- Home

- »

- Next Generation Technologies

- »

-

Travel Insurance Market Size, Share & Trends Report, 2030GVR Report cover

![Travel Insurance Market Size, Share & Trends Report]()

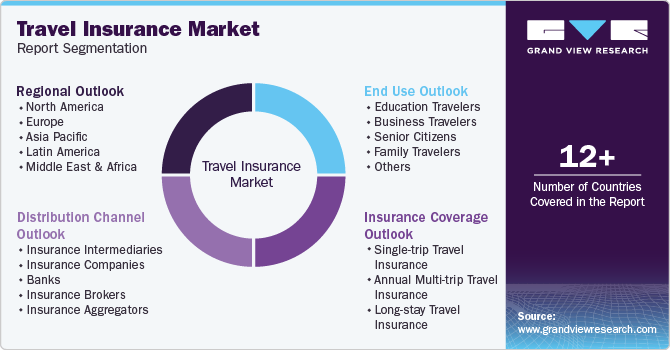

Travel Insurance Market Size, Share & Trends Analysis Report By Insurance Coverage (Single-trip Travel, Annual Multi-trip Travel, Long-stay Travel), By Distribution Channel (Insurance Companies, Banks), By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-972-0

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Travel Insurance Market Size & Trends

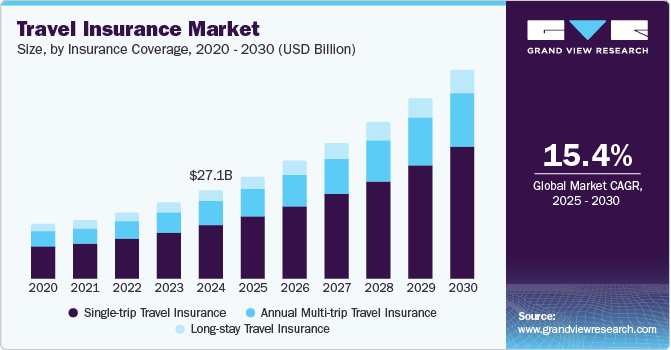

The global travel insurance market size was estimated at USD 27.05 billion in 2024 and is projected to grow at a CAGR of 15.4% from 2025 to 2030. The growth of the market can be attributed to the growing popularity of travel and tourism and the subsequent awareness about buying dedicated insurance coverage covering various unforeseen events, such as flight delays, loss of luggage and other personal effects, and cancellation of trips, occurring while traveling. Furthermore, the adoption of travel insurance is gaining traction as advances in technology are allowing to bundle travel insurance purchases with online ticket booking, thereby contributing to the growth of the market.

Several insurance companies across the globe are striking partnerships with other insurance companies to launch travel insurance policies and provide comprehensive coverage at competitive rates. For instance, in October 2023, Trawick International, an insurance company, announced its partnership with STARR INTERNATIONAL COMPANY, INC., an insurer, to launch three new travel insurance policies underwritten by STARR’s U.S. subsidiary, Starr Indemnity & Liability Company. The newly launched trip cancellation policies, backed by the "A" (excellent) rating from A.M. Best, are called Safe Travels Defend, Safe Travels Armor, and Safe Travels Protect. These policies offer reliable and comprehensive coverage at competitive rates.

Insurance companies are integrating cloud computing into advanced analytics for enhanced results. The insurance industry's core skills and outdated business models can be transformed into a new and flexible model. Therefore, cloud, mobility, and advanced analytics are being incorporated to drive efficiency, security, and cost efficiency. In addition, insurance businesses are adopting the test-and-learn process to stratify massive unstructured data influxes using real-time data analysis. With the use of cutting-edge analytics software, insurance businesses can easily eliminate flaws in the execution of core operations, such as insurance underwriting.

A key trend in the market is the shift toward digital solutions, which streamline the purchase, claims, and customer service processes. Insurers are heavily investing in AI-driven technologies to enhance customer experiences, improve response times, and detect fraud more efficiently. Digital platforms are now providing on-demand insurance solutions and integrating with online travel booking sites, making travel insurance a seamless add-on during the booking process. As a result, travel insurance is becoming more accessible and user-friendly, especially for digitally savvy consumers who prioritize convenience.

In response to changing traveler demographics, insurers are also developing products tailored to specific travel segments, including adventure tourism, eco-tourism, and long-term remote work stays. Younger travelers, especially Millennials and Gen Z, are driving demand for flexible policies that can be modified or extended as their travel plans evolve. Insurers are capitalizing on this trend by offering modular policies that allow travelers to adjust coverage for different destinations, activities, and trip durations. This evolution in product design underscores a broader trend toward personalization, as travel insurance providers cater to the diverse and dynamic needs of modern travelers.

Insurance Coverage Insights

Single-trip travel insurance accounted for the largest share of 61.1% in 2024. The growth of the single-trip travel insurance segment can be attributed to the factors such as loss of baggage, emergency dental treatment costs, personal liability cover, fire cover, trip interruption or cancellation, missed flight connection, and many more such services. The growing awareness of potential travel disruptions ranging from flight cancellations and lost baggage to unforeseen medical needs has prompted more individuals to opt for single-trip coverage as a practical safeguard. Insurers are responding by offering streamlined, easily accessible single-trip policies that travelers can purchase directly through digital channels, often as an add-on to the booking process.

Annual multi-trip travel insurance segment is anticipated to grow at a significant CAGR during the forecast period. The segment growth can be attributed to the increasing demand among business people, travelers, and other groups who go on multiple trips in a year. As global travel becomes more accessible, many individuals and families are opting for annual policies to cover multiple trips in a year, eliminating the need to purchase separate insurance each time they travel. This option is not only cost-effective but also offers convenience, as it provides continuous coverage throughout the year, appealing to those with dynamic travel schedules. Insurers are enhancing these policies with flexible add-ons, like extended medical coverage, sports and adventure packages, and family plans, making them adaptable to various travel styles and destinations.

Distribution Channel Insights

Insurance companies held the largest market share in 2024. The growth of this segment can be attributed to the factors such as increasing consolidating risk among numerous policyholders and the setting up of premiums according to the likelihood that a specific occurrence will occur and will lead to typical financial loss. As travelers increasingly seek tailored solutions that address their unique needs and concerns, insurance companies are leveraging advanced data analytics and technology to create customized insurance packages. This shift is fueled by the rising demand for flexibility in coverage options, especially in response to uncertainties such as global pandemics and changing travel regulations.

The banks segment is anticipated to grow at a significant CAGR during the forecast period. The increasing insurance sales and underwriting by banks across regions such as Europe, Asia, and Australia are driving the market growth in this segment. In addition, the rise of digital banking has enabled banks to leverage technology to streamline the purchasing process for travel insurance, making it more accessible to customers through online platforms and mobile apps. As banks continue to focus on enhancing their customer experience and expanding their product portfolios, the integration of travel insurance services is becoming a strategic priority in meeting the evolving needs of travelers.

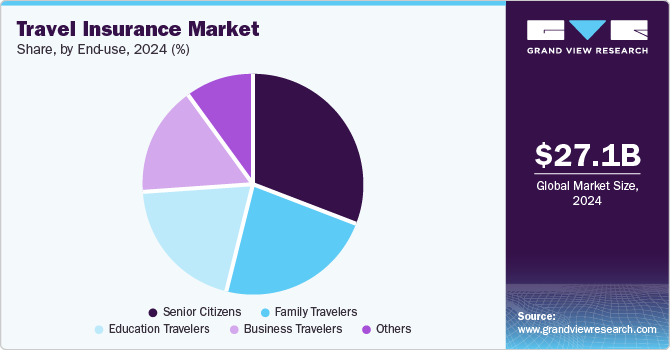

End Use Insights

The senior citizens segment dominated the market in 2024. The primary reason senior citizens seek travel insurance is to reduce emergency expenses incurred during vacations. The age group of senior citizens varies from country to country. Senior citizen travel insurance policies typically include coverage for emergency evacuation, repatriation of remains, hospital accommodations, ambulance services, trip interruption or delays, loss of baggage or personal belongings, and accidental death coverage. In addition, providers such as Tata AIG General Insurance Company Limited, Travel Guard, and Southern Cross Benefits Limited offer various products and services for senior travelers.

The business travelers segment is anticipated to grow at a significant CAGR during the forecast period. Travel insurance policies for business travelers mainly cover company employees who regularly travel for business meetings, special events, and other work-related tasks. Travel insurance is a plan that protects various expenses, such as eviction, flight cancellation, evacuation, medical care, and damaged or lost luggage. Furthermore, business travel insurance helps employers in fulfilling their duty of care responsibilities to employees traveling on behalf of the company, regardless of whether the trip is local, out of state, or international. For instance, Zurich American Insurance Company's Zurich Travel Assist helps employees in medical, security, and travel emergencies occurring at a distance of 100 miles or more from their home.

Regional Insights

The North America travel insurance market is expected to grow at a significant CAGR during the forecast period. The North America travel insurance market is experiencing robust growth, driven by a surge in both domestic and international travel as restrictions ease and consumer confidence rebounds. Travelers in the region increasingly recognize the importance of securing insurance to protect against unforeseen circumstances such as trip cancellations, medical emergencies, and travel delays. Insurers are responding to this demand by offering a wider range of flexible and comprehensive coverage options that cater to various travel needs, including adventure travel and business trips.

U.S. Travel Insurance Market Trends

The U.S. travel insurance market held a dominant position in 2024 due to the growing emphasis on personalized and flexible coverage options, reflecting the diverse needs of travelers, is a significant factor contributing to the growth of the U.S. travel insurance market. This trend is fueled by the increased awareness among consumers about the importance of tailored insurance plans that cater to specific travel scenarios.

Europe Travel Insurance Market Trends

Europe travel insurance market dominated and accounted for the largest share of 35.1% in 2024. As European travelers increasingly prioritize safety and security, there is a growing demand for comprehensive insurance coverage that addresses various concerns, from health emergencies to trip cancellations. Insurers are responding by developing innovative products that cater to specific travel preferences, including multi-trip policies and coverage tailored for adventure or business travelers. Furthermore, the rise of digital technology has transformed the purchasing experience, with many consumers opting for online platforms to easily compare policies and secure coverage quickly.

The UK travel insurance market is expected to grow rapidly in the coming years due to factors such as increased availability of package holidays, rising disposable incomes, extensive media coverage of diverse holiday options, and the convenience of online travel bookings. As the tourism industry expands, there is a consistent increase in reported incidents involving essential document misplacement, lost luggage, occurrences of natural disasters, and medical challenges

The Germany travel insurance market held a substantial market share in 2024 owing to various products tailored to different types of travelers, including business travelers, families, and adventure seekers. This adaptability ensures that travelers can find suitable coverage that meets their specific needs.

Asia Pacific Travel Insurance Market Trends

The Asia Pacific region is expected to grow at a significant CAGR during the forecast period. Travel insurance has become increasingly important in the Asia-Pacific region, where diverse travel patterns and a growing middle class are driving more people to explore both regional and international destinations. As travelers encounter varied climates, healthcare standards, and security conditions across Asia-Pacific countries, the need for protection against unexpected events such as illness, injury, or travel disruptions has grown considerably. Medical expenses, which can be high in certain countries, are often a primary concern, making comprehensive health coverage crucial for travelers in the region.

The Japan travel insurance market is expected to grow rapidly in the coming years. Japan, travel insurance has gained importance as Japanese travelers increasingly venture abroad, valuing the security and support it offers in unfamiliar environments. Japanese travelers are particularly concerned about health and safety while overseas, where healthcare systems and language barriers can make medical emergencies challenging.

The China travel insurance market held a substantial market share in 2024 owing to the importance of travel insurance has risen alongside the country’s rapid increase in outbound tourism, as Chinese travelers now make up a significant portion of the global travel market.

Key Travel Insurance Company Insights

Some of the key companies in the travel insurance market include Allianz, American International Group, Inc., AXA, ASSICURAZIONI GENERALI S.P.A., and others. Prominent players dominate with comprehensive coverage options, leveraging extensive distribution networks and strong brand trust to capture significant portions of the market. Companies with integrated digital platforms and advanced data analytics have been particularly successful as they streamline the customer journey from policy selection to claims processing, catering to tech-savvy travelers seeking convenience. Additionally, partnerships with airlines, travel agencies, and banks have proven to be strategic for expanding market reach and enhancing product visibility at critical touchpoints.

-

Allianz provides a broad array of coverage options tailored to meet the needs of diverse travelers, including those seeking comprehensive protection for leisure, business, and adventure trips. Allianz has also embraced digital innovation, providing a seamless online platform and mobile app to simplify policy management, claim filing, and service access, which makes it a popular choice for tech-savvy travelers looking for convenience alongside comprehensive protection.

-

American International Group, Inc. offers a range of travel insurance solutions designed to address the specific needs of travelers worldwide, including policies focused on comprehensive medical coverage, trip cancellation, and personal liability. Known for its robust financial backing, the company is equipped to support travelers in complex or high-risk situations, making it an appealing choice for international travelers and expatriates.

Key Travel Insurance Companies:

The following are the leading companies in the travel insurance market. These companies collectively hold the largest market share and dictate industry trends.

- Allianz

- American International Group, Inc.

- AXA

- ASSICURAZIONI GENERALI S.P.A.

- USI Insurance Services, LLC

- battleface

- Insure & Go Insurance Services Limited

- Seven Corners Inc.

- Travel Insured International

- Zurich

- Delphi Financial Group, Inc.

- Ping An Insurance (Group) Company of China, Ltd.

View a comprehensive list of companies in the Travel Insurance Market

Recent Developments

-

In December 2023, World Nomads launched Travel Wiser, an ultimate online travel companion. Travel Wiser offers practical advice, survival tips to navigate unexpected situations, and wellness guidance to enhance customers’ journeys. With Travel Wiser, travelers can access wellness content that addresses various needs, such as combating altitude sickness and overcoming loneliness during solo trips.

-

In January 2023, BATTLEFACE UNDERWRITING SERVICES SRL launched a new technology-enabled platform as a service called Robin Assist. Robin Assist leverages Application Programming Interface (API) and is apt for general agents, insurance brokers, and enterprise partners involved in providing travel insurance. It supports customer service and emergency claims.

Travel Insurance Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 31.25 billion

Revenue forecast in 2030

USD 63.87 billion

Growth rate

CAGR of 15.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Insurance coverage, distribution channel, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Ireland; China; Japan; India; Australia; New Zealand; Brazil; KSA; UAE; South Africa

Key companies profiled

Allianz; American International Group, Inc.; AXA; ASSICURAZIONI GENERALI S.P.A.; USI Insurance Services, LLC; battleface; Insure & Go Insurance Services Limited; Seven Corners Inc.; Travel Insured International; Zurich; Delphi Financial Group, Inc.; Ping An Insurance (Group) Company of China, Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Travel Insurance Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global travel insurance market report based on, insurance coverage, distribution channel, end use, and region.

-

Insurance Coverage Outlook (Revenue, USD Million, 2018 - 2030)

-

Single-trip Travel Insurance

-

Annual Multi-trip Travel Insurance

-

Long-stay Travel Insurance

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Insurance Intermediaries

-

Insurance Companies

-

Banks

-

Insurance Brokers

-

Insurance Aggregators

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Education Travelers

-

Business Travelers

-

Senior Citizens

-

Family Travelers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Ireland

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

New Zealand

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global travel insurance market size was estimated at USD 27.05 billion in 2024 and is expected to reach USD 31.35 billion in 2025.

b. The global travel insurance market is expected to grow at a compound annual growth rate of 15.4% from 2025 to 2030 to reach USD 63.87 billion by 2030.

b. Europe dominated the travel insurance market with a share of 35.1% in 2024. This is attributable to the increasing travel & tourism and peace among the neighboring countries.

b. Some key players operating in the travel insurance market include Allianz; American International Group, Inc.; AXA; ASSICURAZIONI GENERALI S.P.A.; USI Insurance Services, LLC; battleface; Insure & Go Insurance Services Limited; Seven Corners Inc.; Travel Insured International; Zurich; Delphi Financial Group, Inc.; Ping An Insurance (Group) Company of China, Ltd.

b. Key factors driving the market growth include the rise in tourism and the technological development in the travel insurance industry across the globe.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."