- Home

- »

- Medical Devices

- »

-

Trauma Devices Market Size, Share, Industry Trend Report, 2018-2025GVR Report cover

![Trauma Devices Market Size, Share & Trends Report]()

Trauma Devices Market Size, Share & Trends Analysis Report By Type (Internal, External Fixators), By Surgical Site (Upper, Lower Extremities), By End Use (Hospitals, ASC), By Region, And Segment Forecasts, 2018 - 2025

- Report ID: GVR-2-68038-454-3

- Number of Pages: 90

- Format: Electronic (PDF)

- Historical Range: 2014 - 2017

- Industry: Healthcare

Industry Insights

The global trauma devices market size was valued at around USD 6.9 billion in 2017 and is anticipated to exhibit a CAGR of 6.1% over the forecast period. The market is majorly driven by a dramatic rise in geriatric population across the globe and an alarming surge in the number of road accidents. Severe fracture cases resulting from falls and mishaps among the elderly population are expected to contribute to the growing demand for fracture fixators.

Around 40.0% of trauma injuries are as a result of falls and motor vehicle accidents. Elderly population as well as children below the age of seven are more prone to falls. Motor vehicle accidents account for over 28% of trauma injuries. This is a key factor benefiting the global market.

Dynamic investments in R&D activities pave the way for the introduction of innovative trauma solutions. Depuy Synthes, a subsidiary of Johnson & Johnson (J&J) manufacturing medical devices, invested around USD 1.6 billion in R&D activities in 2015. The company spent USD 1.65 billion and USD 1.78 billion on the same in 2014 and 2013, respectively.

The market is also fueled by technological advancements, with leading players introducing an array of products through extensive research capabilities and expanding their segment portfolio through partnerships with other players. For instance, in July 2017, Cardinal Health acquired the patient recovery business from Medtronic for USD 6.1 billion. The acquisition helped expand Cardinal Health’s portfolio by adding 23 product categories, including segment leader brands such as Kendall, Curity, Kangaroo, Dover, and Argyle.

Type Insights

Internal fixators held majority of the market in terms of revenue in 2017. Internal fixation involves healing and stabilization of broken bones with the help of screws, plates, rods, and others. Demand for internal fixators is rising owing to a shorter hospital stay, less scarring and bruising, and early functionality for patients. Acumed’s wrist fixation implants, including Acu-Loc and Acu-Loc 2, achieved sales of 0.5 million in July 2016.

The external fixators segment is expected to register the highest growth over the forecast period. External fixator stabilizes damaged bones, thereby speeding up the healing process. The procedure is generally performed during the treatment of open fractures. Moreover, external fixators are preferred in case of fractures in children as permanent internal fixators are not viable in growing bones.

Surgical Site Insights

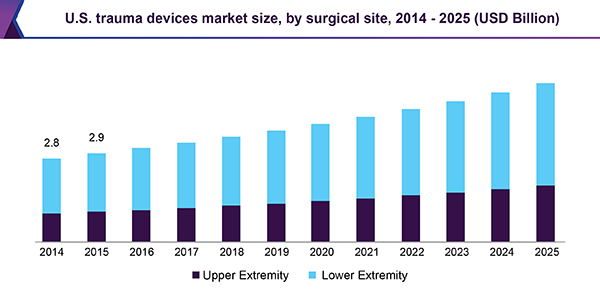

Based on surgical site, the trauma devices market is segmented into upper and lower extremities. The upper extremities segment is expected to grow at a rapid rate owing to factors such as increased physical and sports activities among people 18 years or less, resulting in a rise in sports-related injuries. Upper extremities include injury to the hand, wrist, shoulder, arm, and elbow.

The lower extremities section dominated the market by surgical site in 2017 due to an increase in the number of motorcycle accidents, causing severe injury to the ankle, foot, and thigh. Causes for lower leg injuries can be blunt force trauma and stress in the Achilles tendon, which causes impairment in its functioning.

End-use Insights

The market is classified into hospitals and ambulatory surgical centers based on end use. Hospitals dominated the overall market in terms of revenue in 2017. On the other hand, ambulatory surgery centers are likely to experience the fastest growth over the forecast period. Ambulatory surgical centers offer treatment facilities to patients at lower costs and greater flexibility of scheduling as compared to hospitals. Also referred to as same-day surgery centers, these medical facilities discharge patients after minor surgeries.

Regional Insights

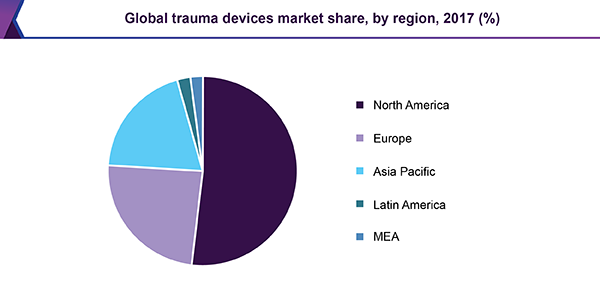

North America held a majority of the overall market in 2017 due to the high rate of accidental injuries and a large geriatric population. Various trauma centers established by governments are specialized in handling emergency situations and thus create a defined market for trauma devices.

Asia Pacific is expected to be the most lucrative segment over the forecast period, with India expected to spearhead the growth. Rising geriatric population in Japan and China, an alarming rise in road accidents, and rapidly developing economies are among factors expected to promote the market in Asia Pacific. Demand for surgical staples in this region is mainly driven by medical tourism for bariatric and other minimally invasive surgeries.

Trauma Devices Market Share Insights

Some of the key players operating in this market are Depuy Synthes, Stryker, Zimmer Biomet, Smith & Nephew, Wright Medical Group N.V., Integra LifeSciences, Acumed, Bioretec Ltd, and Cardinal Health. These companies are investing in R&D activities in order to capitalize on untapped markets. In addition, some of the players are opting for the acquisition of smaller players to expand and strengthen their geographical reach. For instance, in May 2013, Smith & Nephew acquired Adler Mediequip Pvt. Ltd. to mark its footprint in India. The deal was aimed at providing the company with an entry point in the booming Indian market.

Industry players are involved in the comprehensive manufacturing of trauma devices, including internal and external fixators. In June 2018, DePuy Synthes announced the launch of the Femoral Recon Nail System in the U.S. for treatment of thigh bone fractures, expanding the company’s trauma portfolio for patients suffering from hip and femur fractures. In May 2018, the company announced a definitive agreement to acquire the assets of Medical Enterprises Distribution, LLC, a developer of surgical impactor technology, to further develop surgical impactor technology for orthopedic surgical procedures.

Report Scope

Attribute

Details

Base year for estimation

2017

Actual estimates/Historical data

2014 - 2017

Forecast period

2018 - 2025

Market representation

Revenue in USD Million and CAGR from 2018 to 2025

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S., Canada, U.K., Germany, India, China, Japan, Brazil, Mexico, South Africa

Report coverage

Revenue forecast, company share, competitive landscape, growth factors & trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels, and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global trauma devices market report on the basis of type, surgical site, end use, and region:

-

Type Outlook (Revenue, USD Million, 2014 - 2025)

-

Internal Fixators

-

Plates & Screws

-

Rods & Pins

-

Others

-

-

External Fixators

-

Uniplanar & Biplanar Fixators

-

Circular Fixators

-

Hybrid Fixators

-

-

-

Surgical Site Outlook (Revenue, USD Million, 2014 - 2025)

-

Upper Extremity

-

Hand & Wrist

-

Shoulder

-

Arm

-

Elbow

-

-

Lower Extremity

-

Hip & Pelvis

-

Lower Leg

-

Foot & Ankle

-

Knee

-

Thigh

-

-

-

End-use Outlook (Revenue, USD Million, 2014 - 2025)

-

Hospitals

-

Ambulatory Surgical Centers

-

-

Regional Outlook (Revenue, USD Million, 2014 - 2025)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

The U.K.

-

Germany

-

-

Asia Pacific

-

India

-

China

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."