- Home

- »

- Homecare & Decor

- »

-

Thermostatic Faucet Market Size, Industry Report, 2030GVR Report cover

![Thermostatic Faucet Market Size, Share & Trends Report]()

Thermostatic Faucet Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Single Lever Mixers, Two Handle Mixer, Others), By End Use (Residential, Commercial), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-464-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Thermostatic Faucet Market Summary

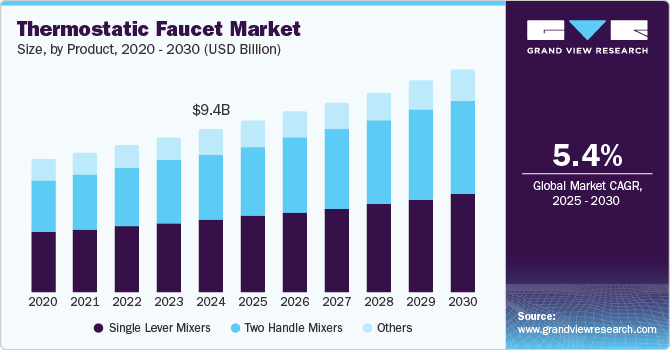

The global thermostatic faucet market size was valued at USD 9.42 billion in 2024 and is projected to reach USD 12.88 billion by 2030, growing at a CAGR of 5.4% from 2025 to 2030. Rising awareness regarding the need for water conservation, the use of products to prevent scalding, the large number of home improvements, and the increase in new residential constructions worldwide are some of the key growth factors for this market.

Key Market Trends & Insights

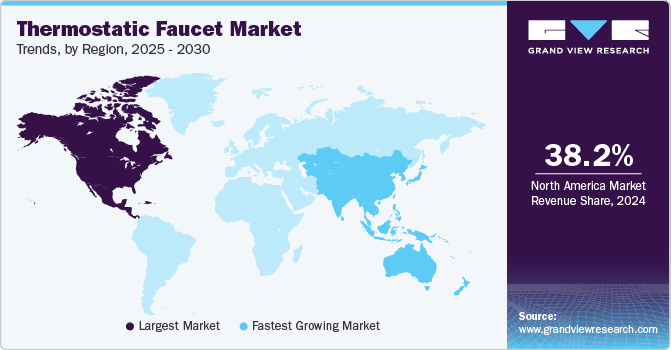

- North America dominated the global thermostatic faucet industry with a revenue share of 38.2% in 2024.

- Asia Pacific thermostatic faucet market is expected to experience the fastest CAGR during the forecast period.

- In terms of product, the single lever mixers segment dominated the global thermostatic faucet industry with a revenue share of 44.3% in 2024.

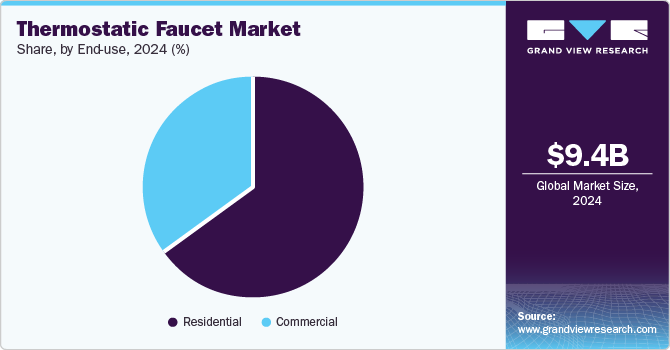

- Based on end use, the residential use segment held the largest revenue share of the global thermostatic faucet industry in 2024.

Market Size & Forecast

- 2024 Market Size: USD 9.42 Billion

- 2030 Projected Market Size: USD 12.88 Billion

- CAGR (2025-2030): 5.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

In recent years, multiple countries such as the U.S., China, India, Germany, France, Australia, and others have experienced a rise in new home developments and refurbishments. This growth is mainly driven by the increasing migration of families and individuals to urbanized areas in the country. By 2050, 68.0% of the world population and 89.0% of the population in the U.S. are estimated to live in urban areas. [KA1] The continuous growth in housing requirements and investments in commercial spaces in large cities is expected to generate growth for this market.

In November 2024, the total construction spending across the U.S. was estimated at approximately USD 2,152.58 billion with a seasonally adjusted annual rate. This marked a 3.0% increase from November 2023, with construction spending at USD 2,090.69 billion. Continuous growth in new developments of private residences, lodging facilities, commercial offices, healthcare centers, educational sector buildings, public safety constructions, amusement and recreation spaces, and more is likely to offer novel growth opportunities for this market during the forecast period.

The availability of advanced products that feature innovation-based technology and the launch of immersive bathroom experience collections by key market participants have also been contributing to the growth of this market. For instance, in May 2024, Delta Faucet Company introduced its latest addition to its portfolio, Touch2O, equipped with touchless technology. The product is designed to reduce time spent cleaning kitchen faucets and areas by adding motion sensors.

Product Insights

The single lever mixers segment dominated the global thermostatic faucet industry with a revenue share of 44.3% in 2024. A single-lever mixer is a product type that utilizes a single lever to control flow and water temperatures. This product is extensively used in modern kitchens and bathrooms. Growing demand from commercial buyers and residential users in urban areas is adding to the growth experienced by this segment. Single lever mixers are primarily used in bathroom fittings to control two inlet pipes with hot and cold water flow. Efficiency, inclusion in advanced bathroom products, and ease of use are expected to generate greater demand for this product during the forecast period.

The handle mixer segment is anticipated to experience the fastest growth during the forecast period. Enhanced control over temperature and water flow offered by the two-handle mixers, increasing incorporation in luxury bathroom developments, and aesthetic balance offered by design are some of the product's key benefits. Growing demand from commercial buyers and increasing utilization in settings such as luxury hotels, commercial office buildings, and others are likely to add growth to this segment.

End Use Insights

The residential use segment held the largest revenue share of the global thermostatic faucet industry in 2024. This is mainly driven by the increasing home developments in developing countries such as India and continuous growth in housing solutions across urbanized areas worldwide. The use of products in kitchen and bathroom fittings and the launch of newly designed collections of bathroom and kitchen products are anticipated to fuel the growth of this segment.

The commercial users segment is projected to experience the fastest CAGR during the forecast period. This is attributed to the rising new developments of commercial spaces, luxury hotels, amusement and recreation parks, public welfare facilities, healthcare centers, educational facilities, and more. Increasing investments by governments in infrastructure enhancements in countries such as China, India, and others, growing demand from home developers operating in large cities, and rising refurbishments are adding to the growth opportunities.

Regional Insights

North America dominated the global thermostatic faucet industry with a revenue share of 38.2% in 2024. Growth of this market is mainly driven by the increase in migration to urbanized areas and growing housing requirements in countries such as the U.S., Canada, and others. Government initiatives such as "Building Canada We Want in 2050" and others are expected to contribute to the growth experienced by the region's construction sector and regional industry for thermostatic faucets in process.

U.S. Thermostatic Faucet Market Trends

The U.S. thermostatic faucet market dominated the regional industry in 2024. This market is mainly driven by the growing demand from private residential constructions and growth in commercial construction projects. Large number of private residential development and redevelopments, increase in construction of healthcare facilities and education facilities in the country, and growth in hospitality sector developments are anticipated to fuel growth of this market.

Europe Thermostatic Faucet Market Trends

Europe was identified as one of the key global thermostatic faucet industry regions in 2024. Europe’s urbanization level is expected to grow by 87.3% by 2050. Rising urbanization has led to a growth in demand for housing solutions. The focus of commercial home developers on providing modern kitchens and immersive bathroom experiences is expected to generate growth in demand for thermostatic faucets in the region.

The UK held the largest revenue share of the regional industry for thermostatic faucets. This is attributed to growth in housing requirements driven by the large number of immigrants shifting to the UK and a rise in commercial construction in sectors such as education, health, public welfare, critical infrastructure, and others.

Asia Pacific Thermostatic Faucet Market Trends

Asia Pacific thermostatic faucet market is expected to experience the fastest CAGR during the forecast period. This is attributed to the rising number of new home developments and home refurbishment, significant growth in demand for high-end products, and increasing utilization in luxury hotels and resorts across the region. The availability of products offered by international brands and key domestic industry participants through online portals has also influenced the growth of this market.

China held the largest revenue share of the Asia Pacific thermostatic faucet market in 2024. This market is primarily driven by the robust manufacturing industry, availability of advanced materials, and increasing participation in the global trade of bathroom and kitchen equipment.

Key Thermostatic Faucet Company Insights

Some of the key companies in the global thermostatic faucet market are GROHE AG, Kohler Co., Moen Incorporated, CERA, LIXIL Corporation and others. To address the growing demand from urban consumers and increasing competition in the market, major market participants have embraced strategies such as new launches, collaborations, portfolio expansions, and more.

-

GROHE AG, a brand that provides bathroom and kitchen fitting products, offers a diverse portfolio of designs based on trends and sustainability. This includes showers and thermostats, a bathroom collection, bathtubs and wash basins, kitchen taps, and more.

-

Jaquar Global, a bathroom and lighting solutions brand, offers a portfolio of diverse products in nearly 55 different countries in regional markets such as Europe, the Middle East, Asia Pacific, and Africa. Its bathroom solutions include faucets, showers, sanitary ware, thermostatic mixers, water heaters, shower panels, diverters, shower enclosures, and more.

Key Thermostatic Faucet Companies:

The following are the leading companies in the thermostatic faucet market. These companies collectively hold the largest market share and dictate industry trends.

- GROHE AG

- Kohler Co.

- Moen Incorporated

- CERA

- Roca Sanitario S.A.U.

- Jaquar Global

- Geberit AG

- RWC

- MASCO

- LIXIL Corporation

Recent Developments

-

In April 2024, Jaquar Global launched Qloud, an advanced shower technology equipped with a thermostatic shower mixer, touch control, and numerous color options. The product strengthened the brand's positioning in the region's luxury bathroom experience collections market.

Thermostatic Faucet Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9.92 billion

Revenue forecast in 2030

USD 12.88 billion

Growth rate

CAGR of 5.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, U.K., France, Italy, Spain, China, India, South Korea, Japan, Australia & New Zealand, Brazil, South Africa

Key companies profiled

GROHE AG; Kohler Co.; Moen Incorporated; CERA; Roca Sanitario S.A.U.; Jaquar Global; Geberit AG; RWC; MASCO; LIXIL Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Thermostatic Faucet Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, grand view research has segmented the global thermostatic faucet industry report based on product, end use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Single Lever Mixers

-

Two Handle Mixers

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

South Korea

-

Japan

-

Australia & New Zealand

-

-

Latin America

-

Brazil

-

-

Middle East

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global thermostatic faucet market size was valued at USD 9.42 billion in 2024 and is expected to reach 9.92 billion in 2025

b. The global thermostatic faucet market size is expected to reach USD 12.88 billion by 2030, registering a CAGR of 5.4% over the forecast period

b. The residential segment accounted for the largest revenue share of more than 64.8% in 2024 and is estimated to expand at a significant CAGR from 2025 to 2030

b. Some of the key players in the global thermostatic faucet market are GROHE AG, Kohler Co., Moen Incorporated, CERA, LIXIL Corporation, and others

b. Rising awareness regarding the need for water conservation, the use of products to prevent scalding, the large number of home improvements, and the increase in new residential constructions worldwide are some of the key growth factors for this market.

b. The single lever mixers segment accounted for the largest revenue share of more than 44.3% in 2024 and is estimated to expand at a significant CAGR from 2025 to 2030

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.