- Home

- »

- Automotive & Transportation

- »

-

Tower Crane Market Size, Share And Growth Report, 2030GVR Report cover

![Tower Crane Market Size, Share & Trends Report]()

Tower Crane Market (2023 - 2030) Size, Share & Trends Analysis Report By Product, By Design (Top Slewing, Bottom Slewing), By Lifting Capacity (Below 5 Metric Tons, 6-80 Metric Tons), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-148-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Tower Crane Market Summary

The global tower crane market size was estimated at USD 5.29 billion in 2022 and is projected to reach USD 7.83 billion by 2030, growing at a compound annual growth rate (CAGR) of 5.19% from 2023 to 2030. The growth can be attributed to the ongoing surge in construction and infrastructure development projects worldwide.

Key Market Trends & Insights

- North America dominated the market with a revenue share of nearly 37% in 2022.

- Asia Pacific is expected to register the highest CAGR of 6.4% over the forecast period.

- Based on lifting capacity, the 6 to 80 metric tons segment accounted for the largest market share of over 46% in 2022.

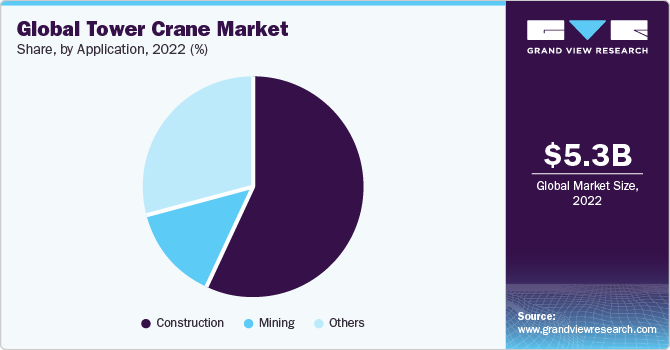

- Based on the application, the construction segment accounted for the largest market share of nearly 49% in 2022.

- Based on design, the top-slewing crane segment accounted for the largest market share of 59% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 5.29 Billion

- 2030 Projected Market Size: USD 7.83 Billion

- CAGR (2023-2030): 5.19%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

For instance, in June 2023, the Rebuilding American Infrastructure with Sustainability and Equity (RAISE) program funded projects in rail, road, port, and transit. The program allocated funds of over USD 2.2 billion for 162 infrastructure projects across the nation. These projects encompass a wide array of initiatives, such as road and bridge improvements, public transportation enhancements, railway upgrades, port developments, and various sustainable infrastructure projects.

As cities expand, the demand for tower cranes rises, enabling developers to meet tight project timelines and handle complex construction challenges. In addition, the construction industry is booming in residential, commercial, and industrial sectors owing to urban population growth and the need for sustainable and modern infrastructure. As countries continue to invest in urbanization, industrialization, and modernization, the demand for efficient and reliable tower cranes remains strong. Tower cranes play a significant role in tall building construction, heavy lifting tasks, and maneuvering materials within confined spaces, making them indispensable for large-scale construction projects.

As the global population continues to grow, more and more people are migrating to urban areas in search of better economic opportunities and improved quality of life. For instance, according to an article published by Stats NZ, an official statistical agency of New Zealand, in July 2023, New Zealand recorded a net migration gain of 96,200. The record net migration gain is likely to have a positive impact on the New Zealand economy. It will help to boost the labor force and increase demand for goods and services.

However, this migration may also put some strain on infrastructure and housing. This influx of people into cities has created a pressing need for the development of modern infrastructure, including skyscrapers, residential buildings, and commercial complexes. Tower cranes are essential for construction projects, enabling the efficient and safe lifting and placement of heavy materials and equipment at great heights. As a result, the construction industry has witnessed a surge in demand for tower cranes to keep pace with the ever-expanding urban landscape.

Economic development in many regions has led to increased investments in construction and real estate. Governments and private investors are pouring resources into urban development projects to stimulate economic growth and create jobs. This fuels the demand for tower cranes as construction projects become more numerous and ambitious. For instance, in June 2022, the Ministry of Road Transport and Highways in India announced the inauguration of 15 new national highway projects in Bihar, North India. These projects, with a total value of USD 1.7 billion, aimed to improve the transportation infrastructure in the region.

The global energy sector is witnessing a significant transformation, with a shift toward cleaner and more sustainable energy sources. This transition has led to a surge in demand for specialized cranes, to facilitate the construction and maintenance of various energy infrastructure projects. The installation of wind turbines and solar panels requires sophisticated lifting solutions that can handle the precise and delicate positioning of these intricate components. With the increasing adoption of renewable energy technologies, the tower crane market is poised to capitalize on this trend. Manufacturers are likely to focus on developing cranes tailored to the specific requirements of renewable energy projects, ensuring efficiency, safety, and precision during installation and maintenance activities.

The versatility of tower cranes allows them to be utilized across various stages of energy infrastructure development, from the construction of power plants and wind farms to the installation of solar arrays and transmission lines. Consequently, the evolving energy landscape presents a lucrative opportunity for the market to expand its offerings and cater to the specialized demands of the energy sector. However, the complexity and the substantial financial commitment required to acquire or lease tower cranes pose significant challenges to the market. These machines come with a hefty price tag, encompassing the cost of the crane itself, its transportation, assembly, and ongoing maintenance. For small construction firms or those looking to expand their fleet, this initial investment can act as a hurdle.

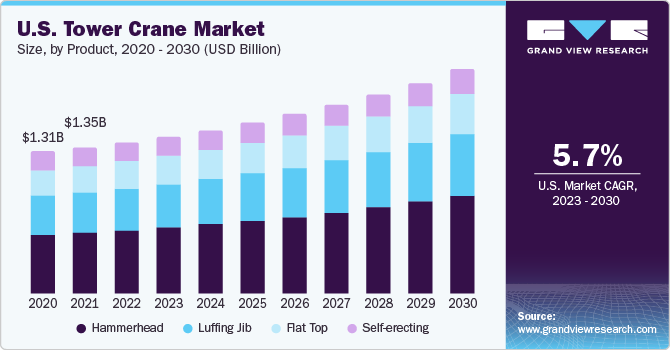

Product Insights

Based on product, the hammerhead segment accounted for the largest market share of over 41% in 2022. Hammerheads can reach extraordinary heights and carry heavy loads with precision, allowing construction companies to tackle complex projects with ease. Their ability to work in tight urban spaces further adds to their appeal, as they can maximize construction potential in densely populated areas. Hammerheads are designed to be energy-efficient and produce lower emissions compared to traditional construction machinery, contributing to a more environment-friendly construction industry.

In December 2021, LIEBHERR Australia installed hammerhead cranes within its lineup. The installation supported the construction of the WestConnex M4-M5 Link Tunnels. The incorporation of energy-efficient components in the crane underscores the company's focus on minimizing its environmental footprint and cutting down on operational expenses. Luffing jib is expected to register a considerable growth over the forecast period. The growth of the segment is owing to their versatility and ability to operate in confined urban spaces, making them a preferred choice for high-rise construction projects in densely populated areas. They offer a compact footprint and can navigate complex construction sites, minimizing disruption to the surrounding environment. Their ability to lift heavy loads to great heights makes them essential for projects such as skyscrapers, bridges, and wind turbine installations.

Design Insights

Based on design, the top-slewing crane segment accounted for the largest market share of 59% in 2022. The growth is attributed to its exceptional lifting capacity and reach, making it an ideal choice for handling heavy loads and materials, allowing for efficient and rapid construction progress. This crane's adaptability to various construction environments, from skyscrapers to bridge building and beyond, contributes to its global prominence. Moreover, the top-slewing crane's innovation and technological advancements have played a crucial role in its widespread adoption. With features such as computerized controls, enhanced safety systems, and improved energy efficiency, these cranes continue to evolve, meeting the ever-growing demands of modern construction projects.

The bottom slewing segment is anticipated to grow at a considerable rate over the forecast period. The growth can be attributed to their versatility and adaptability, making them indispensable in a wide range of construction and industrial applications. Their relatively compact design and high load-bearing capacity make them a preferred choice in urban areas with limited space. Additionally, advancements in crane technology have led to increased efficiency and safety features, further driving their popularity. Modern bottom slewing cranes come equipped with sophisticated control systems, remote operation capabilities, and advanced safety measures, reducing the risk of accidents and enhancing overall productivity.

Application Insights

Based on the application, the construction segment accounted for the largest market share of nearly 49% in 2022. The construction industry's increasing demand, owing to the growing urbanization and population growth, and technological advancements in the construction sector have contributed to the rising demand for tower cranes. These cranes are equipped with advanced features such as remote-control systems, precision engineering, and increased automation, which enhance safety and improve efficiency on construction sites. In July 2023, Radius Group, a provider of lifting solutions, collaborated with Skyline Cockpit, an Israeli technology provider for cranes to introduce a remote-control technology for tower cranes. This initiative would help in enhancing efficiency and safety on construction sites as it provides real-time data on wind direction and speed, load weight, and crane height.

The mining segment is anticipated to grow at a considerable CAGR of 5.1% over the forecast period. The mining sector plays a pivotal role in the global economy, as it provides essential raw materials for various industries, including construction, manufacturing, and energy production. As mining operations expand to meet the rising global demand for minerals, the need for efficient and versatile equipment such as tower cranes becomes imperative. These cranes are instrumental in the construction and maintenance of mining infrastructure, such as conveyor systems, processing plants, and storage facilities, making them indispensable for the industry's growth.

Moreover, safety and productivity are paramount concerns in mining operations, and tower cranes offer significant advantages in these aspects. Their height and lifting capabilities enable the swift and precise positioning of heavy machinery, materials, and components, reducing downtime and enhancing operational efficiency. Additionally, tower cranes are designed to withstand challenging environmental conditions commonly encountered in mining sites, further increasing their appeal to industry.

Lifting Capacity Insights

Based on lifting capacity, the 6 to 80 metric tons segment accounted for the largest market share of over 46% in 2022. The global demand for taller and more complex structures, such as skyscrapers, bridges, and industrial facilities, fuels the continuous development of these towering giants. Architects and engineers constantly push the limits of design and construction, necessitating crane technology that can keep up with their ambitions.

The above-80 metric tons segment is expected to register the second-highest growth rate over the forecast period. This growth can be attributed to the increasing demand for mega-infrastructure projects, such as skyscrapers, bridges, and industrial facilities, which necessitates the use of these heavy-duty cranes to handle massive loads and reach great heights. Urbanization and population growth have fueled the construction industry's expansion, leading to a surge in the need for larger and more powerful tower cranes. Additionally, advancements in crane technology have made it possible to manufacture and operate tower cranes with ever-increasing capacities.

Regional Insights

North America dominated the market with a revenue share of nearly 37% in 2022. The growth of the region is primarily driven by electricity or diesel engines, depending on the specific job site requirements and environmental considerations. In the region, electric tower cranes are becoming increasingly popular due to their eco-friendliness and cost-efficiency. They are connected to the local power grid, drawing electricity to operate their motors, which drive the crane's various movements such as lifting, lowering, and slewing. On the other hand, diesel-powered tower cranes are preferred for remote or off-grid construction sites where access to electrical power may be limited.

Asia Pacific is expected to register the highest CAGR of 6.4% over the forecast period. The soaring demand for skyscrapers, infrastructure projects, and urban development has fuelled the proliferation of tower cranes across the region. These cranes are essential for lifting heavy materials and equipment to great heights, making them indispensable in the construction of high-rise buildings and large-scale infrastructure. Apart from the region’s continuous urbanization and population growth, government investments in infrastructure, such as transportation networks and energy facilities, have contributed to the high demand for these cranes. As countries in the region strive to modernize and accommodate their expanding populations, tower cranes remain a symbol of progress and development, ensuring that Asia Pacific's construction sector continues to flourish.

Key Companies & Market Share Insights

Key players in the global tower cranes industry are engaged in several growth strategies, including partnerships, mergers & acquisitions, and geographical expansion, to stay afloat in the competitive market scenario. For instance, in January 2023, The Manitowoc Company, Inc. launched flat top tower crane named Potain MCT 1005 M50 in China. It is designed to be used in Southeast Asia and other emerging markets with a lifting capacity of 50 tons.

Key Tower Crane Companies:

- COMANSA

- FAVELLE FAVCO BERHAD

- Grúas Sáez, S.L.

- JASO Tower Cranes

- LIEBHERR

- Raimondi

- Sichuan Construction Machinery (Group)Co., Ltd

- Terex Corporation

- The Manitowoc Company, Inc.

- WOLFFKRAN International AG.

- XCMG Group

- Zoomlion Heavy Industry Science & Technology Co., Ltd.

Tower Crane Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 5.49 billion

Revenue forecast in 2030

USD 7.83 billion

Growth rate

CAGR of 5.19% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in units; revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, design, lifting capacity, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

COMANSA; FAVELLE FAVCO BERHAD; Grúas Sáez, S.L.; JASO Tower Cranes; LIEBHERR; Raimondi; Sichuan Construction Machinery (Group)Co., Ltd; Terex Corporation; The Manitowoc Company, Inc.; WOLFFKRAN International AG.; XCMG Group; and Zoomlion Heavy Industry Science&Technology Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Tower Crane Market Report Segmentation

The report forecasts volume and revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global tower crane market report based on product, design, lifting capacity, application, and region:

-

Product Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Flat Top

-

Hammerhead

-

Luffing Jib

-

Self-erecting

-

-

Design Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Top Slewing Crane

-

Bottom Slewing Crane

-

-

Lifting Capacity Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Below 5 Metric Tons

-

6 to 80 Metric Tons

-

Above 80 Metric Tons

-

-

Application Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Construction

-

Mining

-

Others

-

-

Regional Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa (MEA)

-

U.A.E.

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global tower cranes market size was estimated at USD 5.29 billion in 2022 and is expected to reach USD 5.49 billion in 2023.

b. The global tower cranes market is expected to grow at a compound annual growth rate of 5.19% from 2023 to 2030 to reach USD 7.83 billion by 2030.

b. North America dominated the tower cranes market owing to the need for efficient and precise construction processes contributing significantly to the region's skyline and infrastructure development.

b. Some key players operating in the tower cranes market include COMANSA; FAVELLE FAVCO BERHAD; Grúas Sáez, S.L.; JASO Tower Cranes; LIEBHERR; Raimondi; Sichuan Construction Machinery (Group)Co.,Ltd; Terex Corporation; The Manitowoc Company, Inc.; WOLFFKRAN International AG.; XCMG Group; and Zoomlion Heavy Industry Science&Technology Co., Ltd.

b. Key factors that are driving the tower cranes market growth is owing to gorwing construction industries due to urbanization, renewable energy projects, and rising government regulations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.