- Home

- »

- Electronic Devices

- »

-

Turboexpander Market Size & Share Report, 2030GVR Report cover

![Turboexpander Market Size, Share & Trends Report]()

Turboexpander Market Size, Share & Trends Analysis Report By Product Type (Axial, Radial), By Loading Device (Compressors, Generator, Hydraulic), By Power Capacity, By End Use, By Application, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-920-4

- Number of Report Pages: 165

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Semiconductors & Electronics

Report Overview

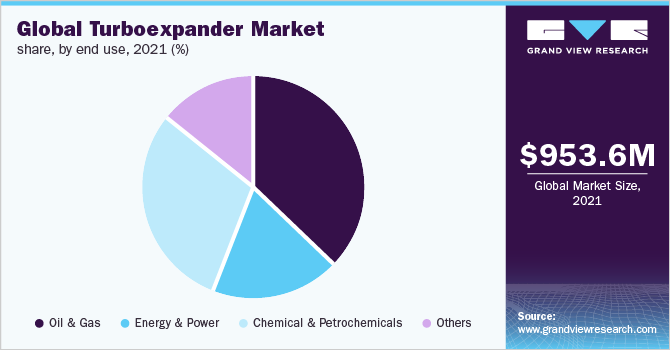

The global turboexpander market size was valued at USD 953.6 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 4.8% from 2022 to 2030. The increasing demand for natural gas in industries and the residential sector is expected to continue driving the growth of the market over the forecast period. Additionally, continuous technological advancements in bearing technology and growing preference for Active Magnetic Bearings (AMB) over oil-bearing in turboexpanders are presumed to drive the market growth. However, the high product development cycle of the turboexpander is likely to continue to refrain the market growth over the next few years.

The COVID-19 outbreak had a slight slump on the turboexpander market in 2020. It is ascribed to lower demand for oil & gas across the economies, which prompted many companies to reschedule or delay investment decisions in LNG projects. This pushed the installation of the new turboexpanders by over two to three years. However, the demand for liquid oxygen since the onset of the pandemic has witnessed a sharp rise amidst which several countries announced plans to set up new oxygen plants. This created new growth prospects for turboexpanders OEMs in 2021 and is expected to continue for the next few years.

Turboexpander, also known as expansion turbines, is a rotating radial or axial flow turbine through which high-pressure gas is expanded to produce energy loaded with three devices generator, compressor, or hydraulic/oil brakes. The hydrocarbon processing and air separation plants are the two major markets where turboexpanders are extensively used. They also find applications in liquefaction of gases, heat recovery, and geothermal applications. They form a pivotal element of any compressor system. Therefore, the growth is likely to be instigated by demand from various industrial applications.

Increasing awareness among industries to curb Green House Gas (GHG) emissions will also be a factor to create the need for turboexpanders in geothermal and heat recovery applications. The increasing demand for LNG vehicles and the growing demand for cryogen products in process industries are expected to be critical drivers for market growth. Also, the ever-increasing demand for LNG for domestic applications and the subsequent need to store and transport LNG is expected to drive the demand for turboexpanders in the near future. Natural gas is considered a cleaner and more reliable energy source. Hence, favorable government initiatives to promote and boost the adoption of alternative fuels are also expected to drive the demand for turboexpanders over the next few years.

For instance, in October 2021, Chinese energy companies, namely Sinopec Corporation, China National Offshore Oil Company (CNOOC), and local government-backed energy distributors such as Zhejiang Energy, initiated the discussion with the U.S. natural exporters such as Cheniere Energy (LNG.A) and Venture Global. The initiative was intended to secure a long-term partnership to prevent the shortage of LNG supplies amid soaring gas prices and domestic power shortages due to low coal production. In light of the aforementioned factors, the market for turboexpanders is expected to gain moderate growth over the forecast period. However, delays in Financial Investment Decisions (FIDs) could pose a challenge for the market over the mid-term of the forecast period.

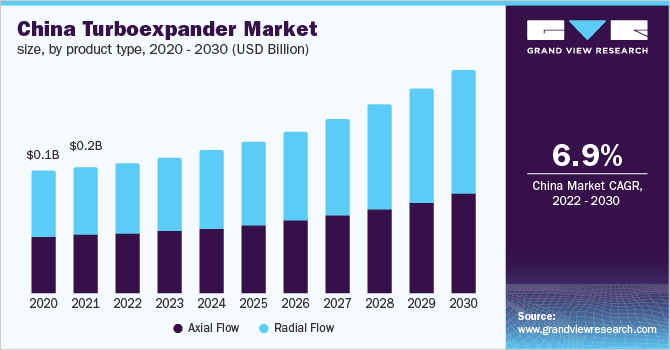

Product Type Insights

The axial flow segment is projected to reach USD 623.1 million by 2030. The growth of the segment can be attributed to the increase in demand for high power applications such as geothermal and heat recovery applications. Moreover, the axial flow turboexpanders are dominated and extensively used for large gas turbine applications. Major power plants install axial gas turboexpanders to provide heat and power for the district heating process, facilities and electricity to the grid.

Based on product type, the market has been further bifurcated into the axial flow and radial flow. The radial flow segment accounted for more than 50% of the overall market in 2021. The large-scale adoption of radial expanders for low output power applications such as hot gas expanders used in refineries, binary cycle geothermal plants, and other low power cryogenic plants contributed to the high share of the segment. The demand for radial flow turboexpanders in binary cycle geothermal plants is intended to produce carbon dioxide-free electricity. It is expected to favor market growth. In light of the ‘Net-Zero by 2050’ initiative undertaken by the United Nations (UN), favorable government policies have prompted companies to expand geothermal plant power capacities, subsequently creating a demand in the forthcoming years.

Loading Device Insights

The compressor segment accounted for more than 40% of the global market share in 2021, growing at a CAGR of 4.7% from 2022 to 2030. Compressor-loaded turboexpander is the most common arrangement in industries and is extensively used in LNG feed-gas treatment (onshore and floating), high-demanding cryogenic, and energy recovery applications. Based on loading devices, the market has been further categorized into the compressor, generator, and hydraulic/oil brake.

The generator segment is expected to register the highest CAGR over the forecast period. The market growth can be ascribed to a surge in demand for hydrogen turboexpanders used during the hydrogen liquefaction process. Furthermore, an increase in demand for blue and green hydrogen in aerospace and automotive is further expected to drive market growth over the forecast period. Owing to the surge in demand for hydrogen generations, OEMs in this space are focused on offering customized turboexpanders to their customers.

Power Capacity Insights

Combined, the less than 1 MW, 1 MW-4 MW, and 5MW -9 MW power capacities accounted for 70% of the overall market in 2021. These segments are expected to grow at a CAGR exceeding 4-5% over the forecast period. Based on power capacity, the market has been segmented into less than 1MW, 1 MW-4 MW, 5 MW-9 MW, 10 MW-19 MW, 20 MW-24 MW, 25 MW-40 MW, and above 40 MW.

End users primarily focus on low power capacity turboexpanders, preferably less than 10 MW, across the economies. Due to a low product development cycle and low costs, less time is taken for installation, commission, and maintenance during downtime. The low power capacity is extensively used in oil & gas processing, air separation plants, refining, dew point control, Natural Gas Liquids (NGL) recovery, and Nitrogen Rejection Units (NRU).

Application Insights

The cryogenic applications are expected to dominate the market over the forecast period. The market for cryogenic applications recorded growth in late 2020 and H1/2021 due to the pent-up demand and backlog orders resulting from the pandemic. However, in H2 2021, owing to supply chain disruptions still posed a threat due to low inventory levels at an OEM level for the short term. Based on application, the market has been segmented into air separation, oil & gas processing, cryogenic application, and others.

The oil & gas processing segment is expected to witness a moderate 4.9% CAGR over the forecast period. Delay in new construction for LNG projects is expected to be one of the bottlenecks for the OEMs over the short term. Furthermore, the ongoing Russia- Ukraine conflict is likely to create a shortage of cryogen liquids, notably Helium and other LNG by-products, hike in the raw materials prices and logistics costs which may hamper the market profitability of the OEMs over the next few years.

End-use Insights

The oil & gas segment accounted for the largest market share with more than 30% in 2021 and is expected to maintain its dominance over the next eight years. The oil & gas segment includes on-shore and offshore LNG applications. The surge in demand for LNG for industrial, commercial, and residential sectors is one of the primary factors for the market growth. Based on end use, the market has been segmented into oil & gas, energy & power, chemical & petrochemicals, and others.

Favorable government initiatives to promote clean energy and net zero emissions by 2050 are anticipated to surge the demand for LNG gas, expected to drive market growth over the forecast period. The energy & power segment is expected to register a CAGR of 4.9% during the forecast period. Due to soaring carbon prices, utility companies in Europe are transiting to cleaner-burning gas. The rising popularity of Cryogenic Energy Storage (CES) and, in particular, energy storage with liquid air is also anticipated to drive the market growth over the forecast period.

Regional Insights

Asia Pacific to register the highest CAGR of 5.8% in the market over the forecast period. China, Japan, India, and Southeast Asian countries such as Malaysia, the Philippines, and other emerging economies primarily drive the market. The surge in demand for cryogens for ultra-high vacuum environments required for semiconductor production processes is expected to drive the market in the forecast period. Furthermore, favorable government initiatives to boost and promote the hydrogen economy across the automotive sectors are expected to drive market growth.

Europe accounted for the second-largest market share of 27.1% in 2021 and is expected to register a CAGR of 4.3% from 2022 to 2030. The market is primarily driven by Russia, the U.K., Germany, and the rest of Europe. It is ascribed to the dominance of natural gas production and favorable government policies to boost clean energy projects and curb GHG emissions across European economies. The current ongoing Russia-Ukraine conflict followed by sanctions imposed by NATO allies is expected to hamper the LNG supply further. Furthermore, geopolitical tension between Algeria and Morocco could also undermine the LNG supply in Europe, thus prompting European countries to choose alternate options for LNG supply subsequently, impacting the turboexpander demand over the short term.

Key Companies & Market Share Insights

The market is a moderately consolidated market characterized by globally recognized and well-established players. Most OEMs compete based on product portfolios, power ratings ranging from a few kilowatts to several megawatts, reliability, and availability of the products, product efficiency, aftermarket service capabilities, installed bases, and prices. In terms of installed base and number of projects carried out across the economies, Atlas Copco AB ranked at the top and emerged as the leader in turboexpanders with more than 5,000 installed bases, followed by Air Products Inc. (ROTOFLOW), Linde Plc (Cryostar) and Siemens Energy.

Mergers & acquisitions as part of the market players’ efforts to expand their geographical presence and increase their customer base can also be considered one of the major highlights of the market. For instance, the acquisition of L.A Turbine by Chart Industries in 2021 and Nikkiso Cryogenic Industries acquisition by Air Liquide in the same year. Local and regional companies do have market relevance; however, they are engaged in the provision of aftermarket services. The services include the provision of spare parts, installation, commissioning, training, and maintenance. Some prominent players in the global turboexpander market include

-

Atlas Copco AB

-

Air Products Inc. (ROTOFLOW)

-

Air Liquide (formerly Nikkiso Cryogenic Industries)

-

Baker Hughes Company

-

Chart Industries (L.A. Turbine)

-

Linde Plc (Cryostar)

-

R&D Dynamics Corporation

-

Elliott Group (EBARA Corporation)

-

Siemens Energy (Siemens AG)

-

Man Energy

-

PBS Group, a. s.

-

Turbogaz

-

Others (Honeywell International Inc.; Blair Engineering; Tibo; Sichuan Air Separation Plant Group; and Suzhou XIDA Cryogenic Equipment Co., Ltd)

Turboexpander Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 965.1 million

Revenue forecast in 2030

USD 1,404.1 million

Growth rate

CAGR of 4.8% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Market representation

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segment Coverage

Product type, loading device power capacity, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Rest of Europe; China; India; Japan; Rest of Asia Pacific; Brazil, Mexico, Rest of Latin America; Middle East & Africa

Key Company Profiles

Atlas Copco AB; Air Products Inc. (Rotoflow); Air Liquide (formerly Nikkiso Cryogenic Industries); Baker Hughes Company; L.A. Turbine (Chart Industries); Cryostar SAS (Linde Plc); R&D Dynamics Corporation; Elliott Group (EBARA Corporation); Siemens Energy (Siemens AG); Man Energy; PBS Group, a.s; Turbogaz

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global turboexpander market report based on product type, loading device, power capacity, application, end use, and region:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Axial Flow

-

Radial Flow

-

-

Loading Device Outlook (Revenue, USD Million, 2018 - 2030)

-

Compressor

-

Generator

-

Hydraulic/Oil-brake

-

-

Power Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Less than 1 MW

-

1MW - 4 MW

-

5MW - 9MW

-

10MW - 19MW

-

20MW - 24 MW

-

25 MW - 40 MW

-

Above 40 MW

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Air Separation

-

Oil & Gas Processing

-

Cryogenic Application

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Oil & Gas

-

Energy & Power

-

Chemical & Petrochemicals

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K

-

Germany

-

France

-

Rest of Europe

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Mexico

-

Rest of Latin America

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global turboexpander market size was estimated at USD 953.6 million in 2021 and is expected to reach USD 965.1 million in 2022.

b. The global turboexpander market is expected to grow at a compound annual growth rate of 4.8% from 2022 to 2030 to reach USD 1,404.1 million by 2030.

b. The Asia Pacific dominated the turboexpander market with a share of 34.0% in 2021. This is attributable to the rising popularity of hydrogen liquefaction and the need for cryogen for creating a vacuum environment for semiconductor production.

b. Some key players operating in the turboexpander market include Atlas Copco AB, Air Products Inc. (ROTOFLOW), Air Liquide (formerly Nikkiso Cryogenic Industries), Baker Hughes Company, Chart Industries (L.A. Turbine), Linde Plc (Cryostar), R&D Dynamics Corporation, Elliott Group (EBARA Corporation), Siemens Energy (Siemens AG), Man Energy, PBS Group, a. s., Turbogaz, Others (Honeywell International Inc.; Blair Engineering; Tibo; Sichuan Air Separation Plant Group; and Suzhou XIDA Cryogenic Equipment Co., Ltd) .

b. Key factors that are driving the turboexpander market growth include increasing demand for LNG in residential and industrial sectors, the rising popularity of hydrogen liquefaction, and the growing preference for AMBs over oil-bearing.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."