- Home

- »

- Biotechnology

- »

-

RNA Analysis Market Size, Share And Trends Report, 2030GVR Report cover

![RNA Report]()

RNA Analysis Market Size, Share & Trends Analysis Report By Product (Kits & Reagents, Services, Instruments), By Technology (qPCR, Microarray, Sequencing), By Application, By End-use And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-534-2

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

RNA Analysis Market Size & Trends

The global RNA analysis market size was valued at USD 9.56 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 10.86% from 2023 to 2030. Transcriptomics is the study of the entire set of RNA transcripts present in a cell population to examine the gene expressions. Transcriptomics incorporates everything involving RNAs. Increased technological advancement activities in the field of transcriptomics and a rise in funding by numerous government and private organizations drive the growth of the industry. The COVID-19 pandemic has created abundant opportunities for industry players. For instance, in June 2020, NanoString Technologies, Inc. launched the nCounter Host Response Gene Expression Panel for the study of immune system response during COVID-19 virus research.

The product along with GeoMx Digital Spatial Profiler assisted the researchers in November 2021 study, to understand how COVID-19 did not infect olfactory sensory neurons in the patients. Similarly, in April 2021, Qiagen launched QIAseq DIRECT SARS-CoV-2 Kit, viral library preparation, and genome enrichment platform to reduce plastics use and library turnaround times when compared to primer-based sequencing. The company launched this product to cater to the increasing demand for high-throughput sequencing to carry out research and surveillance of novel and more hazardous variants of SARS-CoV-2.

The development and launch of novel products are anticipated to propel the industry growth as it assists CROs to enhance the quality of research and aid pharmaceutical & biotechnology companies in vaccination development. For instance, in March 2021, Rebus Biosystems launched the spatial transcriptomics analysis platform, the Rebus Esper, for spatial analysis of the transcriptome. This platform uses laser-powered optics for high-resolution images and allows researchers to analyze individual cells. Moreover, in recent years, the revolution in the research and clinical application of RNA-based techniques has increased.

The continuous development of the molecular technologies used for the analysis of transcriptomes and the implementation of next-generation sequencing platforms significantly changed the landscape of RNA research globally. RNA-seq is gaining an enormous role in the clinical care of cancer patients, as well as preclinical research. It allows an understanding of the molecular mechanisms underlying cancer, which has increased several clinical trials associated with transcriptome-based personalized oncology. Furthermore, the growing availability of transcriptome profiling allows for the introduction of transcriptomics in clinics.

Recently, numerous predictive and prognostic gene expression assays, along with cancer biomarkers, have been in use in clinical oncology. In addition, the change in the pattern of cancer classification-from clinical and histopathological to molecular opens a more personalized outlook for tumor therapy and diagnostics. The further development of transcriptome profiling will also allow for standardization and the reduction of its analysis cost, which will be the subsequent step for transcriptomics to become a standard of contemporary cancer medicine.

Product Insights

The kits & reagents products segment dominated the global market in 2022 and accounted for the largest share of 59.49% of the overall revenue. Rising requirements for high-quality reagents and kits coupled with the repeated usage of reagents and media in transcriptome studies drive the growth of this segment. High-quality reagents and kits aid in delivering unmatched efficiency and strong performance ensure reliable and reproducible sequencing outcomes at a minimal cost.

The services segment is expected to grow at the fastest CAGR of 11.80% from 2023 to 2030. Growing R&D activities in the pharmaceutical sector and increasing government investments in life science research are expected to raise the demand for RNA analysis services. Several companies such as Eurofins Scientific, Genewiz, QIAGEN are actively involved in offering a variety of RNA analysis services including mRNA sequencing, transcriptome profiling, and end-to-end solutions such as RNA sample preparation, library construction, sequencing, and data analysis. Availability of a variety of services is expected to boost the market in the coming years.

Technology Insights

The real-time-PCR (qPCR) technology segment dominated the market in 2022 and accounted for the largest share of 43.43% of the global revenue. The high share was attributed to the wide usage of PCR for COVID-19 diagnostic across the globe. The qPCR technology is highly sensitive & quantitative and one of the most suitable methods for interrogating a comparatively small number of transcripts in a broad set of samples. PCR offers relatively high-sensitivity detection of SARS-CoV-2, evaluation of viral RNA in various types of clinical samples, detecting SARS-CoV-2 mutations, and evaluation of anti-SARS-CoV-2 drugs.

The sequencing segment is anticipated to witness the fastest CAGR of 11.26% by 2030 owing to advancements in the next-generation and SMRT sequencing technology. The presence of several companies providing single-cell RNA sequencing services and the advent of bioinformatics algorithms are also driving the market. Furthermore, increasing scientific awareness and decreasing costs of sequencing technologies are expected to fuel the segment over the forecast period.

Application Insights

The infectious diseases and pathogenesis application segment dominated the market with a share of 18.03% in 2022. The identification of susceptible cells is crucial for understanding the pathogenic mechanism. Hence, there is increasing adoption of scRNA-sequencing to provide information about cell types susceptible to infection. Next-generation sequencing is transforming the health approach to infectious diseases and pathogenesis, as well as treating individuals. Various methodologies have come for measuring gene expression and biomarkers for making their translation into clinical practice more feasible.

The epigenetics segment is expected to register a significant CAGR of 11.07% from 2023 to 2030 as pharmaceutical importance of understanding epigenetics for studying disease prognosis and epidemiology is gradually increasing. In addition, molecular dynamics will also become a versatile tool to complement experimental investigations of RNA structural dynamics to provide opportunities for expanding the field and maximize gains from the molecular dynamic simulations, without any further methodological advances. As epigenetic modifications such as DNA methylation and histone modifications can alter the binding of transcription factors and other regulatory proteins, epigenetic analyses for understanding gene expression are expected to witness a high demand in the near future.

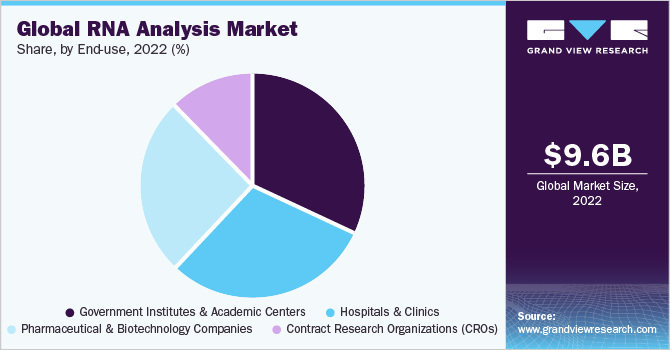

End-use Insights

The government institutes & academic centers segment held the highest revenue share of 32.05% in 2022. The rising adoption rate of high throughput technologies for the effective process of RNA analysis by government institutes and academic centers drives the segment growth. Increasing applications of transcriptomics technologies in drug discovery are propelling the demand in the pharmaceutical as well as biotechnological industries. Similarly, research in drug discovery is also contributing to the market that is followed by clinical diagnostics. For instance, in April 2021, researchers developed TORNADO-seq, an RNA sequencing-based drug discovery platform to monitor the expression of the large gene for a detailed study of cellular phenotypes in organoids.

The Contract Research Organizations (CROs) segment is expected to grow at the fastest CAGR of 13.11% over the forecast period. Strategic activities by key market players support the segment growth. For instance, in Jan 2022, 10x Genomics announced the expansion of its 10x Certified Service Provider Network to incorporate three leading CROs. The CROs will partner with 10x Genomics to support leading biopharmaceutical companies seeking the advantage of 10x Genomics’ single-cell and spatial technologies to accelerate drug development and power novel therapeutic findings. The three CROs chosen for the 10x Genomics program are Azenta Life Sciences, Q2 Solutions, and CellCarta.

Regional Insights

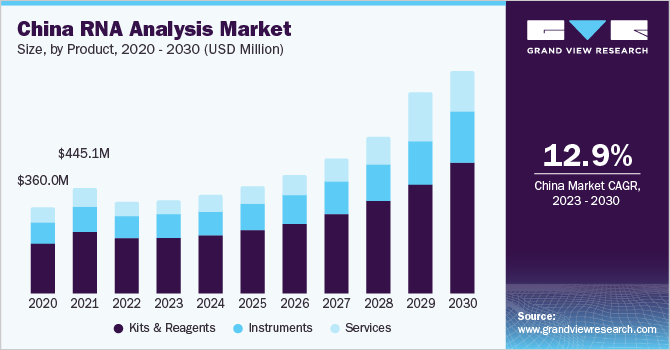

North America accounted for the largest share of 44.10% in 2022. The growth is attributed to the rapid development of structure-based drug designs, increasing focus on transcriptomics research, and high investments in biopharmaceutical research and development. In addition, increasing investment in pharmaceutical research and drug development is the key factor that is accelerating the revenue growth of the companies in this region. However, Asia Pacific is projected to register the fastest CAGR during the forecast period. Growing investments by governments & enterprises are accelerating biotechnology research in the countries of Asia Pacific.

Asia Pacific region is expected to grow at the fastest CAGR of 11.23% from 2023 to 2030. The Japanese government and non-government organizations are highly supportive of the growth of biotechnology research in the country and provide funds for research in the fields of medicine and life sciences. This encourages researchers to actively explore the transcriptomics space. Furthermore, increasing focus on APAC countries, owing to the low-cost manufacturing service, is expected to provide growth opportunities for the manufacturers. In addition, strategic activities, such as partnerships, will further augment the growth of this region. For instance, in January 2020, Genetron Holdings Ltd. entered into a strategic partnership agreement with Thermo Fisher Scientific to expand its precision cancer monitoring and diagnosis in China’s public hospitals.

Key Companies & Market Share Insights

The market is highly fragmented with the presence of several small, mid, and large players that compete by adopting several organic growth strategies, such as product development and regional expansion, to enhance their industry presence. For instance, in May 2023, Twist Bioscience Corporation launched several RNA sequencing products, including Twist Ribosomal RNA & Hemoglobin Depletion Kit, Twist RNA Exome, and Twist RNA Library Preparation Kit to maintain its market presence.

-

Agilent Technologies, Inc.

-

F. Hoffmann-La Roche AG

-

Illumina, Inc.

-

QIAGEN

-

Thermo Fisher Scientific, Inc.

-

Eurofins Scientific

-

Merck KGaA

-

Bio-Rad Laboratories, Inc.

-

Pacific Bioscience of California, Inc.

-

Affymetrix, Inc.

-

Danaher

-

Promega

RNA Analysis Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 9.82 billion

Revenue forecast in 2030

USD 20.21 billion

Growth rate

CAGR of 10.86% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

June 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Agilent Technologies, Inc.; F. Hoffmann-La Roche AG; Illumina, Inc.; QIAGEN; Thermo Fisher Scientific, Inc.; Eurofins Scientific; Merck KGaA; Bio-Rad Laboratories, Inc.; Pacific Bioscience of California, Inc.; Affymetrix, Inc.; Danaher; Promega

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global RNA Analysis Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented RNA analysis market on the basis of product, technology, application, end-use and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Kits & Reagents

-

miRNA & siRNA

-

Reverse Transcriptases & RT-PCR

-

RNA Extraction & Purification

-

RNA Interference

-

Others

-

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Real Time-PCR (qPCR)

-

Microarray

-

Sequencing

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Construction of RNA Expression Atlas

-

Epigenetics

-

Infectious Diseases & Pathogenesis

-

Alternative RNA Splicing

-

RNA Structure & Molecular Dynamics

-

Development & Delivery of RNA Therapeutics

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Government Institutes & Academic Centers

-

Pharmaceutical & Biotechnology Companies

-

Hospitals & Clinics

-

Contract Research Organizations (CROs)

-

-

Regional Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global RNA analysis market size was estimated at USD 9.56 billion in 2022 and is expected to reach USD 9.82 billion in 2023.

b. The global RNA analysis market is expected to grow at a compound annual growth rate of 10.86% from 2023 to 2030 to reach USD 20.21 billion by 2030.

b. North America dominated the RNA analysis market with a share of 44.10% in 2022. This is attributable to increasing market activities by U.S.-based companies to translate transcriptomics insights into clinical practices.

b. Some key players operating in the RNA analysis market include Agilent Technologies; Bio-Rad Laboratories, Inc.; F. Hoffmann-La Roche AG; Illumina, Inc.; QIAGEN; Thermo Fisher Scientific, Inc.; Eurofins Scientific; Merck KGaA; Pacific Bioscience of California, Inc.; Affymetrix, Inc.; Danaher; Promega

b. Key factors that are driving the RNA analysis market growth include increasing interest of research entities in studying the transcriptomic profiles of humans and growing knowledge on the role of transcriptomics in disease diagnosis.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."