UAE Organic Personal Care Market Trends

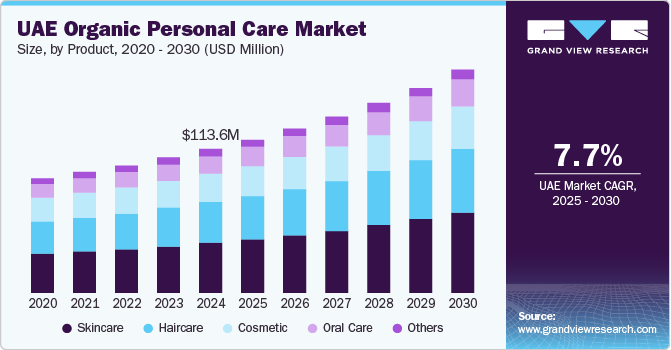

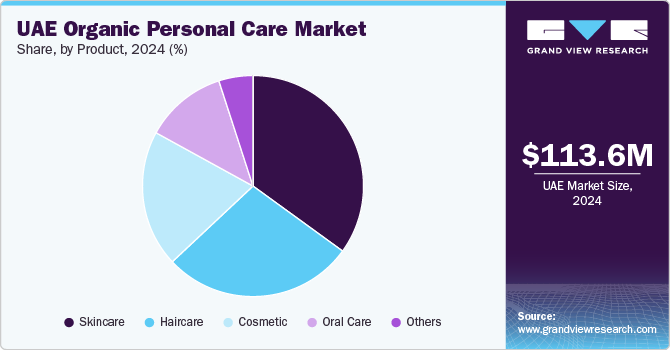

The UAE organic personal care market size was valued at USD 113.6 million in 2024 and is expected to grow at a CAGR of 7.7% from 2025 to 2030. The market growth is attributed to the rising consumer awareness about the benefits of organic and natural products over synthetic ones, leading to increased demand for personal care items free from harmful chemicals such as parabens, phthalates, and aluminum salts. Additionally, the growing preference for environmentally friendly and cruelty-free products is contributing to market expansion.

The UAE's affluent population is willing to spend more on high-quality personal care products, further boosting market growth. Technological innovations in product formulation and packaging, as well as stringent regulations promoting organic ingredients, are also crucial in driving the market. Furthermore, growing demand for personal care and self-pamper is expected to drive market growth.

The market includes various products for oral, hair, and skincare as well as cosmetics, among a few other products. Consumers are becoming increasingly health-conscious and demanding natural and chemical-free products. Furthermore, stringent regulations promoting the use of organic ingredients in the skincare industry are likely to propel the demand for organic personal products. Technological innovations involving oligopeptide, which are used to increase the efficiency and shelf life of products, are expected to positively impact the market.

Various raw materials, such as neem, xanthan gum, and fish oil, are used extensively in manufacturing high-quality herbal cosmetics and beauty products. The demand for these products is increasing globally owing to their efficiency and zero side effects. Furthermore, leading herbal companies strive to manufacture products such as lipsticks and foundations containing natural extracts to cope with the growing demand for these products.

Hypermarkets, pharmacies, and supermarkets are increasingly stocking internationally certified natural and organic products. Consumers in the UAE are willing to spend more on skin, hair, and cosmetic products. These products are sold in most beauty stores, salons, pharmaceuticals, and online stores, maximizing their penetration in the UAE market.

Product Insights

Skincare dominated the market with the largest revenue share of 35.1% in 2024.The increasing consumer awareness about the benefits of organic skincare products, which are free from harmful chemicals and rich in natural ingredients, has significantly boosted demand. The rise in disposable incomes and the desire to invest in high-quality premium skincare products have also contributed to this growth. Furthermore, the popularity of social media and beauty influencers has amplified the trend towards organic skincare, encouraging more consumers to adopt natural products in their daily routines. Technological advancements in product formulations and the introduction of innovative organic skincare solutions have further driven market expansion.

The haircare segment is expected to grow at a significant CAGR of 8.0% over the forecast period.The increasing awareness about the harmful effects of synthetic ingredients in conventional haircare products is encouraging consumers to switch to organic alternatives. Organic haircare products, which are free from sulfates, parabens, and other harsh chemicals, are gaining popularity for their gentle and nourishing properties. Additionally, the rising trend of adopting a holistic approach to personal care, where consumers prioritize overall well-being, is boosting the demand for organic haircare solutions. The influence of social media and beauty influencers, who promote natural and eco-friendly products, is also contributing to market expansion. Moreover, the introduction of innovative organic haircare products, such as those tailored for specific hair types and concerns, is attracting a broader consumer base.

Key UAE Organic Personal Care Company Insights

Some key UAE organic personal care market companies include Natura&Co, The Estée Lauder Companies, Yves Rocher, Amway Corp, and others.

-

Natura&Co is popular for its commitment to sustainability and natural ingredients. The company offers a wide range of organic personal care products, including skincare, haircare, and body care items. Natura&Co's products are free from harmful chemicals and are designed to be environmentally friendly. The company's focus on ethical sourcing and eco-friendly packaging resonates well with consumers who prioritize sustainability. Natura&Co's brands, such as The Body Shop and Aesop, are well-recognized in the UAE market and contribute significantly to the company's growth in the region.

-

The Estée Lauder Companies is another major player in the UAE organic personal care industry. The company offers a variety of organic skincare and cosmetic products under its numerous brands, including Estée Lauder, Clinique, and Origins. These products are formulated with natural ingredients and are free from synthetic chemicals, catering to consumers who seek high-quality, natural beauty solutions.

Key UAE Organic Personal Care Companies:

- Natura&Co

- The Estée Lauder Companies

- Yves Rocher

- Amway Corp

- Kiehl’s

- Oriflame Cosmetics AG

- Lush Retail Ltd.

- Neal's Yard Remedies

Recent Developments

-

In May 2024, Katrina Kaif’s makeup brand, Kay Beauty, was officially launched in the UAE following its substantial growth in India, where it achieved a gross margin value of nearly USD 17 million in just four years. The brand aims to expand globally with over 300 stores and a presence in 1,600 cities. Its UAE entry, in partnership with Nysaa, reflects a commitment to diversity, catering to various skin types and demographics within the culturally rich GCC market.

UAE Organic Personal Care Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 121.1 million

|

|

Revenue forecast in 2030

|

USD 175.8 million

|

|

Growth Rate

|

CAGR of 7.7% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Revenue in USD million and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product

|

|

Country scope

|

UAE

|

|

Key companies profiled

|

Natura&Co; The Estée Lauder Companies; Yves Rocher; Amway Corp; Kiehl’s; Oriflame Cosmetics AG; Lush Retail Ltd.; Neal's Yard Remedies

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

UAE Organic Personal Care Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the UAE organic personal care market report based on product: