- Home

- »

- Sensors & Controls

- »

-

Ultrasonic Sensors Market Size & Trends Report, 2021-2027GVR Report cover

![Ultrasonic Sensors Market Size, Share & Trends Report]()

Ultrasonic Sensors Market Size, Share & Trends Analysis Report By Technology (Retro-reflective Sensor, Through-beam Sensor), By Type, By End-use (Automotive, Consumer Electronics), By Region, And Segment Forecasts, 2021 - 2027

- Report ID: GVR-4-68039-283-5

- Number of Report Pages: 154

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2019

- Forecast Period: 2021 - 2027

- Industry: Semiconductors & Electronics

Report Overview

The global ultrasonic sensors market size was valued at USD 3.89 billion in 2020. It is expected to expand at a compound annual growth rate (CAGR) of 6.6% from 2021 to 2027. An ultrasonic sensor measures the distance of a target object using ultrasonic sound waves, wherein a transducer is used to send and receive ultrasonic pulses and measure time lapses between their transmission and reception. The growth of the market is driven by the increasing use of ultrasonic sensors for object detection, distance measurement, and pallet detection, among others, across various industries and sectors. Furthermore, as these sensors meet a diverse range of requirements such as material handling, processing, and hygiene detection in the food and beverage industry, their demand has grown significantly in recent years. Moreover, the increasing demand for these systems in the medical industry, for applications such as echo graphs and echocardiograms, is expected to work in favor of the market in near future.

As ultrasonic sensors use higher frequencies compared to electromagnetic sensors, they produce shorter wavelengths that translate into a higher resolution for image processing. As a result, these systems are increasingly being adopted in healthcare applications such as radiography. Furthermore, these systems are used in autonomous mobile robots (AMRs) for the detection of obstacles and determining the vehicle’s distance from the nearest one. As a result, the increasing demand for AMRs in industries and sectors, including automotive, healthcare, oil & gas, and energy, is likely to boost market growth significantly.

In recent years, the increasing demand for features such as collision detection and parking assistance in driverless cars has significantly boosted the growth of the market. Ultrasonic sensors detect the distance to a nearby obstacle and help avoidance of collision with that object. Furthermore, technology companies such as Cruise LLC, Waymo LLC, and Zoox are focused on the development and provision of self-driving car services, which bodes well for market growth. For instance, in December 2018, Waymo LLC announced that it would be launching a self-driving car service in the city of Phoenix, Arizona, U.S. Moreover, several companies, including Texas Instruments Incorporated, Murata Manufacturing Co., Ltd., and NXP Semiconductors, are focusing on the development of ultrasonic sensors for Advanced Driver Assistance System (ADAS), further fueling the market growth. For instance, in March 2019, Texas Instruments Incorporated launched its new ultrasonic sensor MA40S4S, which can detect obstacles from a distance of 20 meters and was designed explicitly for ADAS applications.

Funding by various universities and governments globally for the development of ultrasonic sensors has significantly driven the growth of the market over recent years. For instance, Inductosense, received funding worth USD 12 million in October 2018 from a consortium of investors, including IP Group plc and the University of Bristol, for the development of ultrasonic sensors for monitoring cracks, corrosion, and defects in metals. Furthermore, there has been an increase in demand for ultrasonic sensors for robotic applications such as object detection. This trend, coupled with the rising demand for robots in industries such as healthcare, automotive, and manufacturing in China, Japan, and South Korea, is likely to work well for the market.

The increasing use of these sensors in the manufacturing sector has positively impacted the growth of the market. In the manufacturing sector, ultrasonic sensors find usage for applications such as high-speed counting of objects on a conveyor belt, liquid level control, box sorting scheme, and robotic sensing. Rising demand across other industrial applications, including precision robotics, inventory control systems, and unmanned aerial vehicles, has impacted market growth. In recent years, there has been a significant rise in the application of these systems for level detection in biogas plants, favoring market growth. However, drawbacks such as limited detection range could hamper the market growth. Owing to the presence of the crash protection bar, ultrasonic parking sensors may prove to be physically too deep for installation in the bumper of a range of vehicles.

COVID-19 Impact Analysis

In response to the outbreak of COVID-19, several governments globally have implemented lockdowns, which is likely to impact the growth of the market. These lockdowns have influenced the deliveries of ultrasonic sensors for various manufacturers, including Balluff Inc. and Murata Manufacturing Co., Ltd. Furthermore, some of the market’s leading players have large production facilities in China, which negatively impacted the production capability of these companies. However, productions have streamlined since the resumption of operations in some manufacturing facilities from March 2020.

The COVID-19 pandemic has severely impacted the automotive components industry. Auto components include batteries, brakes, and various sensors. This is likely to affect the growth of the market. While the pandemic continues to disrupt Chinese exports and the operations of assembly plants across the European region, the use of robotics in the detection of COVID-19 could positively impact the adoption of these systems; robotic systems help automate the process of drawing blood and reduce the risk of infections to medical personnel.

Owing to lockdowns, there has been a notable rise in the usage of Unmanned Aerial Vehicles (UAVs) for applications such as activity monitoring activities and delivery of essential products. As a result, the demand for ultrasonic sensors has increased significantly. Furthermore, various public safety authorities are emphasizing the usage of UAVs for sterilizing bus stops, railway stations, and hospitals, further driving the market growth.

Type Insights

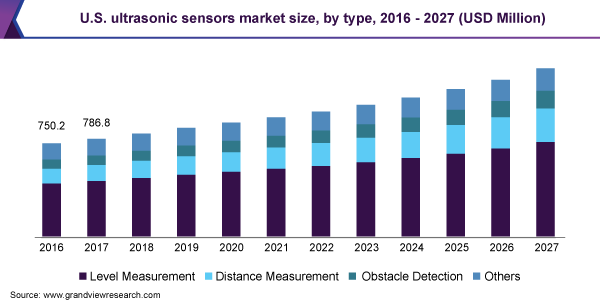

The obstacle detection segment accounted for over 10% of the market share in 2020 owing to the increasing usage of these systems in collision avoidance systems of automobiles. Stringent government policies and regulations related to the installation of vehicle safety features such as collision avoidance systems and airbags have further fueled the growth prospects of the segment. The segment is also expected to benefit from the rising deployment of parking assistance systems that use a combination of ultrasonic sensors and vision-based systems across vehicles manufactured by companies such as Audi AG and BMW AG. For instance, since December 2015, Audi AG and BMW are adopting parking assistance systems that consist of integrated ultrasonic sensors and surround-view cameras. Moreover, the increasing adoption of these systems in robotics for obstacle detection has further fueled the segment growth.

The level measurement segment is anticipated to register a promising CAGR owing to the increasing demand for level sensors for continuous level monitoring in oil and gas, food and beverage, and water and wastewater infrastructure. The rising usage of level sensors for monitoring storage units and downstream processing plants has positively impacted demand across the oil and gas sector. Moreover, an increase in shale gas exploration activities in countries such as China, Russia, and the U.S. further drives the growth prospects of the segment. The segment could also benefit from the increasing demand for level sensors in the food & beverage industry for use in level controllers in flour silos of large bakeries.

End-use Insights

The automotive segment accounted for a 15% share of the market in 2020. In the automotive industry, ultrasonic sensors are widely used in applications such as parking assistance and collision avoidance. Moreover, several companies, such as Pepperl+Fuchs GmbH, Omron Corporation, and Texas Instruments Incorporated, are focusing on the development of interfaces for these systems specific to automotive applications. For instance, in March 2018, Texas Instruments Incorporated launched the TIDA-00151 - System on Chip (SOC) sensor interface IC for ultrasonic sensors used in automotive applications such as blind-spot detection systems and parking assistance systems. Moreover, funding provided by various governments globally to start-up companies operating in this area of application has significantly favored the growth of the segment. For instance, in December 2019, Novosound, a Scottish startup, was awarded funding worth USD 4.3 million from the Government of Scotland for the development of automotive ultrasonic sensors.

The healthcare segment is projected to register the highest CAGR over the forecast period, thanks to the rising demand for ultrasonography and ultrasonic scanning. Ultrasonic scanning uses ultrasonic waves to produce images of internal organs and tissues. Furthermore, there has been an increasing demand for ultrasonic sensors in Ultrasonic Surgical Instruments (USI), which is anticipated to provide lucrative opportunities to market players. USIs, with the help of ultrasonic sensors, convert an ultrasonic signal into a mechanical vibration. They can cut bones and other tissues while simultaneously reducing bleeding by coagulating tissue. Moreover, these systems are used in non-invasive therapeutic applications such as extracorporeal shock wave lithotripsy, which uses ultrasonic waves to locate and target kidney stones and destroy them.

Technology Insights

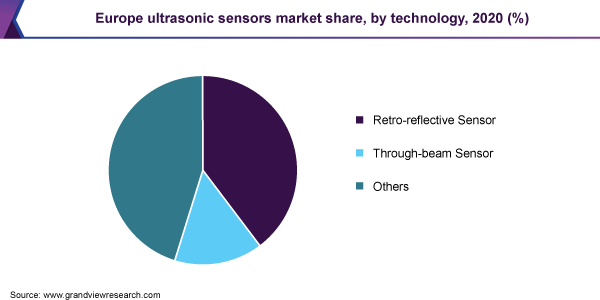

In terms of technology, the retro-reflective segment accounted for the 40% market share in 2020. This can be attributed to the advantages provided by these sensors, including reduced maintenance costs, installation costs, and reliability in detecting transparent objects. Moreover, retro-reflective sensors offer simple optical axis adjustment and wiring, which makes them easy to deploy. Furthermore, the rising adoption of retro-reflective systems in throttle control and precision position measurement of automobiles bodes well for the segment growth. Several market players, including Siemens and Pepperl+Fuchs GmbH, are focusing on establishing partnerships for the development of retro-fit sensors. This is further expected to drive market growth over the forecast period.

The through-beam segment is anticipated to register a high CAGR over the forecast period. This can be attributed to the increasing usage of these sensors in fill-level measurement applications in transparent containers. Furthermore, these sensors are extensively used in water & wastewater treatment plants for measuring the turbidity of water. There has been an increase in the adoption of through-beam sensors in the food & beverage industry by food safety agencies for monitoring the purity of liquids.

Regional Insights

Europe dominated the market with a 30% market share in 2020, owing to the increasing demand for minimally invasive surgeries in the region. In minimally invasive surgery, ultrasonic sensors enable surgeons to operate with high-precision. Furthermore, the rise in initiatives such as Factories of the Future and Logistics Initiative Bavaria has significantly boosted the growth prospects of the regional market. For instance, the Factories of the Future initiative, which was launched in May 2015, emphasizes the development of sensors for enhancing the manufacturing process in the automotive industry. The region is home to countries such as Germany and France, which are regarded as the largest video game networks in the world, and has seen a stark increase in the adoption of these systems in augmented reality and virtual reality devices. Ultrasonic sensors are used in augmented reality and virtual reality headsets used with gaming consoles for measuring the distance to an object.

The Asia Pacific region is anticipated to register a promising CAGR over the forecast period, owing to the increasing demand for factory automation in the region’s manufacturing sector. The rapid expansion of the region’s automotive manufacturing industry is further anticipated to propel the demand for these systems. Ultrasonic sensors are used in consumer electronics such as gaming consoles, cleaning robots, and smartphones. As a result, the region’s rapidly growing consumer electronics industry augurs well for the growth of the regional market. Furthermore, several companies operating in the region, such as Murata Manufacturing Co., Ltd., and TDK Corporation, have received government funding for the development of ultrasonic sensors. For instance, in April 2017, the Japanese government provided funding worth USD 10 million for conducting R&D activities related to the development of ultrasonic sensors.

Key Companies & Market Share Insights

Some of the key players operating in the market are Balluff Inc.; Banner Engineering Corp.; Baumer; Hans Turck GmbH & Co. KG; Ifm electronic GmbH; Murata Manufacturing Co., Ltd.; Omron Corporation; Pepperl+Fuchs GmbH; SICK AG; and Siemens. Extensive investments in R&D activities have enabled these companies to stay competitive in the market by developing new products. For instance, in August 2019, Pepperl+Fuchs GmbH launched the UB and UC range of ultrasonic sensors for multiple applications. Additionally, these sensors feature high noise immunity and multiplex capability.

Several other players are emphasizing partnerships, mergers, and acquisitions for staying competitive in the market. For instance, in December 2017, Omron Corporation completed the acquisition of Microscan Systems, Inc., a developer of ultrasonic sensors for consumer electronics applications. Furthermore, companies are focusing on the expansion of their production capacities via the development of new production facilities. For instance, in October 2019, Baumer opened a new production facility in North Macedonia, Balkans. The factory was aimed at ensuring quick deliveries to customers across Europe. Some of the prominent players in the ultrasonic sensors market include:

-

Balluff Inc.

-

Banner Engineering Corp.

-

Baumer

-

Hans Turck GmbH & Co. KG

-

Ifm electronic GmbH

-

Murata Manufacturing Co., Ltd.

-

Pepperl+Fuchs GmbH

-

SICK AG

-

Siemens

Ultrasonic Sensors Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 4.09 billion

Revenue forecast in 2027

USD 6.00 billion

Growth Rate

CAGR of 6.6% from 2021 to 2027

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2027

Quantitative units

Revenue in USD million, Volume in Million Units, and CAGR from 2021 to 2027

Report coverage

Revenue, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico

Key companies profiled

Balluff Inc.; Banner Engineering Corp.; Baumer; Hans Turck GmbH & Co. KG; Ifm electronic GmbH; Murata Manufacturing Co., Ltd.; Murata Manufacturing Co., Ltd.; Pepperl+Fuchs GmbH; SICK AG; Siemens

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2027. For this study, Grand View Research has segmented the global ultrasonic sensors market report based on technology, type, end-use, and region:

-

Technology Outlook (Volume, Million Units; Revenue, USD Million, 2016 - 2027)

-

Retro-reflective Sensor

-

Through-beam Sensor

-

Others

-

-

Type Outlook (Volume, Million Units; Revenue, USD Million, 2016 - 2027)

-

Level Measurement

-

Distance Measurement

-

Obstacle Detection

-

Others

-

-

End-use Outlook (Volume, Million Units; Revenue, USD Million, 2016 - 2027)

-

Consumer Electronics

-

Automotive

-

Aerospace & Defense

-

Healthcare

-

Industrial

-

Others

-

-

Region Outlook (Volume, Million Units; Revenue, USD Million, 2016 - 2027)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global ultrasonic sensors market size was estimated at USD 3.9 billion in 2020 and is expected to reach USD 4.1 billion in 2021.

b. The global ultrasonic sensors market is expected to grow at a compound annual growth rate of 6.6% from 2021 to 2027 to reach USD 6.0 billion by 2027.

b. Europe dominated the ultrasonic sensors market with a share of 30.0% in 2020. This is attributable to the increasing demand for minimally invasive surgeries in the region. In minimally invasive surgery, ultrasonic sensors enable surgeons to operate with high-precision.

b. Some key players operating in the ultrasonic sensors market include Balluff Inc.; Banner Engineering Corp.; Baumer; Hans Turck GmbH & Co. KG; Ifm electronic GmbH; Murata Manufacturing Co., Ltd.; Omron Corporation; Pepperl+Fuchs GmbH; SICK AG; and Siemens.

b. Key factors that are driving the market growth include increasing use of ultrasonic sensors for object detection, distance measurement, and pallet detection, among others, across various industries and sectors and rising applications of ultrasound in healthcare such as sonography and renal denervation.

b. In March 2019, Texas Instruments Incorporated launched its latest ultrasonic sensor MA40S4S, which has the ability to detect obstacles from a distance of 20 meters and was designed exclusively for ADAS applications. Such developments are supporting the ultrasonic sensors market expansion.

b. The Covid-19 impact analysis of the ultrasonic sensors market suggests that there is an exponential rise in the usage of Unmanned Aerial Vehicles (UAVs) for applications such as the delivery of essential products and public safety authorities including the usage of UAVs for sterilizing railway stations, bus stops, and hospitals.

b. The obstacle detection segment in the ultrasonic sensors market accounted for more than 10% of the revenue share in 2020 owing to its surging usage in collision avoidance systems of automobiles.

b. The industry giants are focusing on the development of ultrasonic sensors for Advanced Driver Assistance System (ADAS) and collision avoidance mechanisms, which is further fueling the market for ultrasonic sensors.

b. The automotive segment accounted for a share of 15% in 2020. In the automotive industry, ultrasonic sensor products are widely used in applications including parking assistance and collision avoidance.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."