- Home

- »

- Medical Devices

- »

-

UK Dental Service Organization Market Size Report, 2030GVR Report cover

![UK Dental Service Organization Market Size, Share & Trends Report]()

UK Dental Service Organization Market Size, Share & Trends Analysis Report By Service (Human Resources, Accounting, Medical Supplies Procurement), By End-use (Dental Surgeons, Endodontists, General Dentists), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-188-6

- Number of Report Pages: 50

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

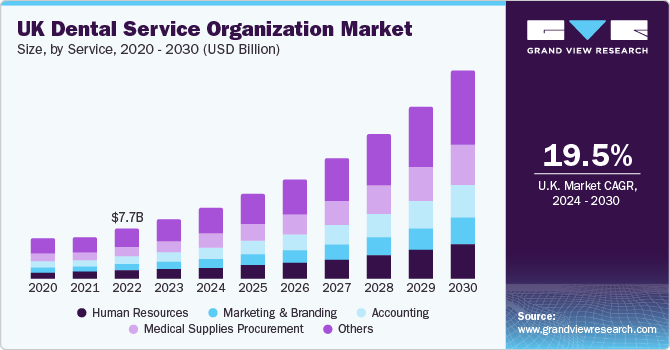

The UK dental service organization market size was valued at USD 9.08 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 19.5% from 2024 to 2030. The market growth is attributed to the rising expenditure on dental care and improved efficiency in nonclinical business management by Dental Service Organizations (DSOs). Dental organizations are focusing on integrating telehealth solutions to expand access to remote areas. Collaborative efforts between dental professionals and technology providers are driving innovation in digital patient records and treatment planning.

The growing preference for enhanced dental aesthetics and cosmetic dentistry is driving the market due to the individuals increasing importance on achieving attractive smiles and facial harmony. These organizations are capitalizing on the rising desire for aesthetic improvements, offering a comprehensive range of cosmetic solutions and treatments to cater to the evolving preferences of patients and contributing to the overall growth of the market. Furthermore, the country has a presence of government support in the form of favorable reimbursement policies and initiatives. The NHS England spends around USD 3.4 billion annually on dental care. According to National Health Services Dental Statistics for England, nearly 35.5% of the adult population and 42.5% of the child population were seen by an NHS dentist. Moreover, the UK celebrates Gum Health Day (GHD) on the 12th of May, which is organized by the European Federation of Periodontology (EFP). Such initiatives create awareness among the end users, resulting in increased market growth.

The UK dental service organization market has exerted a substantial economic impact by centralizing resources, streamlining operations, and offering a diverse range of dental services, these organizations have enhanced efficiency and accessibility. This has attracted investments and generated employment opportunities across the dental industry. Moreover, the collaborative approach of dental service organizations has led to improved patient care and outcomes, driving patient satisfaction. As a result, the market's growth has not only bolstered the dental sector's economic viability but also contributed positively to overall healthcare infrastructure and patient experiences.

According to Oral Health Platform in Europe, nearly 50% of the European population suffers from periodontitis disease, and over 10% of patients have severe forms of periodontitis. Nearly 70% to 85% of the population aged 60 and above suffers from periodontitis. In addition, according to Oral Health Foundation, one in three adults suffer from dental caries in the UK, which is commonly caused due to high-sugar diet and inadequate oral hygiene. Dental services include a wide array of treatments that aid numerous patients in improving their oral health conditions, which is anticipated to fuel the market growth over the forecast period. Furthermore, the UK population continues to grow in size and age, implying an increasing demand for dental services in the country. Over 65s are the fastest increasing age group within this, expected to account for 25% of the UK population by 2050, compared to 18% currently. When compared to younger groups, this expanding age group requires more remedial and restorative therapy, as well as more frequent check-ups.

Market Concentration & Characteristics

There is limited communication between the patient and the DSO outside of the dental practice; however, technological advances provide creative patient engagement strategies. DSOs are utilizing tele-dentistry software to track treatment plans and answer to ad hoc inquiries.

Several market players such as Colosseum are expanding their business by adoption of various strategies. For instance, Curaeos and Colosseum Dental Group entered into a strategic merger in August 2021. These corporations expand their geographic reach and enter new markets through M&A activities.

Supportive government policies to improve awareness and oral hygiene is bound to fuel the market growth. The country has government assistance in the form of favourable reimbursement policies and programmes.

Service Insights

The others services segment held the largest share of 35.1% in 2023. The others segment includes risk management, capital and financing, facility maintenance, compliance, and other services. Risk management strategies are being fine-tuned to ensure operational continuity and patient safety. Capital and financing approaches are adapted by the dental facility to facilitate expansion and innovation. Building maintenance and upkeep is gaining prominence, focusing on creating patient-friendly environments while adhering to sustainability principles. IT services are integral, enabling efficient patient management and data security. The aforementioned factors are driving the market growth in this segment.

The medical supplies procurement segment is anticipated to grow at the fastest CAGR over the forecast period. The purchase of innovative and effective medical devices at a lower cost is a critical component of delivering sustainable progress. DSOs have collaboration arrangements with dental device manufacturers, allowing a dental practice to obtain medical supplies and devices at a cost-effective rate. This increases market demand for medical procurement services.

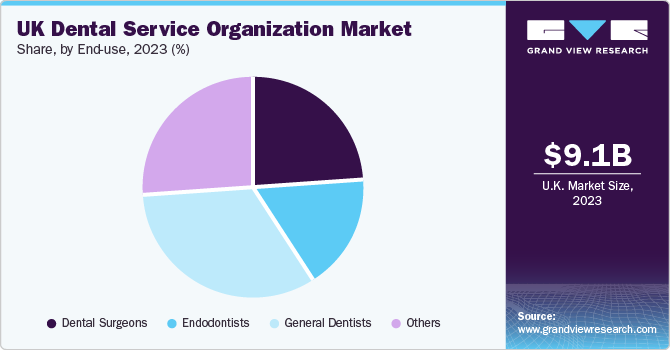

End-use Insights

The general dentists segment held the largest market share in 2023 and is anticipated to grow at the fastest CAGR over the forecast period. General dentists offer a wide range of treatments and procedures. By offering a diverse array of services including preventive, restorative, and basic cosmetic treatments, general dentists with the help of dental service organization cater to various dental needs under one roof. This integrated approach enhances patient convenience and fosters stronger patient relationships.

The other major factor that plays an important role in general dentists choosing a DSO is a less financial risk, better work-life balance, and access to cutting-edge dental technology and tools that are usually provided by the DSO. All these advantages of affiliation with the DSO is expected to boost segment growth.

Key UK Dental Service Organization Company Insights

Major players in the industry are adopting various strategies such as new product launches, acquisitions, partnerships, collaborations, and expansions to enhance their product penetration and expand their customer base. For instance, On October 8, 2021, the merger of Curaeos and Colosseum Dental Group, which had been announced on August 2nd, was successfully completed. Another, example, in February 2021, European Dental Group (EDG), a pan-European dentistry supplier, expanded into the United Kingdom by acquiring a majority position in London-based Dental Beauty Partners.

Key UK Dental Service Organization Companies:

The following are the leading companies in the UK dental service organization market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these UK dental service organization companies are analyzed to map the supply network.

- European Dental Group (EDG)

- Integrated Dental Holdings Group

- Colosseum Dental Group

- Dental Group

- Bupa.

UK Dental Service Organization Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10.77 billion

Revenue forecast in 2030

USD 31.43 billion

Growth rate

CAGR of 19.5% from 2024 to 2030

Base year for estimation

2023

Historic data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Service, end-use

Country scope

UK

Key companies profiled

European Dental Group (EDG); Integrated Dental Holdings Group; Colosseum Dental Group; Dental Group; Bupa

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

UK Dental Service Organization Market Report Segmentation

This report forecasts revenue growth at regional level and provides an analysis of latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the UK dental service organization market report on the basis of service and end-use:

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Human Resources

-

Marketing and Branding

-

Accounting

-

Medical Supplies procurement

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Dental surgeons

-

Endodontists

-

General dentists

-

Others

-

Frequently Asked Questions About This Report

b. The UK dental service organization market is estimated at USD 9.08 billion in 2023 and is expected to reach USD 10.77 billion in 2024.

b. The UK dental service organization market is expected to grow at a compound annual growth rate of 19.5% from 2024 to 2030 to reach USD 31.43 billion in 2030.

b. Based on end-use, the market is segmented into dental surgeons, endodontists, general dentists, and others. The general dentists segment held the largest market share of 33.1% in 2023 and is anticipated to grow at the fastest CAGR of 19.8% over the forecast period.

b. Some key players operating in the UK DSO market include European Dental Group (EDG); Integrated Dental Holdings Group; Colosseum Dental Group; Dental Group; Bupa

b. The market growth is attributed to the rising expenditure on dental care and improved efficiency in nonclinical business management by Dental Service Organizations (DSOs).

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."