- Home

- »

- Homecare & Decor

- »

-

Travel Retail Market Size & Share, Industry Report, 2030GVR Report cover

![Travel Retail Market Size, Share & Trends Report]()

Travel Retail Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Perfume & Cosmetics, Wines & Spirits, Fashion & Accessories, Tobacco Products), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-668-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Travel Retail Market Summary

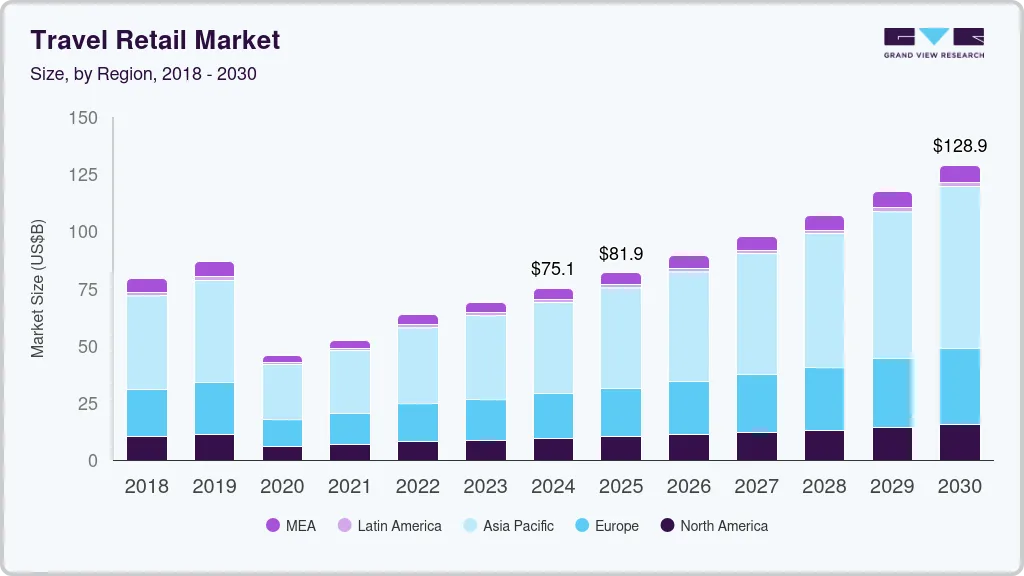

The global travel retail market size was estimated at USD 75.1 billion in 2024 and is projected to reach USD 128.9 billion by 2030, growing at a CAGR of 9.5% from 2025 to 2030.Some of the major factors driving the growth of the global travel retail industry are increasing travel and tourism activities across the globe, expansion of travel infrastructure, and increasing focus on luxury and premium products.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- In terms of segment, perfume & cosmetics accounted for a revenue of USD 81.9 million in 2024.

- Perfume & Cosmetics is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 75.1 Billion

- 2030 Projected Market Size: USD 128.9 Billion

- CAGR (2025-2030): 9.5%

- Asia Pacific: Largest market in 2024

High-end brands are expanding their presence in travel retail, offering duty-free and travel-exclusive collections. This trend is particularly strong in categories such as cosmetics, fragrances, fashion, and electronics. According to the Bureau of Transportation Statistics, domestic and international passenger enplanements in the U.S. reached 82.4 million in February 2024, representing an 8.6% increase compared to 75.9 million in February 2023. This significant rise in passenger numbers has positively impacted the travel retail industry by driving higher foot traffic through airports and travel hubs. As more travelers pass through these points of sale, the demand for duty-free goods, luxury items, and travel essentials increases, leading to greater sales and contributing to the overall growth of the travel retail market.

In Q1 2024, international arrivals (overnight visitors) reached 97% of 2019 levels, signaling a near-complete recovery to pre-pandemic figures. Approximately 285 million tourists traveled internationally during this period, representing a 20% increase from Q1 2023. This robust rebound in international arrivals and year-over-year tourist growth is expected to greatly stimulate demand within the travel retail industry. This surge in global travel activity will drive higher foot traffic in duty-free shops, airport retail outlets, and other travel retail venues, leading to increased sales and revenue opportunities. Consequently, travel retailers can expect enhanced market dynamics, greater consumer spending, and the potential for expanded product offerings and services to cater to the growing influx of international travelers.

The pent-up demand for travel post-pandemic has resulted in a surge of international tourists eager to explore and spend. As a result, travel retail operators are witnessing increased foot traffic and sales. Airports and other travel hubs are capitalizing on this trend by enhancing their retail offerings, expanding product ranges, and creating more engaging shopping experiences to attract and retain customers.

The evolution of consumer preferences towards luxury and high-quality products is shaping the travel retail industry. Travelers are increasingly seeking exclusive, premium brands and products, driving demand for luxury goods, cosmetics, fragrances, and high-end alcoholic beverages. Retailers are responding by curating a diverse portfolio of premium offerings and leveraging brand partnerships to cater to the discerning tastes of international tourists.

Additionally, regulations governing the establishment and operation of duty-free stores at airports and other points of entry create a favorable business environment for retailers. These laws often include tax exemptions and reduced tariffs on specific products, enhancing the price competitiveness of duty-free goods. By capitalizing on these regulatory benefits, travel retail companies can attract a larger customer base, increase sales volumes, and improve profit margins. Moreover, these advantages can enhance the overall shopping experience for travelers, further driving consumer demand and contributing to the sustained growth and expansion of the market.

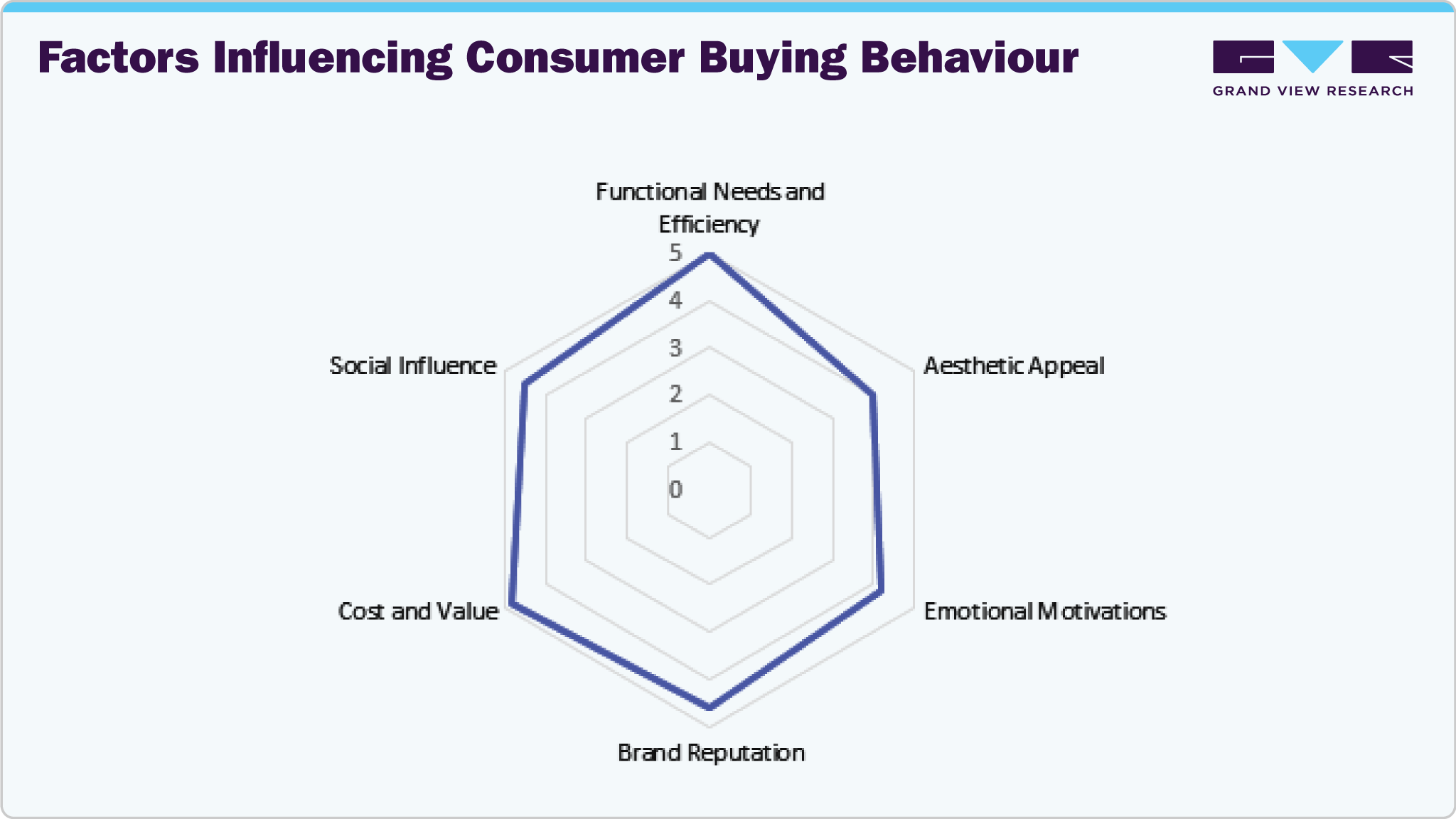

Consumer Insights

Consumer buying behavior in travel retail is influenced by a mix of emotional, situational, and cultural factors that are unique to the travel environment. Travelers are often drawn to perceived value through tax-free pricing and discounts, making purchases they might not consider in regular retail settings. The convenience of shopping during idle time at airports or cruise terminals encourages impulse buying, while the availability of exclusive or limited-edition items adds urgency and appeal. A wide selection of luxury and premium brands enhances this further, with many consumers viewing travel as an opportunity to indulge or reward themselves.

Emotional connections to well-known brands play a significant role, as travelers often associate these names with status, quality, or personal identity. Cultural influences also shape buying decisions, with tourists seeking products that reflect their destination or make thoughtful souvenirs. Marketing efforts, including eye-catching displays and time-limited promotions, are designed to capture attention and drive quick decisions. Social proof via peer recommendations or influencer endorsements adds another layer of influence. Ultimately, a smooth and engaging shopping experience, combined with these various drivers, makes travel retail a powerful channel for consumer spending.

Furthermore, as the travel retail landscape evolves, understanding the distinct preferences and behaviors of different consumer segments has become increasingly important. Among these, Generation Z presents unique challenges and opportunities for brands and retailers. Characterized by digital nativity, value consciousness, and a desire for authenticity, Gen Z travelers often diverge from traditional shopping patterns seen in older generations. Recent data sheds light on their specific habits and reveals important gaps that the industry must address to effectively engage this emerging demographic.

A recent report by M1nd-set and the Nordic Travel Retail Group highlights key statistical insights into Gen Z shopping behavior in travel retail. Only 56% of Gen Z ferry travelers visit duty-free shops, notably lower than the 78% observed among Millennials. In airport environments, while footfall among Gen Z is comparatively higher, their conversion rates into actual purchases are significantly lower. Their average spend is around USD 73, well below the USD 123 average across all age groups. Additionally, just 75% of Gen Z travelers plan their purchases, compared to 80% across other generations, and less than 33% notice duty-free promotions prior to their journey, against a 47% average overall. Interaction with retail staff is also limited among Gen Z, with fewer than half engaging, while roughly two-thirds of other demographics do. These trends point to a need for more targeted engagement, personalized experiences, and value-driven offerings to better capture Gen Z's interest in the travel retail space.

Trump’s Tariff Impact

The U.S. travel retail industry, encompassing duty-free and travel-exclusive goods sold in airports and other travel hubs, is significantly influenced by international trade dynamics. A recent article from Vogue Business discusses the potential impact of proposed U.S. tariffs on the beauty industry. President Donald Trump's administration suggested imposing tariffs ranging from 10% to 60% on imports, particularly targeting goods from China, and a 25% tariff on products from Canada and Mexico. While these tariffs are expected to generate approximately USD 1.2 trillion in revenue, they could also lead to a 0.4% reduction in GDP and the loss of around 340,000 jobs.

Travel retail has long thrived on a model that depends on globalized supply chains, efficient logistics, and competitive pricing factors that are directly threatened by the imposition of these tariffs. Beauty products, especially skincare, fragrances, and cosmetics, are among the top-selling categories in duty-free stores and are typically marketed as luxury items offered at attractive price points. As tariffs increase the cost of raw materials, components, and finished products, brands and retailers may be forced to raise prices, reduce promotional activities, or cut back on the variety of products available in travel retail outlets. This shift could deter price-sensitive international travelers, whose purchasing decisions are often influenced by perceived exclusivity and value. If duty-free prices begin to align with or exceed domestic retail prices due to tariff-driven inflation, the U.S. travel retail market could lose a significant competitive edge globally.

Moreover, the impact on smaller beauty brands, which frequently use the travel retail channel to reach international consumers and build brand visibility, could be even more pronounced. These brands typically operate on tighter margins and rely on efficient sourcing and affordable production to compete with larger, multinational conglomerates. The increased costs stemming from tariffs could limit their ability to invest in travel retail activations such as point-of-sale displays, limited-edition launches, and regional product assortments that are vital for consumer engagement in airports.

Additionally, efforts to reshore or nearshore production in response to the tariffs come with logistical and operational challenges, higher U.S. labor costs, limited domestic manufacturing infrastructure, and difficulty sourcing specific raw ingredients locally. These obstacles could result in longer lead times, inconsistent product availability, and reduced innovation, all of which weaken the supply chain that supports travel retail.

For travel retailers, this volatility may lead to reduced profitability and lower operational efficiency, ultimately affecting staffing, marketing strategies, and future investments. In a market that relies heavily on seamless global movement and consumer spontaneity, the ripple effects of tariffs could redefine the economic landscape of U.S. travel retail for years to come.

Product Insights

The demand for perfumes and cosmetics accounted for a revenue share of 41.39% in 2024. The increasing number of international travelers provides a captive audience for these high-margin products, often viewed as convenient and desirable purchases during travel. Duty-free pricing offers significant savings, making luxury brands more accessible and appealing. Additionally, travelers are drawn to exclusive product ranges and travel-exclusive sets that are not available in regular retail outlets. The convenience of purchasing high-quality beauty products at travel hubs, coupled with the allure of tax-free shopping, drives robust sales growth in this segment.

The demand for electronics and gifts is projected to grow at a CAGR of 11.4% over the forecast period of 2025-2030. The increasing prevalence of tech-savvy travelers has heightened interest in acquiring the latest gadgets, often available at competitive prices in duty-free outlets. Additionally, the convenience of purchasing electronics while traveling, combined with tax-free pricing, makes these items more attractive. The exclusivity of travel retail offerings, alongside a diverse product range, drives increased sales and contributes to market growth in this sector.

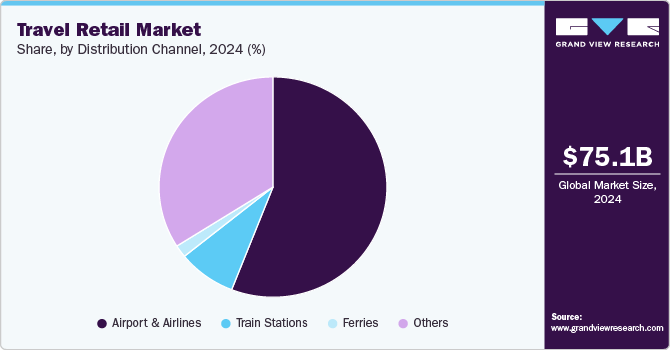

Distribution Channel Insights

The demand for travel retail products at airports and airline outlets held a market share of 55.91% in 2024. The segment growth is mainly driven by increasing air traffic, creating a larger customer base for retail outlets. In 2023-24, India's international air traffic experienced a significant surge, reaching 69.7 million passengers and marking a 22.5% year-on-year growth, outpacing the growth of domestic air traffic. This substantial increase in international travelers has boosted the demand for travel retail products at airport and airline outlets, as the higher passenger volume drives greater foot traffic and sales opportunities, particularly for duty-free items, luxury goods, and travel essentials.

The demand through railway station outlets/shops is projected to grow at a CAGR of 9.1% over the forecast period of 2025-2030. The increasing number of rail passengers, driven by improved rail infrastructure and expanded services, enhances foot traffic in railway stations. The convenience and accessibility of retail outlets within these transit hubs cater to travelers seeking quick, high-quality purchases during their journey. Additionally, the availability of a diverse range of products, from snacks and beverages to travel essentials and souvenirs, meets the immediate needs of travelers.

Regional Insights

The North America travel retail industry held a global revenue share of 12.47% in 2024. Major airports in North America have been investing heavily in modernization and expansion projects. These upgrades not only increase capacity but also improve the shopping experience for travelers, making airports more attractive as retail hubs. The growth is further driven by an expanding middle class, higher disposable incomes, and the resurgence of business and leisure travel post-pandemic.

U.S. Travel Retail Market Trends

The travel retail industry in the U.S. is expected to grow at a CAGR of 9.2% from 2025 to 2030. In the U.S., several travel retail laws and regulations provide benefits to companies, potentially impacting market growth positively. One significant regulation is the duty-free allowance, which permits travelers to bring back a certain amount of goods without paying import duties. This allowance incentivizes travelers to purchase higher quantities of goods, directly boosting sales for travel retailers.

Asia Pacific Travel Retail Market Trends

Asia Pacific emerged and accounted for a revenue share of around 53.22% in 2024. Enhanced airport infrastructure and the proliferation of low-cost carriers have bolstered passenger traffic, while rising disposable incomes have fueled demand for premium and luxury goods. Strategic partnerships between retailers, airports, and brands, alongside innovative digital technologies, are enhancing the shopping experience and catering to diverse consumer preferences.

Europe Travel Retail Market Trends

The Europe travel retail industry is projected to grow at a CAGR of 9.4% from 2025 to 2030. In Europe, the growth of travel retail is buoyed by a dense network of major international airports and robust intra-European travel. The region benefits from a strong tourism industry, diverse cultural attractions, and a high concentration of affluent travelers seeking premium and duty-free products. Advanced airport facilities and convenient transportation infrastructure contribute to increased passenger flows, while strategic alliances between retailers and transport operators optimize the retail experience.

Key Travel Retail Company Insights

The competitive landscape is characterized by intense rivalry among key players striving to capture a significant share of global passenger spending. Established operators such as Dufry, Lagardère Travel Retail, and DFS Group dominate with extensive networks of duty-free shops and concessions in major airports worldwide. These companies leverage strategic alliances with brands, innovative marketing strategies, and advanced digital technologies to enhance customer engagement and drive sales.

Key Travel Retail Companies:

The following are the leading companies in the travel retail market. These companies collectively hold the largest market share and dictate industry trends.

- Avolta AG

- Lotte Corporation

- China Duty Free Group Co. Ltd.

- LVMH Moët Hennessy Louis Vuitton (DFS Group)

- Gebr. Heinemann SE & Co. KG

- Lagardere Travel Retail Group

- The Shilla Duty Free

- The King Power International Group

- Aer Rianta International cpt

- Duty Free Americas

Recent Developments

-

In March 2024, Lagardère Travel Retail unveiled an exclusive partnership with RaiseLab, a trailblazing firm focused on promoting open innovation. This strategic alliance underscores Lagardère Travel Retail's commitment to becoming a leader in innovation within the travel retail sector, aiming to expedite the deployment of cutting-edge solutions.

-

In July 2023, Micro Mobility Systems AG, the global leader in premium mobility solutions, partnered with Dufry, a prominent player in the global travel industry. This partnership aimed to redefine the travel retail experience by integrating Micro's innovative product and solution offerings with Dufry's wide global outreach and expertise.

Travel Retail Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 81.89 billion

Revenue forecast in 2030

USD 128.94 billion

Growth rate

CAGR of 9.5% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Report updated

May 2025

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Avolta AG; Lotte Corporation; China Duty Free Group Co. Ltd.; LVMH Moët Hennessy Louis Vuitton (DFS Group); Gebr. Heinemann SE & Co. KG; Lagardere Travel Retail Group; The Shilla Duty Free; The King Power International Group; Aer Rianta International cpt; Duty Free Americas

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Travel Retail Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the travel retail market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Perfume and Cosmetics

-

Wines and Spirits

-

Fashion and Accessories

-

Tobacco Products

-

Electronics and Gifts

-

Food and Confectionery

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Airport and Airlines

-

Train Stations

-

Ferries

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global travel retail market was estimated at USD 75.13 billion in 2024 and is expected to reach USD 81.89 billion in 2025.

b. The global travel retail market is expected to grow at a compound annual growth rate of 9.5% from 2025 to 2030, reaching USD 128.94 billion by 2030.

b. Asia Pacific dominated the travel retail market, with a share of over 53.22% in 2024. The regional market's growth is mainly driven by the proliferation of low-cost carriers, which have bolstered passenger traffic while raising disposable incomes.

b. Some of the key players operating in the travel retail market include Avolta AG; Lotte Corporation; China Duty Free Group Co. Ltd.; LVMH Moët Hennessy Louis Vuitton (DFS Group); Gebr. Heinemann SE & Co. KG; Lagardere Travel Retail Group; The Shilla Duty Free; The King Power International Group; Aer Rianta International cpt; Duty Free Americas.

b. Key factors driving the growth of the travel retail market include increasing travel and tourism activities worldwide, expanding travel infrastructure, and increasing focus on luxury and premium products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.