- Home

- »

- Homecare & Decor

- »

-

Faucet Market Size, Share And Trends, Industry Report, 2030GVR Report cover

![Faucet Market Size, Share & Trends Report]()

Faucet Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Ball, Disc), By Technology (Manual, Automatic), By End Use (Commercial, Residential), By Application, By Material, By Finish, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-240-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Faucet Market Summary

The global faucet market size was estimated at USD 23.28 billion in 2024 and is projected to reach USD 36.69 billion by 2030, growing at a CAGR of 8.0% from 2025 to 2030. This growth is primarily driven by increasing demand for modern and innovative faucets in residential and commercial construction projects, the rising trend of smart homes and automated kitchens and bathrooms, and growing consumer preference for water-saving and eco-friendly faucets.

Key Market Trends & Insights

- The faucet market in Asia Pacific accounted for a revenue share of 38.7% of the global market in 2024.

- The faucet market in the U.S. accounted for a revenue share of 75.2% in 2024.

- By product, the disc faucets accounted for a revenue share of 33.5% in the overall faucet industry in 2024.

- By technology, the manual faucets segment accounted for a revenue share of 83.7% in 2024.

- By application, use of faucets in the bathroom accounted for a revenue share of over 59% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 23.28 Billion

- 2030 Projected Market Size: USD 36.69 Billion

- CAGR (2025-2030): 8.0%

- Asia Pacific: Largest market in 2024

The increasing urban population, particularly in emerging economies such as China, India, and Brazil, is driving significant residential and commercial construction activities. According to the United Nations, nearly 68% of the global population is expected to reside in urban areas by 2050, necessitating the expansion of housing and commercial infrastructure. This, in turn, is escalating the demand for modern and efficient faucets across residential, commercial, and hospitality sectors.The integration of smart technologies in faucets, including touchless operation, temperature control, and water-saving mechanisms, is revolutionizing the industry. For example, brands like Moen and Kohler have introduced voice-activated and motion-sensor faucets that improve hygiene and water efficiency. The COVID-19 pandemic further accelerated this trend, with increased consumer focus on touchless solutions in both residential and commercial spaces, particularly in healthcare and hospitality settings.

Governments worldwide are implementing stringent regulations to promote water conservation, directly impacting faucet demand. The U.S. Environmental Protection Agency’s (EPA) WaterSense program, for instance, mandates water-efficient faucets that use no more than 1.5 gallons per minute, encouraging widespread adoption. Similarly, European Union regulations on water efficiency are prompting manufacturers to develop eco-friendly faucets that reduce water wastage without compromising performance.

With the rising costs associated with housing values and mortgage rates, homeowners increasingly engage in home remodeling or home improvement projects to change their traditional household structure. Consumers focus on making the kitchen the focal point of their homes and maximizing the functionality of their bathrooms, leading to renovations in kitchens and bathrooms following current trends and products. Growing consumer preference for technologically advanced products, coupled with shifting consumer behavior, has fueled the growth of the faucet market.

The rise in spending on home furnishing and fittings has a positive impact on the faucets market. Spending on home renovations, improvements, and repairs in the U.S. increased by 11.8% from 2020 to 2021, reaching USD 406.0 billion, according to the Harvard Joint Center for Housing Centers (JCHS). In addition, homeowners are spending money on improvements to enhance their quality of life rather than purchasing products with basic functionalities.

The growing penetration of smart home technology has been one of the key factors boosting the adoption of smart faucets in residential settings. According to a study conducted by the Consumer Technology Association (CTA) in January 2020, 69% of households in the U.S. own at least one smart home device. Smart home technology has made it possible to control and monitor various aspects of the home, including the kitchen and bathroom, remotely and with ease. Smart products and fixtures can perform tasks automatically or with minimal human intervention, reducing the time and effort required to perform these tasks manually. For example, a smart faucet can adjust the water temperature and flow based on the user's preferences and behavior.

Consumer Survey & Insights

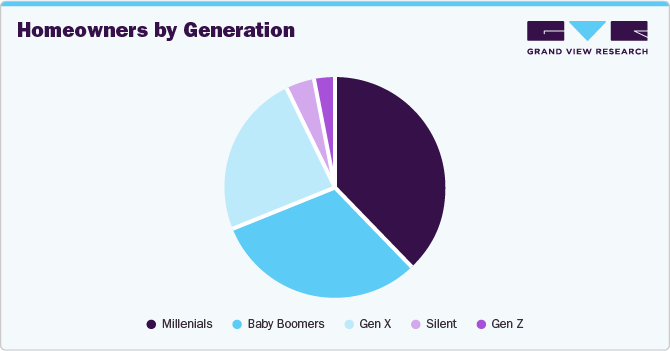

Millennial homeownership has reached a milestone, with 52% of millennials owning homes as of 2022, in the U.S., up from 49% in 2021, according to a blog by Motley Fool Money published in 2024. This generational shift influences the demand for home fixtures like faucets. Millennials accounted for 38% of home buyers in 2023, becoming the largest home-buying generation. However, their delayed homeownership, only 42% owned homes by age 30 compared to 48% of Gen X and 51% of Baby Boomers-indicates unique challenges such as economic hurdles and high mortgage rates. As millennials embrace homeownership later in life, they prioritize energy-efficient and sustainable fixtures, driving demand for modern faucet designs.

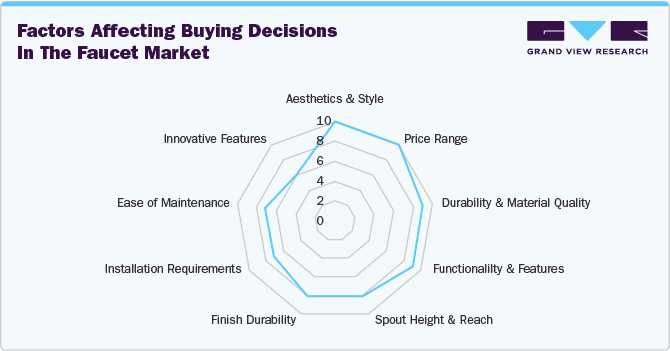

Aesthetics and Style: Consumers seek faucets that match their kitchen or bathroom décor, with finishes like chrome, nickel, bronze, or gold greatly influencing their choices.

Price Range: Buyers focus on budget, aiming for quality at a reasonable price, typically starting at USD 65 for bathroom faucets or USD 100 for kitchen faucets.

Durability and Material Quality: The longevity of a faucet depends on the materials used, with ceramic valves being popular for their reliable, drip-free performance.

Functionality and Features: Buyers prefer faucets with features that meet their needs, such as pull-down sprayers, magnetic catches, or smart technology.

Spout Height and Reach: High-arc spouts are ideal for large pots, while short-reach options may lead to inconvenience.

Finish Durability: Chrome finishes are durable and easy to clean, whereas nickel is more susceptible to water spots.

Installation Requirements: Buyers must ensure compatibility with their sink's configuration and consider the number of holes present.

Ease of Maintenance: Consumers favor easy-to-clean faucets, with ceramic disc valves requiring fewer repairs than ball valves.

Innovative Features: Smart faucets with voice control and hands-free options appeal to tech-savvy buyers, enhancing convenience for all users.

Product Insights

Disc faucets accounted for a revenue share of 33.5% in the overall faucet industry in 2024, owing to their advanced technology, durability, and low maintenance requirements. Their ability to provide precise temperature and water flow control, combined with their long-lasting ceramic disc mechanisms, has made them a preferred choice among consumers.

Demand for ball faucets is expected to grow at a CAGR of 8.5% from 2025 to 2030. Ball faucets are a common choice for kitchen sinks and were the first type of washerless faucet. They are easily identifiable by their single handle, which moves over a rounded, ball-shaped cap located just above the faucet base. Inside, a metal or plastic ball with chambers or slots works with rubber O-rings and spring-loaded seals to control water flow and temperature. The ball and lever assembly adjusts the mix of hot and cold water based on the handle's position. This innovative design made ball faucets a popular choice, offering a sleek, single-handle operation and affordability.

Technology Insights

Manual faucets accounted for a revenue share of 83.7% in 2024 in the overall faucet industrydue to their affordability, widespread availability, simplicity in installation and operation, and widespread use in both residential and commercial applications. Their long-standing presence in the market, combined with ease of repair and availability in a wide range of designs and materials, has made them the go-to option for consumers seeking reliable, budget-friendly faucet solutions.

Demand for automatic faucets is expected to grow at a CAGR of 9.1% from 2025 to 2030. Consumers are showing a preference for smart home water installations that offer enhanced convenience, reduce health and asset-related risks, improve efficiency, yield cost savings, and promote responsible water stewardship. In addition, they are inclined toward plumbing fixtures that align with sustainability principles.

Application Insights

The use of faucets in the bathroom accounted for a revenue share of over 59% in 2024. This is attributed to the higher frequency of faucet usage in bathrooms for daily hygiene activities, such as handwashing, shaving, and grooming, compared to kitchen or other applications. The growing focus on bathroom renovations, modern design trends, and the increasing consumer demand for aesthetically pleasing and functional fixtures have driven significant investments in bathroom faucet upgrades.

The use of faucets in the kitchen is expected to grow at a CAGR of 8.1% from 2025 to 2030. Kitchen faucet trends are evolving to combine functionality, convenience, and style. Touchless faucets are gaining popularity for their hygienic benefits, allowing users to activate water flow with a simple wave or tap, reducing mess and germ transfer. These faucets often feature battery-operated designs and water-saving automatic shut-offs, appealing to tech-savvy homeowners. Moreover, in May 2024, Delta Faucet Company introduced Touch2O with Touchless Technology, a versatile kitchen faucet innovation showcased at the 2024 Kitchen & Bath Industry Show.

End Use Insights

Faucet sales in residential settings accounted for a share of 71.7% of the overall faucet industry in 2024, primarily driven by the continuous growth in housing construction, home renovations, and remodeling activities. Homeowners are increasingly investing in upgrading kitchens and bathrooms with modern, efficient, and aesthetically appealing faucets that align with current design trends. Additionally, the increasing trend of smart home technology integration has boosted the adoption of automatic faucets in homes.

Faucet sales in commercial areas are expected to grow at a CAGR of 8.3% from 2025 to 2030. The expansion of commercial infrastructure across developing economies is supporting this segment’s growth. Over the last few years, the global expansion of the hospitality sector, including hotels, resorts, and hospitals, has offered the faucets market immense opportunities to grow. Europe is one of the largest markets within the hospitality sector, followed by the U.S. Major hotel chains are expanding their operations at a significant rate. Government initiatives aimed at advanced and sustainable infrastructure in emerging economies such as China, India, Brazil, and Mexico are also expected to propel the construction industry.

Material Insights

Faucets made of brass & bronze accounted for a revenue share of 39.9% in 2024 due to their superior durability, corrosion resistance, and aesthetic appeal. These materials are highly valued for their longevity and ability to withstand varying water conditions, making them ideal for both residential and commercial applications. Brass and bronze faucets also offer a premium look, complementing modern and traditional interior designs, which appeals to consumers looking for high-quality, stylish fixtures.

Demand for faucets made of stainless steel is expected to grow at a CAGR of 8.9% from 2025 to 2030. Stainless steel is a popular material for kitchen faucets, especially when paired with matching stainless steel sinks. Known for its strength and higher melting point, stainless steel is harder to cast and machine than brass. However, it contains no lead, aligning with modern regulatory requirements. Its strength allows for thinner castings, reducing material usage. Moreover, durability and safety are derived from its composition, which includes 18% chromium and 8-10% nickel. Chromium enhances corrosion resistance, while nickel strengthens the material and improves malleability. Some 316 steel alloys also contain molybdenum for added resistance to acidic environments.

Finish Insights

Faucets with a chrome finish accounted for a revenue share of 42.5% in 2024. This is attributed to their widespread popularity for their sleek, shiny appearance, which complements a wide range of interior styles, from modern to traditional. Chrome finishes are also highly durable, resistant to corrosion, and easy to clean, making them a practical choice for consumers. Additionally, chrome faucets are typically more affordable compared to other finishes, which makes them accessible to a broad range of consumers.

Faucets with a matt black finish is expected to grow at a CAGR of 9.2% from 2025 to 2030. Matte black faucets are a practical and stylish addition to modern kitchens and bathrooms. Their bold, neutral finish pairs well with a wide range of design styles, from sleek contemporary interiors to warm, nature-inspired aesthetics. The matte surface provides a clean, understated appearance, creating a striking contrast against lighter countertops or blending seamlessly with darker tones. Their adaptability makes them a popular choice for homeowners seeking a functional yet visually appealing upgrade. Matte black faucets work equally well as a focal point or a complement to other design elements.

Distribution Channel Insights

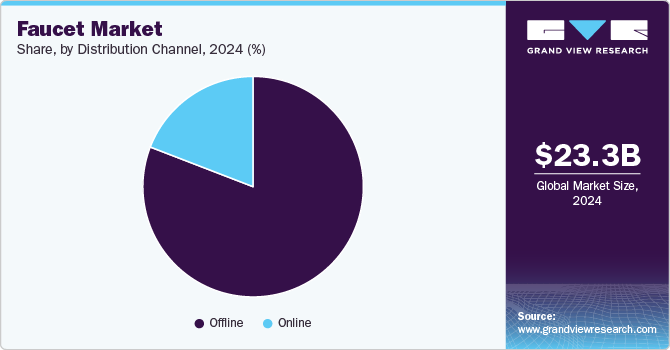

Faucet sales through offline channels accounted for a share of over 80% in 2024, driven by consumer preference for in-person shopping when selecting high-involvement products like faucets. Many consumers prefer to physically examine faucets in retail stores, such as home improvement centers and specialty bath and plumbing stores, to assess their design, finish, and quality before making a purchase.

Faucet sales through online channels are expected to grow at a CAGR of 8.8% from 2025 to 2030. Offline distribution channels for faucets provide customers with quick access to products, allowing them to evaluate the quality, colors, measurements, and patterns visually. Customers can also take precise measurements and discuss them with sales representatives to ensure optimal fit and customization. Through this distribution channel, customers can also seek in-person assistance for installation services and post-purchase support.

Regional Insights

The faucet market in Asia Pacific accounted for a revenue share of 38.7% of the global market in 2024, driven by rapid urbanization, increasing construction activities, and rising infrastructure development in emerging economies such as China, India, and Southeast Asia. The growing middle-class population, coupled with rising disposable incomes, has fueled demand for modern homes and improved living standards, leading to higher demand for faucets in both residential and commercial sectors.

North America Faucet Market Trends

The North America faucet market accounted for a revenue share of 25.1% in 2024, driven by a combination of construction activity, technological innovation, and evolving consumer preferences. A surge in residential and commercial construction, coupled with a rising trend in home renovations and remodeling, has led to increased demand for modern and efficient faucets. Builders and homeowners are investing in high-quality fixtures that not only offer durability and performance but also enhance the aesthetic appeal of their spaces.

The faucet market in the U.S. accounted for a revenue share of 75.2% in 2024. The increased expenditure on repairs and renovations by consumers in the U.S. is anticipated to drive the demand for faucets in the country. Moreover, multi-family homes increasingly cater to families and long-term renters, and the demand for additional bathrooms per unit has grown, directly fueling faucet installations. For instance, the median size of built-for-rent units (998 sq ft) and built-for-sale units (1,345 sq ft) often includes 1-2 bathrooms, driving consistent demand for kitchen and bathroom fixtures. This construction boom aligns with broader trends in the U.S. faucet industry.

Middle East & Africa Faucet Market Trends

The Middle East & Africa faucet market is expected to grow at a CAGR of 8.6% from 2025 to 2030, driven by rapid urbanization, increasing infrastructure development, rising disposable incomes, and changing consumer preferences. In particular, Gulf Cooperation Council (GCC) countries such as the UAE, Saudi Arabia, Qatar, and Kuwait are witnessing a surge in demand for smart and convenient faucets due to technological advancements, increasing water conservation efforts, and a preference for luxury and modern interiors. As urban populations expand and real estate developments flourish, there is a rising need for high-quality and technologically advanced bathroom and kitchen fixtures, making smart faucets popular among homeowners, businesses, and hospitality sectors.

Key Faucet Company Insights

The faucet industry is fragmented primarily due to the presence of several globally recognized players as well as regional players. Some key companies in the faucet industry include Kohler Co., Kraus, USA, American Standard Brands, Grohe America Inc., Pfister, Delta Faucet Company, and others.

-

Kohler Co. manufactures kitchen and bath appliances, engines & power generation systems, furniture & decorative products, and home interiors & tiles. Under the kitchen and bath segment, the company offers sinks & faucets, toilet seating, bathing products, mirrors & vanities, kitchen faucets, shower doors, and lighting products. Its product portfolio comprises furniture and decorative items, including ceramics, wood tiles, beds, tables, and other accessories.

-

Kraus USA Plumbing LLC is a prominent manufacturer specializing in kitchen and bathroom fixtures, particularly known for their high-quality faucets. Kraus places a strong emphasis on quality throughout its manufacturing process. They utilize advanced technology combined with top-quality materials to ensure that every product meets rigorous standards of durability and reliability. Their product line includes a wide range of sinks, faucets, and accessories that are not only aesthetically pleasing but also engineered for exceptional performance.

Key Faucet Companies:

The following are the leading companies in the faucet market. These companies collectively hold the largest market share and dictate industry trends.

- Kohler Co.

- Kraus, USA

- American Standard Brands

- Grohe America Inc.

- Pfister

- Delta Faucet Company

- Moen Incorporated

- Aqua Source Faucet

- Danze Inc.

- Masko Corporation

Recent Developments

-

In February 2025, Moen, a leading innovator in residential water solutions, redefined kitchen convenience with the launch of its Instant Hot SIP™ faucets and Instant Hot tank. Engineered to meet the demands of modern, fast-paced lifestyles, these advanced fixtures provided an elegant and efficient solution for accessing near-boiling water directly from the sink. By streamlining everyday tasks such as meal preparation and cleaning, Moen reinforced its commitment to enhancing functionality, style, and convenience in contemporary kitchens.

-

In March 2024, TOTO Vietnam officially introduced its Matte Black collection of faucets, offering a distinctive visual appeal characterized by an elegant black finish and a sophisticated, high-end surface treatment. This collection redefined conventional design aesthetics, delivering a refined and luxurious appearance. The Matte Black coating was achieved through Physical Vapor Deposition (PVD)-an advanced vacuum deposition technology that applies a thin metal film to surfaces. This cutting-edge application enhanced the durability of the coating, ensuring a smooth, lustrous finish while maintaining uniformity across each faucet design.

Faucet Market Report Scope

Report Attribute

Details

Market revenue in 2025

USD 24.99 billion

Revenue forecast in 2030

USD 36.69 billion

Growth rate

CAGR of 8.0% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, material, application, finish, end use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; China; India; Japan; Australia & New Zealand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Kohler Co; Kraus USA; American Standard Brands; Grohe America Inc.; Pfister; Delta Faucet Company; Moen Incorporated; Aqua Source Faucet; Danze Inc.; Masko Corporation

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Faucet Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global faucet market report based on product, technology, application, material, finish, end use, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Ball

-

Disc

-

Cartridge

-

Compression

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Manual

-

Automatic

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bathroom

-

Kitchen

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Stainless Steel

-

Copper

-

Brass & Bronze

-

Zinc & Zinc Alloys

-

Plastic

-

Others

-

-

Finish Outlook (Revenue, USD Million, 2018 - 2030)

-

Nickel

-

Chrome

-

Stainless Steel

-

Matte Black

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global faucet market was estimated at USD 23.28 billion in 2024 and is expected to reach USD 24.99 billion in 2025.

b. The global faucet market is expected to grow at a compound annual growth rate of 8.0% from 2025 to 2030, reaching USD 36.69 billion by 2030.

b. Asia Pacific dominated the faucet market, with a share of 38.7% in 2024. Regional growth is driven by rapid urbanization, increasing construction activities, and rising infrastructure development in emerging economies such as China, India, and Southeast Asia.

b. Some of the key players operating in the faucet market include Kohler Co., Kraus USA, American Standard Brands, Grohe America Inc., Pfister, Delta Faucet Company, Moen Incorporated, Aqua Source Faucet, Danze Inc., and Masko Corporation.

b. The global faucet market's growth is majorly driven by the increasing demand for modern and innovative faucets in residential and commercial construction projects, the rising trend of smart homes and automated kitchens and bathrooms, and growing consumer preference for water-saving and eco-friendly faucets.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.