- Home

- »

- Next Generation Technologies

- »

-

Trade Surveillance Market Size, Share, Industry Report, 2030GVR Report cover

![Trade Surveillance Market Size, Share & Trends Report]()

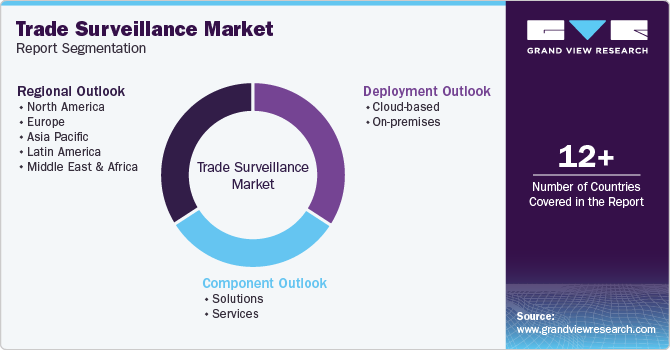

Trade Surveillance Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Solutions, Services), By Deployment, By Region (North America, Europe, Asia Pacific, Latin America, Middle East Africa), And Segment Forecasts

- Report ID: GVR-4-68038-187-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Trade Surveillance Market Summary

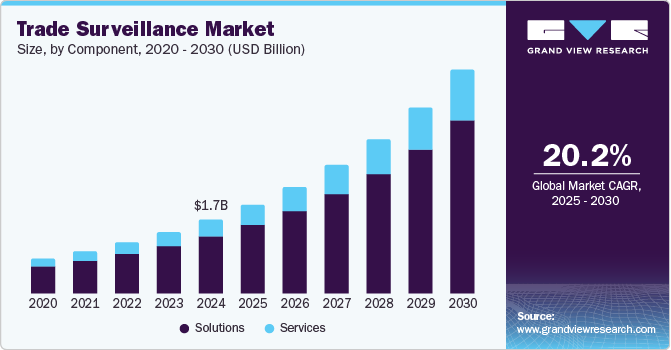

The global trade surveillance market size was estimated at USD 1.7 billion in 2024 and is projected to reach USD 5.2 billion by 2030, growing at a CAGR of 20.2% from 2025 to 2030. The rising need for regulatory compliance and the growing complexity of financial transactions are encouraging trade surveillance market expansion.

Key Market Trends & Insights

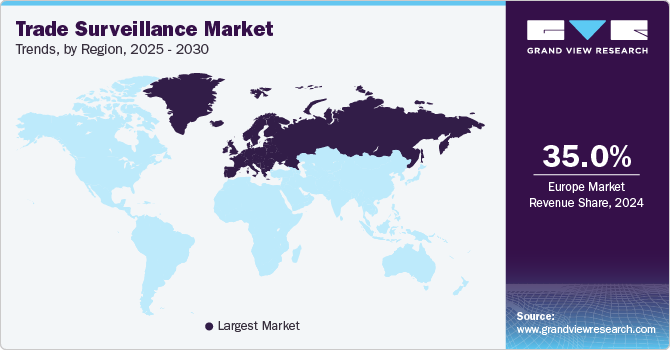

- Europe trade surveillance industry dominated the market, accounting for 35.0% of the share in 2024 and registering the highest CAGR over the forecast period.

- The U.S. trade surveillance market is expanding due to strict regulatory enforcement and the growing need for advanced compliance solutions.

- Based on component, the solutions segment dominated the trade surveillance market, accounting for 76.7% of the market share in 2024.

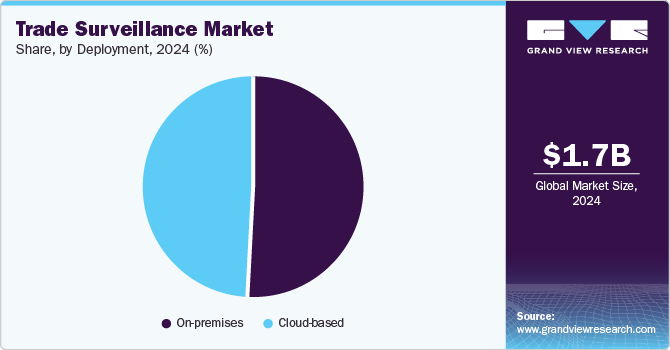

- On-premises deployment segment accounted for the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.7 Billion

- 2030 Projected Market Size: USD 5.2 Billion

- CAGR (2025-2030): 20.2%

- Europe: Largest market in 2024

Additionally, technologies such as artificial intelligence and machine learning advancements are enhancing surveillance capabilities, enabling organizations to detect market vulnerabilities, insider trading, and other fraudulent activities more efficiently. As more financial institutions are prioritizing risk management and data-driven decision-making, the adoption of sophisticated trade surveillance solutions continues to grow worldwide.

The increasing adoption of cloud-based trade surveillance solutions is transforming market dynamics by offering scalability, flexibility, and cost efficiency. Financial institutions are leveraging cloud technology to upgrade their data storage, streamline analytics, and ensure real-time monitoring of trading activities. In addition, regulatory bodies worldwide continue to impose stringent compliance mandates, compelling organizations to integrate advanced surveillance systems that provide comprehensive risk assessment and reporting capabilities. With automated trading strategies boosting market efficiency, the risks associated with fraud, manipulation, and regulatory violations are growing consistently. The shift from manual to algorithmic trading has further emphasized the need for sophisticated monitoring solutions.

The integration of artificial intelligence and big data analytics further strengthens market growth by improving anomaly detection and predictive capabilities. Machine learning algorithms refine trade monitoring processes by identifying patterns indicative of suspicious activities, thereby reducing false positives and enhancing operational efficiency. In addition, the rise of high-frequency trading with high-speed and high-volume transactions has amplified the concerns over potential market abuse. With financial markets evolving, the demand for adaptive and automated trade surveillance solutions is expected to rise, supporting proactive regulatory compliance and market integrity. This has highlighted the need for surveillance systems essential for mitigating risks and ensuring adhesion to compliance.

Component Insights

The Solutions segment dominated the trade surveillance market, accounting for 76.7% of the market share in 2024. The segment's growth is driven by its ability to optimize surveillance data, enhance compliance management, and streamline case handling. The rising adoption of internal compliance measures and strict regulatory norms by financial institutions and exchange departments has further fueled the demand for trade surveillance solutions. Furthermore, increasing reliance on AI-driven analytics, the need for real-time monitoring, and compliance automation are further contributing to market transparency. Financial institutions are increasingly integrating trade surveillance solutions to combat market abuse and other unethical practices such as insider trading. All these factors are contributing to the growth of the segment.

Services are expected to experience notable growth over the forecast period. The increasing complexity of regulatory frameworks and the need for customized surveillance strategies drive demand for consulting, implementation, and managed services. Financial firms seek specialized expertise to optimize their surveillance systems, ensure compliance with evolving regulations, and enhance operational efficiency. With trade surveillance requirements becoming more relevant to organizations, service providers offering tailored solutions are expected to play a vital role in market development.

Deployment Insights

On-premises deployment segment accounted for the largest market share in 2024. Financial institutions prefer on-premises solutions owing to better control over data security, adhesion to regulatory compliance, and system customization. These solutions integrate seamlessly with existing IT infrastructure and provide high data security compared to cloud-based alternatives. On-premises trade surveillance systems support pre-trade monitoring through pattern recognition and behavioral analysis, helping organizations detect market manipulation risks. Sectors such as government and banking, which handle sensitive financial data, rely on on-premises solutions to maintain privacy and regulatory compliance.

Cloud-based deployment is projected to register the highest CAGR of 20.7% over the forecast period. The growing shift toward cloud-based solutions is driven by scalability, cost-effectiveness, and seamless integration with advanced analytics tools. Cloud-based trade surveillance solutions provide real-time monitoring, automated compliance management, and improved accessibility, making them a preferred choice for firms seeking agility in trade surveillance operations. With financial institutions increasingly embracing cloud technology to enhance operational efficiency and regulatory compliance, this segment is expected to grow substantially.

Regional Insights

North America trade surveillance market is experiencing growth, driven by stringent regulatory compliance requirements and the increasing adoption of advanced monitoring solutions across financial institutions. Regulatory bodies enforce strict guidelines, prompting organizations to integrate AI-driven analytics and real-time surveillance tools to detect market manipulation and insider trading. The presence of key market players and technological advancements further support market expansion, with financial firms investing in automation to enhance compliance management.

U.S. Trade Surveillance Market Trends

The U.S. trade surveillance market is expanding due to strict regulatory enforcement and the growing need for advanced compliance solutions. The increasing adoption of AI-powered analytics, real-time monitoring, and automated trade compliance technologies drives market growth. The rising focus on detecting market manipulation, insider trading, and fraudulent activities fuels the demand for robust surveillance systems. In addition, advancements in cloud-based platforms and data security measures further support adoption. The presence of major financial institutions and regulatory bodies continues to reinforce the trade surveillance industry.

Europe Trade Surveillance Market Trends

Europe trade surveillance industry dominated the market, accounting for 35.0% of the share in 2024 and registering the highest CAGR over the forecast period. The region's robust regulatory framework, particularly the Markets in Financial Instruments Directive II (MiFID II), has significantly enhanced market transparency and investor protection, leading to increased adoption of advanced surveillance solutions among financial institutions. The directive mandates comprehensive monitoring and reporting of trading activities to prevent market abuse and manipulation.

In addition, the Market Abuse Regulation (MAR) complements MiFID II by enforcing stringent measures against insider trading and other fraudulent activities, further driving the demand for robust trade surveillance systems. The presence of major financial hubs and proactive regulatory bodies in Europe continues to reinforce the growth of the trade surveillance industry.

The U.K. trade surveillance industry dominated the market in 2024. Stringent regulatory requirements, particularly under the Financial Conduct Authority (FCA), have driven the widespread adoption of surveillance solutions to detect market abuse and ensure compliance. The FCA’s MAR enforces strict monitoring and reporting obligations, compelling financial institutions to implement advanced surveillance systems. In addition, the U.K.’s position as a global financial hub, with a high volume of trading activities, further strengthens the demand for sophisticated trade monitoring solutions. The emphasis on preventing financial misconduct and enhancing market integrity continues to support the growth of the market.

Asia Pacific Trade Surveillance Market Trends

Asia Pacific trade surveillance market is experiencing significant growth, driven by expanding financial markets, regulatory reforms, and the adoption of advanced monitoring technologies. Countries such as China, Japan, and India are strengthening trade regulations to address issues associated with market abuse and insider trading, leading to increased demand for surveillance solutions. The region’s growing digital transformation in financial services, coupled with the rise of algorithmic and high-frequency trading, has further accelerated the adoption of AI-driven analytics and real-time monitoring tools. In a recent development, the Securities and Exchange Board of India (SEBI) mandated that stockbrokers implement surveillance systems for trading activities, introduce internal controls, and establish whistle-blower policies to prevent fraud and market abuse. These measures highlight the increasing regulatory focus on market transparency and integrity across the region.

China trade surveillance market dominated the Asia Pacific market in 2024. The country’s rapidly expanding financial sector and stringent regulatory measures have driven the adoption of advanced trade monitoring solutions. Financial authorities, such as the China Securities Regulatory Commission (CSRC), have intensified efforts to combat market manipulation and insider trading, leading to increased investments in AI-driven surveillance technologies. In a recent move, the CSRC introduced stricter compliance requirements for high-frequency trading firms to enhance market integrity and transparency. These developments continue to reinforce the growth of trade surveillance solutions in China.

Middle East & Africa Trade Surveillance Market Trends

The Middle East & Africa trade surveillance industry is experiencing growth, driven by regulatory advancements and the increasing adoption of digital trading platforms. Financial hubs such as the UAE and Saudi Arabia are implementing stricter compliance measures to enhance market transparency and mitigate financial misconduct. The Dubai Financial Services Authority (DFSA) has introduced new guidelines to strengthen surveillance mechanisms and combat market abuse. In addition, the growing presence of international financial institutions in the region contributes to the demand for robust trade surveillance solutions, supporting market expansion.

Key Trade Surveillance Company Insights

Some of the key companies operating in the market are NICE; Crisil Limited; and Software GmbH. These companies are expanding their market presence by launching new products, collaborating, and adopting various other strategies.

-

NICE is a global provider of financial crime, risk, and compliance solutions, with a strong presence in trade surveillance. The company offers advanced analytics and artificial intelligence-driven technologies to monitor and detect market manipulation, fraud, and regulatory violations. Its solutions help financial institutions enhance compliance, mitigate risks, and ensure market integrity.

-

Crisil Limited is a prominent player in the trade surveillance market, offering financial institutions risk management and regulatory compliance solutions. The company provides advanced analytics, market intelligence, and technology-driven insights to detect anomalies, monitor trading activities, and ensure regulatory adherence. With a focus on transparency and efficiency, Crisil Limited supports firms in mitigating risks and maintaining market integrity.

Key Trade Surveillance Companies:

The following are the leading companies in the trade surveillance market. These companies collectively hold the largest market share and dictate industry trends.

- NICE

- Crisil Limited

- Software GmbH

- Aquis Exchange

- Nexi S.p.A.

- Nasdaq, Inc.

- Scila

- OneMarketData, LLC

- ACA Group

- IPC System, Inc.

- b-next

- Trading Technologies International, Inc.

- FIS

- Wipro

- Red Deer (Kaizen Regtech Group Limited.)

Recent Developments

-

In September 2022, NICE launched Compliancentral, a cloud-based communications monitoring and trade compliance platform for financial services firms. The platform captures and analyzes various forms of employee communications, including traditional telephony channels and modern platforms such as Microsoft Teams, Cisco Webex, Zoom, and WhatsApp. By integrating trade and behavioral data, Compliancentral helps firms identify hidden conduct risks, enhancing compliance and market integrity.

-

In February 2022, CRISIL partnered with Apparity LLC to enhance end-user computing (EUC) and model governance solutions for financial institutions. This collaboration integrates CRISIL’s expertise in EUC governance and regulatory standards with Apparity’s advanced tracking solutions, helping firms manage EUC risks across various business functions and locations.

Trade Surveillance Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.1 billion

Revenue forecast in 2030

USD 5.2 billion

Growth rate

CAGR of 20.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Component, deployment, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, China, Japan, India, Australia, South Korea, Brazil, South Africa, Saudi Arabia, UAE

Key companies profiled

NICE; Crisil Limited; Software GmbH; Aquis Exchange; Nexi S.p.A.; Nasdaq, Inc.; Scila; OneMarketData, LLC; ACA Group; IPC System, Inc.; b-next; Trading Technologies International, Inc.; FIS; Wipro; Red Deer (Kaizen Regtech Group Limited.)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Trade Surveillance Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global Trade Surveillance Market report based on component, deployment, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solutions

-

Risk and compliance

-

Reporting and monitoring

-

Surveillance & analytics

-

Case management

-

Others

-

-

Services

-

Managed Services

-

Professional Services

-

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud-based

-

On-premises

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global trade surveillance market size was estimated at USD 717.4 million in 2019 and is expected to reach USD 843.71 million in 2020.

b. The global trade surveillance market is expected to grow at a compound annual growth rate of 19.7% from 2020 to 2027 to reach USD 2,976.7 million by 2027.

b. Europe dominated the trade surveillance market with a share of 32.6% in 2019. This is attributable to large adoption of cloud-based trade surveillance systems by enterprises and trading regulations imposed by the governments in the region.

b. Some key players operating in the trade surveillance market include NICE Systems; Crisil Limited; Aquis Technologies; Scila AB; OneMarketData, LLC; IPC System, Inc.; B-Next; ACA Compliance Group; Red Deer (Jersey) Ltd.; Nasdaq, Inc.; and SIA S.P.A.

b. Key factors that are driving the market growth include increasing need for security in the wake of increasing occurrences of data manipulation and fraudulent activities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.