- Home

- »

- Advanced Interior Materials

- »

-

Treated Wood Market Size, Share And Growth Report, 2030GVR Report cover

![Treated Wood Market Size, Share & Trends Report]()

Treated Wood Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Decking, Fencing, Construction, Furniture), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-474-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Treated Wood Market Size & Trends

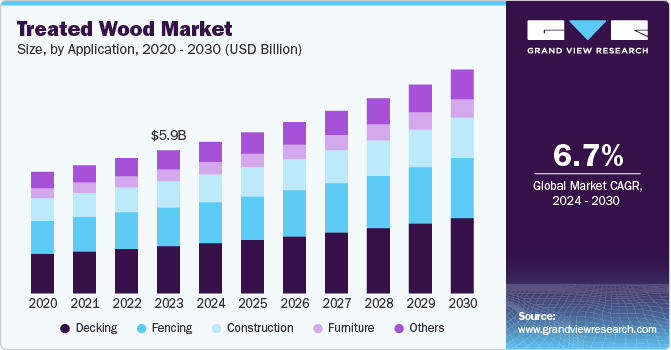

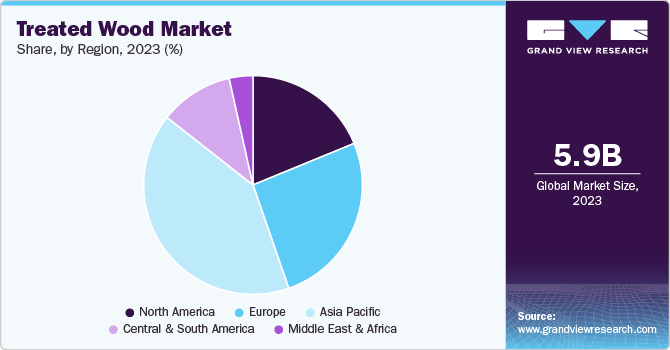

The global treated wood market size was estimated at USD 5.86 billion in 2023 and is projected to grow at a CAGR of 6.7% from 2024 to 2030. Treated wood is valued for its ability to resist decay, insects, and moisture, which makes it suitable for outdoor applications such as decking, fencing, and marine structures. This resistance to environmental degradation extends the lifespan of wood products, making them more cost-effective in the long run. As a result, consumers and industries prefer this wood over untreated wood, especially in regions with harsh climates or high humidity, where untreated wood would quickly deteriorate.

The global construction boom, particularly in emerging economies in Asia-Pacific and Latin America, is significantly driving the demand for treated wood. Urbanization and population growth are leading to an increased need for residential and commercial buildings, which often incorporate treated wood for structural elements, outdoor spaces, and landscaping. Moreover, treated wood is a preferred material in infrastructure projects, especially for outdoor uses such as bridges, utility poles, and railway sleepers, where longevity is crucial.

As environmental awareness grows, treated wood is seen as a sustainable alternative to synthetic materials like plastic or metal. Modern treatment processes use environmentally friendly chemicals, making treated wood a greener choice for construction and outdoor use. Wood is also renewable, biodegradable, and has a lower carbon footprint compared to non-renewable materials. This aligns with global trends towards eco-friendly building practices, especially in regions with strict environmental regulations such as Europe and North America.

Advances in wood treatment technologies have made treated wood more appealing by improving its aesthetic qualities and expanding its use. New treatment processes ensure that the wood retains its natural appearance, making it more attractive for residential and commercial projects where aesthetics matter. Furthermore, these technological improvements enhance the safety and efficacy of treatments, ensuring that treated wood remains a popular choice for builders and consumers.

With the rise in home improvement projects, particularly during the COVID-19 pandemic, there has been a growing trend toward enhancing outdoor living spaces. Homeowners are investing in patios, decks, pergolas, and garden structures, driving the demand for pressure-treated wood, which is known for its durability in outdoor environments. This trend is particularly notable in North America, where residential construction and renovation projects are strong growth drivers

Application Insights

Based on application, the decking segment led the market with the largest revenue share of 33.03% in 2023. This decking segment is growing rapidly in the market, driven primarily by the rising demand for outdoor living spaces and home improvement projects. Over the past few years, there has been a noticeable shift in consumer preferences toward expanding outdoor areas like patios, decks, and gardens, particularly in North America and Europe. The COVID-19 pandemic accelerated this trend, as homeowners spent more time at home and sought to create outdoor environments for relaxation and socializing. Treated wood is the material of choice for decking because of its durability, resistance to decay, and ability to withstand harsh weather conditions. In addition, treated wood is more cost-effective than composite materials or other alternatives, making it a popular option for both residential and commercial decking.

Construction is a significant segment in the market due to its extensive use in both residential and commercial projects. This wood is commonly used in framing, beams, and support structures, especially for outdoor construction, where it must withstand environmental factors like moisture, rot, and insect damage. The construction industry relies heavily on treated wood because it offers an economical, durable solution for structural components in both residential and commercial buildings.

In infrastructure, this wood is utilized in utility poles, railway sleepers, and bridges, where the material’s strength and longevity are crucial. Developing economies in Asia-Pacific and Latin America are significantly driving demand as they invest in large-scale infrastructure projects to support urbanization and economic growth.

Regional Insights

The North America treated wood market is anticipated to grow at the fastest CAGR during the forecast period, the demand for treated lumber is primarily driven by the strong construction sector and the rising popularity of outdoor living spaces. The U.S. and Canada have seen a steady increase in residential construction and renovation projects, with homeowners investing heavily in outdoor decking, fencing, and landscaping. The preference for treated lumer in these applications is due to its durability, resistance to pests, and ability to withstand various weather conditions, making it ideal for both structural and aesthetic purposes. Furthermore, North America's timber-rich regions provide easy access to raw materials, keeping production costs competitive. Government investments in infrastructure projects, particularly in rural and coastal areas, are also boosting demand for this wood in utility poles, railway ties, and marine applications

Asia Pacific Treated Wood Market Trends

Asia Pacific dominated the treated woods market with the largest revenue share of 40.9% in 2023. Asia Pacific has emerged as the dominant region in the global treated lumber market due to several key factors, including rapid urbanization, industrialization, and infrastructure development, coupled with increasing environmental awareness. The region’s diverse range of climatic conditions and the expanding construction and real estate sectors have made treated wood a crucial material for both residential and commercial applications.

One of the most significant factors contributing to Asia Pacific’s dominance in this market is the ongoing urbanization and massive construction activities in emerging economies such as China, India, and Southeast Asian countries. These nations are experiencing rapid population growth and urban migration, leading to increased demand for housing and infrastructure. This lumber is widely used in the construction of homes, bridges, and utility poles due to its enhanced durability and resistance to decay, making it an essential material in both residential and commercial building projects.

Asia Pacific is also witnessing large-scale investments in infrastructure, particularly in sectors such as railways, bridges, and transportation networks, which heavily rely on treated lumber for structural purposes. Many countries in the region, including Vietnam, Indonesia, and the Philippines, are in the midst of expanding their transportation infrastructure, where treated wood plays a critical role in providing long-lasting and cost-effective solutions for outdoor construction, utility poles, and railway sleepers.

The treated woods market inChina, in particular, is undergoing a substantial construction boom as part of its long-term urbanization strategy, where affordable housing and large-scale infrastructure projects, including transportation networks, demand durable materials like treated wood. India's Smart Cities Mission and growing real estate sector are also key drivers of demand for this wood, as the government pushes for sustainable and cost-effective building materials to support urban infrastructure.

Europe Treated Wood Market Trends

The treated woods market in Europe is largely driven by its focus on sustainability and stringent environmental regulations. Countries such as Germany, the UK, and France have adopted strict building codes that favor the use of renewable and eco-friendly materials like treated wood. European consumers and industries are increasingly turning to treated lumber for both residential and commercial construction, particularly in outdoor applications such as decking, fencing, and landscaping. The emphasis on reducing carbon footprints has positioned this wood as a preferred alternative to synthetic materials, which have a higher environmental impact. In addition, the adoption of sustainable forestry practices and innovations in lumber treatment processes have made this wood more attractive in the European market. Growth is particularly strong in green building projects and the renewable energy sector, where treated wood is used in wind turbine platforms and other sustainable infrastructure.

Key Treated Wood Company Insights

Some of the key players operating in the market UFP Industries, Inc., Stella-Jones, and West Fraser:

-

UFP Industries, Inc. was established in 1955 and is headquartered in Michigan, U.S. It is involved in manufacturing and distributing of lumber and wood-alternative products for diverse range of markets, including residential and commercial construction, industrial products, and retail solutions. Its product portfolio includes Pressure-Treated Lumber, Engineered Wood, lumber Fencing and Posts, Decking and Railing, and outdoor living products

-

Stella-Jones is a North American manufacturer and supplier of pressure-treated lumber products for infrastructure, residential, and commercial applications. It was established in 1992 in Canada. Its product portfolio comprises pressure-treated lumber poles, railway ties, treated wood for industrial applications, including bridges, marine structures, and retaining walls, and treated lumber and pilings

Biewer lumber and FLAMEPROOF COMPANIES are some of the emerging participants in the market.

-

Biewer Lumber was founded in 1964 and is a manufacturer and distributor of lumber and related lumber for residential, commercial, and industrial applications. Furthermore, it operates multiple sawmills and distribution centers across the U.S. Its products include pressure-treated lumber, untreated lumber, decking, fencing, timber, wooden pallets, lumber chips, and sawdust

-

FLAMEPROOF COMPANIES was established in 1917 and headquartered in Montgomery, Illinois. It is a manufacturer and a supplier of fire-retardant wood products. The company serves residential, commercial, and industrial construction markets, offering lumber products designed to improve safety and fire performance in buildings and structures. It sells lumber, plywood, and custom & preservative-treated wood

Key Treated Wood Companies:

The following are the leading companies in the treated wood market. These companies collectively hold the largest market share and dictate industry trends.

- UFP Industries, Inc.

- Akash Industries.

- MANTRI INDUSTRIES

- Koppers

- FLAMEPROOF COMPANIES

- Stella-Jones

- Biewer lumber

- Canfor

- West Fraser

- Taiga Building Products

Recent Developments

-

In April 2024, Koppers acquired Brown Wood Preserving Company, Inc. for around USD 100 million. This acquisition helped Koppers to strengthen its production and sales of timber products and enter new geographical area

Treated Wood Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.21 billion

Revenue forecast in 2030

USD 9.16 billion

Growth rate

CAGR of 6.7% from 2023 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Saudi Arabia

Key companies profiled

UFP Industries, Inc.; Akash Industries.; MANTRI INDUSTRIES; Kopper; FLAMEPROOF COMPANIES; Stella-Jones; Biewer lumber; Canfor; West Fraser; Taiga Building Products

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Treated Wood Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the industry trends in each of the segments from 2018 to 2030. For this study, Grand View Research has segmented the global treated wood market report based on application, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Decking

-

Fencing

-

Construction

-

Furniture

-

Other Applications

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global treated wood market size was estimated at USD 5.86 billion in 2023 and is expected to reach USD 6.21 billion in 2024.

b. The global treated wood market is expected to grow at a compound annual growth rate (CAGR) of 6.7% from 2024 to 2030 to reach USD 9.16 billion by 2030.

b. Asia Pacific accounted for the largest revenue share of 40.9% in 2023 owing to rapid urbanization, industrialization, and infrastructure development, coupled with increasing environmental awareness.

b. Some key players operating in the treated wood market include UFP Industries, Inc., Akash Industries., MANTRI INDUSTRIES, Koppers, FLAMEPROOF COMPANIES, Stella-Jones, Biewer lumber, Canfor, West Fraser, Taiga Building Products.

b. The key factors driving the treated wood market growth includes its growing usage in outdoor applications such as decking, fencing, and marine structures owing to its ability to resist decay, insects, and moisture.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.