- Home

- »

- Plastics, Polymers & Resins

- »

-

Tobacco Packaging Market Size, Industry Report, 2030GVR Report cover

![Tobacco Packaging Market Size, Share & Trends Report]()

Tobacco Packaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Paper & Paperboard, Plastic), By Packaging Type (Primary, Secondary), By Product (Boxes, Folding Cartons, Bags & Pouches), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-311-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Tobacco Packaging Market Summary

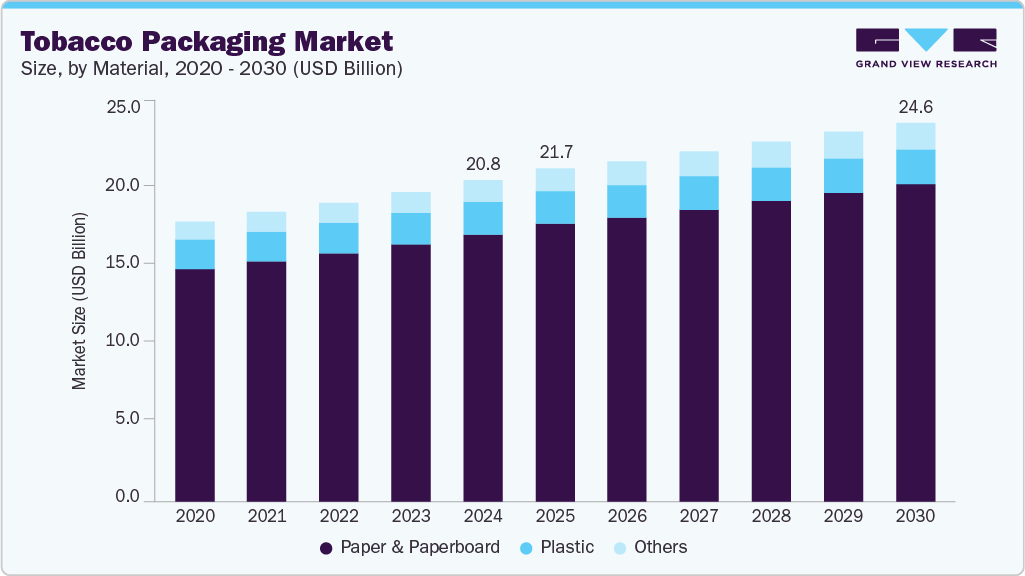

The global tobacco packaging market size was estimated at USD 20.85 billion in 2024 and is projected to reach USD 24.63 billion by 2030, growing at a CAGR of 2.6% from 2025 to 2030. The tobacco packaging market is primarily driven by the growing demand for smokeless tobacco products, such as chewing and dipping alternatives, along with the rising penetration of e-cigarettes.

Key Market Trends & Insights

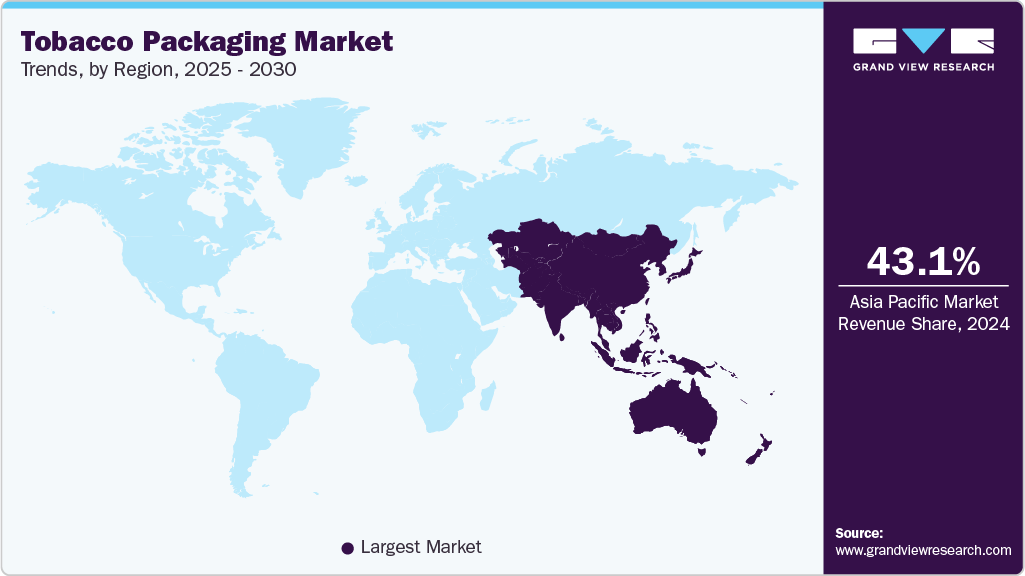

- The Asia Pacific region dominated the tobacco packaging market with a revenue share of 43.1% in 2024.

- The U.S. dominated the North American tobacco packaging market in 2024.

- By material, the paper & paperboard segment held the highest market share of 83.2% in 2024.

- By packaging type, the secondary segment held the highest market share of 76.5 % in 2024.

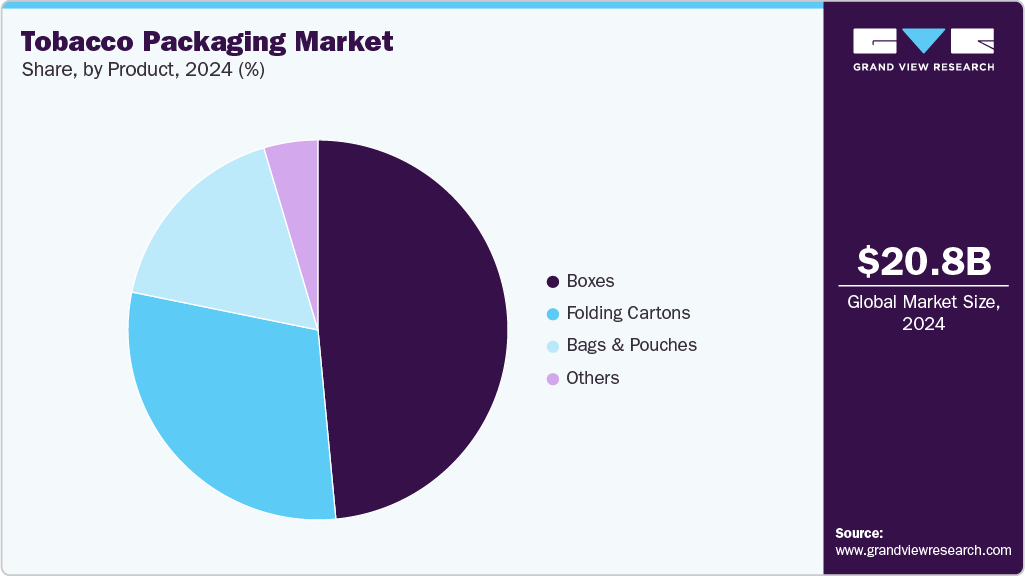

- By product, the boxes segment held the highest market share of 48.5% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 20.85 Billion

- 2030 Projected Market Size: USD 24.63 Billion

- CAGR (2025-2030): 2.6%

- Asia Pacific: Largest market in 2024

Urbanization, along with increased stress and workload, has led to a shift in consumer behavior, with many turning to tobacco products as a form of stress relief. Furthermore, companies actively leverage branding, product differentiation, and innovative marketing strategies to enhance consumer appeal, further propelling market growth. Consumer interest in smokeless tobacco and specially heated tobacco units (HTU) has replaced smoking tobacco as a new trend that is spurring the demand for the product. The rise in smoking behavior among end-users is attributed to hectic lifestyles, increased workloads, and hectic work schedules. Furthermore, hookah bar and pub culture trends have led to an increase in tobacco consumption, increasing the need for tobacco manufacturers to choose creative packaging solutions, which is expected to drive the market. Tobacco companies have exploited packaging innovations to appeal and mitigate the impact of health warning labels. For instance, in December 2024, Binhao (Guangzhou) Packaging Materials Co., Ltd. launched a new line of Heat‑Not‑Burn (HNB) tobacco packaging materials in China, including acetate filter rods, aluminum foil cigarette paper, plug wrap paper, tipping paper, and cardboard boxes.

The level of mergers and acquisitions in the tobacco packaging market is moderate. Larger packaging firms continue to acquire niche players to strengthen their capabilities in sustainable, compliant, and specialized packaging. These acquisitions are often aimed at expanding geographical reach and diversifying material offerings. In June 2025, Siegwerk announced its membership in Topac, an independent organization that delivers the latest market and technology updates, supports converters, printers, and brand owners, and shares trends in tobacco packaging production.

In April 2024, Oman initiated the plain packaging concept for tobacco products. Oman became the 2nd country in the Eastern Mediterranean region to enforce such packaging, aligning with its national tobacco control goals. Plain packaging strips these products of all branding, i.e., no logos, colors, or glamour. This policy aims to lessen the allure of the products by allowing only an unattractive, plain, uniform look for packaging while magnifying health warnings.

Material Insights

The paper & paperboard segment dominated the market with a revenue share of 83.2% in 2024. This growth is driven by increasing environmental concerns and stringent regulatory frameworks, which are accelerating the shift from plastic to sustainable, biodegradable alternatives. Paper-based materials are well-aligned with corporate ESG goals, offering recyclability, reduced environmental impact, and compatibility. Beyond regulatory compliance, paperboard offers operational and commercial advantages, including cost-effective production, high-speed machinability, and design versatility. These enable brands to maintain premium shelf presence even under visual restrictions. For instance, Stora Enso offers paperboard material such as Koppar and Ensocoat, a lightweight yet structurally rigid solution for both hard and soft tobacco pack formats.

The plastics segment is anticipated to grow at a significant CAGR from 2025 to 2030.The market is driven by its superior durability, cost-efficiency, moisture resistance, and customization capabilities. Plastic formats offer enhanced barrier properties, ensuring product freshness and extended shelf life. Further, growth is fueled by the rising popularity of heated tobacco and e-cigarette products, which rely on compact plastic packaging.

Packaging Type Insights

The secondary segment accounted for the largest revenue share in 2024. Secondary packaging supports mandates by integrating unique identifiers, QR codes, and tamper-evident features. Secondary packaging provides an extra layer of branding and distinction. Increasing demand for innovative cigarette boxes and rising consumption of cigarettes in social gatherings have driven the segment. Secondary packing protects not only tobacco products but also the original packaging.

The primary segment is anticipated to record the fastest CAGR from 2025 to 2030. The main function of primary packaging is to seal the product completely and eliminate the probability of product contamination via internal/external interferences. It also serves the purpose of increasing the product's shelf life, thereby making it desirable for prolonged consumption. An efficient primary packaging also prevents the product from getting damaged during transportation.

Product Insights

The boxes segment held the largest revenue share and is anticipated to record the fastest CAGR from 2025 to 2030. The market is driven by premium positioning and growing emphasis on sustainability and product security. Box formats offer a stable, printable surface ideal for meeting mandates such as large health warnings, tax stamps, and track-and-trace labeling. The rigid structure also supports anti-counterfeiting measures and facilitates automated packaging processes.

The folding cartons segment is anticipated to record a significant CAGR from 2025 to 2030. Folding cartons are commonly constructed from materials that can be recycled or decomposed, making them a greener option when compared to certain types of packaging. Manufacturers can select from various sizes, shapes, and finish to design a distinctive packaging solution that enhances the product's attractiveness.

Regional Insights

The North American market is anticipated to grow rapidly from 2025 to 2030. The market is driven by regulatory compliance and product diversification. Stringent government regulations in the U.S. and Canada, including health warning mandates and traceability requirements, are increasing the need for compliant and secure packaging solutions.

U.S. Tobacco Packaging Market Trends

The U.S. dominated the North American tobacco packaging market in 2024 due to sustainability trends and innovative packaging. Consumer and regulatory pressure to reduce plastic use is accelerating the shift toward recyclable and biodegradable materials. Companies also enhance packaging with authentication features such as QR codes and serialization to combat illicit trade.

Europe Tobacco Packaging Market Trends

The European tobacco packaging market held a considerable share in 2024. Stringent regulatory mandates and the diversification of tobacco products primarily drive the market. Sustainability trends influence material choices, with manufacturers shifting toward recyclable and biodegradable solutions.

Asia Pacific Tobacco Packaging Market Trends

The Asia Pacific region dominated the tobacco packaging market, with a revenue share of 43.1% in 2024. The market is driven by increasing tobacco consumption and the expansion of manufacturing bases. Regulatory developments such as plain packaging laws and health warning mandates encourage the adoption of advanced, compliant packaging solutions.

India is anticipated to record the fastest CAGR from 2025 to 2030. The market is driven by increasing demand for premium and compliant packaging formats. Urbanization and lifestyle shifts further boost demand for aesthetically appealing, durable packaging formats such as folding cartons. In addition, the emergence of organized retail and e-commerce has increased the importance of shelf visibility and branding.

Key Tobacco Packaging Company Insights

Some key players in the tobacco packaging industry include WestRock Company., Amcor plc, and International Paper.

-

WestRock Company offers sustainable paper and packaging solutions, with operations spanning over 40 countries and a strong presence in consumer and industrial markets. It has a comprehensive portfolio tailored to the tobacco industry, led by its premium Promina solid bleached sulfate (SBS) paperboard, designed specifically for cigarette and vaping packaging

Key Tobacco Packaging Companies:

The following are the leading companies in the tobacco packaging market. These companies collectively hold the largest market share and dictate industry trends.

- WestRock Company.

- Amcor plc

- International Paper.

- Mondi.

- Sonoco Products Company

- Siegwerk Druckfarben AG & Co. KGaA

- Stora Enso

Recent Development

-

In April 2025, RX Packaging launched an innovative push‑button tobacco packaging box for Fernway. The new box offers a precision-engineered locking system, eliminating the risk of accidental opening. It not only improves usability but also adds a layer of sophistication.

-

In July 2024, Philip Morris International Inc. announced an MoU with South Korea's producer of tobacco & nicotine products, KT&G. The agreement provides PMI an exclusive right to commercialize KT&G’s smoke-free products outside South Korea.

Tobacco Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 21.66 billion

Revenue forecast in 2030

USD 24.63 billion

Growth rate

CAGR of 2.6 % from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Material, packaging type, product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

WestRock Company, Amcor plc, International Paper, Mondi, Sonoco Products Company, Siegwerk Druckfarben AG & Co. KGaA, Stora Enso

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Tobacco Packaging Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the tobacco packaging market report based on material, packaging type, product, and region:

-

Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

Paper & Paperboard

-

Plastic

-

Other

-

-

Packaging Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Primary

-

Secondary

-

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Boxes

-

Folding Cartons

-

Bags & Pouches

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global tobacco packaging market size was estimated at USD 20.58 billion in 2024 and is expected to reach USD 22.09 billion in 2025.

b. The global tobacco packaging market is expected to grow at a compound annual growth rate of 2.6% from 2025 to 2030 to reach USD 24.63 billion by 2030.

b. Asia Pacific dominated the tobacco packaging market with a share of 43.1% in 2025. This is attributable to increasing consumption of cigarettes and chewing tobacco among consumers

b. Some key players operating in the tobacco packaging market include Innovia Films; WestRock; Amcor Ltd.; ITC; Mondi Group; British American Tobacco; Novelis; Philip Morris International Inc.; Reynolds American Corporation; and Sonoco.

b. Key factors that are driving the market growth include rising cigarette consumption globally is expected to increase the demand for cigarette. Furthermore, introduction of tobacco that are smokeless for dipping or chewing and increasing penetration of e-cigarettes are some of the significant factors driving the market worldwide.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.