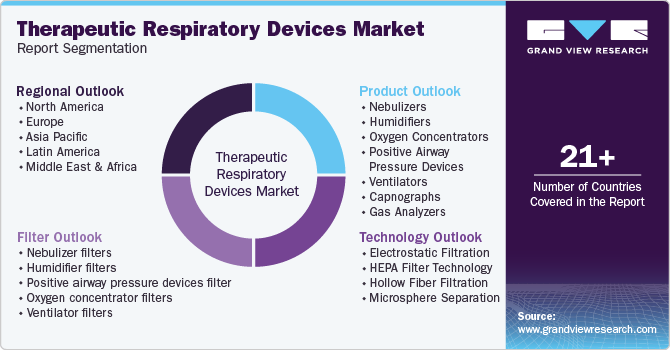

This report forecasts revenue growth and provides at global, regional, and country levels an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global therapeutic respiratory devices market report based on product, technology, filter, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Nebulizers

-

Compressor-based Nebulizers

-

Piston based hand held nebulizer

-

Ultrasonic Nebulizer

-

-

Humidifiers

-

Heated Humidifiers

-

Passover Humidifiers

-

Integrated Humidifiers

-

Built-In Humidifiers

-

Stand-alone Humidifiers

-

-

Oxygen Concentrators

-

Fixed Oxygen Concentrators

-

Portable Oxygen Concentrators

-

-

Positive Airway Pressure Devices

-

Continuous Positive Airway Pressure Devices

-

Auto-titrating Positive Airway Pressure Devices

-

Bi-level Positive Airway Pressure Devices

-

-

Ventilators

-

Adult Ventilators

-

Neonatal Ventilators

-

-

Capnographs

-

Gas Analyzers

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Electrostatic Filtration

-

HEPA Filter Technology

-

Hollow Fiber Filtration

-

Microsphere Separation

-

-

Filter Outlook (Revenue, USD Million, 2018 - 2030)

-

Nebulizer filters

-

Inlet filter

-

Replacement filter

-

Cabinet filter

-

-

Humidifier filters

-

Wick filters

-

Permanent cleanable filters

-

Mineral absorption pads

-

Demineralization cartridges

-

-

Positive airway pressure devices filter

-

Ultra-fine foam inlet filters

-

Polyester non-woven fiber filters

-

Acrylic & Polypropylene fiber filters

-

-

Oxygen concentrator filters

-

HEPA Filter

-

Cabinet Filter

-

Pre-Inlet Filter

-

Inlet Filter

-

Micro Disk Filter

-

Felt Intake Filter

-

Bacterial Filter

-

Hollow-membrane Filter

-

-

Ventilator filters

-

Mechanical filters

-

HEPA Filters

-

ULPA Filters

-

Activated Carbon Filters

-

-

Electrostatic filters

-

Tribocharged Filters

-

Fibrillated Filters

-

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

Switzerland

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global therapeutic respiratory devices market is expected to grow at a compound annual growth rate of 5.8% from 2024 to 2030 to reach USD 18.4 billion by 2030.

b. North America dominated the therapeutic respiratory devices market with a share of 41.2% in 2023. The increasing prevalence of respiratory conditions and technological advancements in respiratory devices, such as portable and compact models with enhanced features is driving the therapeutic respiratory devices market in the region.

b. Some key players operating in the therapeutic respiratory devices market include GE Healthcare; Koninklijke Philips N.V.; ICU Medical (Smiths Medical); Invacare Corporation; React Health; Medtronic; Fisher & Paykel Healthcare; ResMed; CAIRE, Inc. (NGK SPARK PLUG CO., LTD.); Linde; Mindray; Chart Industries; Drägerwerk AG & Co. KGaA; Drive DeVilbiss International; Inogen, Inc., Novartis International AG; Hamilton Medical.

b. Key factors that are driving the therapeutic respiratory devices market growth include the rising prevalence of respiratory diseases & growing geriatric population, the launch of new-generation products, and supportive initiatives by government and private organizations

b. The global therapeutic respiratory devices market size was estimated at USD 12.5 billion in 2023 and is expected to reach USD 13.2 billion in 2024.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.