- Home

- »

- Power Generation & Storage

- »

-

Underground Gas Storage Market Size & Share Report, 2030GVR Report cover

![Underground Gas Storage Market Size, Share & Trends Report]()

Underground Gas Storage Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Natural Gas, Hydrogen), By Type (Aquifer Reservoir, Salt Caverns), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-027-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global underground gas storage market size was estimated at 468.20 BCM in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 2.5% from 2023 to 2030. Underground gas storage facilities are primarily developed to meet seasonal demand for gases worldwide. Gases are kept in storage facilities during their low-demand period and are taken out during their peak-demand period. Large underground reservoirs are used to store gases. Depleted gas reservoirs, salt caverns, and aquifer reservoirs are different types of underground natural gas storage facilities used across the world. These storage facilities are essential to ensure a continuous supply of gas to meet the rising global demand for energy.

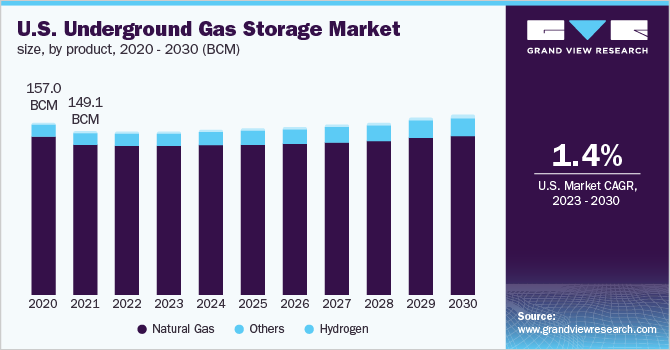

The U.S. market is anticipated to witness substantial growth over the forecast period owing to the large volumes of natural gas produced in the country. According to the U.S. Energy Information Administration, there are more than 400 active underground gas storage facilities in the country that are mostly located in the Eastern states of the U.S. The majority of the existing underground gas storage facilities are located in depleted natural gas or oil fields that are close to their consumption centers. However, there has been a surge in the number of underground gas storage facilities in the U.S. that are based on natural aquifers and salt caverns. Over the past few years, the industry has experienced tremendous growth across the world.

The ongoing industrialization is the primary factor promoting the expansion of this market. Natural gas is considered the most significant energy source worldwide. This gas is expected to continue playing an increasingly significant role in countries with high-energy requirements owing to its abundance and eco-friendliness, along with its increased usage in a wide range of applications. The U.S. has also been witnessing an increased demand for hydrogen owing to the large-scale development and adoption of hydrogen cells and hydrogen-powered vehicles in the country. A number of companies have started to invest in underground hydrogen storage facilities in the U.S. to fulfill the growing demand for hydrogen in the country.

Product Insights

The natural gas segment led the industry in 2022 and accounted for 91.86% of the global volume share, owing to the wide application of natural gas, hydrogen, and others in various sectors. Natural gas is used in the commercial sector to heat buildings and water, run refrigeration and cooling equipment, cook, dry clothes, and provide outdoor lighting. Natural gas is also used as a fuel in heat and power systems. In 2021, the commercial sector accounted for approximately 11% of the total natural gas consumption; natural gas accounted for approximately 20% of the total commercial energy consumption in the U.S.

Underground natural gas storage is essential to meet the demand for gas supply. As of 2022, nearly 430 billion cubic meters (bcm) of natural gas have been stored worldwide, which equates to about 10% of the total demand. Natural gas storage facilities can accommodate short-term demand and seasonal fluctuations. The two main factors driving the industry growth are seasonal differences in natural gas prices between winter and summer and short-term price volatility. The practice of storing hydrogen underground, in salt domes, abandoned oil & gas fields, and caves, comes under underground hydrogen storage.

For many years, large amounts of gaseous hydrogen have been kept in caverns. Grid energy storage, which is crucial for the hydrogen economy, can be accomplished by storing large amounts of hydrogen underground in mines, aquifers, excavated rock caverns, solution-mined salt domes, or other structures. The other segment includes carbon dioxide and helium. Supercritical Carbon Dioxide (CO2) with a critical point of 31.1°C and 72.9 atm (roughly 1,057 psi) can be kept underground. CO2 exhibits both gaseous and liquid characteristics at high temperatures and pressure. Carbon Capture and Storage (CCS) is used to remove CO2 from industrial emissions before they are released into the atmosphere; the gas is then stored in subterranean geologic formations.

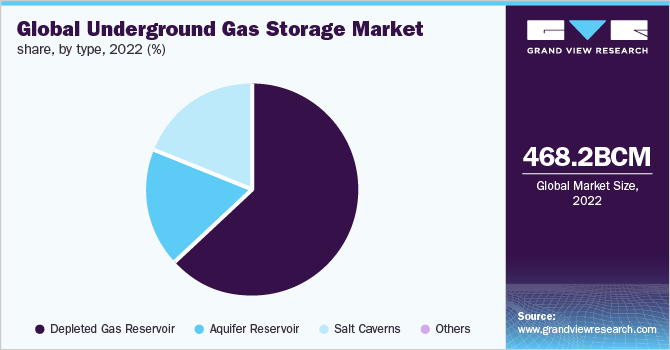

Type Insights

The type segment consists of depleted gas reservoirs, aquifer reservoirs, salt caverns, and others. The depleted gas reservoir segment led the industry in 2022 and accounted for 63.81% of the global volume share, owing to the increasing production of gas. Depleted natural gas reservoirs account for 76% of the world's total natural gas storage volume and are being used for decades. Gas fields are larger in volume and are more widely distributed than salt caverns. The global demand for such reservoirs is expected to be driven by increasing government arbitration in regulating their growth.

Aquifers accounted for approximately 11% of the existing underground natural gas storage volume globally, as of 2022. The geology of aquifers is similar to that of depleted natural gas fields. Aquifers are natural water reservoirs, formed within underground porous and permeable rock formations. However, they are a comparatively less desirable and more expensive type of natural gas storage option. Salt caverns are formed from existing salt deposits. They are suitable for gas storage as the walls possess the structural strength of steel, making the caverns resilient against reservoir degradation over the life of the storage facility.

A small portion of the natural gas that is injected into storage can escape from salt caverns unless it is specifically extracted. Over the course of the salt storage facility’s life, the walls are sturdy and gastight. Compared to depleted gas reservoirs and aquifer storage facilities, salt caverns are typically much smaller. The others segment includes lined hard rock cavern storage and pore storage. Natural gas liquids (propane, butane) and crude oil are stored in lined hard rock caverns. Hydrogen is also stored in liquefied or compressed gas form at pressures of 100 to 250 bar in hard rock caverns.

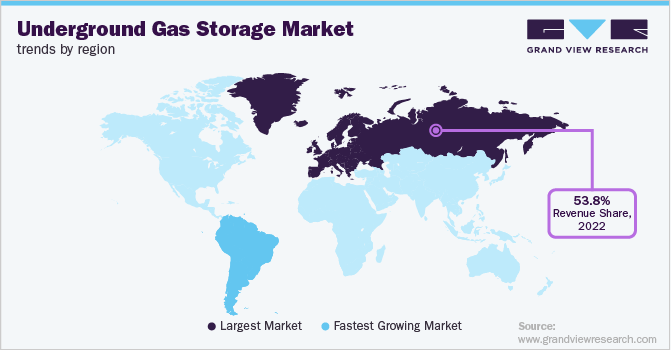

Regional Insights

Europe dominated the global industry in 2022 and accounted for the largest share of over 53.80%. Russia has the largest proven natural gas reserves in the world, with overall resources at 38 TCM (1,341 trillion cubic feet). Around 4,269.6 bcf (billion cubic feet) of underground gas storage is available in Europe at more than 170 sites, 42% of which is in Germany. Demand for natural gas storage is strongest in terms of depleted reservoirs in France, Germany, Russia, and Italy. Depleted fields hold the largest volume of gas as they are deep and are naturally known to have hydrocarbon deposits.

North America is anticipated to emerge as a leading regional market during the forecast period. This is owing to the increasing exploration and production of natural gas and hydrogen in the region. The U.S. is the largest market for underground gas storage in North America owing to the large volumes of natural gas produced in the country. The majority of the existing underground gas storage facilities are located in depleted natural gas or oil fields that are close to their consumption centers. However, there has been a surge in the number of underground gas storage facilities in the U.S. that are based on natural aquifers and salt caverns.

Asia Pacific is expected to witness significant growth over the forecast period owing to increasing domestic demand from end-use industries in countries such as China. In China, there has been increased investment in underground gas storage and the development of new facilities. The country has built gas storage facilities to fulfill the growing demand. China has newly built Bannan gas storage and Suqiao gas storage and has formed Dagang, North China gas storage clusters to store natural gas underground.

Key Companies & Market Share Insights

The global market is highly competitive on account of the presence of major companies that are fairly concentrated and highly competitive. Some of the prominent players operating in the global underground gas storage market are:

-

ADNOC

-

Baker Hughes Company

-

Chart Industries

-

Enbridge Inc.

-

NAFTA a. s.

-

NOV Inc.

-

Royal Vopak

-

TransCanada PipeLines Ltd.

-

Uniper SE

-

Weatherford

Underground Gas Storage Market Report Scope

Report Attribute

Details

Market size volume in 2023

474.71 BCM

Volume forecast in 2030

565.74 BCM

Growth rate

CAGR of 2.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in MCM and CAGR from 2023 to 2030

Report coverage

Volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, region

Region scope

North America; Europe; Asia Pacific; Middle East & North Africa; Latin America

Country scope

U.S.; Canada; Germany; Russia; France; Italy; China; India; Australia; Mexico; Brazil; Algeria; Egypt; Libya; UAE

Key companies profiled

Weatherford; TransCanada PipeLines Ltd.; Baker Hughes Company; NOV Inc.; John Wood Group PLC; Magellan Midstream Partners, L.P.; Blade Energy Partners; Uniper SE; NAFTA a. s.; Chart Industries;Enbridge Inc.; Royal Vopak; ADNOC; Buckeye Partners, L.P.; Texas Brine Company, LLC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Underground Gas Storage Market Segmentation

This report forecasts volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global underground gas storage market report based on product, type, and region:

-

Product Outlook (Volume, MCM, 2018 - 2030)

-

Natural Gas

-

Hydrogen

-

Others

-

-

Type Outlook (Volume, MCM, 2018 - 2030)

-

Depleted Gas Reservoir

-

Aquifer Reservoir

-

Salt Caverns

-

Others

-

-

Regional Outlook (Volume, MCM, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

Russia

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Australia

-

-

Latin America

-

Mexico

-

Brazil

-

-

Middle East & North Africa

-

Algeria

-

Egypt

-

Libya

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global underground gas storage market size was estimated at 468.20 BCM in 2022 and is expected to reach USD 474.72 BCM m in 2023

b. The global underground gas storage market is expected to witness a compound annual growth rate of 2.5% from 2023 to 2030 to reach 565.74 BCM by 2030

b. The Natural gas was the largest product segment accounting for 91.86% of the total volume in 2022 owing to its wide applications in industrial, commercial, residential and transportation sectors

b. Some of the key players operating in the underground gas storage market include Weatherford, ENBRIDGE INC., ADNOC and Royal Vopak

b. Key factors driving the growth of the underground gas storage market include the increasing demand for underground natural gas and increasing demand for underground hydrogen storage

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.