- Home

- »

- Medical Devices

- »

-

Transcatheter Aortic Valve Replacement Market Report, 2033GVR Report cover

![Transcatheter Aortic Valve Replacement Market Size, Share & Trends Report]()

Transcatheter Aortic Valve Replacement Market (2025 - 2033) Size, Share & Trends Analysis Report By Implantation Procedure (Transaortic, Transfemoral, Transapical), By Material (Nitinol, Cobalt Chromium), By Mechanism, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-511-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Transcatheter Aortic Valve Replacement Market Summary

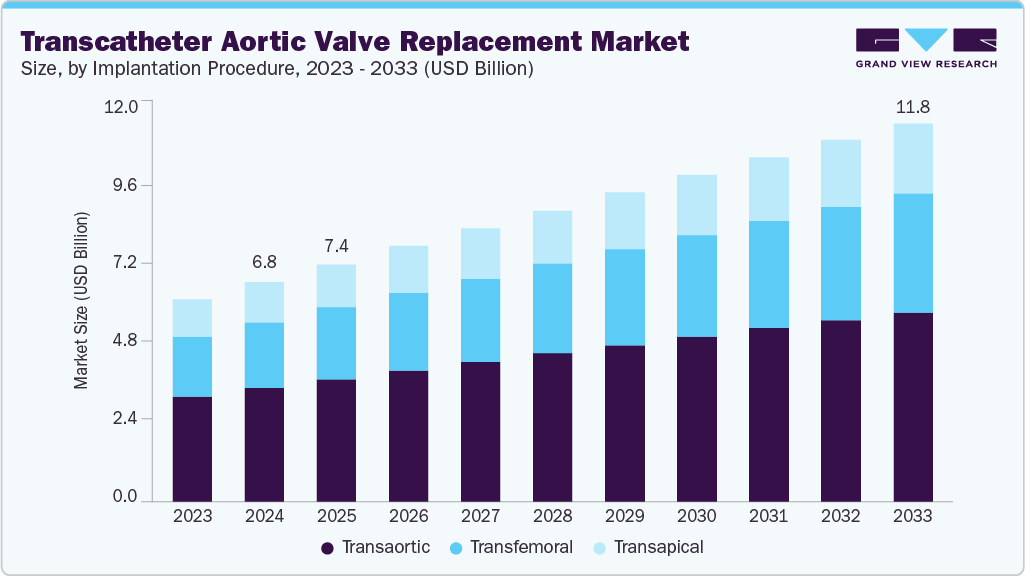

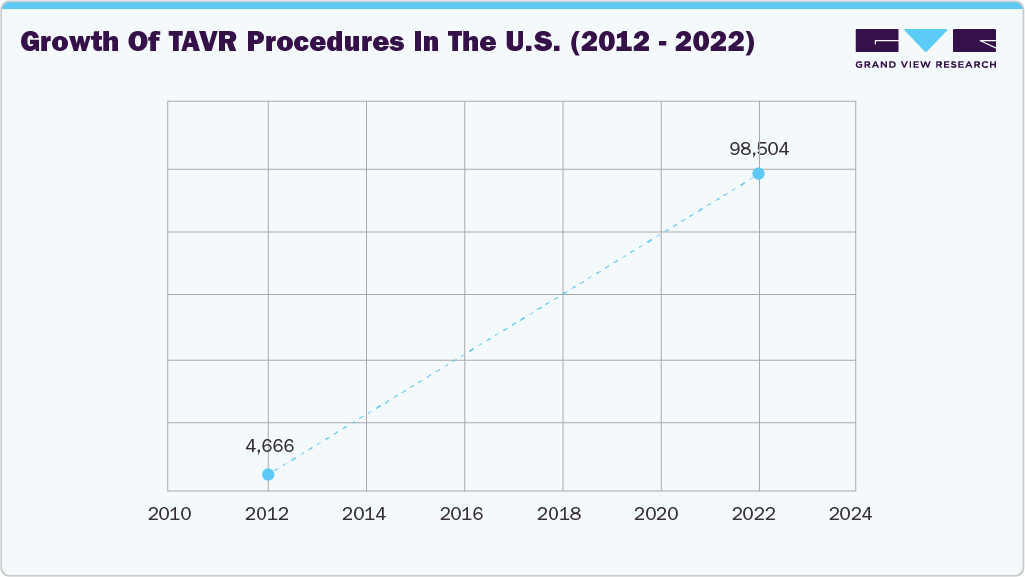

The global transcatheter aortic valve replacement market size was estimated at USD 6.83 billion in 2024 and is projected to reach USD 11.76 billion by 2033, growing at a CAGR of 5.99% from 2025 to 2033. Factors driving the demand for transcatheter aortic valve replacement (TAVR) include the rising prevalence of aortic valve stenosis (AS), increasing preference for minimally invasive procedures, and the growing geriatric population.

Key Market Trends & Insights

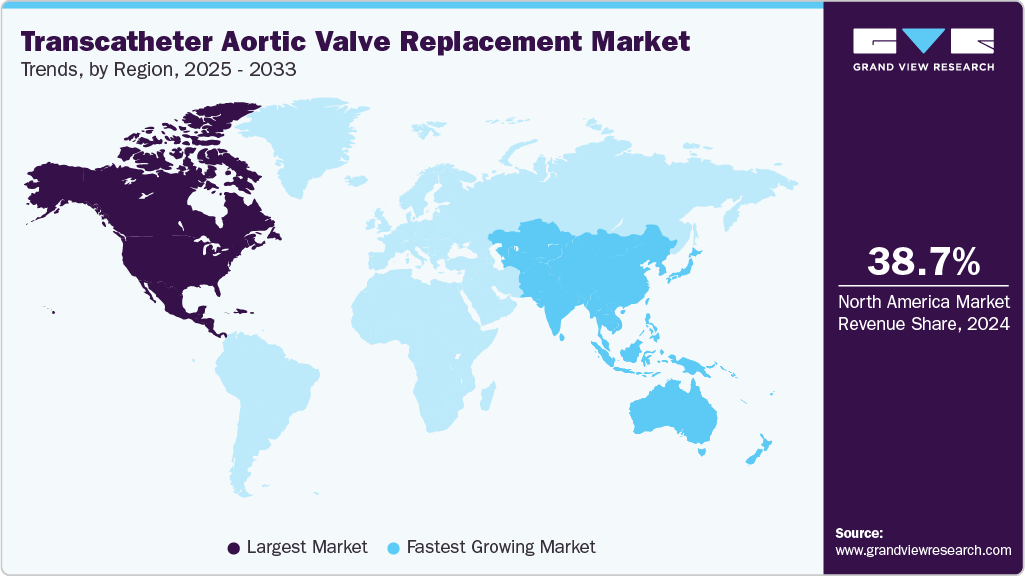

- North America transcatheter aortic valve replacement market dominated global market in 2024 and accounted for the largest revenue share of 38.68%.

- Canada transcatheter aortic valve replacement market is anticipated to register the fastest growth rate during the forecast period.

- In terms of implantation procedure segment, the transfemoral segment held the largest revenue share in 2024.

- In terms of material segment, the nitinol segment held the largest revenue share in 2024.

- In terms of mechanism segment, the balloon-expandable segment held the largest revenue share in 2024.

- In terms of end use segment, the hospitals segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6.83 Billion

- 2033 Projected Market Size: USD 11.76 Billion

- CAGR (2025-2033): 5.99%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

According to an NCBI article published in February 2023, aortic stenosis is a structural heart condition characterized by a hemodynamic obstruction at the aortic valve, impeding blood flow. Among its various causes, calcific stenosis (CAS) is the most prevalent and is estimated to affect approximately 12.6 million people globally. This includes a significant prevalence rate of 1,841 cases per 100,000 adults aged 70 and older, highlighting its impact on the aging population.The global increase in the geriatric population is another key market driver. Older adults are more susceptible to cardiovascular diseases, which necessitates effective treatment options. According to the World Health Organization article published in October 2024, the proportion of the world's population over 60 years old is expected to double by 2050, reaching approximately 2.1 billion. The global population of individuals aged 80 years and older is projected to experience a threefold increase from 2020 to 2050, reaching an estimated total of 426 million. This demographic shift means more elderly patients will require medical interventions for age-related conditions. The elderly are often high-risk candidates for conventional surgical procedures, making the less invasive procedures a more viable and safer alternative.

The rising adoption of TAVR systems for minimally invasive aortic stenosis treatment drives market growth. Strong clinical outcomes and benchmark-surpassing results reinforce confidence in wider adoption. In July 2025, Johns Hopkins Aramco Healthcare (JHAH) reported that its outcomes beat U.S. benchmarks: 26% of patients stayed in hospital longer than three days after TAVR (versus the U.S. benchmark of <30%), 8.5% required a new pacemaker (within the U.S. benchmark range of 7-12%), general anesthesia was used in 28% of cases (target <30%), and 91% of patients were discharged home (versus a benchmark of >90%).

In addition, technological advancements in TAVR procedures significantly contribute to market growth. Innovations in valve design, catheter technologies, and imaging techniques have improved the safety, efficacy, and accessibility. For instance, in January 2023, Abbott revealed that the U.S. FDA approved its newest TAVR system, Navitor, for treating high-risk individuals undergoing open-heart surgery. Advanced imaging technologies, such as 3D echocardiography and CT scans, enable precise planning and execution of the procedure, minimizing complications. In addition, improvements in catheter technology allow for smaller, more flexible catheters, further reducing the procedure's invasiveness. These technological advancements enhance patient outcomes and expand the potential patient pool by making TAVR a feasible option for those previously deemed ineligible.

Furthermore, in May 2024, Edwards Lifesciences introduced the Sapien 3 Ultra Resilia valve in Europe, marking a milestone as the first TAVR system to integrate the company’s advanced Resilia tissue technology. Engineered to treat conditions such as native calcific stenosis and failed bioprosthetic valves, the system caters to patients across different surgical risk categories, including those deemed unsuitable for open-heart surgery. This innovative technology is poised to enhance patient outcomes by offering a minimally invasive alternative, encouraging greater system adoption, and driving market expansion.

Annals of Cardiothoracic Surgery

In March 2025, the Annals of Cardiothoracic Surgery published an article analyzing trends in post-TAVR re-interventions using the Society of Thoracic Surgeons National Database, highlighting increased use, shifts from surgical aortic valve replacement (SAVR), and elevated risks associated with subsequent cardiac surgeries, especially in younger patients and those with bicuspid valves, emphasizing careful patient selection and shared decision-making.

Company Categorization

Sr No.

Company Category

Company Name

Reason/Description

1

Progressive Companies

Medtronic

Global presence, established TAVR portfolio, continuous innovation.

Abbott

Leading structural heart company, strong R&D in TAVR.

Edwards Lifesciences Corporation

Pioneer in TAVR, extensive clinical data and innovation.

2

Dynamic Companies

Meril Life Sciences Pvt. Ltd

Expanding TAVR portfolio, increasing clinical adoption.

Biosensors International Group, Ltd.

Evolving offerings, actively improving structural heart devices.

MicroPort Scientific Corporation

Growing presence in TAVR, expanding international reach.

3

Starting Blocks

Anteris Technologies

Early-stage company, flexible and adaptable to market changes.

Venus Medtech (Hangzhou) Inc.

Emerging company, limited global presence but adaptable.

JenaValve

Developing solutions, moderate adoption, still early-stage.

HLT Medical (Bracco)

Engaged in structural heart interventions, early-stage TAVR adoption.

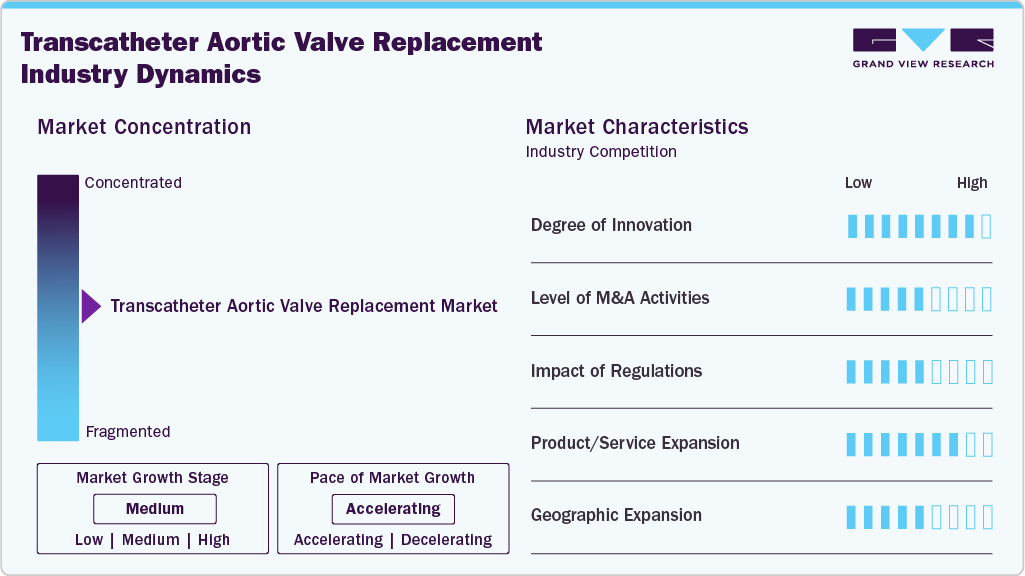

Market Concentration & Characteristics

The transcatheter aortic valve replacement industry is highly innovative. Continuous advancements in valve design, imaging technologies, and minimally invasive techniques have significantly enhanced procedural safety and efficacy. These innovations have expanded patient eligibility and improved outcomes, driving substantial growth and establishing this market as a crucial alternative to traditional surgical methods for replacement. In Aug 2024, Boston Scientific obtained the CE mark for its ACURATE Prime Aortic Valve System, the latest TAVR technology offering an expanded valve size range and enhanced deployment for precise positioning, now available for European patients.

Mergers and acquisitions in the transcatheter aortic valve replacement industry are moderate. Companies are strategically consolidating to enhance their technological capabilities, expand their product portfolios, and increase market reach. These activities foster innovation and drive competition, ultimately benefiting the market by improving access to advanced TAVR solutions and accelerating growth within the industry.

Regulations have a high impact on the transcatheter aortic valve replacement industry. Stringent regulatory standards ensure the safety and efficacy of devices, influencing market dynamics. Regulatory approvals, such as those from the FDA and EMA, are crucial for product launches and market entry, shaping innovation and competition while ensuring that only high-quality, reliable devices are available to patients.

Product expansion in the transcatheter aortic valve replacement industry is high. For instance, in December 2024, Sahajanand Medical Technologies (SMT), a global innovator in cardiovascular solutions, introduced its Hydra Transcatheter Aortic Valve Replacement system in Mexico. This launch represents a significant advancement in SMT’s commitment to providing state-of-the-art, minimally invasive cardiac treatments to patients across the globe. This robust product expansion drives market growth, offering a wider range of options for different patient needs and expanding the applicability of procedures.

Regional expansion in the transcatheter aortic valve replacement industry is high. Companies are increasingly targeting emerging markets and expanding their presence in developed regions to capitalize on the growing demand for minimally invasive cardiac procedures. This expansion involves establishing new distribution channels, forming strategic partnerships, and obtaining regulatory approvals across various regions, enhancing global access to advanced technologies and driving overall market growth.

Implantation Procedure Insights

By implantation procedure, transfemoral segment dominated the market with the largest revenue share of 51.50% in 2024. This approach involves inserting the valve through the femoral artery, offering a less invasive alternative to traditional open-heart surgery. Technological advancements, improved procedural outcomes, and expanding patient eligibility criteria drive the increasing adoption of transfemoral TAVR procedures. According to the Elsevier B.V. article published in December 2024, in a recent study evaluating 10,120 patients who underwent transfemoral TAVR across 10 heart centers, 7,165 patients (approximately 71%) preferred TF access. This method remains the dominant choice due to its reliable outcomes and the availability of advanced technologies that improve procedural safety. The rise of alternatives such as trans-radial secondary access (TR-SA) and TF access continues to fuel market growth.

The transapical segment is anticipated to grow at the fastest CAGR over the forecast period. The transapical approach offers advantages such as a shorter distance between the left ventricular apex and the aortic valve, allowing greater maneuverability for operators during device implantation. Furthermore, it accommodates larger sheath diameters, facilitating smoother procedures. Various companies have innovated and introduced advanced transapical devices. According to the American College of Cardiology Foundation article published in May 2023, Edwards Lifesciences developed the Sapien device, which utilizes a balloon-expandable system. The Sapien device boasted extensive clinical experience and was the inaugural device approved for transapical implantation by regulatory authorities, highlighting its pioneering role in advancing minimally invasive treatment options for replacement.

Material Insights

By material, the nitinol segment dominated the market with the largest revenue share of 35.34% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. Nitinol, an alloy composed of nearly equal parts nickel and titanium, is widely used in TAVR devices due to its unique properties, such as non-magnetism, biocompatibility, flexibility, and fatigue resistance. These characteristics make it ideal for minimally invasive surgeries and implants, enhancing medical outcomes and driving segment growth. Notable devices incorporating nitinol in their frame structures include the Evolut R (Medtronic), Portico valve (St. Jude Medical, Inc.), and JenaValve (JenaValve Technology GmbH).

The cobalt chromium segment is anticipated to grow significantly over the forecast period. Cobalt-chromium is a durable, corrosion-resistant alloy commonly used in TAVR devices. Its strength, biocompatibility, and flexibility make it ideal for crafting valve frames that can withstand the high-pressure environment of the heart while ensuring long-term performance and safety. Due to their higher radiopacity and resilience compared to steel stents, which allow for a smaller mesh size and reduce the risk of thrombosis, cobalt-chromium stents also offer excellent biocompatibility. For example, Edwards Lifesciences' Sapien 3 device, the fourth generation in the balloon-expandable Sapien line, features a cobalt-chromium frame.

Mechanism Insights

By mechanism, the balloon-expandable segment dominated the market with the largest revenue share of 55.68% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. The balloon-expandable valve is the most widely used in TAVR procedures. Its non-repositionable, intra-annular design with a lower stent frame profile facilitates easier coronary access. In addition, the more steerable delivery method compared to self-expanding devices aids valve implantation in patients with complex vascular anatomies, such as a horizontal aorta (aortic angulation >60°). Numerous product launches are also driving the segment’s growth. For instance, in November 2024, Abbott announced the first patient procedures using its investigational balloon-expandable TAVI system to treat symptomatic severe AS. This system represents an initial step toward developing a software-guided, AI-integrated TAVI platform.

The self-expandable segment is anticipated to grow at a significant CAGR over the forecast period. Most self-expanding valves are supra-annular, providing a larger effective orifice area, lower gradients, and a reduced rate of severe prosthesis-patient mismatch (PPM). Moreover, major manufacturers continually focus on product development, driving segment growth. For instance, in August 2024, Boston Scientific received CE Mark approval for its Acurate Prime TAVR system, designed for patients with severe stenosis. Building on the Acurate Neo2 platform, it features extended valve sizes for larger anatomies, an improved valve frame, and faster, controlled deployment. The self-expanding, supra-annular system suits low-, intermediate-, and high-risk patients.

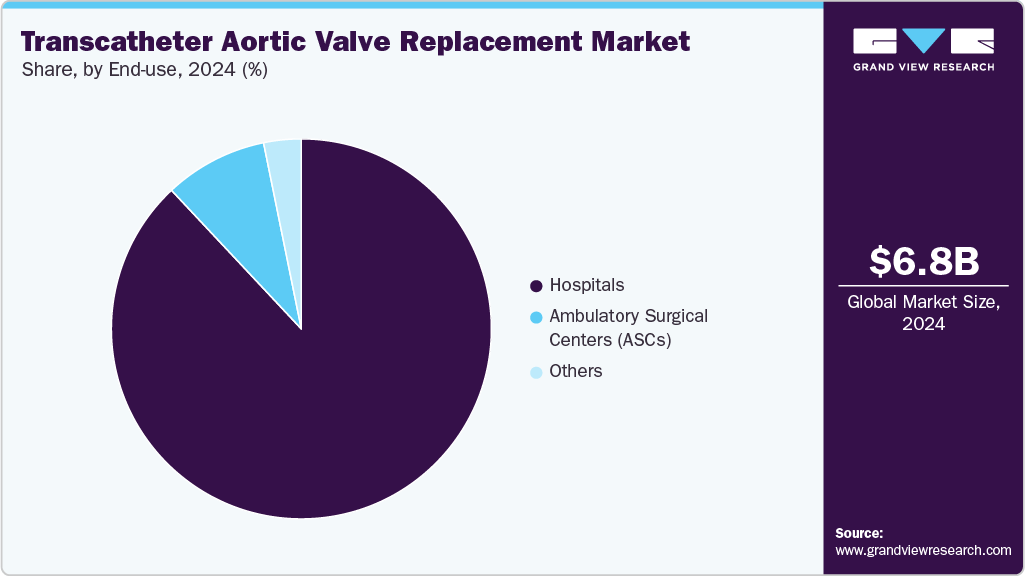

End-use Insights

By end use, the hospitals segment dominated the market with a revenue share of 88.02% in 2024, driven by the rising incidence of aortic conditions and increased TAVR procedures. In February 2025, Eisenhower Health was the first hospital in the U.S. to serve as an Edwards Benchmark Case Observation Site, reflecting its record of nearly 1,000 procedures with a 99% success rate and its role in advancing minimally invasive cardiac care. In addition, technological advancements in products and systems, improved healthcare infrastructure, and favorable reimbursement scenarios in both developed and developing countries are propelling segment growth. For instance, the Centers for Medicare & Medicaid Services covers TAVR for treating severe aortic stenosis under the “Coverage with Evidence Development” program.

The ambulatory surgical centers (ASCs) segment is expected to grow fastest during the forecast period. These centers are cost-efficient and charge 45.0%-60.0% less than hospitals, with lower overhead, fixed costs, and shorter hospital stays. For instance, in October 2024, a new cardiovascular-focused ambulatory surgery center is set to open in the Short Pump area of Henrico, Virginia, thanks to a partnership between Compass Surgical Partners, Bon Secours Mercy Health, and AlignedCardio. Expected to be operational by late 2025, this state-of-the-art facility will offer top-tier outpatient cardiovascular treatments to patients throughout the Greater Richmond area, providing an alternative to traditional hospital admissions and overnight stays. The center's focus on convenience and high-quality care aims to improve patient experience while expanding access to essential cardiovascular services.

Regional Insights

North America transcatheter aortic valve replacement market dominated the industry with a revenue share of 38.68% in 2024, driven by its well-developed healthcare infrastructure and the increasing prevalence of conditions such as stenosis and aortic regurgitation. The rising incidence of these disorders is expected to propel market expansion throughout the forecast period. According to the American Heart Association, Inc. article published in May 2024, in the U.S., the incidence of aortic stenosis is approximately 15.6 events per 100 individuals, significantly contributing to the growing demand for TAVR procedures.

U.S. Transcatheter Aortic Valve Replacement Market Trends

The transcatheter aortic valve replacement (TAVR) market in the U.S. dominated the North America region in 2024, with key players such as Edwards Lifesciences, Medtronic, and Boston Scientific flourishing. These companies drive market growth through strategic developments, including innovative product launches, FDA approvals, and partnerships. For instance, in August 2024, Edwards Lifesciences acquired JC Medical, a U.S.-based company specializing in transcatheter aortic valve replacement (TAVR), from Genesis MedTech, a Singapore-based firm, for an undisclosed sum. Their focus on technological advancements and expanding applications enhances procedural outcomes and patient access to this minimally invasive treatment.

Europe Transcatheter Aortic Valve Replacement Market Trends

The transcatheter aortic valve replacement (TAVR) market in Europe is expected to grow significantly over the forecast period. Several factors, including rising CVD cases, the increasing number of TAVR procedures, economic development, regulatory impacts, and new product launches in the EU, drive this expansion. According to a World Health Organization article published in May 2024, Cardiovascular diseases (CVDs) are the leading cause of disability and premature death in Europe, responsible for over 42.5% of all annual deaths, or approximately 10,000 fatalities daily. Conditions such as aortic stenosis significantly contribute to the disease burden.

The UK transcatheter aortic valve replacement (TAVR) market is expected to grow significantly during the forecast period. The increasing incidence of stenosis and government initiatives drive market growth. According to the Guy's and St Thomas Specialist Care article published in March 2024, about 400,000 individuals in the UK are affected by aortic stenosis, with its prevalence rising due to the aging population. It is recognized as a progressive condition requiring timely intervention to manage its impact effectively.

The transcatheter aortic valve replacement (TAVR) market in Germany is expected to witness growth over the forecast period, driven by advancements in technology and increased minimally invasive procedures. According to the Deutsche Gesellschaft article published in July 2024 in Germany, transcatheter heart valve procedures' consistent growth and adoption resulted in 23,752 reported TAVR procedures in 2023. This steady increase reflects the growing reliance on minimally invasive solutions to address severe aortic stenosis, particularly among aging populations.

France transcatheter aortic valve replacement (TAVR) market is growing over the forecast period. The increasing incidence of aortic stenosis and government initiatives drive market growth. According to the Elsevier B.V. article published in November 2024, in France, approximately 363,574 individuals are reported to have AS, highlighting the growing burden of this condition within the population. With the increasing prevalence of AS, particularly among aging demographics, the demand for advanced treatment options continues to rise.

Asia Pacific Transcatheter Aortic Valve Replacement Market Trends

The transcatheter aortic valve replacement (TAVR) market in the Asia Pacific is expected to register the fastest growth rate over the forecast period, driven by an aging population, rising prevalence of aortic stenosis, increasing healthcare expenditure, and growing adoption of minimally invasive procedures. Rapid improvements in TAVR device technology and expanding reimbursement policies across key markets are further fueling demand. In November 2024, the Journal of Asian Pacific Society of Cardiology published an article providing regional guidance on TAVI for severe conditions, outlining patient selection, procedural strategies, and post-procedure management, and highlighting emerging evidence on device performance and safety outcomes.

China transcatheter aortic valve replacement (TAVR) market is anticipated to register considerable growth during the forecast period. Increasing CVD cases and the rising prevalence of aortic stenosis drive market growth. According to the NCBI article published in December 2023, China faced a significant healthcare challenge, with approximately 330 million individuals affected by cardiovascular diseases (CVD) in 2022. This growing burden highlights the critical need for advanced treatment solutions, such as TAVR.

The transcatheter aortic valve replacement (TAVR) market in Japan is expected to witness rapid growth, driven by advanced technology and evolving market factors, over the forecast period. Innovations in valve designs and delivery systems enhance procedural outcomes and expand treatment options for patients with severe diseases. These advancements are pivotal in meeting the growing demand for minimally invasive cardiovascular interventions in Japan's aging population. In March 2025, the Annals of Cardiothoracic Surgery published an article detailing TAVR explantation at a high-volume Japanese center, reporting on 32 patients with a mean age of 79.5 years, of whom 56% underwent concomitant procedures. The study highlighted a 30-day mortality of 19% and a 1-year survival rate of 59%, emphasizing high-risk profiles and poor short- and mid-term outcomes.

India transcatheter aortic valve replacement (TAVR) market is growing over the forecast period. Increasing aortic cases and government initiatives drive market growth. According to the Sage Journals article published in July 2024, in India, approximately 7.3% of the population diagnosed with isolated aortic conditions is estimated to be eligible for TAVI, equating to around 300,000 individuals.

Latin America Transcatheter Aortic Valve Replacement Market Trends

The transcatheter aortic valve replacement (TAVR) market in Latin America is anticipated to witness considerable growth over the forecast period due to the increasing prevalence of cardiovascular diseases, driven by an aging population. As life expectancy rises, the demand for minimally invasive procedures grows. In May 2024, A 14-year review from the Brazilian TAVR Registry (RIBAC-NT), published in Arquivos Brasileiros de Cardiologia, looked at over 8,600 procedures, finding 5.8% in-hospital mortality and more than 94% device success, showing real-world outcomes for Brazil’s elderly with severe aortic conditions.

Brazil transcatheter aortic valve replacement industry is anticipated to register considerable growth during the forecast period. Increasing cases of aortic diseases and government initiatives drive market growth. In February 2025, a Hospital de Clínicas de Porto Alegre study focused on TAVI in Brazil’s public health system, reporting 125 procedures from 2018 to 2024 with 95% device success and results similar to international registries.

Middle East and Africa Transcatheter Aortic Valve Replacement Market Trends

The transcatheter aortic valve replacement (TAVR) market in the MEA is anticipated to witness considerable growth over the forecast period, influenced by the high prevalence of heart diseases, including severe semilunar valve conditions. As cardiovascular diseases continue to rise in the region, TAVR procedures are becoming increasingly important for managing these conditions in patients who are at high or intermediate surgical risk. In August 2024, Aster Hospital Al Qusais performed a TAVR on a 76-year-old patient with severe aortic disease and multiple conditions, showcasing advanced cardiac care and positioning it as a minimally invasive alternative to surgery for high-risk patients.

Saudi Arabia transcatheter aortic valve replacement industry is anticipated to register considerable growth during the forecast period. Increasing CVD incidence and government initiatives drive market growth. According to the article published by BioMed Central Ltd in March 2024, in Saudi Arabia, the prevalence of cardiovascular disease (CVD) among individuals aged 15 years and older is approximately 1.6%, highlighting a significant health burden within the population. With the aging demographic and the associated increase in aortic cases, the demand for advanced treatment options is rising.

Key Transcatheter Aortic Valve Replacement Company Insights

Key participants in the transcatheter aortic valve replacement industry focus on devising innovative business growth strategies, such as expanding their product portfolios, partnerships and collaborations, mergers and acquisitions, and business footprints.

Key Transcatheter Aortic Valve Replacement Companies:

The following are the leading companies in the transcatheter aortic valve replacement (TAVR) market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- Abbott

- MicroPort Scientific Corporation

- Meril Life Sciences Pvt. Ltd

- Edwards Lifesciences Corporation

- Anteris Technologies

- Venus Medtech (Hangzhou) Inc.

- JenaValve

- Biosensors International Group, Ltd.

- HLT Medical (Bracco)

Recent Developments

-

In June 2025, SIMS Hospital in Chennai successfully carried out India’s first hybrid procedure combining transcatheter aortic valve replacement (TAVR) with a Frozen Elephant Trunk (FET) graft on a 61-year-old patient who had previously undergone a Bentall operation.

-

In May 2025, Edwards Lifesciences’ SAPIEN 3 TAVR system was FDA-approved for use in patients with asymptomatic severe aortic stenosis, based on the EARLY TAVR trial showing better outcomes than standard clinical monitoring.

-

In May 2024, the University of Alabama at Birmingham became one of the first centers worldwide to perform a valve-in-valve procedure using a new TAVR system, designed with enhanced coronary access for improved safety, lower mortality and stroke rates, and better outcomes in high-risk aortic stenosis patients.

Transcatheter Aortic Valve Replacement Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.39 billion

Revenue forecast in 2033

USD 11.76 billion

Growth rate

CAGR of 5.99% from 2025 to 2033

Actual data

2021 - 2024

Forecast data

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Implantation procedure, material, mechanism, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; Spain; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medtronic; Abbott; MicroPort Scientific Corporation; Meril Life Sciences Pvt. Ltd; Edwards Lifesciences Corporation; Anteris Technologies; Venus Medtech (Hangzhou) Inc.; JenaValve; Biosensors International Group, Ltd.; HLT Medical (Bracco)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Transcatheter Aortic Valve Replacement Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels, and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global transcatheter aortic valve replacement market report based on implantation procedure, material, mechanism, end-use, and region:

-

Implantation Procedure Outlook (Revenue USD Million, 2021 - 2033)

-

Transfemoral

-

Transapical

-

Transaortic

-

-

Material Outlook (Revenue USD Million, 2021 - 2033)

-

Nitinol

-

Cobalt Chromium

-

Stainless Steel

-

Others

-

-

Mechanism Outlook (Revenue USD Million, 2021 - 2033)

-

Balloon-expandable

-

Self-expandable

-

-

End-use Outlook (Revenue USD Million, 2021 - 2033)

-

Hospitals

-

Ambulatory Surgical Centers (ASCs)

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.