- Home

- »

- Advanced Interior Materials

- »

-

Thermal Paper Market Size & Share, Industry Report, 2030GVR Report cover

![Thermal Paper Market Size, Share & Trends Report]()

Thermal Paper Market (2025 - 2030) Size, Share & Trends Analysis Report By Width (57mm, 80mm), By Application (POS, Tags & Label, Lottery & Gaming, Ticketing, Medical), By Technology (Direct Transfer, Thermal Transfer), By Region, And Segment Forecasts

- Report ID: 978-1-68038-690-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Thermal Paper Market Summary

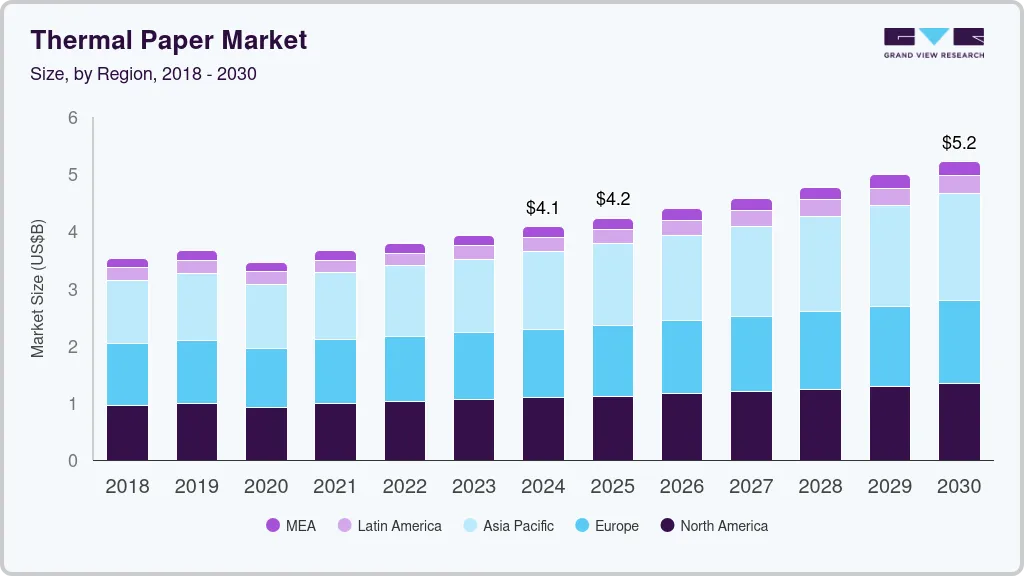

The global thermal paper market size was estimated at USD 4,076.0 million in 2024 and is projected to reach USD 5,215.9 million by 2030, growing at a CAGR of 4.2% from 2025 to 2030. The rapid expansion of the retail and e-commerce sectors is a significant driver of the market growth.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, point-of-sale (pos) accounted for a revenue of USD 2,491.0 million in 2024.

- Tags & Label is the most lucrative application segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 4,076.0 million

- 2030 Projected Market Size: USD 5,215.9 Million

- CAGR (2025-2030): 4.2%

- Asia Pacific: Largest market in 2024

Thermal paper is extensively used for point-of-sale (POS) receipts, labels, and tags in these industries. With the rise of online shopping, there is an increasing demand for shipping labels and tracking tags, which are primarily made from thermal paper. Retail outlets and logistics providers rely on thermal paper for its cost-effectiveness, reliability, and efficiency in providing quick printouts, further boosting market demand.

Technological advancements in thermal printing are making thermal printers more efficient, durable, and capable of handling high-speed printing tasks. These improvements have encouraged businesses to adopt thermal printing over traditional printing methods, driving the demand for thermal paper. Innovations such as color thermal printing and enhanced image durability have expanded the applications of thermal paper beyond conventional uses, such as for event tickets, lottery tickets, and medical charts.

Thermal paper plays a vital role in the healthcare industry, particularly for printing medical reports, diagnostic images, and prescription labels. The increasing focus on digital healthcare solutions and patient record-keeping has not diminished the demand for physical prints in critical applications, where thermal paper offers high-resolution and durable printouts. In addition, the growing prevalence of chronic diseases necessitates diagnostic and monitoring equipment, which often uses thermal paper for data printing. Thermal paper is widely used for labeling in the food and beverage sector, particularly for perishable products that require accurate and clear labeling of expiry dates, batch numbers, and storage instructions. The rise in global food consumption and stringent labeling regulations have significantly contributed to the demand for thermal paper. Furthermore, the adoption of thermal paper in self-checkout systems in supermarkets and fast-food restaurants has gained traction.

Width Insights

The 80mm segment accounted for 46.0% of the revenue share in 2024. The 80mm segment is the most widely used thermal paper width in retail and hospitality industries due to its compatibility with standard point-of-sale (POS) systems. Retailers and restaurants prefer 80mm thermal paper rolls for their ability to produce detailed receipts, including logos, promotional messages, and transaction information, enhancing the customer experience. The increasing penetration of advanced POS systems in these industries continues to drive the demand for 80mm thermal paper.

The 57mm segment is expected to grow at the fastest CAGR of 4.7% over the forecast period. The 57mm thermal paper segment is driven by the increasing popularity of mobile and compact printers used in applications such as on-the-go billing, ticketing, and delivery receipt generation. These portable printers are widely used by delivery personnel, parking attendants, and small vendors due to their convenience and compatibility with 57mm thermal rolls. The growth of e-commerce and last-mile delivery services has further fueled the demand for this segment.

Application Insights

The Point-of-Sale (POS) segment accounted for 61.11% of the revenue share in 2024. The modernization of POS systems with advanced features, such as touchscreens and wireless connectivity, has broadened their application across various industries. These systems rely on thermal paper for quick and efficient printing, minimizing delays in customer service. The increasing availability of compact and portable POS terminals in retail outlets and small businesses has further accelerated thermal paper adoption.

The tags & label segment is anticipated to grow at the fastest CAGR of 5.4% over the forecast period. Retail businesses are major consumers of thermal paper tags and labels, which are essential for pricing, barcode printing, and product information. The growth of organized retail formats, supermarkets, and hypermarkets has amplified the need for cost-effective and high-quality labeling solutions. Thermal paper labels provide quick printing capabilities, making them ideal for real-time price changes and inventory updates, which are critical in the dynamic retail environment.

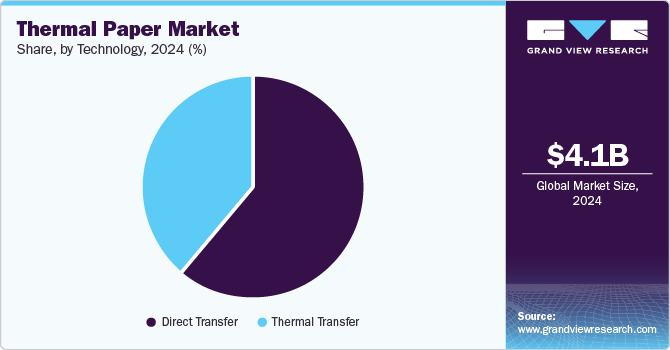

Technology Insights

The direct thermal segment accounted for 61.0% of the revenue share in 2024. Direct thermal technology is widely utilized in logistics and supply chain management for printing shipping labels, warehouse tags, and inventory labels. Its ability to provide clear, durable prints suitable for short-term use aligns perfectly with the fast-paced nature of the logistics industry. As global trade expands and businesses increasingly adopt advanced supply chain solutions, the demand for direct thermal printing continues to grow.

The thermal transfer segment is expected to grow at the fastest CAGR of 4.8% over the forecast period. The thermal transfer segment benefits from regulatory requirements mandating clear and durable labeling in industries such as food and beverage, pharmaceuticals, and chemicals. For instance, in the pharmaceutical sector, thermal transfer labels are widely used to meet stringent regulatory standards for traceability and compliance. The ability of thermal transfer labels to maintain print integrity over extended periods makes them indispensable in such regulated environments.

Regional Insights

The North America thermal paper market growth is driven by the stringent regulations and labeling standards for thermal paper, particularly in the food and pharmaceutical sectors. The Food and Drug Administration (FDA) and other regulatory bodies require clear and accurate labeling, including the use of batch numbers, expiration dates, and safety instructions. As a result, thermal paper is a preferred option for compliance due to its ability to print durable, high-quality labels that meet regulatory standards. The continuous evolution of regulatory requirements, especially in food safety and pharmaceuticals, ensures sustained demand for thermal paper products.

U.S. Thermal Paper Market Trends

The thermal paper market in the U.S. is driven by the increasing adoption of self-checkout kiosks in retail stores, supermarkets, and fast-food chains, which contribute significantly to the demand for thermal paper. These self-service systems rely on thermal printers to produce receipts and labels quickly. As retailers focus on enhancing customer experience and reducing labor costs, the use of thermal paper for such systems is expected to continue rising, driving further growth in the market.

Central & South America Thermal Paper Market Trends

The thermal paper market in CSA is anticipated to grow due to the adoption of advanced thermal printing technology that is creating new opportunities in the market. Enhanced printer reliability, lower maintenance costs, and the ability to handle high-volume printing have made thermal printing an attractive option for businesses. Innovations such as color thermal printing and heat-sensitive paper with longer shelf life are increasing thermal paper's appeal across various applications, including event tickets, parking tickets, and medical reports.

Asia Pacific Thermal Paper Market Trends

The Asia Pacific thermal paper market dominated globally and accounted for 33.2% of global revenue share in 2024. The Asia-Pacific region has witnessed a remarkable expansion in the retail and e-commerce sectors, driven by rising disposable incomes, urbanization, and a growing middle-class population. Countries like China, India, and Southeast Asian nations are leading this growth, with thermal paper being widely used for point-of-sale (POS) systems, receipts, and shipping labels. The rapid adoption of online shopping platforms and increased reliance on logistics and supply chain operations further amplify the demand for thermal paper in this region.

The thermal paper market in China is driven by the rapidly expanding food delivery and logistics industries, which contribute significantly to the demand for thermal paper. These sectors rely on thermal paper for labeling, packaging information, and real-time printing of receipts and invoices. The growth of online-to-offline (O2O) services in urban areas has also added to the consumption of thermal paper in labeling solutions for streamlined operations.

Europe Thermal Paper Market Trends

Europe thermal paper market is witnessing significant advancements in retail technology, particularly in point-of-sale (POS) systems. Retailers across Europe are increasingly adopting thermal printers for receipt generation, inventory management, and ticketing, owing to their speed, cost-efficiency, and reliability. As more retailers upgrade their systems and deploy self-checkout kiosks, the demand for thermal paper continues to rise. The widespread use of mobile POS systems and the shift toward cashless transactions also favor the adoption of thermal printing technologies in European markets.

Key Thermal Paper Company Insights

Some of the key players operating in the market include Oji Holdings Corporation, Appvion Inc. Others

-

Oji Holdings offers a wide range of high-quality thermal papers used in point-of-sale receipts, labels, and tickets. Their product offerings include eco-friendly, BPA-free thermal paper options that meet global sustainability standards, as well as advanced thermal papers for specialized applications like medical records, barcode labels, and lottery tickets.

-

Appvion's product offerings include high-quality thermal papers used for point-of-sale receipts, labels, tickets, and other applications. They offer a range of thermal paper products, such as coated and uncoated rolls, custom-printed thermal papers, and eco-friendly BPA-free thermal papers. The company emphasizes sustainable production practices and consistently adapts its product portfolio to meet the evolving demands of global markets, with an increasing focus on providing durable, high-performance, and environmentally responsible solutions.

Key Thermal Paper Companies:

The following are the leading companies in the thermal paper market. These companies collectively hold the largest market share and dictate industry trends.

- Oji Holdings Corporation

- Appvion Inc

- Koehler Group

- Mitsubishi Paper Mills Limited

- Hansol Paper Co. Ltd.

- Gold Huasheng Paper Co. Ltd.

- Henan Province JiangHe Paper Co. Ltd.

- Thermal Solutions International Inc.

- Iconex LLC

- Twin Rivers Paper Company

- Rotolificio Bergamasco Srl

- Jujo Thermal Limited

Thermal Paper Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.23 billion

Revenue forecast in 2030

USD 5.22 billion

Growth Rate

CAGR of 4.2% from 2025 to 2030

Base year for estimation

2024

Actual estimates/Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Regional Scope

North America; Europe; Asia Pacific; Central and South America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; Russia; China; India; Japan; South Korea; Australia; New Zealand; Brazil; Argentina; Saudi Arabia; UAE; Qatar; South Africa

Segments covered

Width, technology, application, region

Key companies profiled

Oji Holdings Corporation; Appvion Inc; Koehler Group; Mitsubishi Paper Mills Limited; Hansol Paper Co. Ltd.; Gold Huasheng Paper Co. Ltd.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Thermal Paper Market Report Segmentation

This report forecasts revenue & volume growth at country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global thermal paper market based on width, technology, application, and region:

-

Width Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

57mm

-

80mm

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

POS

-

Tags & Label

-

Lottery & Gaming

-

Ticketing

-

Medical

-

Others

-

-

Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Direct Transfer

-

Thermal Transfer

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Itay

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

New Zealand

-

Vietnam

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Qatar

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Some of the key players operating in the thermal paper market include Oji Holdings Corporation, Appvion Inc, Koehler Group, Mitsubishi Paper Mills Limited, Hansol Paper Co. Ltd., and Gold Huasheng Paper Co. Ltd.

b. The key factors that are driving the thermal paper market are increasing usage of POS terminals for monetary transactions due to the expansion of the e-commerce and packaging industries.

b. The global thermal paper market size was estimated at USD 4.08 billion in 2024 and is expected to reach USD 4.23 billion in 2025.

b. The global thermal paper market is expected to grow at a compound annual growth rate of 4.2% from 2025 to 2030 to reach USD 5.22 billion by 2030.

b. POS dominated the thermal paper market with a share of 62.04% in 2024 due to the expansion of retail chain stores in countries, resulting in increased monetary transactions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.