- Home

- »

- Medical Devices

- »

-

Therapeutic Respiratory Devices Market Share Report, 2030GVR Report cover

![Therapeutic Respiratory Devices Market Size, Share & Trends Report]()

Therapeutic Respiratory Devices Market Size, Share & Trends Analysis Report By Product Type (Nebulizer, Humidifiers, Oxygen Concentrators), By Technology, By Filters, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-488-8

- Number of Report Pages: 187

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2020

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global therapeutic respiratory devices market size was valued at USD 18.0 billion in 2022 and is expected to witness a compound annual growth rate (CAGR) of 6.10% from 2023 to 2030. The rising geriatric population and prevalence of respiratory diseases and the launch of new-generation products are the key factors driving the market growth. Apart from this, a significant number of supportive initiatives by government and private organizations are further promoting the market. For instance, the OMRON medical molecular sieve-based oxygen concentrator, the latest oxygen delivery system from OMRON Healthcare, the healthcare division of OMRON, was introduced in July 2022. The portable device uses Pressure Swing Adsorption (PSA) technology and delivers high-purity (>90%) oxygen at a rate of 5 liters per minute, while filtering out undesirable molecules from ambient air, such as nitrogen & argon.

The global COVID-19 pandemic had a favorable impact on the sales of therapeutic respiratory devices. While operations that were not absolutely required, such as normal patient-doctor visits, elective surgery, and screenings, were canceled or delayed when a number of regional and national governments initially issued orders to shelter in place, connected care businesses experienced a large boost owing to the unexpected increase in demand. In these ways, this certainly benefited prominent market companies. For instance, a notable player such as Philips N.V. stated in its 2020 annual report that the pandemic had an impact on every aspect of its business in the first half of 2020, however, the connected care businesses, including the ventilator portfolio, had exceptional growth that was fueled by COVID-19-related demands, leading to the company delivering 3% comparable sales growth with a strong cash flow of EUR 1.9 billion.

Furthermore, a significant factor anticipated to drive the growth of the market in the near future is the rising demand for therapeutic respiratory devices in home healthcare applications. Home healthcare devices have been gaining popularity and market share in recent years. Additionally, the introduction of therapeutic respiratory devices for home healthcare is another area of interest for both established global manufacturers and other emerging vendors. For instance, in October 2021, Movair, a respiratory therapy corporation previously known as International Biophysics Corporation, announced the U.S. commercial introduction of Luisa-an innovative ventilator proposed for use in homes, hospitals, and institutions or portable applications for both invasive and noninvasive ventilation.

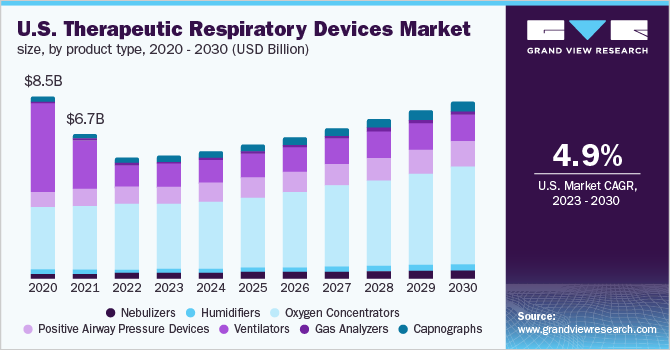

Product Type Insights

With a revenue share of over 44.0% in 2022 and an anticipated continuation of this dominance throughout the forecast period, the oxygen concentrators segment dominated the market. This can be attributed to the growing demand for home oxygen therapy, the rise in the incidence of respiratory diseases, rapid growth in the aging population, high tobacco consumption, and technological advancements in respiratory devices are some of the reasons driving the segment. Furthermore, the COVID-19 pandemic led to an increase in demand for respiratory care products, including concentrators. For instance, Invacare Corporation witnessed a 72.2% increase in sales of respiratory products in the fourth quarter of 2020 in North America owing to the pandemic. The use of oxygen concentrators in the treatment of COVID-19 is a major reason for a significant increase in demand in 2020.

Capnographs, on the other hand, are anticipated to have rapid growth over the forecast period at a CAGR of over 8.5%. This is attributable to the use of capnography in the treatment of respiratory disorders, which is anticipated to increase the medical effectiveness of these devices for patient monitoring because of their increased dependability and effectiveness. Furthermore, the market is anticipated to see fierce rivalry due to the huge number of startups looking for opportunities in this sector. Koninklijke Philips and Masimo, for instance, reached an agreement in May 2020 to license Masimo's measuring technologies, including as NomoLine capnography and O3 regional oximetry, for use in a subset of Philips' IntelliVue MX-series multi-parameter monitors.

Technology Insights

With over 35.0% revenue share in 2022, the HEPA filter segment led the market. For particle removal and retention in various therapeutic respiratory devices, HEPA filters are used. Therapeutic equipment must include HEPA filtration technology for air filtration in accordance with CDC requirements. One of the things causing the need for HEPA filters is the prevalence of respiratory disorders and the manner they spread.

According to the Department of Energy (DOE) of the U.S., HEPA filters eliminate 99.97% of all particles larger than 0.3 microns. In the following seven years, the market is anticipated to benefit from technological developments in the sector. The Minimum Efficiency Reporting Value (MERV)-rated HEPA 4 technology and washable HEPA filters are examples of these developments. It is used to gauge how well air filters are able to clear the air of suspended particles.

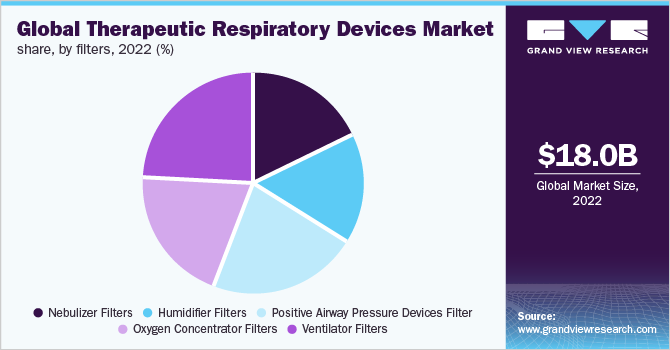

Filters Insights

The market for humidifier filters is expected to witness the fastest CAGR of 7.0% over the forecast period. This is due to the increasing need for them for several therapeutic reasons. As filters are required to stop the formation of fungus and bacteria in the circulating air, an increase in the demand for humidifiers in households, healthcare institutions, hospitals, and schools is expected to fuel the expansion of the humidifier filter market. The need for filters in humidifiers is also driven by the rise in the prevalence of airborne illnesses like TB, which is encouraging market growth.

Using a humidifier increases air humidity and offers protection against environmental dryness. Demand for humidifier equipment is expected to rise as consumers become more aware of ailments including sinusitis, asthma, and specific allergies. As a result, it drives the humidifier filters market. On the other hand, COPD and asthma, which are among the major factors driving the use of ventilators, are expected to have a significant impact on the ventilator filter market, accounting for over 23.5% of revenue share in 2021. Additionally, it is anticipated that the market for homecare ventilators would benefit from the increase in demand for in-home healthcare, which will eventually have a beneficial impact on the ventilator filter market.

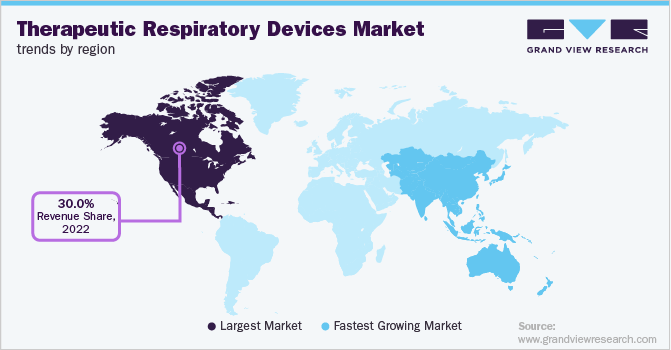

Regional Insights

North America dominated the market in 2022 with over 30.0% share, owing to favorable reimbursement in outpatient treatments, economic growth assisted by growing insurance coverage, U.S. healthcare center accounts, improving healthcare knowledge, and enhanced healthcare systems. The therapeutic respiratory devices market in the Asia Pacific region is expected to expand significantly due to the rising prevalence of illnesses like asthma in both adults and children as well as technological advancements. In addition to ambulatory surgical centers and hospitals, there is currently a large need for medical oxygen concentrators in home healthcare settings.

As a result, since the COVID-19 outbreak started, the market for therapeutic devices has been growing quickly. In addition, it is anticipated that further product releases by important regional players would increase demand for respiratory devices. For instance, Max Ventilator launched multifunctional noninvasive ventilators in India in May 2022 that also treated oxygen. Additionally, the market for therapeutic respiratory devices is anticipated to rise throughout the projected period due to the increased focus on the development of novel respiratory devices.

Key Companies & Market Share Insights

Major key players implement strategies such as mergers and acquisitions as well as new product launches to expand their market share. For instance, in June 2022, CAIRE launched a portable oxygen concentrator in the U.S.-LifeStyle-to significantly improve the quality of life of oxygen users across the country. Some of the prominent players in the global therapeutic respiratory devices market include:

-

GE Healthcare

-

Koninklijke Philips N.V.

-

ICU Medical (Smiths Medical)

-

Invacare Corporation

-

Medtronic

-

Fisher & Paykel Healthcare

-

ResMed

-

Linde

-

Mindray

-

Chart Industries

-

Drägerwerk AG & Co. KGaA

-

DeVilbiss Healthcare

Therapeutic Respiratory Devices Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 18.5 billion

Revenue forecast in 2030

USD 28.0 billion

Growth Rate

CAGR of 6.10% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2020

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Product type, technology, filter, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Germany; France; Italy; Spain; Switzerland; Japan; China; India; Brazil; Mexico; South Africa

Key companies profiled

GE Healthcare; Koninklijke Philips N.V.; ICU Medical (Smiths Medical); Invacare Corporation; Medtronic; Fisher & Paykel Healthcare; ResMed; Linde; Mindray; Chart Industries; Drägerwerk AG & Co. KGaA; DeVilbiss Healthcare

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

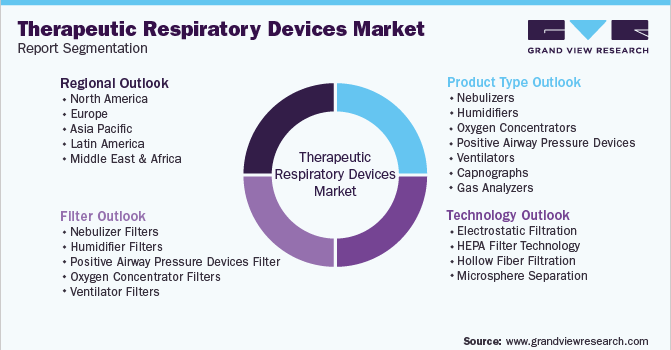

Global Therapeutic Respiratory Devices Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global therapeutic respiratory devices market on the basis of product type, technology, filter, and region:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Nebulizers

-

Compressor-based Nebulizers

-

Piston based handheld nebulizer

-

Ultrasonic Nebulizer

-

-

Humidifiers

-

Heated Humidifiers

-

Passover Humidifiers

-

Integrated Humidifiers

-

Built-In Humidifiers

-

Stand-alone Humidifiers

-

-

Oxygen Concentrators

-

Fixed Oxygen Concentrators

-

Portable Oxygen Concentrators

-

-

Positive Airway Pressure Devices

-

Continuous Positive Airway Pressure Devices

-

Auto-titrating Positive Airway Pressure Devices

-

Bi-level Positive Airway Pressure Devices

-

-

Ventilators

-

Adult Ventilators

-

Neonatal Ventilators

-

-

Capnographs

-

Gas Analyzers

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Electrostatic Filtration

-

HEPA Filter Technology

-

Hollow Fiber Filtration

-

Microsphere Separation

-

-

Filter Outlook (Revenue, USD Million, 2018 - 2030)

-

Nebulizer filters

-

Inlet filter

-

Replacement filter

-

Cabinet filter

-

-

Humidifier filters

-

Wick filters

-

Permanent cleanable filters

-

Mineral absorption pads

-

Demineralization cartridges

-

-

Positive airway pressure devices filter

-

Ultra-fine foam inlet filters

-

Polyester non-woven fiber filters

-

Acrylic & Polypropylene fiber filters

-

-

Oxygen concentrator filters

-

HEPA Filter

-

Cabinet Filter

-

Pre-Inlet Filter

-

Inlet Filter

-

Micro Disk Filter

-

Felt Intake Filter

-

Bacterial Filter

-

Hollow-membrane Filter

-

-

Ventilator filters

-

Mechanical filters

-

HEPA Filters

-

ULPA Filters

-

Activated Carbon Filters

-

-

Electrostatic filters

-

Tribocharged Filters

-

Fibrillated Filters

-

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global therapeutic respiratory devices market is expected to grow at a compound annual growth rate of 6.10% from 2023 to 2030 to reach USD 28.0 billion by 2030.

b. North America dominated the therapeutic respiratory devices market with a share of 44.95% in 2021. This is attributable to the presence of a large geriatric population base and the rising prevalence of chronic respiratory diseases.

b. Some key players operating in the therapeutic respiratory devices market include GE Healthcare; Koninklijke Philips N.V.; ICU Medical (Smiths Medical); Invacare Corporation; Medtronic; Fisher & Paykel Healthcare; ResMed; Linde; Mindray; Chart Industries; Drägerwerk AG & Co. KGaA; DeVilbiss Healthcare

b. Key factors that are driving the therapeutic respiratory devices market growth include the rising prevalence of respiratory diseases & growing geriatric population, the launch of new-generation products, and supportive initiatives by government and private organizations

b. The global therapeutic respiratory devices market size was estimated at USD 18.0 billion in 2022 and is expected to reach USD 18.05 billion in 2023.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."