- Home

- »

- Clothing, Footwear & Accessories

- »

-

Trail Camera Market Size, Share And Growth Report, 2030GVR Report cover

![Trail Camera Market Size, Share & Trends Report]()

Trail Camera Market (2023 - 2030) Size, Share & Trends Analysis Report By Pixel Size (Below 8 MP, 8 to 12 MP, 12 MP to 16 MP, 17 MP to 21 MP, 22 MP to 30 MP, Above 30 MP), By Application, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-191-7

- Number of Report Pages: 88

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Trail Camera Market Summary

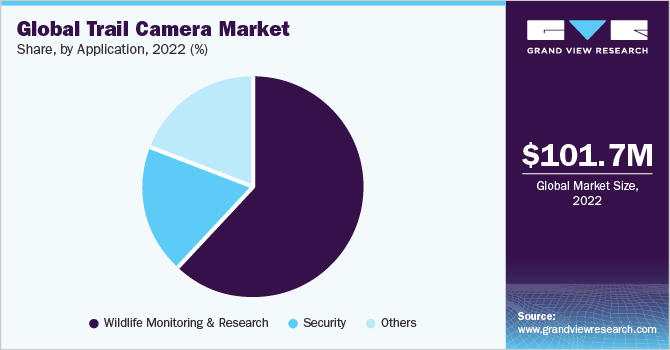

The global trail camera market size was estimated at USD 101.7 million in 2022 and is expected to expand at a CAGR of 7.0% from 2023 to 2030. Increasing spending on wildlife research and monitoring is expected to remain a key factor driving the market.

Key Market Trends & Insights

- North America dominated the global trail camera market with the largest revenue share of over 30.9% in 2022.

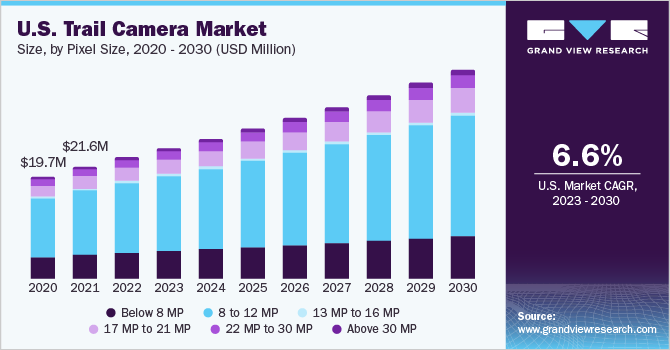

- The trail camera market in the U.S. led the North America market and held the largest revenue share in 2022.

- By pixel size, the 8 to 12 MP segment led the market, holding the largest revenue share of over 57.5% in 2022.

- By application, the others segment is expected to grow at the fastest CAGR from 2023 to 2030.

Market Size & Forecast

- 2022 Market Size: USD 101.7 Million

- 2030 Projected Market Size: USD 175.1 Million

- CAGR (2023-2030): 7.0%

- North America: Largest market in 2022

Moreover, increasing the scope of application in outdoor security is likely to boost the product demand further. It has been over a year since the initial outbreak of COVID-19 and consumers are still grappling to come to terms with the socio-economic impact of the pandemic. Shelter-at-home, social distancing, and lockdowns have been imposed in countries in varying degrees to limit the spread of the virus, including strict regulations imposed across the European and North American regions.

Trail cameras with image/video resolution between 8 and 12 MP are witnessing a rapid surge in demand to get higher quality pictures as these have advanced camera processors that click a higher resolution image. New models with improved technologies and design modifications are expected to hit the market in 2022. For instance, dual sim card transmission technology in trail cameras enables the usage of both AT&T and Verizon sim cards. The camera can identify the strongest signal in the geographical area and use that network. It is a cutting-edge technology that will probably market itself quite well.

Moreover, companies are increasingly adopting strategies such as product launches to expand their geographical reach. Product development based on the application area, price, competition, technological innovation, subscription plans, and competent distribution channels are among the key strategies for gaining a competitive advantage.

Apart from product innovation, many manufacturers are also focusing on partnerships and advertising as these market strategies significantly help target the right audience and boost brand visibility. For instance, in January 2020, Moultrie launched its flagship cellular game camera- The Delta. The Delta features industry-first High Dynamic Range (HDR) imaging combined with best-in-class 32MP resolution. HDR imaging allows the Delta to capture enhanced detail in highlights and shadows - even in the most difficult lighting conditions.

By Pixel Size

The 8 to 12 MP segment dominated the market with a share of over 57.5% in 2022. New models with improved technologies and design modifications are expected to hit the market in 2022. For instance, dual sim card transmission technology in trail cameras enables the usage of both AT&T and Verizon sim cards. The camera can identify the strongest signal in the geographical area and use that network.

It is a cutting-edge technology that will probably market itself quite well. Tasco, Wildgame Innovations, Moultrie (PRADCO Outdoor Brands), and Stealth Cam are the prominent manufacturers of trail cameras ranging from 8 MP to 12 MP. Moreover, companies such as SKYPOINT have higher penetration of 10-12MP trail cameras in both cellular and non-cellular categories to enhance their customer base across the U.S.

The 17 to 21 MP segment is expected to expand at the fastest CAGR over the forecast period. Several consumers seek and research trail cameras that are rugged, waterproof, and designed for extended and unsupervised use outdoors with additional features such as night vision, low glow infrared, HD video, high-quality image resolution, and fast trigger speed technology. This, in turn, is driving the demand for trail cameras with more than 12 MP resolution.

Wildlife enthusiasts opt for trail cameras with 20-megapixel and shoot video at a maximum 1296p resolution, which offers them the liberty to monitor wildlife from quite a distance away from where the camera is mounted. Similarly, Bushnell offers a range of trail cameras with 30 MP, which are advanced in features and easy to use, connected by AT&T & Verizon, and operated by cell phones. These product offerings are expected to offer a significant boost to the segment growth in the coming years.

Application Insights

Wildlife monitoring and research dominated the market with a revenue share of 61.8% in 2022. Trail cameras have become an increasingly popular tool for viewing wildlife and are used in wildlife research to study animal activity and behavior. With continuous improvements in camera technology, manufacturers have made trail cameras available commercially, and the products have become more affordable and much easier to use. Trail cameras can be used for more than just nature viewing or scouting and can be a powerful management tool for landowners, land managers, and homeowners for security enhancement purposes. Cellular trail cameras are a cost-effective alternative to installing home security cameras.

The others segment is expected to expand at the fastest CAGR over the forecast period. These devices are also used in photographing trail rides and mountain bike races as most cellular trail cameras have the ability to take a picture and immediately send it to a cell phone or email, which increases their use. Moreover, cellular cameras work on certain networks, such as Verizon or AT&T, and produce their wireless network to provide real-time access to movements.

Trail cameras also find their potential use in wildlife photography. The growing availability of trail cameras in a variety of choices in an affordable price range and configurations is driving the demand among wildlife photographers to capture animals in their natural habitats.

Regional Insights

In 2022, North America held the largest share of over 30.9%. North America has emerged as the most lucrative market for trail cameras and is expected to retain its dominance throughout the forecast period. Owing to ongoing technological advancements, trail cameras have evolved and become more reliable, adaptable, and convenient. Consumers, particularly hunters and outdoor enthusiasts across the region, are relying on cellular trail cameras for hunting, wildlife watching and photography, and home security, which is driving the product demand in the region.

Asia Pacific is expanding rapidly owing to lucrative opportunities and a growing consumer base in the region. Rising end-user awareness, an increase in the number of applications, and the presence of leading manufacturers in the region are all likely to provide a plethora of growth opportunities.

Technological advancements and new product development in the field are also driving the market. For instance, Korea Advanced Institute of Science and Technology (KAIST) has been developing ecological AI, which it has dubbed "AI Ecologist." This artificial intelligence can recognize and count cranes in and around the Korean Demilitarized Zone (DMZ). When combined with remote sensing technologies such as trail cameras, drones, and satellites, AI can expand the scope and speed of environmental monitoring by analyzing large amounts of data almost instantly.

Key Companies & Market Share Insights

The global market is characterized by the presence of a few well-established players. Some prominent players are launching new trail cameras with innovative and attractive features and advanced technologies. For instance, in May 2022, Browning Trail Cameras released the Browning Elite HP5 cameras. The company has completely changed the camera module for the HP5s and it now boasts a significantly larger lens when compared to previous models.

The impact of major players on the market is quite high as most of them are characterized by a global presence. Major players are making efforts to strengthen their presence across new regions in the global market through partnerships with established distributors.

-

In January 2022, Cuddeback announced the launch of “Tracks” cellular trail cameras. This line of trail cameras mainly focuses on traditional cell cameras outside of the CuddeLink eco-system.

-

In October 2021, Wildgame Innovations launched the encounter cellular trail camera and the updated HuntSmart app. It is designed to work on all cellular networks regardless of the service provider, allowing for connectivity anywhere a cellular signal is available.

-

In January 2021, Bushnell launched new lines of trail camera models at the ATA 2021 Online tradeshow. The new models included the Bushnell CORE DS4K and 4KS for improved high-quality images and video, in addition to the new Prime L20 trail camera for those seeking an entry-level option with increased functionality and simple operation.

Some prominent players in the global trail camera market include:

-

Wildgame Innovations (Good Sportsman Marketing, LLC)

-

Browning Trail Cameras

-

Vista Outdoor Operations LLC

-

SPYPOINT

-

Boly Media Communications Inc.

-

Covert Scouting Cameras, Inc.

-

Reconyx Inc.

-

Cuddeback

-

Easy Storage Technologies Co., Ltd.

-

MINOXGmbH.

Trail Camera Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 109.5 million

Revenue forecast in 2030

USD 175.1 million

Growth rate

CAGR of 7.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, brand share analysis, and trends

Segments covered

Pixel size, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; India; China; Japan; South Korea; Australia; Brazil; South Africa

Key companies profiled

Wildgame Innovations LLC; Browning Trail Cameras; Vista Outdoor Inc.; SPYPOINT; Boly Media Communications Inc.; Covert Scouting Cameras, Inc.; Reconyx, Inc.; Cuddeback; Easy Storage Technologies Co., Ltd.; MINOX GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Trail Camera Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the trail camera market on the basis of pixel size, application, and region.

-

Pixel Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Below 8 MP

-

8 to 12 MP

-

12 MP to 16 MP

-

17 MP to 21 MP

-

22 MP to 30 MP

-

Above 30 MP

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Wildlife Monitoring & Research

-

Security

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

Italy

-

France

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global trail camera market size was estimated at USD 101.7 million in 2022 and is expected to reach USD 109.5 million in 2023.

b. The global trail camera market is expected to grow at a compound annual growth rate of 7.0% from 2023 to 2030 to reach USD 175.1 million by 2030.

b. North America dominated the trail camera market with a share of 31.0% in 2022. This is attributable to rising recreational and animal monitoring & research activities in the region along with an increasing number of geological surveys.

b. Some key players operating in the trail camera market include Browning Trail Cameras; Wildgame Innovations LLC; Vista Outdoor, Inc.; and GG Telecom

b. Key factors that are driving the market growth include increasing spending on wildlife research and monitoring along with increasing scope of application in the outdoor security and usage of this product for research activities by zoologists and biologists.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.