- Home

- »

- Homecare & Decor

- »

-

Tissue Paper Market Size, Share & Trends Report, 2028GVR Report cover

![Tissue Paper Market Size, Share & Trend Report]()

Tissue Paper Market Size, Share & Trend Analysis Report By Application (At Home, Away From Home), By Product Type (Paper Tissues, Wet Wipes, Facial Tissue), By Distribution Channel, By Region, And Segment Forecasts, 2022 - 2028

- Report ID: GVR-4-68039-936-0

- Number of Report Pages: 78

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2028

- Industry: Consumer Goods

Report Overview

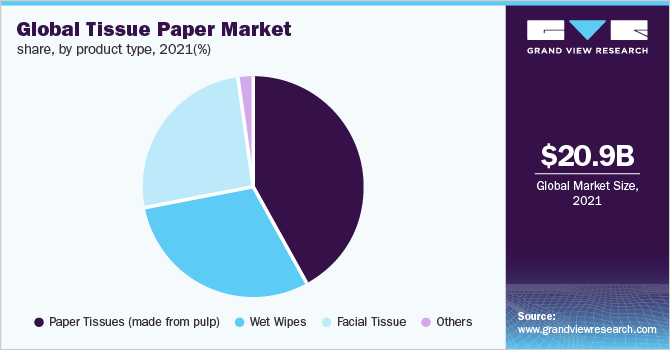

The global tissue paper market size was valued at USD 20.86 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 3.3% from 2022 to 2028. This is attributable to the rising responsiveness to hygiene and cleanliness. Also, the growing awareness about sanitation and personal care is likely to boost the market demand.

Increasing government initiatives regarding the development of environment-friendly and green sustainable consumer products are anticipated to drive the demand for biodegradable tissue paper products. Thus, major key players are investing in the development of recyclable and biodegradable products to lower the extensive cutting of trees, therefore reducing the burden on the environment. The rising introduction of a variety of natural ingredients in the development of tissue paper such as almond oils, aloe vera, etc., which help to lower the bacterial infection spread, is further expected to fuel the growth of this market in the coming years.

The increasing need for sanitary and personal care items for maintaining cleanliness and hygiene drives the demand for tissue paper products. Also, rising awareness about the spread of the COVID-19 virus is fueling the growth of this market. Rising spending on healthcare by the growing population augments the usage of personal care products and thus nurtures market growth. Additionally, rapid urbanization leads to substantial infrastructural developments resulting in an upsurge in demand for tissue paper products in future years.

Increasing investments by key players to introduce new eco-friendly and sustainable products is further anticipated to enhance the industry sales. However, increasing environmental concerns such as global warming and deforestation confines the growth of pulp-based products and hinder the tissue paper market growth.

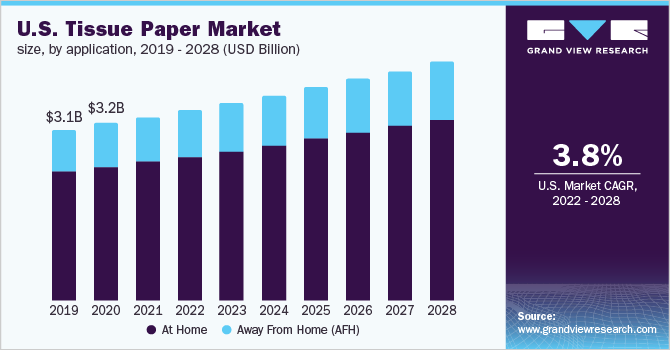

Application Insights

At home, application segment contributed the highest share of 75% of the global market revenue in 2021. Increasing awareness regarding cleanliness and personal hygiene among the consumers is driving the growth of this segment over the forecast period. Also growing usage of facial and wet wipes at home is expected to drive this segment growth. Moreover, rising environmental concerns and the growing demand for sustainable products are among the major prevailing trends in the market.

The away from home application segment is expected to register steady growth during the forecast period. The rising corporate sector is expected to propel the demand for wet wipes and paper tissue products. Moreover, rapid urbanization, a growing working-class population around the globe along with rising health and hygiene awareness among the consumer are estimated to drive the growth of the segment in the coming years. Furthermore, increased utilization of tissue paper products in commercial spaces and office complexes is expected to accelerate the segmental growth during the forecast period.

Product Type Insights

Paper tissues (made from pulp) product type segment contributed a share of more than 40% in 2021 due to its increasing demand. The rising utilization of paper tissues for the general purposes of cleanliness at home is expected to drive the growth of the paper tissue product type segment during the forecast period. However, increasing environmental concerns such as global warming and deforestation confines the growth of pulp-based products and hinder the growth of the paper tissues segment of the market.

The facial tissue product type segment is the fastest-growing segment and is expected to witness significant gains in the forecast period. The segment is growing at 4.0% from 2022 to 2028 owing to the increasing demand for cleanliness and personal hygiene of face among millennials across the world. Additionally, an increase in demand for sustainable and eco-friendly personal care and sanitation products is likely to create more opportunities for this segment, thus significantly driving the growth of this market during the forecast period.

Distribution Channel Insights

The offline distribution channel segment contributed to the highest share of over 80% of the global market revenue in 2021. The offline segment includes specialty stores, hypermarkets, supermarkets, independent retail stores, etc. The growing structured retail sector in developing economies such as India and China is projected to enhance the demand for tissue paper products in the coming years.

The online segment is projected to register the highest growth over the forecast period owing to its growing usage. The surge in sales of tissue paper products mainly through company websites and e-commerce companies is expected to boost the growth of the online distribution channel segment in the coming years. The increasing penetration of the internet and smart devices will further boost industry sales.

Regional Insights

The Asia Pacific holds the majority of industry share of over 30% in 2021 owing to the majority of tissue paper utilization done in the region. Furthermore, the rising disposable income of the middle-class population and changing lifestyles in developing countries are propelling the growth of this market. The growing demand for facial tissues and wet wipes among millennials in this region is also expected to drive the growth of this market in the coming years. Also, an increasing chain of hotels and restaurants is propelling the growth of this market as paper tissues are widely utilized during the serving of food in hotels.

North America is expected to witness a CAGR of 3.9% from 2022 to 2028. This can be attributable to the growing demand for biodegradable tissue paper products. Moreover, rising sales of sustainable and eco-friendly tissue paper products in this region is the prime factor that drives the growth of this market. Also, there has been a large consumption of paper tissues in countries such as Canada and the U.S.

Key Companies & Market Share Insights

Key players are focusing on R&D and introducing new green and environment-friendly products to meet increasing demand. Furthermore, key players are investing in new production plants to increase production capacity along with expansion in the market. For instance, Kruger Products L.P. and KP Tissue Inc. have announced the start-up of their Sherbrooke manufacturing facility in Canada and also invested worth USD 240 million for its TAD tissue machine line for expansion. This investment is part of the company’s focus on expanding its business and offering tissue products to customers across North America. Such initiatives are expected to boost the adoption rate of the product among consumers around the globe. The market is further driven by mergers, acquisitions, and innovative packaging design. Some of the key companies operating in the global tissue paper market include:

-

Procter & Gamble (Cascade)

-

Kimberly - Clark

-

Essity

-

Kirkland Signature (Costco)

-

Georgia- Pacific

-

Solaris Paper

-

Seventh Generation

-

Charmin Paper

-

Angel Soft

-

Naturelle

Tissue Paper Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 21.55 billion

Revenue forecast in 2028

USD 26.23 billion

Growth Rate

CAGR of 3.3% from 2022 to 2028

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2028

Quantitative units

Revenue in USD Million/Billion and CAGR from 2022 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, product type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; U.K.; France; China; India; South Africa; Brazil

Key companies profiled

Procter & Gamble (Cascade); Kimberly – Clark; Essity Kirkland Signature (Costco); Georgia- Pacific; Solaris Paper; Seventh Generation; Charmin Paper; Angel Soft; Naturelle

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segment from 2017 to 2028. For this study, Grand View Research has segmented the global tissue paper market based on application, product type, distribution channel, and region.

-

Application Outlook (Revenue, USD Million, 2017 - 2028)

-

At Home

-

Away From Home

-

-

Product Type Outlook (Revenue, USD Million, 2017 - 2028)

-

Paper Tissues (made from pulp)

-

Wet Wipes

-

Facial Tissue

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2028)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million; 2017 - 2028)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global tissue paper market size was estimated at USD 20.86 billion in 2021 and is expected to reach USD 21.55 billion in 2022.

b. The global tissue paper market is expected to grow at a compound annual growth rate of 3.3% from 2022 to 2028 to reach USD 26.23 billion by 2028.

b. The Asia Pacific dominated the tissue paper market with a share of 34.2% in 2021. This is attributable to the rising disposable income of the middle class coupled with changing lifestyles of developing countries.

b. Some key players operating in the tissue paper market include Procter & Gamble (Cascade); Kimberly – Clark; Essity; Kirkland Signature (Costco); Georgia- Pacific; Kruger Products; Solaris Paper; Seventh Generation; Charmin Paper; Angel Soft; Naturelle.

b. Key factors that are driving the tissue paper market growth include rising responsiveness to hygiene and cleanliness, growing awareness about sanitation and personal care, and government initiatives regarding the development of environment-friendly and green sustainable consumer products across the world.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."