- Home

- »

- Pharmaceuticals

- »

-

Urothelial Cancer Drugs Market Size Report, 2030GVR Report cover

![Urothelial Cancer Drugs Market Size, Share & Trends Report]()

Urothelial Cancer Drugs Market Size, Share & Trends Analysis Report By Type (Urothelial Carcinoma, Squamous Cell Carcinoma, Adenocarcinoma), By Treatment, By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-429-1

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Report Overview

The global urothelial cancer drugs market size was valued at USD 3.24 billion in 2023 and is anticipated to grow at a CAGR of 11.1% from 2024 to 2030. This growth is driven by the rising prevalence of urothelial cancer, particularly bladder cancer. Innovations in cancer treatment, such as the development of targeted therapies and immunotherapies, have expanded the options available to patients, leading to more personalized and effective treatment plans.

In addition, increased investments in research and development by pharmaceutical companies are propelling the market forward. The growing geriatric population, which is more susceptible to urothelial cancer, further contributes to market growth. In addition, heightened awareness and early diagnosis of bladder-related conditions are encouraging more patients to seek treatment, thereby driving market expansion.

There has been a notable rise in funding dedicated to developing novel cancer therapies, with many companies focusing on innovative approaches such as immunotherapy and targeted therapies. This investment is crucial as it leads to the creation of new treatments that can improve patient outcomes and extend survival rates.

The approval of over 200 cancer drugs in recent years by regulatory agencies such as the FDA indicates a favorable environment for drug development. This trend encourages companies to invest more in R&D, knowing that successful innovations can quickly reach the market. For instance, Janssen Pharmaceuticals has made significant strides in developing a new treatment for metastatic urothelial cancer, supported by strong clinical trial results and expedited review processes due to its potential benefits.

Companies are also forming strategic partnerships and collaborations to enhance their R&D capabilities. For example, FUJIFILM Corporation's joint project with the National Cancer Center Japan focuses on developing new immunotherapies, showcasing a commitment to advancing cancer treatment through collaborative research efforts.

Type Insights

The urothelial carcinoma segment accounted for 57.5% of the market revenue in 2023. Urothelial carcinoma, also known as transitional cell carcinoma, is the most common type of bladder cancer, representing about 90% of all bladder cancer cases. This high prevalence significantly drives the demand for effective treatments. The segment’s dominance is further reinforced by advancements in targeted therapies and immunotherapies, which have improved treatment outcomes and patient survival rates.

On the other hand, the squamous cell carcinoma segment is expected to grow at a CAGR of 10.0% from 2024 to 2030 attributed to the increasing focus on developing specialized treatments for this type of cancer. Advances in molecular biology and a better understanding of the disease’s pathogenesis are leading to the development of targeted therapies that can more effectively combat squamous cell carcinoma. Moreover, the rising incidence of this cancer type, particularly in regions with high rates of chronic bladder irritation and infection, is driving the demand for new and effective treatment options.

Treatment Insights

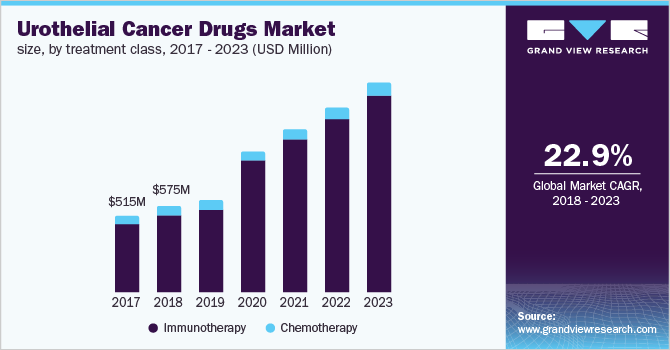

The immunotherapy segment held the largest revenue share in the global urothelial cancer drugs market in 2023 attributed to the success of immune checkpoint inhibitors, such as pembrolizumab and atezolizumab, which have shown significant efficacy in treating urothelial carcinoma. These therapies have become a cornerstone in the management of advanced and metastatic urothelial cancer, offering improved survival rates and better quality of life for patients.

The targeted therapy segment is expected to grow significantly over the forecast period as targeted therapies have gained traction due to its potential to offer more effective and less toxic treatment options compared to traditional chemotherapy. The growth of this segment is fueled by advancements in molecular biology and genomics, which have led to the identification of new therapeutic targets and the development of novel targeted agents. For instance, the approval of FGFR inhibitors for patients with specific genetic mutations in urothelial cancer has opened new avenues for personalized treatment.

End Use Insights

The hospital segment dominated the global urothelial cancer drugs market in 2023 driven by the availability of multidisciplinary teams that can offer personalized treatment plans tailored to individual patient needs. Additionally, hospitals often participate in clinical trials, providing patients access to cutting-edge therapies that may not be available in other settings. The extensive infrastructure and resources available in hospitals ensure that patients receive high-quality care, contributing to the segment’s significant market share.

The clinics segment is expected to grow at the fastest rate from 2024 to 2030. Clinics, including specialized cancer treatment centers and outpatient facilities, are becoming increasingly popular due to their accessibility and convenience. Advances in medical technology and the development of less invasive treatment options have made it feasible to administer complex cancer therapies in clinic settings. Furthermore, clinics are often more cost-effective than hospitals, making them an attractive option for both patients and healthcare providers. The increasing number of clinics specializing in cancer care and their expanding capabilities are expected to drive significant growth in this segment over the forecast period.

Regional Insights

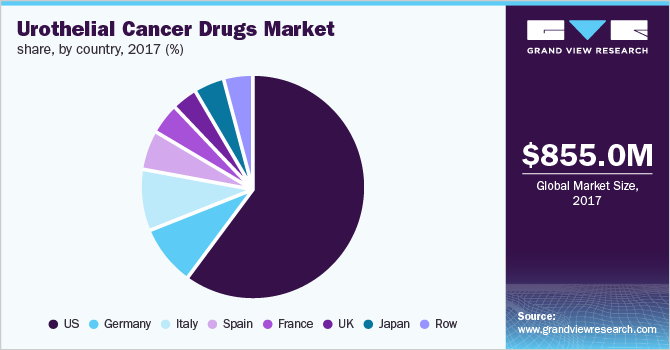

North America dominated the global urothelial cancer drugs market with a revenue share of 37.7% in 2023, driven by a high prevalence of bladder cancer and the availability of advanced treatment options. The region’s strong healthcare infrastructure and significant investment in research and development have also contributed to its leading position.

U.S. Urothelial Cancer Drugs Market Trends

The U.S. accounted for the largest revenue share in the North America urothelial cancer drugs market in 2023 attributed to the high incidence of urothelial cancer, with 82,290 new cases and 16,710 deaths from bladder cancer reported in the year according to the National Cancer Institute. Extensive healthcare spending, significant investment in research and development, and the presence of major pharmaceutical companies further bolster this position. The aging population and lifestyle factors such as smoking increase the demand for effective treatments. In addition, the incidence of new cases and mortality rates are slowly declining in the U.S. by about 1% a year, reflecting the region's strong healthcare infrastructure and ongoing advancements in medical research.

Asia Pacific Urothelial Cancer Drugs Market Trends

The Asia Pacific region is projected to witness the fastest CAGR of 12.1% over the forecast period owing to the factors such as increasing awareness about cancer treatments, improving healthcare infrastructure, and rising healthcare expenditure are driving this growth. Countries such as China and India are at the forefront due to their large populations and growing incidence of cancer.

China urothelial cancer drugs market held a substantial share in Asia Pacific in 2023, supported by a large patient population and increasing government initiatives to improve cancer care. The presence of local pharmaceutical companies and ongoing clinical trials for new treatments also contribute to the market’s expansion. In 2024, China's National Medical Products Administration (NMPA) approved PADCEV for treating locally advanced or metastatic urothelial cancer, accepted Astellas' sBLA for urothelial cancer treatment, and approved Mabwell to conduct a Phase III trial for an urothelial carcinoma drug. These regulatory developments underscore China's dedication to advancing cancer care and broadening treatment options.

Europe Urothelial Cancer Drugs Market Trends

The European urothelial cancer drugs market is projected to grow steadily from 2024 to 2030 driven by the increasing adoption of advanced therapies, supportive government policies, and a rising number of clinical trials. Countries such as Germany, the UK, and France are key contributors to the market due to their robust healthcare systems.

MEA Urothelial Cancer Drugs Market Trends

The Middle East and Africa (MEA) urothelial cancer drugs market is projected to grow at a CAGR of 10.0% over the forecast period fueled by improving healthcare infrastructure, increasing awareness about cancer treatments, and rising investments in healthcare by governments and private sectors.

Key Companies & Market Share Insights

The global urothelial cancer drugs market is driven by major companies such as Merck & Co., Inc., F. Hoffmann-La Roche AG, AstraZeneca PLC, and Novartis AG, among others.

-

Merck & Co., Inc. is a significant player in the urothelial cancer drugs market, primarily through its development of pembrolizumab (Keytruda), an anti-PD-1 therapy. This drug has been pivotal in treating various cancers, including urothelial carcinoma. Pembrolizumab was granted accelerated FDA approval for patients with locally advanced or metastatic urothelial carcinoma who have disease progression during or following platinum-containing chemotherapy.

-

AstraZeneca PLC has made substantial advancements in the urothelial cancer treatment landscape with its drug durvalumab (Imfinzi), which received accelerated approval for locally advanced or metastatic urothelial carcinoma and is currently being evaluated in various clinical trials for its efficacy in combination with chemotherapy.

Key Urothelial Cancer Drugs Companies:

The following are the leading companies in the urothelial cancer drugs market. These companies collectively hold the largest market share and dictate industry trends.

- Merck & Co., Inc.

- F. Hoffmann-La Roche AG

- Bristol-Myers Squibb Company

- AstraZeneca PLC

- Novartis AG

- GlaxoSmithKline PLC

- Sanofi SA

- Pfizer Inc.

- Astellas Pharma Inc.

- UroGen Pharma Ltd.

Recent Developments

-

In May 2024, Novartis acquired German biotech MorphoSys, expanding its oncology pipeline with several clinical-stage candidates. The acquisition included a clinical trial evaluating ARID1A-mutated endometrial cancer patients, as well as cohorts of patients with urothelial cancer, ovarian cancer, mesothelioma, refractory lymphomas, or soft-tissue disease. The trial focuses on patients with specific genetic mutations associated with these cancers, such as ARID1A or BAP1.

-

In January 2024, ImmunityBio, Inc. finalized a strategic partnership with Oberland Capital, obtaining up to USD 320 million in royalty financing and equity investment. This substantial capital injection will accelerate the company's commercialization initiatives, bolstering its prospects for potential regulatory approval. Furthermore, these added resources will empower ImmunityBio to broaden its research and development portfolio in the expansive field of urological cancer.

-

In January 2024, the U.S. Food and Drug Administration granted full approval to Johnson & Johnson’s (J&J) oral FGFR kinase inhibitor, Balversa (erdafitinib), for the treatment of adult patients with locally advanced or metastatic urothelial carcinoma harboring susceptible FGFR3 genetic alterations. This approval extends Balversa’s indication to patients whose disease has progressed following at least one prior line of systemic therapy.

-

In December 2023, the FDA granted accelerated approval for the combination of enfortumab vedotin (Padcev) and pembrolizumab (Keytruda) for treating adult patients with locally advanced or metastatic urothelial carcinoma.

Urothelial Cancer Drugs Market Scope

Report Attribute

Details

Market size value in 2024

USD 3.60 billion

Revenue forecast in 2030

USD 6.78 billion

Growth rate

CAGR of 11.1% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, treatment, end use, region

Key companies profiled

Merck & Co., Inc., F. Hoffmann-La Roche AG, Bristol-Myers Squibb Company, AstraZeneca PLC, Novartis AG, GlaxoSmithKline PLC, Sanofi SA, Pfizer Inc., Astellas Pharma Inc., UroGen Pharma Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Urothelial Cancer Drugs Market Segmentation

This report forecasts revenue & volume growth of the urothelial cancer drugs market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global agrochemicals market report based on type treatment, end use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Urothelial Carcinoma

-

Squamous Cell Carcinoma

-

Adenocarcinoma

-

-

Treatment Outlook (Revenue, USD Million, 2018 - 2030)

-

Chemotherapy

-

Immunotherapy

-

Targeted Therapy

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."