- Home

- »

- Biotechnology

- »

-

Global Transfer Membrane Market Size & Share Report, 2030GVR Report cover

![Transfer Membrane Market Size, Share & Trends Report]()

Transfer Membrane Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (PVDF, Nitrocellulose, Nylon), By Transfer Method, By Application, By End-User, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-041-7

- Number of Report Pages: 115

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global transfer membrane market was valued at USD 385.1 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.53% from 2023 to 2030. Transfer membranes are used as solid phase supports for transferring nucleic acids or proteins from gel matrices in various blotting technique. These membranes aid in the detection and analysis of specific proteins or nucleic acids and thus play an important role in the diagnosis of various diseases. Hence, demand for transfer membranes is expected grow in the near future owing to the high prevalence of infectious and genetic diseases. For instance, according to HIV.gov, an estimated 1.5 million individuals worldwide acquired the HIV infection in 2021, while around 38.4 million individuals were suffering with the disease in the same year. Since western blotting technique is widely used as a confirmatory assay for the detection of HIV infection, the high demand for transfer membranes used in such assays is expected to fuel the market in the coming years.

The COVID-19 outbreak positively affected the market in 2020 and 2021 as transfer membranes were used in the clinical investigation and diagnostic applications for the disease. For instance, Western blots were used as a confirmatory test for the positive or borderline-positive results from other screening tests. Similarly, Northern blotting techniques were used in identification of various sub-genomes of the SARS-CoV-2 virus. In addition , by May 2021, the U.S. and Germany had invested more than USD 2.0 billion and USD 1.5 billion, respectively, in COVID-19 vaccine research and development activities which boosted growth of the life science research tools such as transfer membranes in 2021.

Moreover, the demand for transfer membranes is growing due to the increasing scope of application for various blotting techniques. For instance, the applications of Southern blotting can range from confirmatory assays for cloning or knockout experiments to clinical diagnostics involving the identification of gene mutations in diseases such as sickle cell anemia. Hence, with the increasing scope for expansion in the genetic engineering domain, adoption of transfer membranes for molecular biology experimentation is expected to grow during the forecast period.

Furthermore, transfer membranes are being increasingly used in the biopharmaceutical industry wherein protein purification and characterization form an important aspect of several research and development activities. For instance, during the drug development phases, transfer membranes form an essential part of the protein analysis workflows where they are used for separation of proteins for further staining procedures. In addition, the high investments in research and development activities by key biopharmaceutical companies are expected to drive the market growth. For instance, in 2021, F. Hoffmann-La Roche Ltd. had a research & development budget of around USD 16.1 billion, while Johnson & Johnson and Bristol Myers Squibb had a budget of about USD 14.7 billion and USD 11.3 billion, respectively.

However, techniques such as Western and Southern blotting have certain disadvantages which make them less preferable over other alternatives. For instance, these techniques are labor intensive, require large quantities of samples & skilled personnel for carrying out the experiments, and incur high operational costs due to the expensive antibodies and imaging equipment involved.

As a result, such techniques are being increasingly replaced by the technologies such as Enzyme-Linked Immunosorbent Assay (ELISA) and Polymerase Chain Reaction (PCR), which can offer better throughput and faster processing time at lower costs. As a result, with the increasing substitution of blotting techniques the usage of transfer membranes may also diminish, which may hinder the market growth during the forecast period.

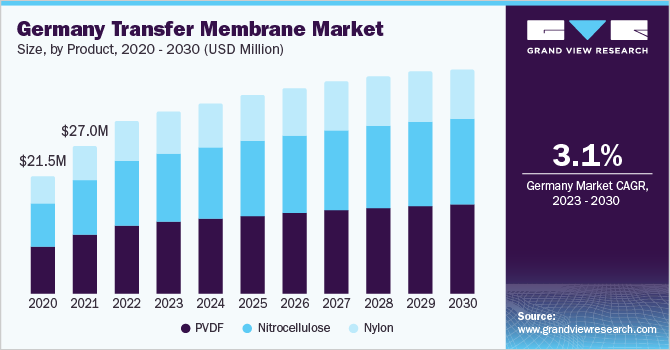

Product Insights

Based on the product, the PVDF membranes segment dominated the market with the largest share of 39.57% in 2022. PVDF transfer membranes offer a chemically inert and highly robust alternative to other types of membranes as well as facilitate easier stripping and re-probing for proteins. These membranes are hydrophobic in nature and can form strong interactions with proteins thereby enabling greater protein binding and efficient protein transfer. These advantages offered by PVDF transfer membranes have resulted in a high market penetration of PVDF products which is fueling the segment growth.

The nitrocellulose membranes segment is expected to grow at a rapid pace during the forecast period as these membranes can be easily hydrated and result in a low background signal for various applications. In addition, such membranes can be used for the nucleic acid analysis as well as dot/slot blotting and are ideal for the detection of low molecular weight proteins. Hence, a broad range of applications for nitrocellulose transfer membranes is expected to drive the segment.

Transfer Method Insights

Based on transfer method, the dry electro blotting (dry transfer) method held the largest market share of 37.54% in 2022 owing to its benefits, such as its user-friendly and convenient mode of operation as well as a rapid transfer speed. In addition, the method eliminates the need to equilibrate gels in buffer thereby reducing the amount of time required for completion of the transfer. Furthermore, no transfer buffer preparation or pre-soaking of filter paper with deionized water is needed. These advantages are fueling the adoption of the technique.

The semi-dry electro blotting (semi-dry transfer) method is estimated to expand at a rapid CAGR by 2030. The method utilizes horizontal cassette assemblies that consists a gel, filter paper, pre-wetted membranes, and filters that are all soaked in transfer buffer. The method is advantageous as it can quickly transfer proteins to membranes at room temperature and requires only small volumes of transfer buffer. This reduces the amount of hazardous waste produced and increases the utility of the method. These factors are propelling adoption of the method.

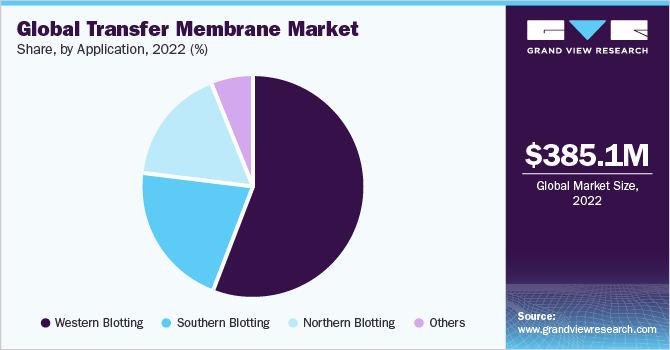

Application Insights

The Western blotting segment dominated the market with the largest revenue share of 55.95% in 2022. This can be attributed to the high usage rate of the technique used for the diagnostic and clinical testing activities. Western blotting offers advantages such as high sensitivity and specificity for the protein detection which enables its use as an analytical technique.

Furthermore, the technique can selectively detect a single target protein in a mixture of more than 300,000 different proteins which greatly enhances its usage in exploratory research applications. Moreover, the availability of transfer systems such as Bio-Rad Laboratories’ Trans-Blot Turbo Transfer System, a high-performance transfer system for Western blotting that comes with either PVDF or nitrocellulose membranes is increasing the utility of the technique and propelling the segment.

The Southern blotting segment is expected to witness a significant growth during the forecast period as the technique has prominent applications in the DNA fingerprinting technology. The technique can be used for paternity testing, criminal investigation and studies based on restriction fragment length polymorphism. Moreover, the method is also used in the diagnosis of several genetic defects which increases its usage in carrier screening tests. For instance, DNA-based molecular analysis by using Southern blot and PCR techniques is the preferred method for the diagnosis of fragile X syndrome disorder and FMR1 triplet repeat number determination.

End-user Insights

Biopharmaceutical & pharmaceutical companies accounted for the largest market share of 62.80% in 2022 due to the increasing research and development activities undertaken by such companies for the creation of novel therapeutics and vaccines. For instance, in June 2023, GlaxoSmithKline announced a USD 1.25 billion (GBP 1 billion) investment in research & development activities for the development of new therapies to tackle the infectious disease burden in low-income countries. Such investments are likely to boost the usage of molecular biology tools such as transfer membranes and can positively affect the market.

The academic & research institutes segment is expected to witness the fastest expansion at a CAGR of 5.23% by 2030. The strong government support and high extent of research finding available in developed countries are boosting the segment growth. For instance, in August 2022, The University of California, U.S. attracted above USD 1.07 billion in external researches funding for the fiscal year 2021-22. Furthermore, the high market penetration of blotting techniques among established academic research institutions is expected to boost the revenue generation opportunities for transfer membranes in the coming years.

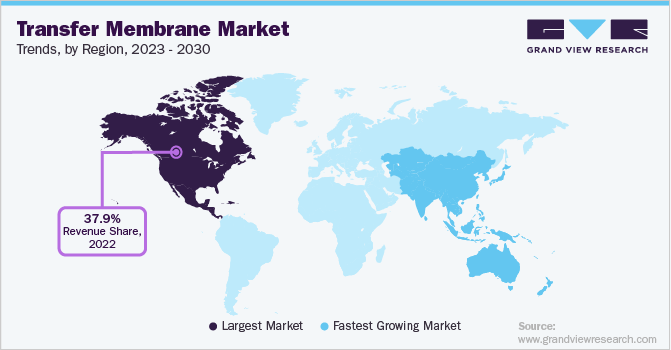

Regional Insights

North America dominated the market in 2022 with a share of 37.91% owing to the presence of well-established research infrastructure and rising government investments in the life sciences domain. For instance, in September 2022, the U.S. Department of Health and Human Services declared an investment of above USD 40.0 million as a part of the National Biotechnology and bio-manufacturing initiative for the expansion of biotechnology research and manufacturing in the country. Moreover, the presence of key market players such as Danaher, PerkinElmer, Inc. and others in the region is expected to boost the market growth.

Asia Pacific is anticipated to expand at the fastest CAGR of 5.94% during the forecast period as the region is home to some of the fastest growing economies and biotechnological industries in the world. In addition, availability of a large patient population in countries such as India and China provides significant opportunities for the clinical research activities that involve disease testing and surveillance procedures. These factors are anticipated to drive the adoption of transfer membranes and boost the market in the near future.

Key Companies & Market Share Insights

The global transfer membrane market is highly competitive, with key players accounting for a majority of the market share. Companies involved in the market are adopting various strategies, such as the launch of innovative products, partnerships & collaborations, and mergers & acquisitions to maintain their market presence. Furthermore, companies such as Thermo Fisher Scientific, Inc. and PerkinElmer offer an extensive portfolio of PVDF, nitrocellulose, and nylon membranes in both roll and pre-cut sheet formats. Some of the prominent key players in global transfer membrane market include:

-

Thermo Fisher Scientific, Inc.

-

Danaher

-

Bio-Rad Laboratories

-

Merck KGaA

-

PerkinElmer, Inc.

-

Abcam Plc.

-

Santa Cruz Biotechnology, Inc.

-

ATTO Corporation

-

Azure Bio systems Inc.

-

Advansta Inc.

-

GVS S.p.A.

Transfer Membrane Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 406.7 million

Revenue forecast in 2030

USD 554.4 million

Growth rate

CAGR of 4.53% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Revenue in USD million, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, transfer method, application, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand;South Korea; Brazil; Mexico, Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific, Inc.; Danaher; Bio-Rad Laboratories; Merck KGaA; PerkinElmer, Inc.; Abcam Plc.; Santa Cruz Biotechnology, Inc.; ATTO Corporation; Azure Bio systems Inc.; Advansta Inc.; GVS S.p.A.

Customization scope

Free report customization (equivalent up to 8 analyst's working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Transfer Membrane Market Segmentation

This report forecasts revenue growth at global, regional, and country levels in addition to provides an analysis on the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global transfer membrane market report based on product, transfer method, application, end-user, and regions:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

PVDF

-

Nitrocellulose

-

Nylon

-

-

Transfer Method Outlook (Revenue, USD Million, 2018 - 2030)

-

Wet or Tank Transfer

-

Semi-dry Electro Blotting (Semi-dry Transfer)

-

Dry Electro Blotting (Dry Transfer)

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Western Blotting

-

Southern Blotting

-

Northern Blotting

-

Others

-

-

End-User Outlook (Revenue, USD Million, 2018 - 2030)

-

Biopharmaceutical & Pharmaceutical Companies

-

Academic & Research Institutes

-

Diagnostic Labs

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global transfer membrane market size was estimated at USD 385.1 million in 2022 and is expected to reach USD 406.7 million in 2023.

b. The global transfer membrane market is expected to grow at a compound annual growth rate of 4.53% from 2023 to 2030 to reach USD 554.4 million by 2030.

b. North America dominated the market in 2022 with a share of 37.91% owing to the presence of well-established research infrastructure and rising government investments in the life sciences domain.

b. Some key players operating in the transfer membrane market include Thermo Fisher Scientific, Inc.; Danaher; Bio-Rad Laboratories; Merck KGaA; PerkinElmer, Inc; Abcam Plc; Santa Cruz Biotechnology, Inc.; ATTO Corporation; Azure Biosystems Inc.; Advansta Inc.; GVS S.p.A.

b. The demand for transfer membranes is expected grow in the near future owing to the high prevalence of infectious and genetic diseases, and increasing scope of application of these membranes for various blotting techniques.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.