- Home

- »

- Next Generation Technologies

- »

-

True Wireless Stereo Earbuds Market Size Report, 2030GVR Report cover

![True Wireless Stereo Earbuds Market Size, Share, & Trends Report]()

True Wireless Stereo Earbuds Market (2022 - 2030) Size, Share, & Trends Analysis Report By Price Band (Below USD 100, USD 100-199, Over USD 200), By Region (APAC, North America), And Segment Forecasts

- Report ID: GVR-4-68039-402-8

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

True Wireless Stereo Earbuds Market Summary

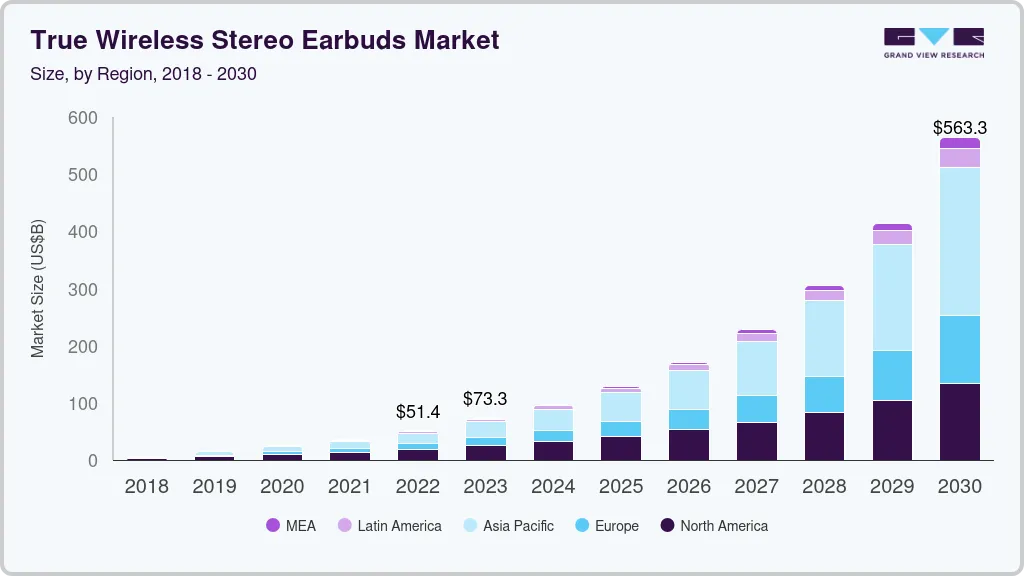

The global true wireless stereo earbuds market size was estimated at USD 35.37 billion in 2021 and is projected to reach USD 563.2 billion by 2030, growing at a CAGR of 34.9% from 2022 to 2030. The increasing per capita income of consumers in developed and developing countries, along with the improved standard of living is expected to increase demand for smart wearable products among athletes and personal users and is a major factor expected to drive the growth of the market.

Key Market Trends & Insights

- North America led the market demand in 2021 with a market share of more than 35.0%

- China and India are likely to lead the Asia Pacific market.

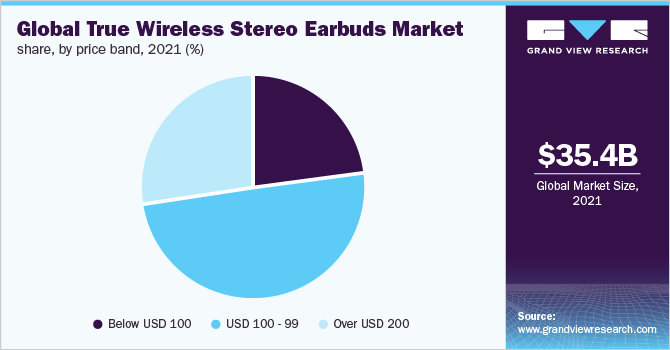

- By price band, the USD 100-199 segment accounted for 40% of overall sales.

Market Size & Forecast

- 2021 Market Size: USD 35.37 Billion

- 2030 Projected Market Size: USD 563.2 Billion

- CAGR (2022-2030): 34.9%

- North America: Largest market in 2021

Besides, continued development in the semiconductor industry has made it possible for OEMs to develop compact feature-loaded products. The push for compact parts is driven by the need for smaller assemblies in specific electronics, such as smart earbuds, and the need to drive down material costs. These factors are anticipated to positively impact the market growth.

Technological advancements and miniaturization are making it possible for electronic companies to embed sensors and microchips into earphones and earbuds, thereby turning them into smart products. In addition, the miniaturization of electronic chips and sensors allows manufacturers to develop trendy designs to attract young consumers. These factors support the market growth.

In 2021, Asia Pacific gained a significant share of the market with a strong desire for products in the price range of below USD 100. The market in APAC is dynamic, with a mix of customers seeking both expensive and affordable products. Products from Japan and South Korea are popular among consumers who value convenience and good quality over pricing. Southeast Asian nations, on the other hand, have demonstrated a strong preference for low- to moderate-priced devices. Over the course of the period, suppliers like Xiaomi and Realme are projected to work more to increase product availability in price-sensitive areas, driving up demand for affordable devices in APAC.

The true wireless stereo (TWS) earbuds market experienced a minor setback due to the supply chain disruptions caused by COVID-19. Earlier in 2020, TWS earbud manufacturing in China was hampered; however, by the second quarter, it had fully recovered. However, since a significant number of TWS earbud sales were made online, the pandemic had no impact on consumer demand. During the pandemic, the market growth has been consistent due to the increased demand for TWS earbuds for fitness activities and working remotely.

Earbuds are also becoming more prominent as hearing aid devices. Manufacturers are focusing on introducing hearing assistance capabilities to their earbuds to support those with hearing impairments. The microchip enables users to build a personalized sound ID based on each person's ear profile and listening capacity. Such developments allow manufacturers to add new features to their products, which is expected to impact future market growth favorably.

Price Band Insights

In 2021, the USD 100-199 segment accounted for 40% of overall sales. Vendors such as Apple Inc., Samsung Electronics Co. Ltd., and Jabra have largely contributed to the market share. Apple Inc. is anticipated to dominate the global wearables market over the forecast period. However, the economic downturn and related uncertainties caused by the COVID-19 pandemic have boosted the growth of the below USD 100 segment.

Companies such as Noise, Baseus, Xiaomi, boAt, and PTron are focused on introducing products that are below the USD 100 price band to increase the customer base. This introduction of low-price band products led to a decline in consumer preference for high-priced products. Likewise, the pandemic lowered consumer spending on high-priced products, ultimately increasing traction for mid-range products. Thus, lower consumer spending and the introduction of new products under the USD 100-199 price band are expected to support the growth of the market.

Regional Insights

North America led the market demand in 2021 with a market share of more than 35.0%, which was closely followed by Asia Pacific. The success of AirPods has helped to drive demand for TWS in North America. Several smartphone manufacturers have released wireless earphones with dedicated connectivity to their products. As smartphone replacement cycles lengthen, many users are seen investing in related accessories. Smartphone manufacturers are anticipated to seize these chances. High technological penetration and the early availability of newly released items are also important factors driving market growth.

Due to the introduction of multiple suppliers offering feature-packed products at affordable rates, China and India are likely to lead the Asia Pacific market. Many Chinese and Indian sellers seek prospects for expansion in foreign markets. Established vendors use their current supply chain to increase their cross-border e-commerce sales. Furthermore, these sellers provide economic and appealing products that appeal to a larger audience. Asia Pacific has a vast client base and various chances for market expansion with minimal entry barriers. These factors are projected to drive TWS earbud sales in Asia Pacific, which is expected to overtake North America throughout the projection period.

Key Companies & Market Share Insights

The true wireless stereo earbuds industry is competitive as market participants are primarily focusing on incorporating unique features into their products to improve the auditory experience. Apple Inc.'s AirPods, for example, have a unique vent design that equalizes pressure within the ear to reduce discomfort, which is common with in-ear models. Since their release in December 2016, the AirPods have enjoyed enormous sales growth. Many premium brands, however, are losing market share to Chinese vendors and local companies that provide differentiated features at affordable rates. Some of the major players operating in the global true wireless stereo earbuds market include:

-

Apple Inc.

-

Bose Corporation

-

Jabra

-

Harman International Industries, Incorporated

-

Sony Corporation

-

Sennheiser Electronic GmbH & Co.

-

Xiaomi

True Wireless Stereo Earbuds Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 51.36 billion

Revenue forecast in 2030

USD 563.2 billion

Growth rate

CAGR of 34.9% from 2022 to 2030

Market demand in 2021

327.8 million units

Market demand in 2030

4,494.9 million units

Growth rate

CAGR of 32.1% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million, volume in million units, and CAGR from 2022 to 2030

Report coverage

Revenue and volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Price band, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Spain;Rest of Europe; Greater China; India; Japan; South Korea; SEA; Rest of Asia Pacific;Brazil; Mexico; Rest of Latin America

Key companies profiled

Apple Inc; Bose Corporation; Harman International Industries, Incorporated; Sony Corporation; Sennheiser Electronic & Co.; and others.

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global True Wireless Stereo Earbuds Market Segmentation

The report forecasts growth in terms of revenue and volume at global, regional, and country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global true wireless stereo earbuds market report based on price band and region:

-

Price Band Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Below USD 100

-

USD 100 - 99

-

Over USD 200

-

-

Region Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Spain

-

Rest of Europe

-

-

Asia Pacific

-

Greater China

-

India

-

Japan

-

South Korea

-

SEA

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Mexico

-

Rest of Latin America

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global true wireless stereo earbuds market size was estimated at USD 35.37 billion in 2021 and is expected to reach USD 51.36 billion in 2022.

b. The global true wireless stereo earbuds market is expected to grow at a compound annual growth rate of 34.9% from 2022 to 2030 to reach USD 563.2 billion by 2030.

b. North America dominated the TWS earbuds market with a share of 35.24% in terms of revenue in 2021. This is attributable to the popularity of Airpods and the early availability of newly launched products across the region.

b. Some key players operating in the true wireless stereo earbuds market include Apple, Inc; Bose Corporation, Jabra, Harman International Industries, Incorporated, Samsung Electronics Co. Ltd; Sennheiser Electronic GmbH & Co; and Sony Corporation.

b. Key factors that are driving the TWS earbuds market growth include the rapid proliferation of social media along with the rising demand for content streaming. Furthermore, the work from home and study from home practices during the pandemic is expected to boost the sales of true wireless stereo earbuds.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.