- Home

- »

- Clothing, Footwear & Accessories

- »

-

Triathlon Clothing Market Size, Share & Growth Report, 2030GVR Report cover

![Triathlon Clothing Market Size, Share & Trends Report]()

Triathlon Clothing Market Size, Share & Trends Analysis Report By Type (Tri Tops, Tri Shorts, Tri Suits), By Application, By Distribution Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-024-8

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Report Overview

The global triathlon clothing market size was estimated at USD 1,910.2 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 8.5% from 2023 to 2030. The growth is attributed to the growing events organized by triathlon governing bodies of different regions and an increase in the number of people participating in triathlons and other sports like swimming, cycling, and running.

The COVID-19 outbreak had a substantial impact on the global triathlon clothing industry in 2020, with most businesses reporting decreased sales. The fact that most consumers of triathlon clothing are located in Europe and North America, two regions that have been badly touched by the pandemic, also had a significant negative influence on triathlon clothing product sales.

Retailers have witnessed significant losses during this period. Department stores like Triathlon LAB, Road Runners Sports, and Nike, and numerous storefronts shut down during the lockdown period and several companies incurred heavy losses. Most regions across the globe have categorized sports clothing under nonessential services, which led to a drastic decline in the sales of these products. The sudden cancelation of triathlon and other sports events like swimming, cycling events, and sports clubs heavily affected the triathlon clothing industry.

The main drivers of the expansion of the triathlon clothing industry are increased commercialization and shifting lifestyle trends, particularly in developing economies. Growing obesity rates and greater public knowledge of the advantages of cycling and swimming will help the triathlon apparel market undergo profitable expansion. Other significant factors supporting the growth of the triathlon clothing market include the rising number of triathletes and the increasing focus of major manufacturers on technological advancements. Moreover, the intensifying type lineup of triathlon clothing and the rising popularity of triathlon competitions and championships coupled with rising awareness about sports among millennials and women also boost the market.

Government initiatives for developing sports infrastructure in many countries boosted the market. For instance, in June 2019, the Ministry of Industry and Information Technology of the Chinese government, the State General Sports Administration of China, and nine departments jointly issued an action plan for developing sports industry infrastructure on a domestic level. This plan is expected to play a key role in increasing consumer awareness about domestic sports activities, thereby boosting the demand for sportswear in the country.

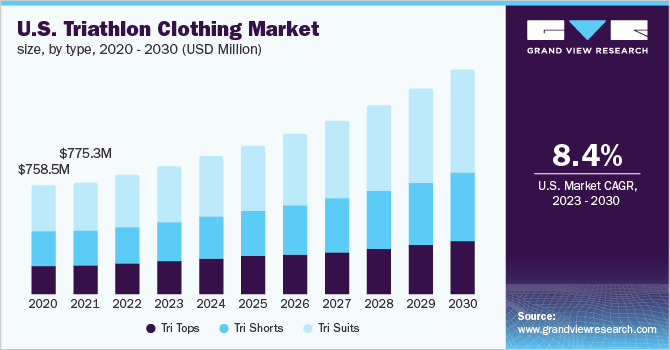

Type Insights

The tri-suits segment accounted for 43.7% of the global revenue share in 2022. Tri-suits are a type of apparel that is suitable for both men and women. They are made of a stretchy material; they can be worn snugly on the body and provide support while jogging or cycling. Features like quick drying technology, breathability and quick-wicking, zipper access, aerodynamic fit and fabric, and the willingness of consumers to spend on triathlon clothing, are among the key factors fueling this segment.

The tri shorts segment is expected to grow at a CAGR of 8.1% over the forecast period. The segment’s growth is attributed to rising interest in sports activities like swimming, cycling, etc. In addition, the demand for comfortable yet fashionable tri shorts has increased consumer preference for triathlon clothing. To meet the growing consumer demand, triathlon apparel manufacturers are introducing new items in a variety of designs for all body shapes and age groups with customization.

Application Insights

The men segment accounted for 64.0% of the global revenue share in 2022 because of the predominance of male attendance at both informal and formal events like Ironman. According to Triathlon Australia, in 2019, the majority of the triathlon participants in Australia were male (64%). In addition, players in the market are also investing their efforts to launch triathlon-clothing collection catering to country-based demand. Brands like HUUBINDIA offer triathlon clothing for men, which includes wet suits, tri suits, and different triathlon gear.

The women segment is expected to grow at the fastest CAGR of 9.6% over the forecast period. The rise in participation of women in triathlon events and government initiatives over the past few years are major growth drivers. For instance, the Canadian government intends to invest more than USD 7.5 billion in Quebec between 2018 and 2028 as part of the Investing in Canada Infrastructure Program (ICIP). In the upcoming years, it is anticipated that more women will participate in a variety of sports due to countries' rising investments in sports infrastructure. Companies like Coeur Sports are concentrating on introducing triathlon clothing specifically made for these activities since they recognize the potential of this target demographic.

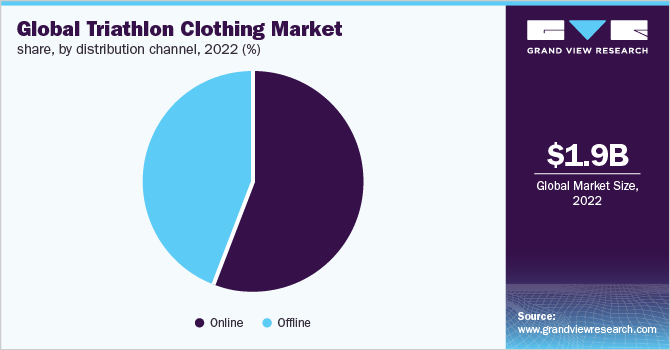

Distribution Channel Insights

The online segment accounted for 45.7% of the global revenue share in 2022. Demand for the segment is being driven by a shift in consumer preference toward online distribution channels. Factors like doorstep delivery, simple payment methods, and increased product availability are encouraging the expansion of online share. Demand for online marketplaces is also expanding as a result of the expansion of internet usage and customers' increasing use of e-commerce websites.

Additionally, the pandemic has spread the digital revolution across several businesses, including the market for triathlon clothing. Due to the pandemic, consumers have changed their purchasing behavior and now prefer to shop online to avoid uncomfortable and unnecessary socialization.

The offline segment is expected to grow at a CAGR of 7.7% over the forecast period. Exclusive showrooms that stock a variety of merchandise, as well as triathlon gear, are driving this segment’s growth. In addition, expansions in offline retail sportswear stores present the sportswear market with strong growth opportunities. For instance, in September 2020, Sigma Sports Limited, a retailer of triathlon clothing, opened a new store in Oakham.

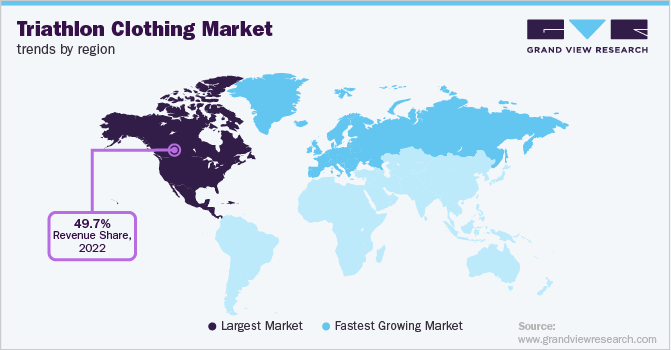

Regional Insights

North America dominated the market and accounted for a share of 49.7% in 2022. This is due to the existence of numerous national and international competitions, including the Sprint Triathlon Championship is held annually in the U.S., along with eight Ironman races with an average participation of 16,000 Ironmen and women.

The U.S. is a major contributor to North American research and development spending on textiles and ethical fashion materials made with low-impact methods, like organic cotton and recycled nylon. Over the course of the forecast period, these factors are anticipated to positively impact the growth of the North American triathlon clothing market.

The Europe market is expected to showcase the fastest growth rate of 8.9% during the forecast period. According to the ‘European health and fitness market report 2020’, which was released by EuropeActive, the number of people who belong to health and fitness clubs climbed to about 65 million in 2019.

The demand for triathlon clothing is being driven by the increased participation of people in triathlon events, swimming, running, cycling, and other sports events. This trend is also encouraging consumer engagement in sports and fitness clubs. In industrialized nations like Germany and the U.K., where attractive triathlon clothing is readily available, increased consumer expenditure is expected to drive market expansion.

Key Companies & Market Share Insights

The global triathlon clothing market is characterized by the presence of numerous players. Companies have been adopting several expansion strategies such as mergers & acquisitions, partnerships, and launching new products to gain a competitive advantage. For instance, in April 2022, Zone3 Ltd. launched a breaststroke wetsuit. The product was designed in response to the large number of people looking for something they can swim front crawl and breaststroke with. It is expected to become essential sportswear for open-water swimmers. Some prominent players in the global triathlon clothing market include:

-

Zone3 Ltd.

-

Zoot Sports

-

De Soto Clothing Company, Inc

-

Louis Garneau Sports

-

Fanatics Inc.

-

2XU

-

Pearl Izumi

-

Orca

-

Kiwami Triathlon

-

TYR SPORT. INC.

Triathlon Clothing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2,050.1 million

Revenue forecast in 2030

USD 3,637.3 million

Growth Rate

CAGR of 8.5% from 2023 to 2030 in terms of revenue

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; U.K.; Germany; France; China; India; Japan; Brazil; South Africa

Key companies profiled

Zone 3 Ltd.; Zoot Sports; De Soto Clothing Company, Inc.; Loud Garneau Sports; Fanatics Inc.; 2XU; Pearl Izumi; Orca; Kiwami Triathlon; TYR SPORT. INC.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Triathlon Clothing Market Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global triathlon clothing market report based on type, application, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Tri Tops

-

Tri Shorts

-

Tri Suits

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Men

-

Women

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global triathlon clothing market size was estimated at USD 1,910.2 million in 2021 and is expected to reach USD 2,050.1 million in 2023.

b. The global triathlon clothing market, in terms of revenue, is expected to grow at a compound annual growth rate of 8.5% from 2023 to 2030 to reach USD 3,637.3 million by 2030.

b. The North America segment dominated the triathlon clothing market with a revenue share of 49.7% in 2022. This is due to the existence of numerous national and international competitions, including the popular Ironman and Sprint Triathlon Championship held yearly in the U.S.

b. Some of the key players operating in the triathlon clothing market include Zone 3 Ltd., Zoot Sports, De Soto Clothing Company, Inc., Loud Garneau Sports, Fanatics Inc., 2XU, Pearl Izumi, Orca, Kiwami Triathlon.

b. The key factors that are driving the triathlon clothing market include growing e-commerce retail market and rising popularity of triathlon and growing participation by kids and women.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."