- Home

- »

- Medical Devices

- »

-

Ultrasonic Electrosurgical Devices Market Size Report, 2030GVR Report cover

![Ultrasonic Electrosurgical Devices Market Size, Share & Trends Report]()

Ultrasonic Electrosurgical Devices Market Size, Share & Trends Analysis Report, By Product (Generators, Consumables), By Type, By Application, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-556-6

- Number of Report Pages: 178

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global ultrasonic electrosurgical devices market size was valued at USD 3.4 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.44% from 2023 to 2030. The factors influencing the market growth are the rising number of surgical procedures owing to the growing prevalence of chronic diseases, rising adoption of minimally invasive surgeries, and developments in minimally invasive surgical techniques including laparoscopy have resulted in the development of ultrasonic electrosurgical devices by major market players. In addition, increasing demand for patient safety during complex surgical operations has led to the growing adoption of ultrasonic electrosurgical devices and the presence of a large number of players, and the growing number of strategic initiatives to enhance their product portfolios are projected to boost the market growth.

Technological development has led to an increase in the number of surgeries being performed each year. Owing to the risk of infections associated with invasive surgeries, people prefer noninvasive or minimally invasive surgeries. Furthermore, an increase in the number of road accidents, an aging population, and rising healthcare expenditure in emerging economies are among the factors likely to boost the number of surgical procedures during the forecast period. These are anticipated to positively influence revenue generation from ultrasonic electrosurgical devices. According to the U.S. Census Bureau, healthcare spending worldwide is anticipated to increase to USD 18.28 trillion by 2040, growing at a CAGR of 2.6%. According to WHO, the world’s population aged 60 years and above is expected to reach 2 billion by 2050 from 900 million in 2015. The geriatric population is more susceptible to a vast number of diseases, which is likely to increase the need to treat diseases effectively, thereby boosting the market.

The rising prevalence of various types of cancer such as breast cancer, colon cancer, prostate cancer, and lung cancer is anticipated to boost the demand for ultrasonic electrosurgical devices for the treatment and surgery of various tumors in the body. Cancer is considered a universal healthcare problem as it is one of the leading causes of death. For instance, according to National Cancer Institute, about 1,806,590 new cancer cases were diagnosed in the U.S. in 2020. In addition, according to the American Cancer Society, around 1.8 million new cancers were estimated to be diagnosed in the U.S. in 2020. Furthermore, the increasing incidence of cancer across the globe is predicted to boost the demand for ultrasonic electrosurgical devices. For instance, according to the WHO, over 3.7 million new cancer cases are diagnosed each year in Europe. Thus, the growing prevalence of cancer throughout the globe is projected to create high growth opportunities for market players during the forecast period.

Furthermore, growing health initiatives and healthcare spending by the government of developing and developed countries for the effective treatment of chronic disorders are expected to boost market growth. The Canadian government is investing heavily in establishing medical centers such as Centre Hospitalier Universitaire Sainte-Justine in Montreal, North Island Hospitals Project, and Centre Hospitalier de l'Université de Montréal. According to an article published by Charles E. Schumer, United States Senator for New York, VA outpatient surgical center in Monroe county received USD 6.9 million in funding for phase II development that will complement the new 84,000 square foot VA community-based outpatient ambulatory surgical clinic. This funding was included in the president’s financial year 2017 budget. Thus, such government initiatives are expected to propel the growth of the market.

Product Insights

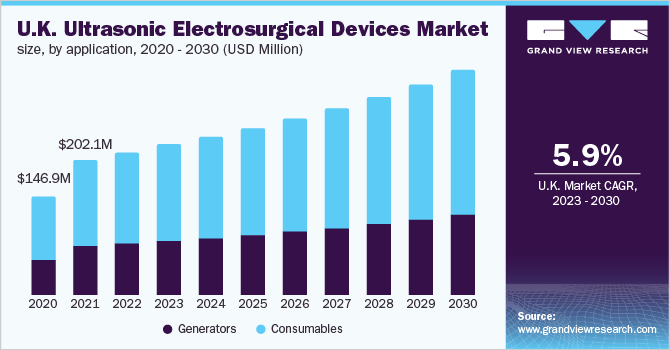

The ultrasonic electrosurgical consumable segment accounted for the largest revenue share of 56.7% in 2020. The ultrasonic electrosurgical consumables segment is further divided into electrosurgical handpieces, electrosurgical electrodes, electrosurgical scalpels, electrosurgical forceps, and electrosurgical pencils. The segment is growing rapidly due to the fact that they are generally disposable or have low durability compared to ultrasonic electrosurgical generators. Also, consumables are reusable in various surgical procedures and have a restricted usage cycle, hence contributing to the largest market share.

The ultrasonic electrosurgical generator segment is anticipated to grow at a lucrative growth rate during the forecast period. The generators pass an electric current through the patient’s body to conduct the surgery. Generators have different power levels and quality control measures to adjust pre-surgery, which takes care of the patient’s safety during the surgery. However, factors such as heavy initial costs, the need for repair and maintenance, and lengthy installation procedures of these devices in hospitals can impede the growth of the market.

Type Insights

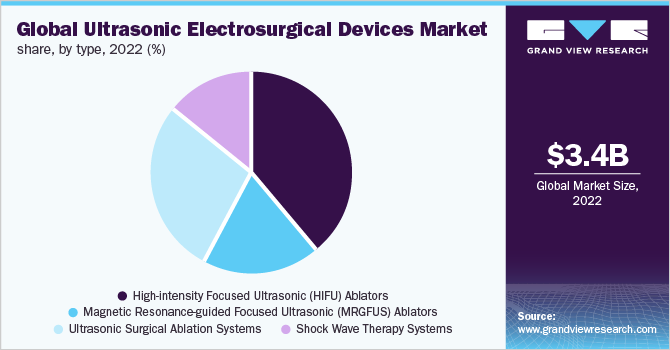

The high-intensity focused ultrasonic (HIFU) ablators held the largest share of 39.35% in 2022. The segment is growing owing to various factors including lowered toxicity as compared with the other techniques of ablation, minimal pain due to non-invasiveness, low cost of procedure than surgery, suitable for patients with high risk as it involves a lower rate of anesthesia, faster recovery rate than the traditional surgical procedures, low risk of infection, and bleeding can be clogged with the help of ultrasound during the procedure.

The ultrasonic surgical ablation systems are expected to be the fastest growing segment during the forecast period owing to the incidence of cardiovascular disorders, growing demand for minimally invasive cardiac surgeries for its treatment, rising prevalence of cancer and chronic pain, growing geriatric population, and technological advancements in the ultrasonic surgical ablation systems.

Application Insights

Cardiology held the largest share of 28.8% in 2022. The factors such as rising cases of cardiac disorders are expected to favor the market growth. As per the CDC, coronary heart disease is among the most common type of heart disease, and around 365,914 people died in 2017 due to this. Also, as per the WHO, about 17.9 million people die of cardiovascular disorders each year. Hence, the increasing prevalence of cardiovascular diseases globally is anticipated to boost market growth.

The gynecology segment is expected to show significant growth during the forecast period. Gynecology is a broader aspect of including all female reproductive organ disorders. These surgeries involve the use of surgical tools such as laparoscopes and hysteroscopies. The growing development of ultrasonic electrosurgical devices for gynecology by key players is expected to contribute towards segment growth.

End Use Insights

The hospital segment captured the highest market share and hold 48.5% market share in 2022. Hospital is the largest revenue-generating segment of the market, attributed to a huge number of cases and preventive surgical procedures being carried out in these settings. Around 125.7 million casualty department visits were reported in the U.S. with the surge in the number of surgeries, such as kidney & liver transplants and angioplasty. In addition, the presence of well-qualified medical experts in one place is fueling the market growth. Ambulatory Surgical Centers (ASCs) are projected to record the highest CAGR of 5.5% during the forecast period. This can be attributed to lower out-of-pocket costs, better patient accessibility, and decreased facility costs.

Regional Insights

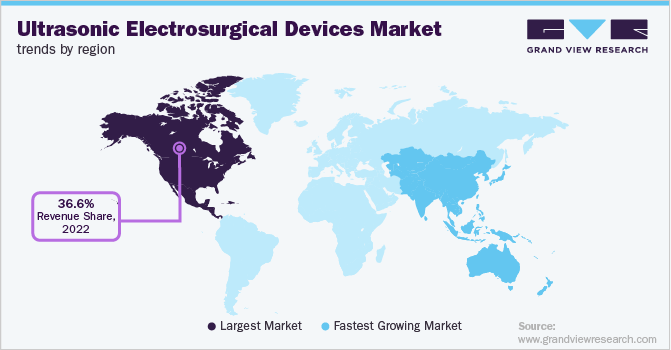

North America accounted for the largest market share of 36.6% in 2022. This growth can mainly be attributed to the increasing number of preventive surgeries and growing burden of chronic disorders, such as cancer, diabetes, and autoimmune diseases, increasing adoption of technologically advanced devices, and rising preference for minimally invasive surgical procedures.

The Asia Pacific is expected to show the fastest growth rate of 5.89% during the forecast period. This growth can be attributed to various factors such as the high adoption of advanced technologies, rising prevalence of chronic disorders, increasing reimbursement scenario, presence of a large geriatric population, growing demand for minimally invasive procedures over traditional methods, and increased need for laparoscopic surgery. In addition, key market players usually invest in developing countries to establish their footprint in the new marketplace to check the huge demand for ultrasonic electro-surgery devices.

Key Companies & Market Share Insights

The key companies have high R&D spending capacity and are observed to invest heavily in the development of new and advanced ultrasonic electrosurgical devices to gain a competitive edge in the market. Furthermore, companies are also focusing on other strategic initiatives, such as new product development, mergers, acquisitions, joint ventures, partnerships, and geographical expansions. For instance, in October 2019, Olympus Corporation has taken over all the commercial activities related to the VERSAPOINT Electrosurgery system from Ethicon, Inc. Some of the prominent players operating in the ultrasonic electrosurgical devices market include:

-

Ethicon - Endo-Surgery

-

Olympus Corporation

-

Medtronic

-

Misonix Inc

-

BOWA-electronic GmbH

-

Söring GmbH

-

Advanced Instrumentations

-

Reach Surgical

-

ITALIA MEDICA SRL.

-

SonaCare Medical

-

Miconvey

Ultrasonic Electrosurgical Devices Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 3.6 billion

Revenue forecast in 2030

USD 5.21 billion

Growth rate

CAGR of 5.44 % from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Norway; Sweden; Russia; Japan; India; China; Australia; South Korea; Brazil; Mexico; Argentina; Columbia; South Africa; Saudi Arabia; UAE; Turkey; Qatar

Key companies profiled

Ethicon - Endo-Surgery; Olympus Corporation; Medtronic; Misonix Inc; BOWA-electronic GmbH; Söring GmbH; Advanced Instrumentations; Reach Surgical,;ITALIA MEDICA SRL.; SonaCare Medical; Miconvey

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ultrasonic Electrosurgical Devices Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For this study, Grand View Research has segmented the global ultrasonic electrosurgical devices market report based on product, type, application, end-use, and region:

-

Product Outlook (Revenue in USD Million; 2018 - 2030)

-

Generators

-

Consumables

-

-

Type Outlook (Revenue in USD Million; 2018 - 2030)

-

High-intensity Focused Ultrasonic (HIFU) Ablators

-

Magnetic Resonance-guided Focused Ultrasonic (MRGFUS) Ablators

-

Ultrasonic Surgical Ablation Systems

-

Shock Wave Therapy Systems

-

-

Application Outlook (Revenue in USD Million; 2018 - 2030)

-

Cardiology

-

Gynecology

-

General Surgery

-

Urology

-

Bariatric Surgery

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global ultrasonic electrosurgical devices market size was estimated at USD 3.4 billion in 2022 and is expected to reach USD 3.6 billion in 2022.

b. The global ultrasonic electrosurgical devices market is expected to grow at a compound annual growth rate of 5.44% from 2023 to 2030 to reach USD 5.21 billion by 2030.

b. North America dominated the ultrasonic electrosurgical devices market with a share of 36.48% in 2020. This is attributable to the rising increasing number of preventive surgeries and the growing burden of chronic disorders, such as cancer, diabetes, and autoimmune diseases, increasing adoption of technologically advanced devices, and rising preference for minimally invasive surgical procedures.

b. Some key players operating in the ultrasonic electrosurgical devices market include Ethicon - Endo-Surgery, Olympus Corporation, Medtronic, Misonix Inc, BOWA-electronic GmbH, Söring GmbH, Advanced Instrumentations, Reach Surgical, Italia Medical Srl, SonaCare Medical, and Miconvey.

b. Key factors that are driving the ultrasonic electrosurgical devices market growth include the rising number of surgical procedures owing to the growing prevalence of chronic diseases, rising adoption of minimally invasive surgeries, and developments in minimally invasive surgical techniques including laparoscopy have resulted in the development of ultrasonic electrosurgical devices by major market players.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."