- Home

- »

- Next Generation Technologies

- »

-

Trade Finance Market Size And Share, Industry Report, 2030GVR Report cover

![Trade Finance Market Size, Share & Trends Report]()

Trade Finance Market (2025 - 2030) Size, Share & Trends Analysis Report By Instrument, By Service Provider (Banks, Financial Institutions), By Trade, By Enterprise Size, By Industry, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-133-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Trade Finance Market Summary

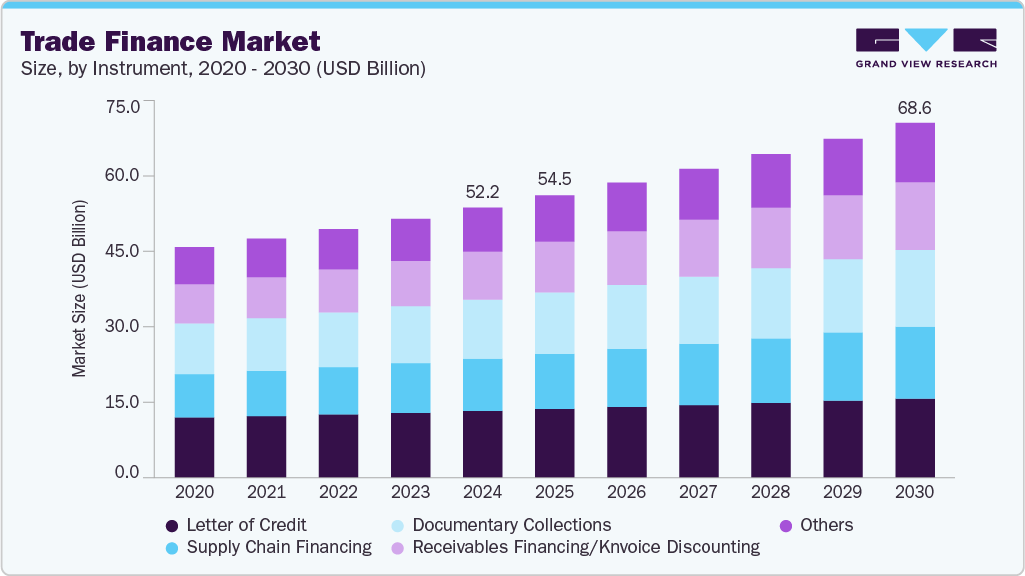

The global trade finance market size was estimated at USD 52.23 billion in 2024 and is projected to reach USD 68.63 billion by 2030, growing at a CAGR of 4.7% from 2025 to 2030. Globalization and international trade have significantly propelled the growth of the market.

Key Market Trends & Insights

- North America trade finance industry dominated globally in 2024 with a revenue share of more than 26.8%.

- The U.S. trade finance industry is being significantly driven by the expansion of cross-border trade activities.

- By instrument, the letter of credit segment dominated the market in 2024 and accounted for a revenue share of more than 24.0%.

- By service provider, the banks segment dominated the market in 2024 and accounted for a revenue share of more than 34%.

- By trade, the international segment dominated the market in 2024 and accounted for a revenue share of over 59.0%.

Market Size & Forecast

- 2024 Market Size: USD 52.23 Billion

- 2030 Projected Market Size: USD 68.63 Billion

- CAGR (2025-2030): 4.7%

- North America: Largest market in 2024

The ever-evolving technological landscape has revolutionized trade finance. Digital platforms and fintech innovations have made it easier for businesses to access and utilize trade financing. These technologies have streamlined the application process, reduced paperwork, and accelerated decision-making, making trade finance more attractive and efficient. Moreover, in an increasingly complex global economy, businesses face various risks, including credit, currency, and geopolitical risks. Trade finance offers risk mitigation solutions, such as credit insurance and hedging options, allowing businesses to protect themselves from unexpected financial losses.Shifts in trade patterns play a significant role in driving the dynamics of the trade finance industry. These shifts encompass a range of factors that collectively influence the demand for trade finance services. One notable factor is the emergence of new trade routes and corridors. As global trade networks evolve, new routes may become more prominent due to factors like infrastructure development, political agreements, or changes in supply and demand. These emerging trade routes often require flexible and tailored financing solutions, making trade finance a crucial component in facilitating international commerce.

In times of economic downturns or heightened uncertainty, businesses often turn to trade finance as a strategic tool to navigate challenging circumstances. Such periods, marked by reduced consumer spending, declining business investment, and a general tightening of credit, can strain a company's financial resources. In response, trade finance becomes a vital lifeline, helping companies manage their cash flow effectively. By accessing short-term credit or trade finance facilities, businesses can ensure they have the liquidity required to meet immediate financial obligations, such as paying suppliers or covering operational costs. This financial breathing room can differentiate between survival and insolvency during economic hardships.

A notable restraint in the market for trade finance is the persistence of traditional and paper-based processes, which can lead to inefficiencies, delays, and increased costs. These legacy methods can hinder the smooth flow of trade finance operations, making them susceptible to manual errors and fraud risks. To overcome this challenge, adopting modern technologies such as blockchain, artificial intelligence, and digital documentation is essential. Implementing blockchain can enhance transparency, security, and traceability in trade transactions, reducing the likelihood of fraud. Embracing digital platforms and automated systems streamlines document processing and accelerates the approval and execution of trade finance transactions, ultimately driving efficiency and cost savings.

Instrument Insights

The letter of credit segment dominated the market in 2024 and accounted for a revenue share of more than 24.0%. The letter of credit segment has historically dominated the market due to its role in providing a secure and trusted mechanism for international trade transactions. Letters of credit act as a financial guarantee, assuring both the buyer and the seller that the terms of the trade will be met. This mitigates the risk of non-payment for sellers and ensures the delivery of goods for buyers.

The receivables financing/invoice discounting segment is anticipated to register significant growth over the forecast period. It offers businesses a flexible and accessible financing solution by allowing them to leverage their outstanding invoices as collateral. This flexibility is particularly attractive to Small & Medium Enterprises (SMEs) that may face cash flow challenges. Moreover, the digitalization of trade finance has significantly streamlined the receivables financing process. Online platforms and fintech innovations have made it easier for businesses to manage and finance their accounts receivable, reducing paperwork and transaction times.

Service Provider Insights

The banks segment dominated the market in 2024 and accounted for a revenue share of more than 34%. They possess extensive networks and established relationships with businesses worldwide, making them trusted intermediaries in international trade transactions. This trust is particularly crucial in cross-border deals, where assurance of payment and delivery is paramount. Moreover, banks offer a wide range of trade finance products and services, including letters of credit, trade loans, and documentary collections. This diversity allows them to cater to the diverse needs of various businesses engaged in global trade.

The financial institutions segment is anticipated to register significant growth over the forecast period. Financial institutions are emerging at a significant rate in the market due to their ability to fill specific niches and offer specialized services. Financial institutions often provide more agile and tailored solutions compared to traditional banks. They leverage technology to streamline processes, reduce paperwork, and offer faster access to financing. This agility allows them to serve a broader spectrum of businesses, including small and medium-sized enterprises that traditional banks may have underserved.

Trade Insights

The international segment dominated the market in 2024 and accounted for a revenue share of over 59.0%. International trade finance has dominated the trade finance industry due to the inherently global nature of trade transactions. This type of trade finance specializes in facilitating cross-border trade by providing financing solutions that bridge gaps in time, distance, and currency. One key reason for its dominance is the scale of international trade, which involves large volumes of goods and services moving between countries.

The domestic segment is anticipated to register significant growth over the forecast period. Domestic trade represents a substantial portion of a country's economic activity, often exceeding international trade volumes. As a result, businesses engaged in domestic trade require financing solutions to manage working capital, bridge cash flow gaps, and ensure the smooth flow of goods and services within a single country. Moreover, the rise of e-commerce and digital platforms has accelerated domestic trade, especially in sectors like retail and distribution.

Enterprise Size Insights

The large enterprises segment dominated the market in 2024 with a revenue share of over 73.0%. Large corporations often engage in extensive international trade operations involving complex supply chains, numerous suppliers, and global customer bases. Managing these intricate networks requires substantial financial resources and sophisticated trade finance solutions to ensure smooth transactions and minimize risks. Moreover, established large enterprises typically have well-established relationships with financial institutions, granting them access to a wide range of trade finance services, including letters of credit, trade credit insurance, and supply chain financing.

The SMEs segment is anticipated to register significant growth. Globalization and digitalization have leveled the playing field, enabling SMEs to participate more easily in international trade. With the help of online platforms and fintech solutions, SMEs can access trade finance services that were once the domain of larger corporations. Moreover, SMEs are often more agile and adaptable, allowing them to identify niche markets and respond quickly to changing consumer preferences.

Industry Insights

The construction segment dominated the market in 2024 with a revenue share of over 21.0%. Due to its unique characteristics and substantial financial needs, the construction industry has established a dominant presence in the market. Construction projects often involve complex, cross-border supply chains that require extensive financing for the procurement of raw materials, heavy machinery, and skilled labor. These projects also tend to be long-term endeavors, further necessitating the availability of trade finance solutions to sustain operations over extended periods.

The shipping & logistics segment is anticipated to register significant growth over the forecast period. The shipping and logistics segment is rapidly emerging due to its pivotal role in global trade operations. This sector operates at the heart of supply chains, facilitating the movement of goods across borders and continents. As international trade continues to grow, the demand for efficient logistics services and financing solutions has surged. Shipping and logistics companies increasingly leverage technology and digitization to optimize their operations, resulting in greater transparency and traceability throughout the supply chain.

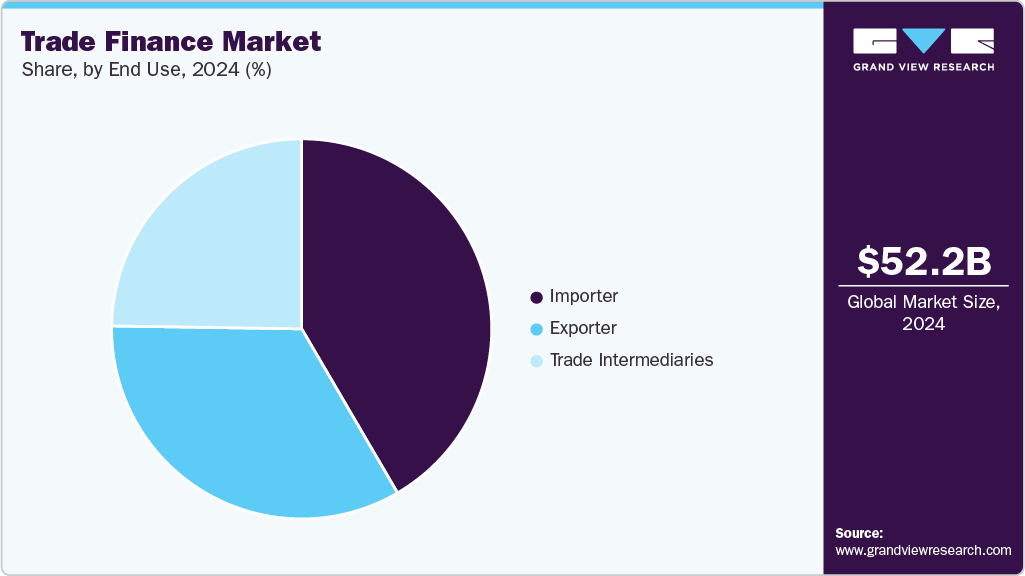

End Use Insights

The importer segment dominated the market in 2024 with a global revenue share of over 40.0%. The importer segment has historically dominated the market due to its crucial role in international trade activities. Importers are often the key initiators of trade transactions, sourcing goods and raw materials from various countries to meet domestic demand. To facilitate these transactions, importers require financial instruments that provide security to their suppliers, ensure the timely delivery of goods, and manage currency fluctuations and payment risks. Import financing tools such as letters of credit, open account financing, and trade credit insurance are essential in this context.

The trade intermediaries segment is anticipated to register significant growth over the forecast period. Trade intermediaries, including agents, brokers, and logistics providers, play a vital role in connecting buyers and sellers across borders, managing complex supply chains, and ensuring the smooth flow of goods. As global trade becomes more intricate, businesses are increasingly relying on intermediaries to navigate regulatory compliance, customs procedures, and the intricacies of international trade finance. Trade intermediaries often possess in-depth knowledge of specific markets, helping companies expand their global footprint and tap into new opportunities.

Regional Insights

North America trade finance industry dominated globally in 2024 with a revenue share of more than 26.8%. The region is home to some of the largest financial institutions, including major banks and financial hubs like New York City. These institutions have a global presence and extensive networks, allowing them to offer a wide range of trade finance services to businesses engaged in international trade. Moreover, North America has a robust and diverse economy with a significant focus on international trade. The U.S., in particular, is one of the world's largest importers and exporters of goods and services. This high level of trade activity naturally drives the demand for trade finance solutions to support the complex financial transactions associated with cross-border trade.

U.S. Trade Finance Market Trends

The U.S. trade finance industry is being significantly driven by the expansion of cross-border trade activities, particularly with key partners such as Mexico, Canada, China, and the European Union. As one of the world’s largest importers and exporters, the U.S. relies heavily on robust trade finance mechanisms to manage the complexities and risks associated with global transactions. The increased demand for secure and flexible financing instruments—such as letters of credit, export credit, and trade receivables financing—is directly linked to the evolving nature of global supply chains and heightened geopolitical dynamics, including the need for U.S. exporters to find alternative markets amid shifting tariff policies.

Asia Pacific Trade Finance Market Trends

The Asia Pacific trade finance industry is anticipated to emerge as the fastest-growing market from 2025 to 2030. Asia Pacific is home to some of the fastest-growing economies, such as India and China, which have become major players in international trade. The region's expanding middle class and consumption-driven growth have led to increased imports and exports, driving up the demand for trade finance services to facilitate these transactions. Moreover, Asia Pacific's geographical proximity to key global supply chains and trading partners has made it a central hub for trade activities. The region's strategic location offers convenient access to major markets across Asia, Europe, and North America, making it an ideal gateway for businesses engaged in international trade.

China’s trade finance industry is largely influenced by its position as one of the leading global exporters and importers. The country’s high volume of cross-border trade activity generates ongoing demand for financing instruments such as letters of credit, export credit, and supplier finance. As firms engage in international transactions, trade finance serves as a mechanism to manage payment risk, working capital, and currency exposure. Government policy is another major driver. Initiatives like the Belt and Road Initiative (BRI) have expanded China’s trade links with developing regions, increasing the need for structured trade finance in infrastructure and large-scale goods transactions.

The trade finance industry in India is driven by its increasing participation in global trade, supported by government initiatives like the Remission of Duties and Taxes on Exported Products (RoDTEP) scheme, which is enhancing the competitiveness of Indian exporters. The reinstatement of RoDTEP in June 2025 aims to reimburse exporters for embedded taxes and levies, thereby reducing the cost burden and promoting exports across various sectors, including textiles, chemicals, and agriculture. In addition, the adoption of digital technologies, such as blockchain and artificial intelligence, is streamlining trade finance processes in India. These technologies enhance transparency, reduce processing times, and improve risk assessment, making trade finance more accessible and efficient for businesses, particularly small and medium-sized enterprises (SMEs).

Europe Trade Finance Market Trends

The Europe trade finance industry is driven by the regulatory developments shaping the market, with the EU’s Digital Finance Strategy and stringent AML/CFT (Anti-Money Laundering/Counter-Financing of Terrorism) requirements pushing financial institutions to adopt automated compliance solutions. In addition, digitalization is revolutionizing the sector, with blockchain and distributed ledger technology (DLT) enhancing transparency and reducing fraud. Platforms like we.trade and Marco Polo Network are gaining traction, while AI-powered tools are improving risk assessment and compliance processes.

The UK trade finance industry is continuing to be influenced by the post-Brexit dynamics, with new trade agreements and supply chain realignments creating both challenges and opportunities. The increased complexity of customs procedures and regulatory divergence from EU standards has led to growing demand for risk mitigation instruments such as letters of credit and trade credit insurance. At the same time, the UK's pursuit of trade deals with CPTPP nations, the U.S., and India is opening new avenues for trade finance providers to support businesses expanding into these markets.

Key Trade Finance Company Insights

Some of the key players operating in the market include DBS Bank Ltd, Santander Bank, JPMorgan Chase & Co., Bank of America Corporation, and Deutsche Bank AG. The market is notably fragmented, comprising a mix of global financial institutions, regional banks, and specialized trade finance providers. Leading market participants are investing in technological innovation and product development to diversify their trade finance solutions and improve service efficiency. These players are also engaging in a range of strategic initiatives to strengthen their market position and expand their international footprint. Such initiatives include launching new digital platforms, forming strategic partnerships, entering into trade facilitation agreements, pursuing mergers and acquisitions, increasing capital allocation to trade-focused services, and exploring emerging markets to capture new growth opportunities.

With an increasing number of financial institutions and fintech startups venturing into this domain, the competition has intensified significantly. However, this heightened competition has yielded notable benefits for businesses seeking trade credit. These advantages include the availability of more favorable interest rates and flexible repayment options, making trade finance more accessible and appealing to a broader range of enterprises.

-

JPMorgan Chase & Co. is a prominent provider of trade finance services with a global footprint that spans more than 100 countries. The company supports corporations and financial institutions in managing the financial aspects of cross-border trade, offering a range of services designed to facilitate international commerce while mitigating associated risks. The company’s trade finance portfolio includes documentary trade services such as letters of credit and documentary collections. These services are structured to provide security for both importers and exporters by ensuring that payment and shipment obligations are met in accordance with pre-agreed terms.

-

Deutsche Bank AG is a global financial institution headquartered in Frankfurt, Germany, with a significant presence in international trade finance. The bank offers a broad range of trade finance products aimed at facilitating international trade flows for corporate clients, financial institutions, and exporters/importers worldwide. Its trade finance services include documentary credits, such as letters of credit, which provide a secure payment mechanism to support cross-border transactions by mitigating payment and delivery risks. Deutsche Bank AG also offers documentary collections and guarantees, which serve to manage the transfer of goods and payments between trading partners under established terms.

Key Trade Finance Companies:

The following are the leading companies in the trade finance market. These companies collectively hold the largest market share and dictate industry trends.

- BNP Paribas

- Citigroup, Inc.

- TD Bank

- UBS

- Arab Bank

- DBS Bank Ltd

- JPMorgan Chase & Co.

- Santander Bank

- Deutsche Bank AG

- Bank of America Corporation

Recent Developments

-

In December 2024, HSBC and the World Bank's International Finance Corporation (IFC) launched a USD 1 billion trade finance program to support emerging markets. This initiative is designed to boost cross-border trade and increase exports in critical sectors. The partnership aims to tackle global supply chain issues and drive economic growth, providing key industries with better access to trade finance solutions.

-

In September 2023, Bank of America Corporation introduced CashPro Supply Chain Solutions, a platform aimed at digitizing trade finance processes. The initial module, Open Account Automation, streamlines invoice approval and payment, reducing processing time from days or weeks to minutes. By integrating data from suppliers, logistics providers, and warehouse systems, the platform enhances visibility and accelerates decision-making across the supply chain. This initiative is part of Bank of America Corporation's multi-year investment to modernize trade finance and improve efficiency for its business clients

-

In January 2023, the International Chamber of Commerce (ICC) introduced ICC TradeFlow, a new digital platform for trade finance. This platform is designed to simplify and digitize the trade finance process, helping to lower costs and enhance efficiency.

Trade Finance Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 54.57 billion

Revenue forecast in 2030

USD 68.63 billion

Growth Rate

CAGR of 4.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Instrument, service provider, trade, enterprise size, industry, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

BNP Paribas; Citigroup, Inc.; TD Bank; UBS; Arab Bank; DBS Bank Ltd; Deutsche Bank AG; JPMorgan Chase & Co.; Santander Bank; Bank of America Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Trade Finance Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the trade finance market report based on instrument, service provider, trade, enterprise size, industry, end use, and region.

-

Instrument Outlook (Revenue, USD Billion, 2018 - 2030)

-

Letter of Credit

-

Supply Chain Financing

-

Documentary Collections

-

Receivables Financing/Invoice Discounting

-

Others

-

-

Service Provider Outlook (Revenue, USD Billion, 2018 - 2030)

-

Banks

-

Financial Institutions

-

Trading Houses

-

Others

-

-

Trade Outlook (Revenue, USD Billion, 2018 - 2030)

-

Domestic

-

International

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

SMEs

-

-

Industry Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Construction

-

Wholesale/Retail

-

Manufacturing

-

Automobile

-

Shipping & Logistics

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Importer

-

Exporter

-

Trade Intermediaries

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

South America

-

Brazil

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global trade finance market size was estimated at USD 52.23 billion in 2024 and is expected to reach USD 54.57 billion in 2025.

b. The global trade finance market is expected to grow at a compound annual growth rate of 4.7% from 2025 to 2030 to reach USD 68.63 billion by 2030.

b. North America dominated the trade finance market with a share of 26.8% in 2024. The region is home to some of the world's largest and most influential financial institutions, including major banks and financial hubs like New York City. These institutions have a global presence and extensive networks, allowing them to offer a wide range of trade finance services to businesses engaged in international trade.

b. Some key players operating in the trade finance market include BNP Paribas; Citigroup, Inc.; TD Bank; UBS; Arab Bank; DBS Bank Ltd.; JPMorgan Chase & Co.; Santander Bank; Deutsche Bank AG; Bank of America Corporation.

b. Key factors that are driving the market growth include globalization and international trade and the ever-evolving technological landscape.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.