- Home

- »

- Next Generation Technologies

- »

-

TV Analytics Market Size, Share And Growth Report, 2030GVR Report cover

![TV Analytics Market Size, Share & Trends Report]()

TV Analytics Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Software, Services), By Transmission (OTT, Satellite TV/DTH, Cable TV, IPTV), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-065-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

TV Analytics Market Size & Trends

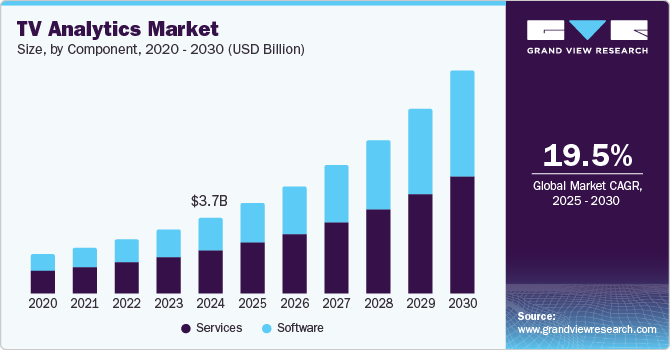

The global TV analytics market size was valued at USD 3.75 billion in 2024 and is projected to grow at a CAGR of 19.5% from 2025 to 2030. Increasing demand for data-driven analysis regarding user behavior and customer preferences and growing viewership for over-the-top (OTT) platforms are primarily driving the growth of this market. The significant role of social media platforms in influencing viewer behavior has led to enhanced efforts by brands to understand viewer-provider interactions, contributing to the increase in demand for the TV analytics market.

The rapid pace of digitization in multiple industries, the inclusion of automation and modern technologies such as artificial intelligence (AI), internet of things (IoT), machine learning (ML), and others, and the growing focus of companies on the adoption of advanced data collection technologies are leading this market towards unprecedented growth. The ease of availability and accessibility of high-quality premium consumer electronic devices and digital on-demand video platforms are also developing positive effects in this market. The rising utilization of social media and its ability to influence the masses and provide stimuli to consumer behavior is one of the key aspects that has resulted in growing efforts by companies to comprehend user preferences and behavior patterns.

The emergence of advanced technologies and brands' increased focus on delivering personalized experiences to viewers have generated demand for TV analytics. The vast amount of data consumers generate through their interactions with the internet-based ecosystem helps the media and entertainment industry include and present offerings that consumers highly prefer in terms of genre, category, and language. Furthermore, an enhanced understanding of viewer preferences enables service providers to deliver marketing campaigns, messages, and notifications that are part of targeted advertising efforts.

Component Insights

The software segment is expected to experience the fastest CAGR of 21.7% from 2025 to 2030. The growing integration of advanced technologies and existing content delivery systems to enable personalized experiences, increasing value of consumer-generated data, rising use of smartphones and other connected devices, availability of modern infrastructures, cloud computing, and other sophisticated network capabilities are driving growth for this segment. New launches by key companies and enhanced efforts to understand the performance of their existing TV ad strategies to improve effectiveness are expected to fuel the demand for TV analytics software.

The services segment dominated the global TV analytics market in 2024 based on components. This includes continuous review of advertisements and TV services to comprehend consumer behavior and preferences. These services assist companies and media houses to understand demand patterns and preferences associated with content, time of viewership, geographical influences, and the role of demographics in shaping behavior. Companies with such insights and reviews of previously delivered advertising campaigns focus on optimizing their strategies accordingly. Growing demand for personalized experience, increasing viewership for OTT platforms, rising online video streaming offerings, and unprecedented growth in internet-based content delivery and consumption are expected to drive the development of this segment.

Transmission Insights

The OTT segment held the largest revenue share of the TV analytics market in 2024. This is attributed to the increasing viewership of OTT platforms and highly personalized content delivered in multiple languages, various genres, and several regions. Also, increasing growth in smartphone use, enhanced availability of high-speed internet, and the large amount of data generated by OTT viewers are further fueling the segment's growth. Integrating modern technologies with strategies and networks has resulted in a growing focus on continuous reviews of TV ad campaigns by companies and media brands. Technological advancements also enable these brands to make necessary changes and quickly align their strategies as and when needed.

The Internet Protocol Television (IPTV) segment is expected to experience a significant CAGR during the forecast period. The cost-effectiveness of IPTV, the flexibility offered to customers, the quality of content delivered through IP networks, the variety in the content available on IPTV such as on-demand content, live broadcasts, interactive features, etc., improved accessibility offered by IPTV, and ongoing expansion of internet networks are expected to drive the growth of this market.

Application Insights

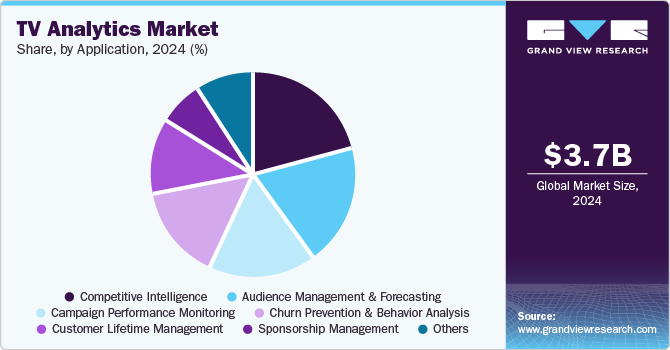

Based on application, the competitive intelligence segment dominated the global market in 2024. Brands compare their strengths with competitors' channels and content deliveries to identify gaps between desired and actual performances. This also includes monitoring TV ad activity, reviewing engagements, generating significant strategies, and reallocating resources if needed. TV analytics platform helps companies identify data points, collect data, ensure the availability of actionable intelligence, and more.

The churn prevention & behavior analysis segment is expected to experience the fastest CAGR during the forecast period. This is attributed to increasing efforts and strategies companies deploy to ensure the reduction or prevention of churn, the role of TV analytics in offering an improved understanding of customer behavior, increasing competition, demand for personalized content, and more.

Regional Insights

North America dominated the global industry with a revenue share of 30.0% in 2024. The presence of large media houses and OTT platform companies in the region, the growing availability of advanced networks, ongoing 5G rollouts, enhanced efforts by companies to understand customer behavior, and brands' focus on offering personalized experiences are some of the key growth driving factors for this market.

U.S. TV Analytics Market Trends

The U.S. TV analytics market dominated the regional industry in 2024. The country is home to prominent companies from the media and entertainment, IT and telecom, and technology sectors. The availability of consumer data, the enhanced focus of businesses on understanding customer behavior, the growing inclusion of TV analytics to measure ROIs on ad performance, the ease of availability, and the growth in competition driven by continuously advancing technologies are fueling growth.

Europe TV Analytics Market Trends

Europe was identified as a key global TV analytics market region in 2024. The rapid pace of digital transformation, social media influences, and increasing adoption of modern technologies are primarily driving growth for this market. TV analytics offers unparalleled consumer behavior insights, enabling brands and media houses to generate highly preferable content. Efforts by companies to enhance customer engagement, reduce churn, monitor campaign performances, and manage customer experiences are expected to assist this market in terms of growth during the forecast period.

The UK TV analytics market held the largest revenue share of the regional industry in 2024. This market is mainly driven by factors such as companies' focus on advancing technology capabilities, the availability of high-quality analytics services, the presence of a robust media and entertainment industry, growing viewership for OTT platforms, and more.

Asia Pacific TV Analytics Market Trends

The Asia Pacific TV analytics market is projected to experience the fastest CAGR of 27.0% from 2025 to 2030. The region has been experiencing rapid growth in technology transformation, the use of smartphones, the availability of high-speed internet connections, and viewership for OTT platforms. Efforts by governments and companies in the region to ensure the availability of enhanced network capabilities have resulted in a growing consumption of media and advertisements. This has led companies to focus on understanding the viewer's behavior and generating content that is highly resonating with its viewers.

China TV analytics market dominated the regional market in 2024. The growing digitization of content delivery platforms, the emergence of OTT platforms, increasing consumption, the integration of artificial intelligence (AI) and other modern technologies, and the presence of global brands and domestic companies in the country are driving demand for this market.

Key TV Analytics Company Insights

Some of the key companies operating in the TV analytics market are The Nielsen Company (US), LLC., Google LLC, Parrot Analytics Limited, Clarivoy, Alphonso Inc., and others. The growth of competition and demand for enhanced solutions have encouraged key companies to adopt strategies such as new product launches, portfolio improvements and expansions, collaborations, partnerships, and others.

-

The Nielsen Company (US), LLC, one of the prominent companies in the analytics industry, offers a range of solutions associated with audience measurement, cross-media measurement, TV measurement, audio measurement, media planning, competitive intelligence, audience segmentation, marketing optimization, content metadata, and more. It also offers a lucrative portfolio of insights, including articles, case studies, podcasts, videos, and others regarding different topics such as advertising, audiences, digital & technology, sports & gaming, TV & streaming, media, and marketing performance.

-

Parrot Analytics Limited, a major market participant in the entertainment analytics industry, offers content panorama, demand360 platform, audience solutions, APIs, and more. Its offerings help media and entertainment companies understand the value of delivered content and consumer preferences on various parameters, including region and demographics. It also assists in the development and implementation of optimized marketing strategies.

Key TV Analytics Companies:

The following are the leading companies in the TV analytics market. These companies collectively hold the largest market share and dictate industry trends.

- The Nielsen Company (US), LLC.

- iSpot.tv, Inc.

- Samba TV, Inc.

- Innovid

- Parrot Analytics Limited

- Clarivoy

- Conviva

- Google LLC

- Alphonso Inc. (LG Electronics)

- Amobee, Inc.

Recent Developments

- In October 2024, Parrot Analytics Limited, a prominent company in the analytics market, introduced Streaming Metrics, which aims to deliver forecasted economic performance metrics and historical data. The offering is expected to assist companies with performance metrics and key data figures associated with subscribers, revenue, churn, and more.

TV Analytics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.45 billion

Revenue forecast in 2030

USD 10.86 billion

Growth Rate

CAGR of 19.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, transmission, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, India, Japan, Australia, South Korea, Brazil, KSA, UAE, South Africa

Key companies profiled

The Nielsen Company (US), LLC.; iSpot.tv, Inc.; Samba TV, Inc.; Innovid; Parrot Analytics Limited; Clarivoy; Conviva; Google LLC; Alphonso Inc.; Amobee, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global TV Analytics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global TV analytics market report based on component, transmission, application, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Services

-

-

Transmission Outlook (Revenue, USD Million, 2018 - 2030)

-

OTT

-

Satellite TV/DTH

-

Cable TV

-

IPTV

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Competitive Intelligence

-

Audience Management & Forecasting

-

Churn Prevention & Behavior Analysis

-

Customer Lifetime Management,

-

Sponsorship Management

-

Campaign Performance Monitoring

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

KSA

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.