- Home

- »

- Healthcare IT

- »

-

UK Mental Health Apps Market Size, Industry Report, 2030GVR Report cover

![UK Mental Health Apps Market Size, Share & Trends Report]()

UK Mental Health Apps Market Size, Share & Trends Analysis Report By Platform Type (iOS, Android), By Application (Depression & Anxiety Management, Stress Management), By Service, By End Use, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-139-1

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

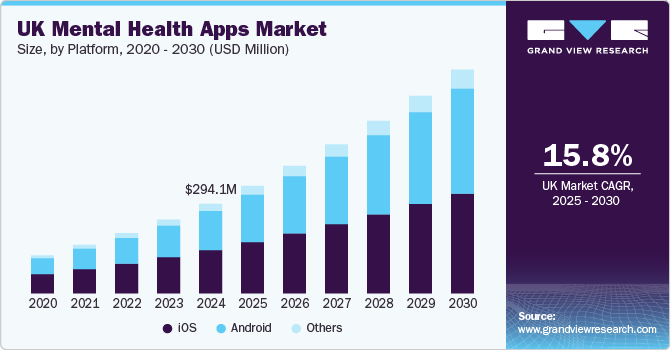

The UK mental health apps market size was estimated at USD 294.1 million in 2024 and is expected to grow at a CAGR of 15.8% from 2025 to 2030. One of the primary drivers propelling market growth is the increasing utilization of mental health apps, attributed to their ability to enhance treatment outcomes and lifestyles and the growing awareness of mental health as a significant medical concern, further contributing to the overall market expansion. In addition, the surge in mental health disorders contributes to the growing usage of mental health applications. For instance, according to a 2023 survey of children and young people’s mental health reported that 20% of children aged 8 to 16 had a probable mental disorder in 2023.

Moreover, as per the mental health statistics report published in 2022 in the UK, more than 8 million people are currently experiencing anxiety disorder. Thus, the increased prevalence of depressive disorders is driving a heightened demand for mental health apps, which is anticipated to contribute to market growth during the forecast period.

Growing smartphone penetration and improving internet coverage directly contribute to adopting mental health solutions. As per the statistics report, in 2023, approximately 83% of UK adults have smartphones, and there are 66.11 million internet users across the UK, accounting for around 98% of the total UK population. Hence, the growing adoption of smartphones and the internet has further propelled the market growth during the forecast period.

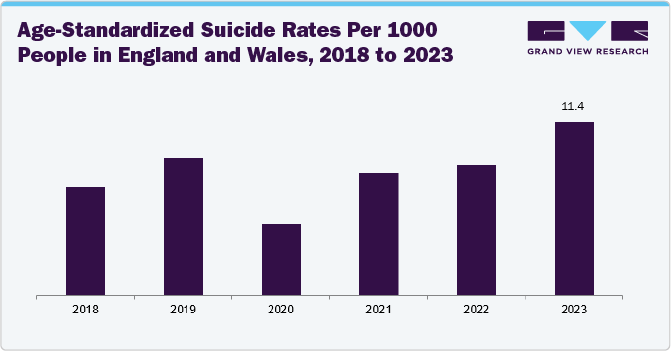

The increase in suicide rates has driven the growth of the mental health app industry. This growth is associated with a rising awareness of mental health issues, which has created a greater demand for accessible mental health support solutions. Mental health applications offer accessible early intervention options such as private assistance and self-evaluation tools. These apps prioritize user confidentiality and privacy, encouraging individuals to reach out for assistance with suicidal intentions and various mental health issues.

Furthermore, favorable government initiatives and growing investments boost the country's market growth. For instance, in 2023/24, local National Health Service (NHS) bodies such as integrated care boards (ICBs) plan to invest USD 15.5 billion in mental health, dementia, and learning disability services in England.

Market Concentration & Characteristics

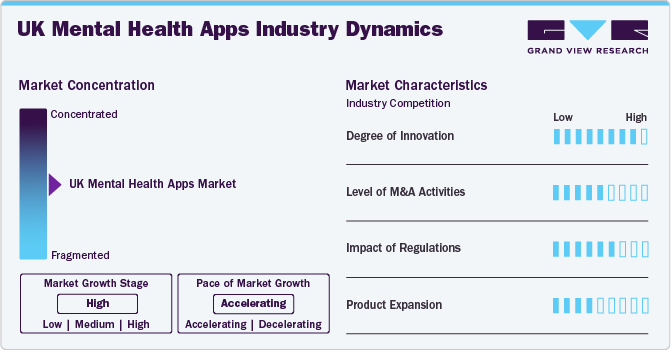

The UK mental health apps market has witnessed varying degrees of innovation over the years, driven by increasing technological advancements integrating AI/ML with mental health apps. For instance, in January 2022, former student and NHS psychiatrist Dr Nick Prior at Queen Mary University of London introduced the ‘Minderful’ app to make mental fitness accessible and engaging.

The UK mental health apps market is characterized by a medium level of merger and acquisition (M&A) activity. These mergers and acquisitions facilitate access to complementary technologies, expertise, and distribution channels, enabling companies to capture a larger market share. For instance, in August 2024,DrDoctor, a patient engagement platform, acquired Maia from Mindwave Ventures mental health care platform.

The mental health app companies are mandated to abide by several regulations. These regulations ensure patient and data safety. Moreover, several regulatory bodies are also undertaking initiatives to streamline the regulations for mental health apps. For instance, in December 2023, the Medical and Healthcare Products Regulatory Agency (MHRA) authorized BlueSkeye AI to start a clinical trial examining its mental health app, TrueBlue, for women at various pregnancy stages.

Several market players are expanding their business by launching new apps to strengthen their market position and expand their product portfolio. For instance, in August 2024, Warwickshire, NHS Coventry, and Solihull Talking Therapies introduced a new chatbot and the “Everyday Mental Health” app to manage anxiety and depression.

Platform Insights

The iOS segment dominated the market with the largest revenue share of 48.3% in 2024, due to the increasing adoption of iOS among consumers. iOS is renowned for its strong security and privacy features, since mental health apps deal with sensitive user data, making it a reliable choice for users. For instance, according to World Population Review, the market share of iOS in the UK was 52.28% in 2023. Thus, increasing iOS adoption among consumers fuels segment growth.

The Android segment is anticipated to grow at the fastest CAGR over the forecast period. Major factors contributing to the segment growth include the rising usage rate of Android-based smartphones and the cost-effective nature of Android-based smartphones. For instance, according to World Population Review, the market share of Android in the UK was 47.16% in 2023. This high market penetration allows mental health app developers to reach a broader and more varied audience, making it an attractive platform for expanding their user base.

Application Insights

The depression and anxiety management segment dominated the market with a revenue share of 28.7% in 2024. The increasing prevalence of anxiety and depression disorders and growing awareness regarding mental health apps for the treatment of these conditions are some of the major factors supporting the segment's growth. For instance, according to Champion Health, an employee wellbeing platform, in 2023, 56% of UK workers experienced mild symptoms of depression, and 1 in 4 employees met the criteria for "clinically relevant symptoms" of depression.

The stress management segment is expected to grow at the fastest CAGR during the forecast period. The rising prevalence of stress and related disorders and the increasing adoption of applications beneficial in stress reduction and management are the pioneering factors fueling the segment's growth during the forecast period. Furthermore, mental health apps provide self-assessment tools that help users track their stress over time, making them reliable during stress management. For instance, ShinyMind launched a mental health and wellbeing app in November 2022 for nursing and midwifery staff across England to improve nurses' mental health and wellbeing.

Service Insights

The subscription/paid (In-App Purchases) segment dominated the market with the largest revenue share of 51.5% in 2024. Factors such as growth in disposable incomes and the rising working population suffering from stress and depression increased the demand for mental health apps. For instance, Wysa AI, an AI chatbot, charges for its premium version with Wysa Emotional Wellbeing Professional Services, which offers direct access to experienced well-being and mental health professionals.

The free segment is anticipated to grow at the fastest CAGR over the forecast period. These applications attract a broad audience, especially in developing countries, as they provide key functionalities without any initial payment. Moreover, the expansion of internet access and the growing adoption of smartphones enable individuals across various demographics to explore mental health apps for free, contributing to the segment's growth. For instance, according to Uswitch Limited, the UK-based company, the internet penetration rate in the UK stood at 98.8% in 2023.

End Use Insights

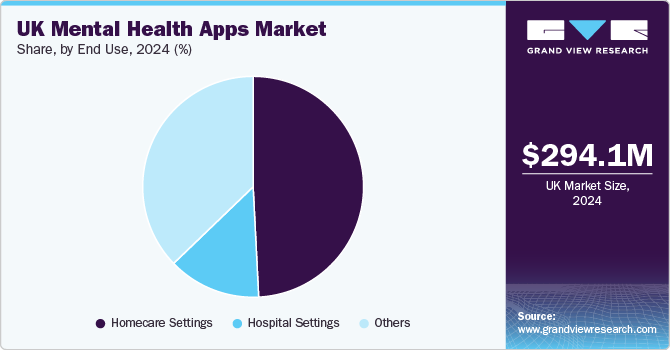

The homecare settings segment dominated the market with a revenue share of 49.2% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. Mental health apps provide users with tools to monitor and manage their mental health daily, promoting proactive care and reducing the risk of mental health crises. Furthermore, mental health apps in homecare settings serve as an extension of traditional care, offering features such as mindfulness exercises and therapy sessions that promote emotional well-being. Thus, such benefits provided by mental health apps boost the segment's growth.

The hospital settings segment is expected to grow at a significant CAGR during the forecast period. The integration of mental health apps in hospital settings has risen significantly. These apps offer various services, such as mood tracking, cognitive behavioral therapy (CBT), access to mental health professionals, and stress management techniques. Hospitals are increasingly adopting these digital solutions as part of their broader patient care strategies to enhance access to mental health services. For instance, South Tees Hospitals NHS Foundation Trust uses Unmind, a mental health platform that empowers staff to enhance their mental well-being using assessments, tools, and training.

Key UK Mental Health Apps Company Insights

Key participants in the UK mental health app market are focusing on developing innovative business growth strategies in the form of mergers & acquisitions, partnerships & collaborations, product portfolio expansions, and business footprint expansions.

Key UK Mental Health Apps Companies:

- Mindscape

- Calm

- MoodMission Pty Ltd.

- Sanvello Health

- Headspace Inc.

- Youper, Inc.

- Wysa AI

View a comprehensive list of companies in the UK Mental Health Apps Market

Recent Developments

- In October 2024, Oxfordshire County Council launched a mental health app in Oxfordshire for young people aged between 11 and 18 for mental health support.

UK Mental Health Apps Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 352.7 million

Revenue forecast in 2030

USD 734.4 million

Growth rate

CAGR of 15.8% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Report updated

November 2024

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Platform, application, service, end use

Key companies profiled

Mindscape; Calm; MoodMission Pty Ltd.; Sanvello Health; Headspace Inc.; Youper, Inc.; Wysa AI

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

UK Mental Health Apps Market Report Segmentation

This report forecasts revenue growth and provides at country level an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the UK mental health apps market report based on platform, application, service, and end use:

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

Android

-

iOS

-

Others

-

-

Application Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Depression and Anxiety Management

-

Meditation Management

-

Stress Management

-

Wellness Management

-

Others

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Subscription/Paid (In-App Purchases)

-

Free

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Settings

-

Homecare Settings

-

Others

-

Frequently Asked Questions About This Report

b. The UK mental health apps market was valued at USD 294.1 million in 2024 and it is expected to reach USD 352.7 million in 2025.

b. The UK mental health apps is expected to expand at a compound annual growth rate (CAGR) of 15.8% from 2025 to 2030 to reach USD 734.4 million by 2030.

b. The iOS segment held the largest revenue share of 48.3% of the UK mental health apps market in 2024.

b. Some of the major players in the UK mental health apps market include Mindscape; Calm; MoodMission Pty Ltd.; Sanvello Health; Headspace Inc.; Flow; Wysa AI; and Youper, Inc.

b. Increasing utilization of mental health apps and surge in mental health disorder are some of the major factors driving the UK mental health apps market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."