- Home

- »

- Pharmaceuticals

- »

-

Tourette Syndrome Treatment Market Size Report, 2030GVR Report cover

![Tourette Syndrome Treatment Market Size, Share & Trends Report]()

Tourette Syndrome Treatment Market Size, Share & Trends Analysis Report By Product (Antipsychotics, Non - Antipsychotics), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-171-1

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Market Size & Trends

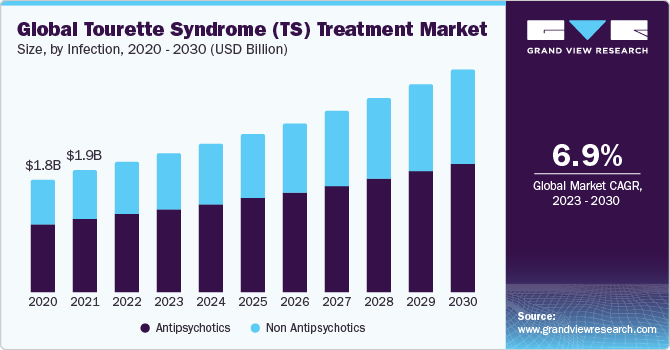

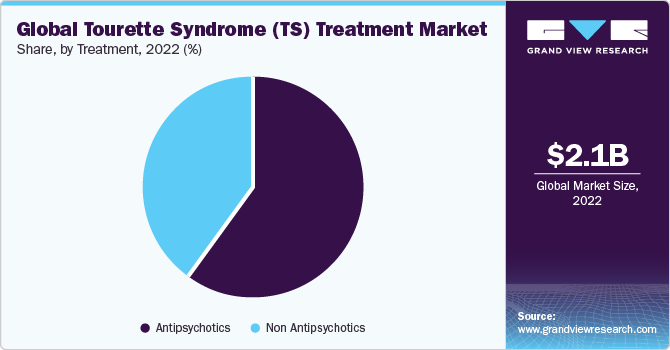

The global tourette syndrome treatment market size was valued at USD 2.07 billion in 2022 and is expected to grow at a Compound Annual Growth Rate (CAGR) of 6.96 % from 2023 to 2030. The ongoing research advancements, increased awareness and advocacy efforts, government initiatives, innovation in therapeutic approaches, patient and caregiver involvement, and regulatory approvals drive the TS treatment market. This dynamic landscape reflects a commitment to understanding TS, developing effective treatments, and creating a supportive environment for affected individuals, contributing to the market's growth.

According to the CDC, the prevalence of moderate to severe TS is reported to be 44%, indicating a significant portion of individuals experiencing notable symptoms of the condition. Interestingly, adolescents between the ages of 12 and 17 show a more than twofold likelihood of being diagnosed with TS compared to children aged 6 to 11. It highlights the impact of TS on various age groups. It emphasizes the substantial demand for effective treatments within the TS treatment market to address the diverse needs of individuals with the condition.

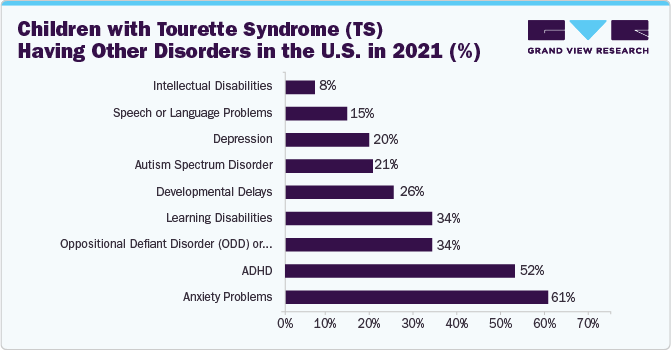

According to the CDC, 83% of children diagnosed with TS also have at least one additional mental, behavioral, or developmental disorder that serves as a driver for the TS treatment market. This high prevalence of comorbidities highlights the complexity of managing TS and underlines the need for comprehensive treatment approaches that address the diverse spectrum of associated conditions. The market is driven by the demand for integrated therapies and interventions that can effectively manage the diverse symptoms and challenges presented by individuals with TS and coexisting disorders.

Furthermore, the Tourette Syndrome Foundation of Canada (TSFC) plays a vital role as a driver in the TS treatment market by serving as a national voluntary health organization. With a dedicated focus on providing support and disseminating valuable information, the TSFC significantly contributes to raising awareness, fostering community engagement, and enhancing the overall understanding of Tourette syndrome across Canada. This proactive involvement catalyzes advancing research, promoting advocacy, and addressing the diverse needs of individuals and families affected by TS. The TSFC's commitment to support and education aligns with the broader efforts to enhance the landscape of TS treatment and care.

Product Insights

On the basis of treatment, the TS treatment market is segmented into antipsychotics and non-antipsychotics. The antipsychotics segment gained a maximum market share in 2022. In March 2023, Emalex Biosciences initiated a Phase 3 clinical trial for ecopipam in treating TS, with the first patient recently dosed. During the open-label phase lasting 12 weeks, participants are administered ecopipam. Following this phase, those exhibiting a minimum 25% decline in the Yale Global Tic Severity Scale-Total Tic Score at weeks eight and 12 will be randomized for the double-blind phase, comparing ecopipam and placebo until relapse, for up to an additional 12 weeks. The trial aims to evaluate efficacy based on the difference in time-to-relapse between the two groups, contributing to the prominence of Antipsychotics in the TS treatment market.

Regional Insights

North America dominated the market in 2022. The findings from a CDC study, relying on parent-reported data, provide insights into the prevalence of TS among children in the U.S. According to this research, approximately 174,000 children, constituting 0.3% of the population aged 3–17, received a diagnosis of TS between 2016 and 2019. This substantial number of diagnosed cases underscores the significance of TS as a health concern in North America, particularly in the U.S., thereby acting as a driving factor for the Tourette syndrome treatment market. On the other hand, Asia Pacific is expected to grow at the fastest CAGR during the forecast period

Competitive Insights

Key players operating in the market are Neurocrine Biosciences, Inc., AstraZeneca Plc, Reviva Pharmaceuticals Inc., Viatris Inc. (Mylan Inc.), Otsuka Holdings Co. Ltd., Catalyst Pharmaceutical, Teva Pharmaceutical Industries Ltd. (Auspex Pharmaceuticals, Inc.), and Novartis AG The market participants are constantly working towards new product development, M&A activities, and other strategic alliances to gain new market avenues. The following are some instances of such initiatives:

-

In June 2023, SciSparc Ltd., a specialized clinical-stage pharmaceutical company dedicated to central nervous system disorder therapies, received approval for its Phase IIb clinical trial involving SCI-110 from the Federal Institute for Drugs and Medical Devices in Germany (BfArM). The trial will focus on treating adult patients with Tourette Syndrome (TS) and will be conducted at the Hannover Medical School in Germany.

-

In May 2022, Neurotherapeutics Ltd, a company from the University of Nottingham, successfully created a prototype device resembling a wristwatch designed for TS participants to use in the comfort of their homes with guidance from Nottingham-based researchers. This trial builds upon prior research and will engage 135 individuals dealing with TS.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."