- Home

- »

- Pharmaceuticals

- »

-

Tuberculosis Therapeutics Market Size & Share Report, 2030GVR Report cover

![Tuberculosis Therapeutics Market Size, Share & Trends Report]()

Tuberculosis Therapeutics Market Size, Share & Trends Analysis Report By Disease Type (Active TB, Latent TB), By Therapy, By Route Of Administration, By Dosage Form, By Distribution Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-500-7

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

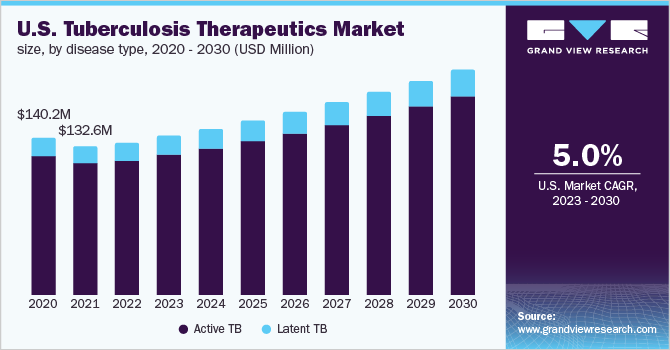

The global tuberculosis therapeutics market size was estimated at USD 2.01 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.09% from 2023 to 2030. The growth is due to factors such as the rising prevalence of tuberculosis, increasing investments in healthcare infrastructure, and the increasing geriatric population. Tuberculosis was the 13th leading cause of death worldwide with an estimated prevalence of 10.6 million in 2021.

A significant shift in TB care has been brought about by the COVID-19 pandemic. Patients with TB that were identified during the COVID-19 pandemic displayed more extensive pulmonary manifestations. Increased household transmission brought on by precautions taken to curb the spread of COVID-19 infection may be the cause of growth in latent TB infection and active TB in children of patient families. These limitations put in place by governments have altered how patient care is provided, having a detrimental effect on the health of the patients by delaying the treatment of acute emergencies, exacerbating chronic diseases, and causing psychological distress.

With the increasing cases of TB, testing has also been on a rise, further leading to the launch of newer testing kits into the market. Recently, in December 2022, a genetic test for determining TB has been launched by a collaboration between LifeCell and HaystackAnalytics. This launch aims to tackle the spread of tuberculosis by providing an affordable, accurate, and timely diagnosis of drug resistance. A significant rise in drug-resistant infection is being witnessed, which requires appropriate diagnosis so that a precise therapeutics regime can be provided.

Moreover, the market has been witnessing significant growth owing to the increasing prevalence of multidrug-resistant (MDR) tuberculosis. According to the WHO, the estimated cases of MDR/RR-TB were around 3.6% globally in 2021. With increasing incidence rates, several steps and initiatives are being taken to tackle the alarming condition of tuberculosis. For instance, in October 2022, a transformative alliance was formed, which will aid the World Health Organization's strategy to end the global tuberculosis epidemic by 2035.

However, the market growth is being restrained by the high costs associated with the treatment of the condition. MDR TB is one of the major public health concerns globally. Half a million cases of MDR TB1 are estimated to occur globally each year, which include extensive drug-resistant cases. Although the cases are increasing rapidly, the treatment is very expensive, takes a longer time to complete, and has potentially life-threatening side effects. According to the CDC, the average direct treatment cost associated with tuberculosis is around USD 182,186 in the case of MDR TB.

Disease Type Insights

The active TB segment held the largest share of the tuberculosis therapeutics market in 2022. The dominance of the segment is attributed to the rising prevalence of active TB among the global population. This condition is caused by Mycobacterium tuberculosis, which majorly infects the lungs. According to the WHO in 2021, it was estimated that approximately 1.6 million people die from the condition, whereas around 8 million people develop active TB each year. The risk of developing the condition is highest in the initial year after infection, but most patients develop the disease many years later. It is seen that around one in every ten people who are infected with M. tuberculosis are expected to develop an active infection at some point in their lives.

The latent TB segment is expected to show the fastest growth rate over the forecast period. The growth of the segment is attributed to the occurrence of the disease among the population without even knowing that the person is suffering from it. This form of infection is generally categorized by being present in the body without making the person feel sick. However, it is seen that few people having latent TB never develop the disease with the bacteria remaining inactive for a lifetime, but in certain cases, the bacteria tend to become active, multiply, and cause TB disease.

Therapy Insights

First-line therapy segment held the largest share of 62.45% in 2022. Isoniazid (INH), rifampicin (RIF), pyrazinamide (PZA), streptomycin (SM), and ethambutol (EMB) are first-line anti-tuberculosis drugs. The World Health Organization recommends combining first-line drugs with a second-line TB drug (levofloxacin). Since its introduction in 1952, isoniazid (INH) has been one of the most effective and specific anti-tuberculosis drugs. M. tuberculosis is extremely sensitive to INH. INH is only active against growing tubercle bacilli and does not affect non-replicating or anaerobic bacilli. Passive diffusion allows INH to enter the mycobacterial cell. The most serious side effects of isoniazid administration are neurotoxicity and hepatotoxicity.

Second-line therapy segment is expected to show the fastest growth over the forecast period. The growth of the segment is attributed to the increasing prevalence of resistant drug tuberculosis among the population. The second-line drugs include bedaquiline, levofloxacin, and moxifloxacin. Pretomanid is also a new second-line drug that was recommended for use in 2019 for the treatment of drug-resistant tuberculosis.

Route Of Administration Insights

The oral segment held the largest share of 73.84% in 2022. Rifampin, isoniazid, and pyrazinamide are three oral medications used to treat tuberculosis. They can be administered by themselves or in combination with one or more other TB medications. The antibiotic drug class includes rifampin, which works to either stop or restrain the growth of bacteria. Isoniazid, pyrazinamide, rifampicin, and ethambutol are given together daily for the first two months; then for the following four months, only two medications are given (isoniazid and rifampicin). The World Health Organization (WHO), in response to the difficulty of this regimen, introduced "directly observed therapy, short course" (DOTS), a new global TB control strategy, in 1997. Direct supervision by experienced individuals is the key element of this method since it guarantees patient adherence to the medication regimen and lowers the risk of drug resistance. However, this method also raises the price of care and makes TB therapy more inconvenient.

The parenteral segment is expected to show the fastest growth over the forecast period. The growth of the segment is attributed to the enhanced bioavailability and efficacy associated with the parenteral route of administration. The route allows medications to be directly absorbed into the body, further enabling a more predictable and quicker result.

Dosage Form Insights

The tablet segment held the largest share in 2022. Isoniazid (INH) is frequently used in conjunction with the medication’s pyrazinamide, ethambutol, and rifampin for the treatment of active TB. The patient usually feels better just a few weeks after beginning the medication. Treating TB takes far longer than treating other bacterial infections. Tuberculosis is generally cured by taking medications. Most of the drugs available for treatment are in form of tablets, capsules, or injections, out of which tablets are one of the most acceptable forms of medication for the treatment of the condition. The drugs are taken in combination and the treatment lasts for about 4-6 months. Isoniazid, ethambutol, and pyrazinamide are all available in the form of tablets.

The injections segment is expected to show the fastest growth over the forecast period. An injectable dosage form was introduced as a strategy for curbing the increasing prevalence of the condition. It has been observed that medication taken through injectables tends to offer results quickly. Moreover, there has been advancement in the dosage form to enhance the efficacy of the formulation. For instance, 1.5 million people died of tuberculosis worldwide in 2020, demonstrating the global need for better access to treatments. To address this issue, researchers at the UNC Institute for Global Health and Infectious Diseases, the International Center for the Advancement of Translational Science, and the University of North Carolina School of Medicine collaborated to create the anti-TB drug rifabutin in the form of a long-acting injectable formulation.

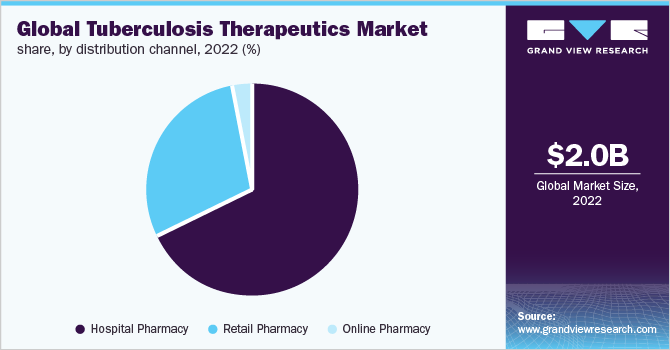

Distribution Channel Insights

The hospital pharmacy segment held the largest share of the tuberculosis therapeutics market in 2022. Hospital pharmacies and pharmacists are key stakeholders in the market as they handle medications in a crucial hospital environment that requires immediate access to medicines & products. Moreover, these pharmacies cover outpatient and in-patient services, facilitating easy treatment of tuberculosis infections. The key segment drivers include proximity to hospitals, ensuring easy access to medication to patients, and emergency medication access for hospitals. The accessibility and availability of anti-tuberculosis agents, their cost of acquisition, the frequency & type of tuberculosis infections, adherence to clinical practice guidelines, the availability of organ transplantation services, local anti-tuberculosis prescribing practices, potential toxicity, and tuberculosis drug resistance all have an impact on the global consumption of tuberculosis therapeutics.

The retail pharmacy segment is expected to show the fastest growth over the forecast period. The retail pharmacy segment is consolidating, and pharmacies are forming groups and pharmacy chains. This horizontal integration is expected to result in market consolidation and the dominance of prominent players. The experience and physical presence of a pharmacist, as well as proximity to these pharmacies, give the segment a competitive advantage over online pharmacies.

Regional Insights

The MEA region held the largest share of the market in 2022 and is expected to maintain its dominant position, in terms of share, throughout the forecast period. This can be attributed to the increasing prevalence of tuberculosis in the region. Globally, TB is the ninth leading cause of death, leading to the death of 1.6 million people, out of which more than a quarter of deaths tend to occur in the African region. Moreover, the occurrence of multidrug-resistant TB poses a major health risk in the fight against TB. However, the growth of the market is hampered owing to the low healthcare funding in the region. According to WHO, in March 2022, inadequate funding and investment for tuberculosis control are expected to hamper global efforts to end the disease by 2030.

Asia Pacific is estimated to show the fastest growth over the forecast period. The growth of the market in the region is due to the increasing prevalence of infectious diseases among the population. Tuberculosis is seen as one of the major causes of death in the region, with the highest cases being seen in Indonesia (9.2%), India (28%), the Philippines (7.0%), China (7.4%), Pakistan (5.8%), Bangladesh (3.6%), South Africa (3.3%), and Nigeria (4.4%). According to WHO, it is observed that two third of global TB cases are observed in these 8 countries.

Key Companies & Market Share Insights

The key players operating in the field of tuberculosis therapeutics are constantly focusing on introducing and changing existing technologies that enhance patient outcomes and significantly increase the effectiveness and efficiency of healthcare. For instance, in August 2022, the Project to Accelerate New Treatments for Tuberculosis (PAN-TB) collaboration announced that it is working towards the advancement of two investigational tuberculosis combinations. Some of the key players in the global tuberculosis therapeutics market include:

-

AstraZeneca

-

Johnson & Johnson Services, Inc.

-

Eli Lilly and Company

-

Viatris Inc. (Mylan N.V.)

-

Teva Pharmaceutical Industries, Ltd.

-

Sanofi

-

Novartis AG

-

Sun Pharmaceutical Industries Ltd.

-

Pfizer Inc.

Tuberculosis Therapeutics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2.10 billion

Revenue forecast in 2030

USD 2.99 billion

Growth rate

CAGR of 5.09% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in (USD Million) and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Disease type, therapy, route of administration, dosage form, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

AstraZeneca; Johnson & Johnson Services; Inc.; Eli Lilly And Company; Mylan N.V.; Teva Pharmaceutical Industries; Ltd.; Sanofi; Novartis AG; Sun Pharmaceutical Industries Ltd.; Pfizer Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Tuberculosis Therapeutics Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global tuberculosis therapeutics market report based on the disease type, therapy, route of administration, dosage form, distribution channel, and region:

-

Disease Type Outlook (Revenue, USD, Million, 2018 - 2030)

-

Active TB

-

Latent TB

-

-

Therapy Outlook (Revenue, USD Million, 2018 - 2030)

-

First-Line Therapy

-

Second-Line Therapy

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Parenteral

-

Others

-

-

Dosage Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Tablets

-

Capsules

-

Injection

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacy

-

Retail Pharmacy

-

Online Pharmacy

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Rest of Latin America

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of Middle East and Africa

-

-

Frequently Asked Questions About This Report

b. The global tuberculosis therapeutics market size was estimated at USD 2.01 billion in 2022 and is expected to reach USD 2.10 billion in 2023.

b. The global tuberculosis therapeutics market is expected to grow at a compound annual growth rate of 5.09% from 2023 to 2030 to reach USD 2.99 billion by 2030.

b. Active TB dominated the tuberculosis therapeutics market with a share of 63.89% in 2022. This is attributable to the rising prevalence of active TB among the population.

b. Some key players operating in the tuberculosis therapeutics market include AstraZeneca, Johnson & Johnson Services, Inc., Eli Lilly And Company, Mylan N.V., Teva Pharmaceutical Industries, Ltd., Sanofi, Novartis AG, Sun Pharmaceutical Industries Ltd., and Pfizer Inc.

b. Key factors that are driving the market growth include as the rising prevalence of tuberculosis, growing adoption of treatment, increasing investment in healthcare by governments, and an increasing geriatric population.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."