- Home

- »

- Next Generation Technologies

- »

-

Underwater Robotics Market Size And Share Report, 2030GVR Report cover

![Underwater Robotics Market Size, Share & Trends Report]()

Underwater Robotics Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (ROV, AUV), By Application (Commercial Exploration, Defense & Security, Scientific Research), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-421-5

- Number of Report Pages: 143

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Underwater Robotics Market Summary

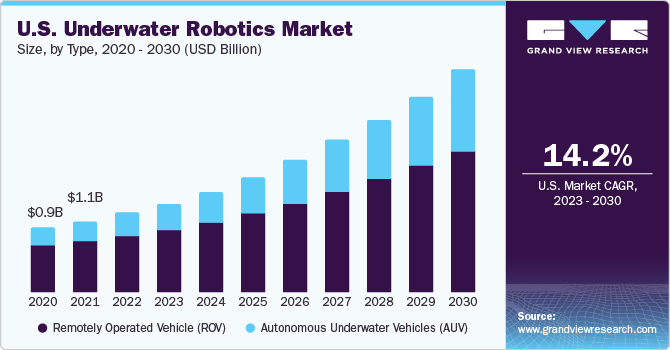

The global underwater robotics market size was valued at USD 4.49 billion in 2022 and is projected to reach USD 13.02 billion by 2030, growing at a CAGR of 14.5% from 2023 to 2030. The potential use in underwater surveillance and offshore oil and gas exploration is expected to boost market growth over the forecast period.

Key Market Trends & Insights

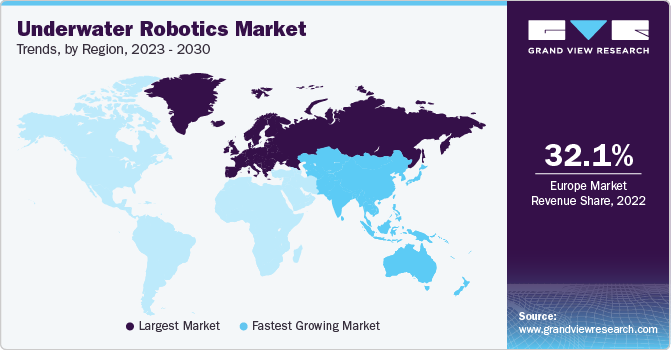

- Europe dominated the market and accounted for the largest revenue share of 32.1% in 2022.

- Asia Pacific is expected to grow at the fastest CAGR of 16.0% during the forecast period.

- By type, the remotely operated vehicles segment accounted for the largest revenue share of 79.8% in 2022.

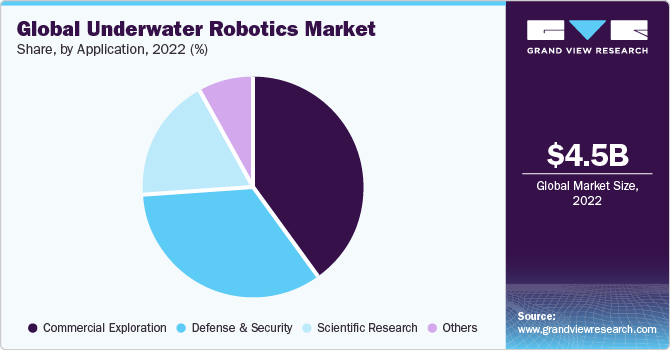

- By application, the commercial exploration segment held the largest revenue share of 39.6% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 4.49 Billion

- 2030 Projected Market Size: USD 13.02 Billion

- CAGR (2023-2030): 14.5%

- Europe: Largest market in 2022

For instance, Remotely Operated Vehicles (ROVs) are extensively used for drilling, development, repair, and maintenance operations for offshore oil and gas exploration while overcoming the limitations of human subsea drivers. Moreover, the growing adoption of robotics in defense and security applications is expected to drive market growth over the next few years. Robotics has been used in manufacturing over the past few years. Tremendous development over the years has made them more sophisticated and reliable for military and law enforcement applications.

Traditionally, a submarine alone has been an important system for underwater surveillance. However, advancements in underwater robotics have provided additional equipment for underwater surveillance. Governments across different countries are investing in this technology for advanced military applications such as intelligence, surveillance, investigation, mine countermeasure, oceanography, communication/navigation, anti-submarine warfare, and others. For instance, in July 2017, the U.S. Defense Advanced Research Projects Agency (DARPA) signed a contract of USD 4.6 Million with BAE Systems to develop an Unmanned Underwater Vehicle (UUV) to supplement manned submarines, aiding them to detect targets by sending sonar pulses.

Navigation and communication are one of the major problems when it comes to the deployment of underwater robotics. It is often difficult to address these issues. In underwater communication, information is transmitted using electromagnetic (E.M.), free-space optical (FSO), or sound waves. The use of sound waves for communication below surface water can be severely affected by surface ambient noise and temperature gradients.

Electromagnetic waves do not perform optimally in an underwater atmosphere, particularly in seawater, owing to their conducting nature. The FSO waves are used as a carrier for wireless communication underwater. However, it is restricted to very short distances. In addition, high power is required for underwater communication owing to extra complex signal processing. Hence, difficulties in communication and navigation in deep water conditions are expected to limit the adoption of underwater robots over the forecast period.

Type Insights

The Remotely Operated Vehicles (ROV) segment accounted for the largest revenue share of 79.8% in 2022. The growth of the ROV segment is attributed to the rising offshore deep-sea oil and drilling industry owing to its capability to perform undersea operations such as drilling, equipment assembling, underwater repair, and maintenance.

The Autonomous Underwater Vehicle (AUV) segment is expected to grow at the fastest CAGR of 17.9% during the forecast period. It is driven by increasing demand and adoption of defense applications such as surveillance, mine counter measurement, anti-warfare applications, and others. Moreover, potential use in ocean floor mapping, testing water samples, polar ice research, and pipeline inspection is expected to drive expansion over the forecast period further.

Application Insights

The commercial exploration segment held the largest revenue share of 39.6% in 2022 and is expected to grow at the fastest CAGR during the forecast period. The growth is attributed to rising use in offshore oil and gas exploration as well as in undersea mineral exploration activity. Underwater robotics is one of the important technologies miners use to explore deep-sea mineral wealth. Mining companies are leveraging robotics technology to extract the rich mineral deposits under the seabed. For instance, a Canadian company, Nautilus Minerals, is planning to deploy underwater robots to extract minerals such as gold, silver, and copper at a depth of 1,600 m near the Papua New Guinea waters.

The scientific research segment is expected to grow at a significant CAGR of 14.4% during the forecast period. It is attributed to the increasing need for cost-effective, safe, and technologically advanced systems that can help in understanding the planet and address global challenges.

Regional Insights

Europe dominated the market and accounted for the largest revenue share of 32.1% in 2022. The region is anticipated to contribute substantially to the global share owing to growing offshore oil and gas exploration activities in European countries. For instance, in May 2018, oil firm Lukoil of Russia completed the construction of a third well in the Filanovsky field of the Caspian Sea in the Russian sector.

Asia Pacific is expected to grow at the fastest CAGR of 16.0% during the forecast period. The underwater robotics market growth in the region is attributed to the growing use of underwater robotics in defense and oil and gas exploration activities in countries such as China, India, South Korea, and Japan.

Key Companies & Market Share Insights

Underwater robotics providers are using strategies like new product development, partnerships, and acquisitions to broaden their product portfolio and strengthen their market position. For instance, in May 2023, Israel Aerospace Industries and ATLAS ELEKTRONIK made the official debut of their latest collaborative project designed for advanced anti-submarine warfare missions (AWS). This cutting-edge system is built upon ELTA's BlueWhale highly developed autonomous underwater multi-mission platform, which is an uncrewed underwater vehicle equipped with an advanced sensor system. The innovative system also integrates ATLAS ELEKTRONIK's distinctive towed passive sonar triplet array, enhancing its ASW capabilities significantly.

Key Underwater Robotics Companies:

- ATLAS MARIDAN Aps

- Deep Ocean Engineering, Inc.

- General Dynamics Mission Systems, Inc.

- ECA GROUP

- International Submarine Engineering Limited

- Eddyfi Technologies

- Oceaneering International, Inc.

- Saab AB

- TechnipFMC plc

- Soil Machine Dynamics Ltd.

Recent Developments

-

In May 2023, Advanced Navigation, a player in AI robotics and navigation technology, unveiled the underwater docking feature of the micro autonomous underwater vehicle at ICRA 2023 in London. This preview showcased Advanced Navigation's groundbreaking innovations, bringing two revolutionary technologies to the forefront in the UK.

-

In April 2023, Nauticus Robotics, a company specializing in autonomous robots with artificial intelligence for ocean industries' data collection and intervention services, unveiled the first of its three second-generation Aquanauts, known as "Mark 2" (MK2). The Aquanauts are set to begin commissioning exercises shortly. Once the commissioning phase is completed, Nauticus plans to deploy the Aquanaut MK2 units to the North Sea and the Gulf of Mexico in the upcoming months.

-

In November 2020, Schilling Robotics decided to integrate Energid's Actin software into its state-of-the-art work class remotely operated vehicles (ROVs). The company aims to leverage the Actin software's advanced motion control capabilities further to enhance the performance and effectiveness of the Gemini manipulators. This integration marks a significant advancement in the field of underwater robotics, pushing the boundaries of what these ROVs can achieve.

-

In March 2020, ECA GROUP supplied the Lithuanian Navy with the underwater robot K-STER, offering an effective ROV solution for clearing sea mines. The K-STER mine disposal vehicle was provided to enhance the Lithuanian Navy's capabilities for conducting mine countermeasures at sea.

-

In January 2020, NOAA's Office of Ocean Exploration and Research and Ocean Infinity entered into a new agreement. This collaboration aimed to create advanced deep-water autonomous technologies capable of collecting ultra-high-resolution ocean data. The partnership's primary goal was to enhance NOAA's mission in exploring and mapping the U.S. Exclusive Economic Zone through the use of unmanned drone systems and artificial intelligence, making the process more efficient.

Underwater Robotics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 5.06 billion

Revenue forecast in 2030

USD 13.02 billion

Growth rate

CAGR of 14.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

ATLAS MARIDAN Aps; Deep Ocean Engineering, Inc.; General Dynamics Mission Systems, Inc.; ECA GROUP; International Submarine Engineering Limited; Eddyfi Technologies; Oceaneering International, Inc.; Saab AB; TechnipFMC plc; Soil Machine Dynamics Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

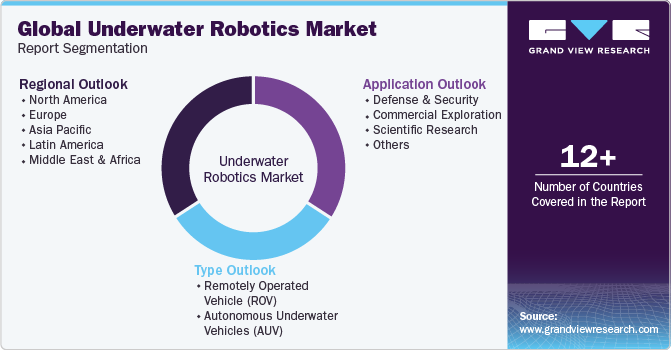

Global Underwater Robotics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global underwater robotics market based on type, application, and region:

-

Type Outlook (Revenue in USD Million, 2017 - 2030)

-

Remotely Operated Vehicle (ROV)

-

Autonomous Underwater Vehicles (AUV)

-

-

Application Outlook (Revenue in USD Million, 2017 - 2030)

-

Defense & Security

-

Commercial Exploration

-

Scientific Research

-

Others

-

-

Regional Outlook (Revenue in USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global underwater robotics market size was estimated at USD 4.49 billion in 2022 and is expected to reach USD 5.06 billion in 2023.

b. The global underwater robotics market is expected to grow at a compound annual growth rate of 14.5% from 2023 to 2030 to reach USD 13.02 billion by 2030.

b. Europe dominated the underwater robotics market with a share of over 32% in 2022. The region is anticipated to contribute substantially to the global share owing to growing offshore oil and gas exploration activities in European countries.

b. Some key players operating in the underwater robotics market include ATLAS MARIDAN ApS; Deep Ocean Engineering, Inc.; Bluefin Robotics Corporation; ECA Group; International Submarine Engineering; Schilling Robotics, LLC; and Soil Machine Dynamics Ltd.

b. Key factors that are driving the underwater robotics market growth include the growing adoption of robotics in defense and security applications, and governments investments in the technology for advanced military applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.