- Home

- »

- Plastics, Polymers & Resins

- »

-

Unsaturated Polyester Resin Market, Industry Report, 2033GVR Report cover

![Unsaturated Polyester Resin Market Size, Share & Trends Report]()

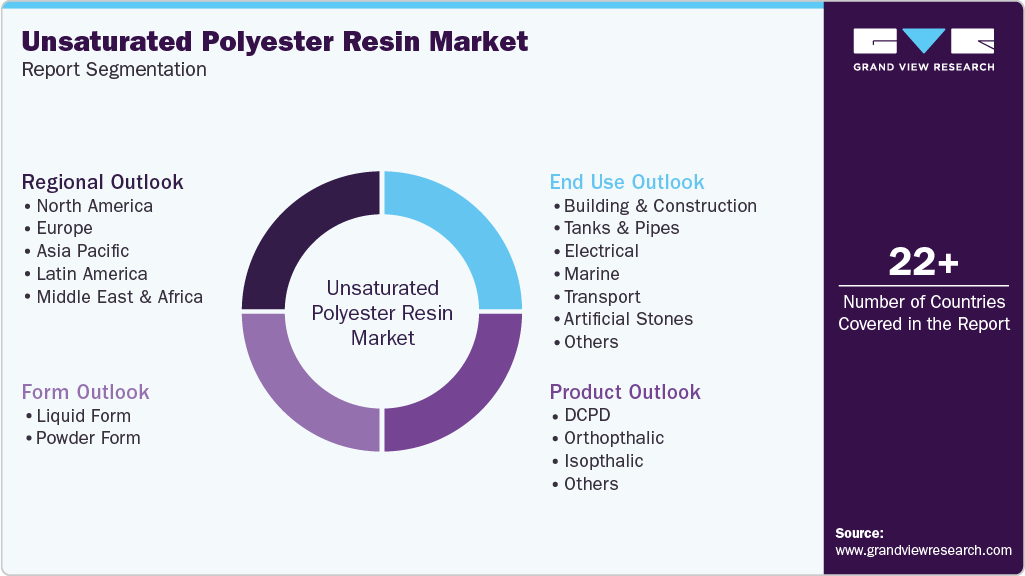

Unsaturated Polyester Resin Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Dicyclopentadiene (DCPD), Orthophthalic, Isophthalic), By End Use (Building & Construction, Tanks & Pipes, Electrical, Marine), By Form, By Region, And Segment Forecasts

- Report ID: 978-1-68038-283-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Unsaturated Polyester Resin Market Summary

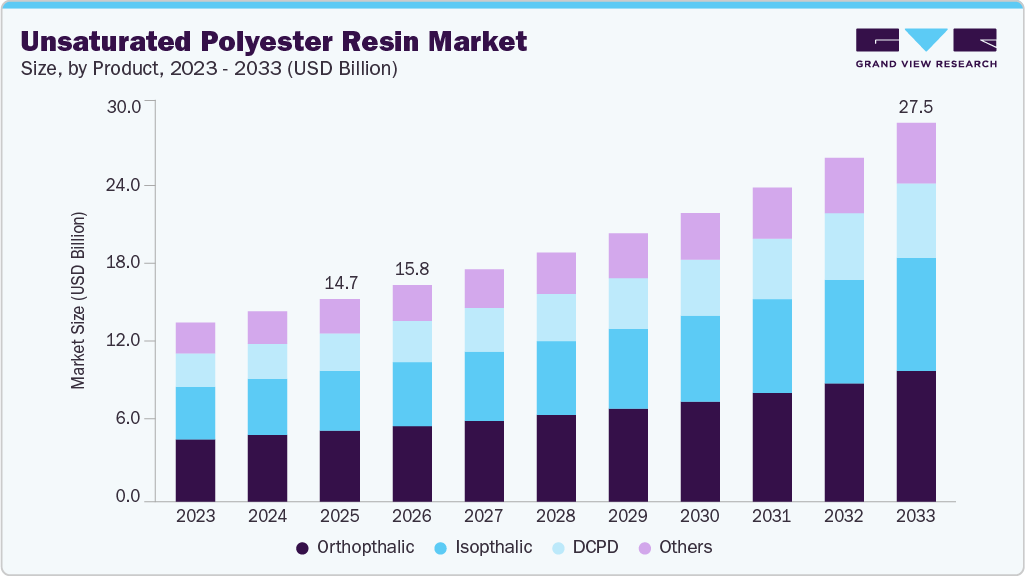

The global unsaturated polyester resin market size was estimated at USD 14.75 billion in 2025 and is projected to reach USD 27.51 billion by 2033, growing at a CAGR of 8.3% from 2026 to 2033. Increasing use of fiber-reinforced plastics in water tanks, pipes, and storage vessels is consistently boosting demand for unsaturated polyester resins.

Key Market Trends & Insights

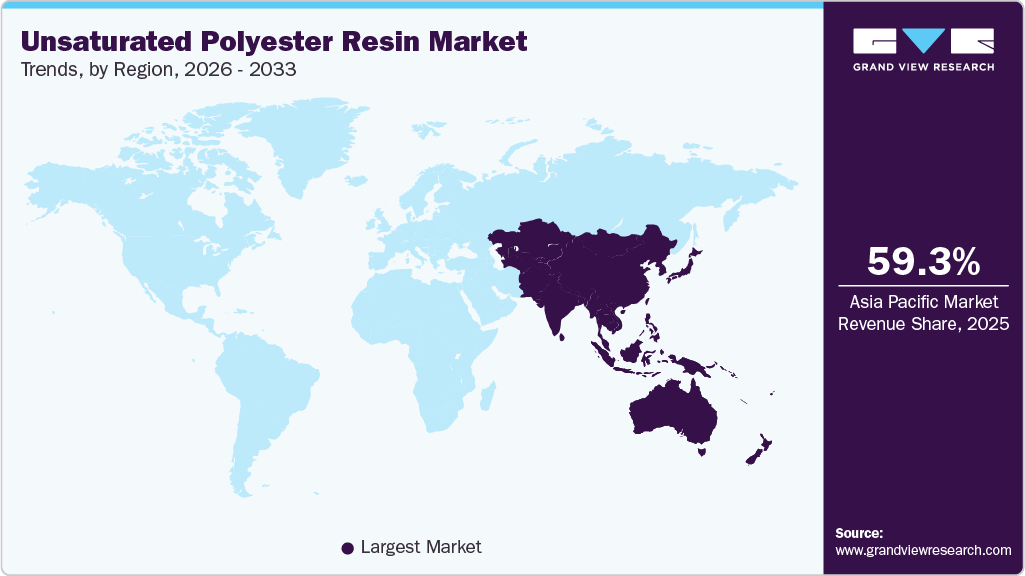

- Asia Pacific dominated the global unsaturated polyester resin industry with the largest revenue share of 59.31% in 2025.

- The unsaturated polyester resin industry in China is expected to grow at a substantial CAGR of 8.8% from 2026 to 2033.

- By product, the DCPD segment is expected to grow at a considerable CAGR of 8.9% from 2026 to 2033 in terms of revenue.

- By form, the liquid form segment is expected to grow at a considerable CAGR of 8.4% from 2026 to 2033 in terms of revenue.

- By end use, the marine segment is expected to grow at a considerable CAGR of 9.3% from 2026 to 2033 in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 14.75 Billion

- 2033 Projected Market Size: USD 27.51 Billion

- CAGR (2026-2033): 8.3%

- Asia Pacific: Largest market in 2025

These applications prefer unsaturated polyester resin because of its low cost, good chemical resistance, and ease of processing on a large scale. Unsaturated polyester resins are mainly used in glass fiber-reinforced plastics (FRP). In addition, due to their various physical and chemical properties such as excellent tensile strength, impact resistance, bonding strength, and corrosion and heat resistance, these resins are extensively used in construction materials, housing equipment, and transportation equipment.

Global demand for unsaturated polyester resins is shifting from basic formulations to higher-performance, low-emission grades. Growth remains steady, driven by construction, marine, and transportation applications that require lightweight, corrosion-resistant composites. Manufacturers are investing in formulation innovation to improve toughness and cure speed while reducing volatile components. Simultaneously, the growing prominence of bio-based thermoplastics influences customer sourcing strategies, creating both competitive and complementary dynamics with thermoplastic solutions.

Drivers, Opportunities & Restraints

End-use expansion in building products, infrastructure composites, and wind energy is the main driver for unsaturated polyester resins. These sectors value unsaturated polyester resin for its low density, chemical resistance, and cost efficiency in molded and laminated parts. Demand is also driven by repair and maintenance markets where unsaturated polyester resin chemistry is well-established and easily specified. Advances in upstream formulation that enhance processing consistency further support adoption across larger structural components.

Regulatory pressure on reactive diluents and corporate net zero targets open a research and development window for styrene-free and bio-based resin systems. Developing styrene-free curatives and incorporating renewable polyols can deliver lower emissions and enhanced sustainability credentials. This transition allows suppliers to offer differentiated value to brand owners seeking lower lifecycle footprints. Partnerships between resin producers and bio-based polymer developers could accelerate commercialization and secure new specifications.

The market faces limitations from dependence on styrene as the reactive diluent and from shifting aromatic feedstock prices. Styrene remains the primary processing aid, and replacing it introduces technical and cost challenges for formulators and converters. Regulatory scrutiny of styrene emissions increases compliance costs for plants and supply chains. These factors slow the adoption of alternative chemistries and create near-term margin pressures for producers.

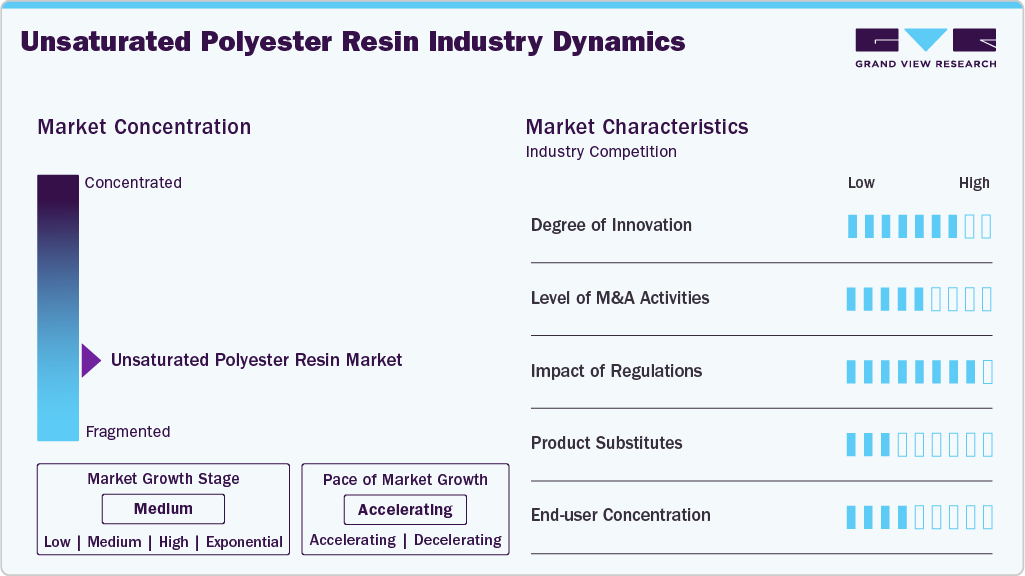

Market Concentration & Characteristics

The market growth stage is medium, and the pace of growth is accelerating. The market exhibits fragmentation, with key players dominating the industry landscape. Major companies such as INEOS, BASF SE, Polynt, Koninklijke DSM N.V., U-PICA Company. Ltd., Eternal Materials Co., Ltd., Satyen Polymers Pvt. Ltd., Dow Inc., UPC Group, Scott Bader Company Ltd., Tianhe Resin Co., Ltd., LERG SA, and others play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and applications to meet the evolving demands of the industry.

The unsaturated polyester resin market is progressing through targeted formulation and performance improvements. Companies are incorporating nano-additives and customized monomers to enhance strength, thermal stability, and environmental resistance, expanding the use of unsaturated polyester resin in demanding industries such as aerospace and automotive. A parallel effort toward bio-based and low-VOC resins reflects both regulatory standards and customer demand for sustainable solutions. These innovations are creating distinct product tiers and helping composite manufacturers meet changing performance and compliance standards.

Unsaturated polyester resin faces competition from alternative matrix materials that challenge its market share in specific applications. Epoxy resins attract customers where superior mechanical performance and adhesion are crucial, especially in high-end composites. Vinyl ester and phenolic resins are used where corrosion or fire resistance is important. In addition, thermoplastics such as nylon and advanced polypropylene grades are replacing unsaturated polyester resin in lightweight structural applications due to recyclability and lower emissions during processing.

Product Insights

Orthopthalic dominated the market across the product segmentation in terms of revenue, accounting for a market share of 34.98% in 2025, and is forecasted to grow at a 8.1% CAGR from 2026 to 2033. Their lower raw material costs and robust processing window make them the top choice for large commodity parts such as tanks, roofing sheets, and general-purpose laminates. Formulators use orthophthalic resins to meet strict price targets while providing acceptable chemical resistance. Market adoption is strengthened by broad converter familiarity and established supply chains that favor scale production and rapid quoting.

The DCPD segment is expected to expand at a substantial CAGR of 8.9% through the forecast period. DCPD-modified polyesters address performance gaps where standard grades fall short. These resins offer higher heat distortion resistance, better hydrolytic stability, and increased toughness compared to conventional orthophthalic systems. Producers market DCPD grades for automotive structural parts, electrical housings, and chemical containment, where longer life and tighter tolerances justify premium prices. Growth continues as end users seek lighter, longer-lasting parts with lower lifecycle costs.

Form Insights

Liquid form dominated the market across the form segmentation in terms of revenue, accounting for a market share of 72.90% in 2025, and is forecasted to grow at a 8.4% CAGR from 2026 to 2033. Liquid unsaturated polyester resins lead the market as they offer manufacturers greater flexibility in processing and wet-out reinforcement. They support methods such as hand lay-up, spray, infusion, and filament winding with consistent curing behavior. This versatility reduces manufacturing complexity for composite producers and accelerates time to market for new parts. As manufacturers shift to faster curing and low-styrene systems, liquid unsaturated polyester resins remain key to expanding composite production in construction and wind energy sectors.

The powder form segment is expected to expand at a substantial CAGR of 8.1% through the forecast period. Powder unsaturated polyester resin and unsaturated polyester resin-based powder coatings provide a solvent-free method for achieving durable, weather-resistant finishes on heat-sensitive substrates. Powder forms enhance workplace safety, lower VOC reporting requirements, and reduce curing energy by allowing targeted thermal or UV cure cycles. Their application is increasing in niche high-value markets such as decorative panels and protective coatings for composite parts. Ongoing research and development in flow and cure kinetics will expand powder coating adoption in industrial applications.

End Use Insights

Building & construction dominated the market across the end use segmentation in terms of revenue, accounting for a market share of 25.71% in 2025, and is forecasted to grow at a 7.9% CAGR from 2026 to 2033. Construction continues to be the largest single end market for unsaturated polyester resin due to demand for affordable, long-lasting materials. Unsaturated polyester resin enables lightweight panels, roofing, pipes, and water tanks that help reduce installation and maintenance costs. Urbanization and infrastructure renewal in Asia and Latin America support steady volume growth. Specifiers favor unsaturated polyester resin where service life and chemical resistance are important, but budget constraints limit more expensive alternatives. This creates a stable recovery path for resin suppliers.

The marine segment is expected to expand at a substantial CAGR of 9.3% through the forecast period. Marine applications drive demand for customized unsaturated polyester resin systems that combine affordability with seawater resistance. Recreational boat manufacturers and small commercial vessel yards prefer unsaturated polyester resin for hulls and deck parts because it wets glass reinforcements effectively and cures quickly. The segment values color stability and UV resistance due to outdoor exposure. Demand trends follow leisure spending and commercial fleet maintenance cycles, so market growth remains steady but is tied to discretionary and maritime trade indicators.

Regional Insights

The Asia Pacific unsaturated polyester resin industry held the largest share, accounting for 59.31% of the revenue in 2025, and is expected to grow at the fastest CAGR of 8.9% over the forecast period, owing to urbanization and infrastructure expansion. Unsaturated polyester resins see high demand in construction panels, pipes, and water storage systems. Rapid industrialization drives growth in electrical housings and transportation parts. Competitive costs and expanding local production make unsaturated polyester resin a favored choice in emerging economies.

China Unsaturated Polyester Resin Market Trends

China drives regional growth through large-scale infrastructure projects and domestic composite manufacturing. Unsaturated polyester resin is widely used in construction materials, chemical tanks, and marine components due to its scalability and cost efficiency. Expansion of wind energy and public utilities sustains long-term demand. Local producers continue to scale capacity to meet domestic needs and reduce reliance on imports.

North America Unsaturated Polyester Resin Market Trends

Demand in North America is driven by replacing aging infrastructure and consistent spending on advanced composite applications. Unsaturated polyester resins are favored for pipes, tanks, and panels due to their durability and affordability. Growth in recreational marine and aftermarket repair also boosts volumes. Manufacturers benefit from established composite manufacturing ecosystems and steady demand from housing renovations and utility projects.

In the U.S., the market is driven by residential construction activity and ongoing investments in water management systems. Demand for unsaturated polyester resin remains strong in bathroom fixtures, storage tanks, and corrosion-resistant components. The marine leisure segment contributes additional growth through boat manufacturing and refurbishments. Regulatory clarity and established supply chains help ensure steady production and consumption levels.

Europe Unsaturated Polyester Resin Market Trends

Europe’s unsaturated polyester resin market is influenced by sustainability regulations and the growing use of advanced composites. Demand is shifting toward low-emission and higher-performance resin grades to meet environmental standards. Key demand areas include building renovations, rail interiors, and wind energy components. Producers concentrate on formulation improvements to balance compliance costs with performance needs across various end-use sectors.

Key Unsaturated Polyester Resin Company Insights

The unsaturated polyester resin industry is highly competitive, with several key players dominating the landscape. Major companies include INEOS, BASF SE, Polynt, Koninklijke DSM N.V., U-PICA Company. Ltd., Eternal Materials Co., Ltd., Satyen Polymers Pvt. Ltd., Dow Inc., UPC Group, Scott Bader Company Ltd., Tianhe Resin Co., Ltd., and LERG SA. The unsaturated polyester resin industry is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key Unsaturated Polyester Resin Companies:

The following are the leading companies in the unsaturated polyester resin market. These companies collectively hold the largest market share and dictate industry trends.

- AOC, LLC

- INEOS

- BASF SE

- Polynt

- LERG SA

- Koninklijke DSM N.V.

- U-PICA Company. Ltd.

- Eternal Materials Co., Ltd.

- Satyen Polymers Pvt. Ltd.

- CIECH Group

- Dow Inc.

- UPC Group

- Scott Bader Company Ltd.

- Deltech Corporation

- Tianhe Resin Co., Ltd.

- Qualipoly Chemical Corp.

Recent Developments

-

In September 2024, Exel Composites agreed to buy over 100 tons of INEOS’s Envirez bio-based unsaturated polyester resin, marking commercial-scale use of a low-carbon UPR in pultrusion and composite profiles.

-

In July 2025, LyondellBasell and Polynt expanded a strategic collaboration to develop low-carbon marine resins using LYB’s Styrene +LC solution, targeting boat and yacht construction with improved carbon footprint.

Unsaturated Polyester Resin Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 15.77 billion

Revenue forecast in 2033

USD 27.51 billion

Growth rate

CAGR of 8.3% from 2026 to 2033

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Report segmentation

Product, form, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Spain; Italy; China; Japan; India; South Korea

Key companies profiled

INEOS; BASF SE; Polynt; Koninklijke DSM N.V.; U-PICA Company. Ltd.; Eternal Materials Co., Ltd.; Satyen Polymers Pvt. Ltd.; Dow Inc.; UPC Group; Scott Bader Company Ltd.; Tianhe Resin Co., Ltd.; LERG SA; AOC, LLC; CIECH Group; Deltech Corporation; Tianhe Resin Co., Ltd.; Qualipoly Chemical Corp.

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Unsaturated Polyester Resin Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the unsaturated polyester resin market report based on form, product, end use and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

DCPD

-

Orthopthalic

-

Isopthalic

-

Others

-

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Liquid Form

-

Powder Form

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Building & Construction

-

Tanks & Pipes

-

Electrical

-

Marine

-

Transport

-

Artificial Stones

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global unsaturated polyester resin market size was estimated at USD 14.75 billion in 2025 and is expected to reach USD 15.77 billion in 2026.

b. The global unsaturated polyester resin market is expected to grow at a compound annual growth rate of 8.3% from 2026 to 2033 to reach USD 27.51 billion by 2033.

b. Orthopthalic dominated the market across the product segmentation in terms of revenue, accounting for a market share of 34.98% in 2025, and is forecasted to grow at a 8.1% CAGR from 2026 to 2033.

b. Some key players operating in the unsaturated polyester resin market include INEOS, BASF SE, Polynt, Koninklijke DSM N.V., U-PICA Company. Ltd., Eternal Materials Co., Ltd., Satyen Polymers Pvt. Ltd., Dow Inc., UPC Group, Scott Bader Company Ltd., Tianhe Resin Co., Ltd., and LERG SA.

b. Increasing use of fiber-reinforced plastics in water tanks, pipes, and storage vessels is consistently boosting demand for unsaturated polyester resins. These applications prefer unsaturated polyester resin because of its low cost, good chemical resistance, and ease of processing on a large scale.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.