- Home

- »

- Pharmaceuticals

- »

-

Thyroid Gland Disorder Treatment Market, Industry Report, 2018-2025GVR Report cover

![Thyroid Gland Disorder Treatment Market Report]()

Thyroid Gland Disorder Treatment Market Analysis Report By Indication (Hypothyroidism, Hyperthyroidism), By RoA (Oral, Intravenous), By Distribution Channel, And Segment Forecasts, 2018 - 2025

- Report ID: GVR-2-68038-118-4

- Number of Report Pages: 92

- Format: PDF, Horizon Databook

- Historical Range: 2014 - 2016

- Forecast Period: 2017 - 2025

- Industry: Healthcare

Industry Insights

The global thyroid gland disorder treatment market size was valued at USD 1.97 billion in 2016 and is expected to register a CAGR of 3.2% during the forecast period. Rising incidence of hypothyroidism and growing awareness levels among individuals are key contributors to market growth. Various companies are collaborating with government organizations to spread awareness regarding disease management and this is anticipated to fuel the adoption of drugs for the treatment of thyroid gland disorders over the forecast period.

Thyroid disorders may result from functional or structural abnormalities. As of now, it affects 200 million people around the world and in most countries, half of the population remains undiagnosed. This condition is more common among women and the elderly. Statistics by the Thyroid Foundation of Canada in 2015, state that one in every 1700 children in Canada is affected by congenital hypothyroidism. This shows the potential demand for anti-thyroid drugs in the coming years.

An increase in collaborative agreements between private and public organizations to spread awareness pertaining to thyroid management among healthcare professionals and patients is expected to fuel market growth. Various government organizations such as The American Thyroid Association (ATA), American Academy of Otolaryngology, British Thyroid Foundation, and Thyroid Foundation of Canada are involved in various promotional activities to create awareness regarding the disease and its treatment options.

Pharmaceutical manufacturers are also undertaking initiatives to support awareness campaigns or implement promotional strategies to create awareness. For instance, in May 2017, Merck announced its support for the 9th International Thyroid Awareness Week (ITAW). Efforts such as these are anticipated to propel demand over the course of the forecast period.

Indication Insights

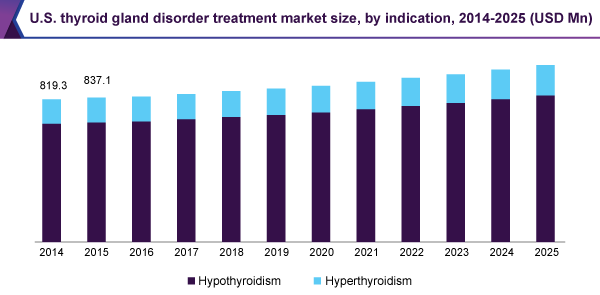

On the basis of indication, the market is bifurcated into hypothyroidism and hyperthyroidism. Hypothyroidism accounted for the largest revenue share as of 2016 owing to high prevalence of this condition, with around 90.0% of the total diseased population showing an indication.

The major drug classes used to treat hypothyroidism are Liothyronine and Levothyroxine. Of these, Levothyroxine, a hormone replacement drug, held the dominant revenue share in 2016 and is expected to maintain its position throughout the forecast period. Brand names of this drug class in the U.S. are Levoxyl, Tirosint, and Synthroid; companies manufacturing generic equivalents for this drug class are Mylan; Merck KGaA; and Lannett Company, Inc.

Route of Administration Insights

By route of administration, the thyroid gland disorder treatment market is segmented into oral, intravenous, and others. The oral segment dominated the market owing to new product development and the presence of a strong pipeline. Factors such as high efficacy, a higher rate of bioavailability, and rapid delivery of drugs are expected to propel segment growth. The oral route of administration is effective against drugs with medium to high oral bioavailability.

Oral therapies minimize the use of central lines for intravenous drug administration and thereby reduce the risk of complications associated with it as well as a hospital stay. The development of promising new drugs and potential clinical pipeline candidates are some of the major factors expected to drive segment growth.

Distribution Channel Insights

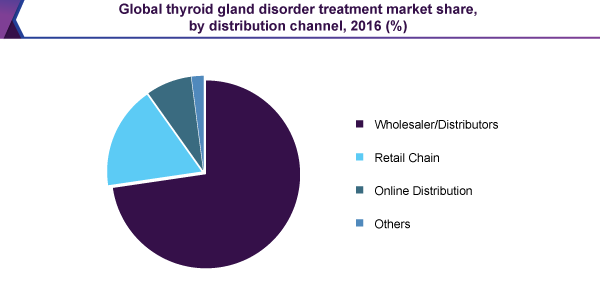

Wholesalers and distributors form a rather mature segment. However, high penetration of these distribution channels for prescription medicines has allowed it to gain the largest revenue share as of 2016. Wholesalers provide discounts on bulk purchases, offer quick delivery, and always have sufficient product stock, owing to which consumers opt for these distribution channels.

Increasing popularity of eCommerce channels for prescription medicines is a key factor for contributing to the lucrativeness of the online distribution segment over the forecast period. Online pharmacies provide a wide range of options to treat this disease and often offer in-depth information pertaining to the condition. Equipped with this knowledge, consumers are more likely to purchase medicines online.

Regional Insights

North America accounted for the largest revenue share as of 2016 and is anticipated to expand at an exponential CAGR throughout the forecast period. The presence of streamlined healthcare facilities, greater awareness levels amongst individuals, and ample availability of treatment options to choose from are some of the factors responsible for its large revenue share.

Strategic partnerships between pharmaceutical companies and government organizations are on a rise in the region, particularly to develop generic drugs and spread awareness amongst healthcare professionals. This makes the North America market highly lucrative. For instance, Genzyme, in partnership with Veracyte Inc., will be delivering personalized solutions for the treatment of disorders related to the thyroid gland.

The Asia Pacific market is expected to exhibit a lucrative CAGR as manufacturers in this region are focusing on the development of low-cost products with higher efficiency. In addition, global players are investing in local companies in the region, attracted by the lower cost of raw material and labor.

Thyroid Gland Disorder Treatment Market Share Insights

The market is fragmented in nature with numerous small and large manufacturers operating in this industry. It is dominated by major participants such as Abbott; Pfizer; Lannett Company, Inc.; GlaxoSmithKline; Merck KGaA; Mylan N.V.; AbbVie Inc.; and Amgen. Companies are adopting strategies such as partnership agreements, regional expansions, promotional activities, and new product development to gain an edge over their competition. In addition, strategic actions undertaken by the U.S. FDA and other government authorities to prevent hurdles in the entry of generic drug makers in the market is expected to boost industry rivalry in the coming years.

Report Scope

Attribute

Details

Base year for estimation

2016

Actual estimates/Historical data

2014 - 2016

Forecast period

2017 - 2025

Market representation

Revenue in USD Million & CAGR from 2017 to 2025

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country Scope

The U.S., Canada, Germany, The U.K., Japan, China, India, Brazil, Mexico, South Africa

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global thyroid gland disorder treatment market report on the basis of indication, route of administration, distribution channel, and region:

-

Indication Outlook (Revenue, USD Million, 2014 - 2025)

-

Hypothyroidism

-

Hyperthyroidism

-

-

RoA Outlook (Revenue, USD Million, 2014 - 2025)

-

Oral

-

Intravenous

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2014 - 2025)

-

Wholesaler/Distributors

-

Retail Chain

-

Online Distribution

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2014 - 2025)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

The U.K.

-

Germany

-

-

Asia Pacific

-

Japan

-

China

-

India

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."