- Home

- »

- Medical Devices

- »

-

U.S. Active Adults (55+) Community Market Size Report, 2033GVR Report cover

![U.S. Active Adults (55+) Community Market Size, Share & Trends Report]()

U.S. Active Adults (55+) Community Market (2025 - 2033) Size, Share & Trends Analysis Report By Gender (Women, Men), By Country (West, Southeast, Southwest, Midwest, Northeast), And Segment Forecasts

- Report ID: GVR-4-68039-165-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

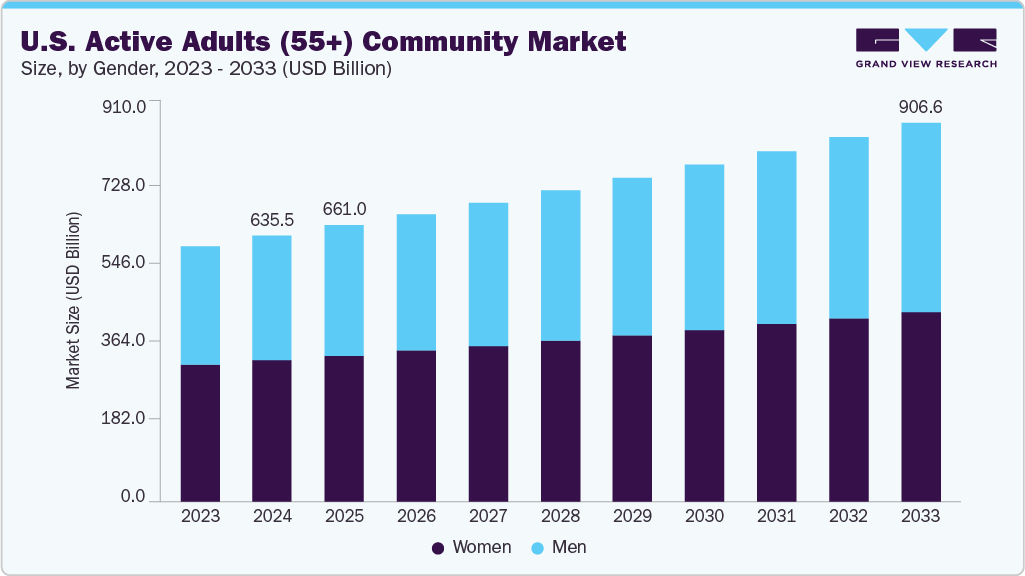

The U.S. active adults (55+) community market size was estimated at USD 635.5 billion in 2024 and is projected to reach USD 906.6 billion by 2033, growing at a CAGR of 4.02% from 2025 to 2033. This growth is fueled by the rapid increase in the aging population, with baby boomers reaching retirement age and seeking vibrant lifestyles beyond traditional senior living. Changing lifestyle preferences, such as the desire for downsizing and maintenance-free living, also play a crucial role. Furthermore, cultural shifts toward “active aging,” emphasizing socialization, travel, hobbies, and lifelong learning, are reinforcing demand for these communities.

Increasing Demand from Aging Baby Boomers

Living preferences of baby boomers are changing, as this population wants to stay independent and lead an active lifestyle. Post-retirement, they prefer to relocate to communities that have residents with shared values and not senior living or assisted living facilities. For instance, the active population in the U.S. aged 55-64 stood at approximately 27.45 million persons in July 2025, according to the U.S. Federal Reserve. This figure highlights the significant presence of older adults who remain engaged in the labor force or are otherwise economically active. In the senior living market, the active adult community has gained a huge market demand and investor appeal in the last few years. This is attributed to the growing demand for independent and maintenance-free living among the age group of 55 to 64 years.

As this generation seeks to downsize or find housing that aligns with their lifestyle, active adult communities present an attractive option that offers low-maintenance living along with amenities that promote social interaction, fitness, and overall wellness. For instance, Del Webb, a prominent developer of 55+ communities, has expanded its projects in both traditional retirement destinations such as Arizona and Florida, as well as suburban areas close to urban centers for Boomers wanting to stay near family while enjoying retirement benefits. Villages in Florida exemplify how the demand from Baby Boomers has spurred extensive development in the area, becoming one of the fastest-growing metro regions in the country.

Preference for Lifestyle-Oriented Living

Today’s older adults have a different perspective on retirement housing compared to earlier generations. Rather than simply viewing it as a place to live, they are now looking for communities that enrich their daily lives, emphasizing health, recreation, and social connection. These individuals are increasingly drawn to environments that provide fitness centers, golf courses, walking and biking trails, wellness and nutrition programs, and various social clubs that promote community engagement.

This shift reflects a rising demand for experience-based living, where housing is paired with amenities that enhance physical vitality, mental stimulation, and emotional well-being. Consequently, developers and operators are creating communities that focus on comfortable homes and vibrant, holistic lifestyles. This approach enables residents to remain active, connected, and fulfilled well into their later years.

Healthcare Accessibility & Integrated Wellness

As people age, healthcare needs become more frequent, and the ability to access medical services conveniently is a key consideration when choosing where to live. Active adult communities increasingly emphasize “aging in place,” offering wellness programs, preventive care initiatives, fitness classes, nutrition guidance, and in some cases, partnerships with nearby hospitals and specialty clinics. This model reduces the stress of managing multiple healthcare providers and enhances residents’ quality of life by keeping them healthy, independent, and socially engaged for longer. By embedding healthcare and wellness into the community design, developers cater to a generation of retirees that values both proactive health management and convenience.

Such as:

-

The Villages (Florida): Offers on-site wellness centers, fitness programs, and nearby hospital partnerships, making healthcare access seamless.

-

Del Webb Communities (nationwide): Includes fitness centers, walking trails, and health-focused events, often located near regional healthcare hubs.

-

Sun City (Arizona): Features recreation centers alongside easy access to Banner Boswell Medical Center, which specializes in senior care.

-

Latitude Margaritaville (Florida & South Carolina): Provides wellness programs and is strategically located close to top medical facilities for senior care.

Technological Adoption & Smart Living

An increasing number of older adults are becoming comfortable with digital technology, making innovative living solutions a significant driver in the U.S. active adults 55+ community industry. These solutions range from smart home devices such as automated lighting, voice-controlled assistants (such as Alexa and Google Home), and security systems, to health-related innovations including wearable fitness trackers, telehealth services, and remote monitoring. Technology is becoming an integral part of daily life. Active adult communities incorporating these features enhance safety and convenience while supporting residents' ability to live independently for extended periods. For instance, telehealth access reduces the necessity for frequent clinic visits, and emergency alert systems, along with fall-detection sensors, provide peace of mind.

Moreover, communities that offer high-speed internet, app-based resident engagement platforms, and virtual social events are particularly appealing to the growing number of tech-savvy retirees. This seamless integration of digital solutions positions technology-driven communities as highly attractive options for modern adults aged 55 and older who seek both comfort and connectedness.

Instance

Description

Benefit to Residents

Smart Home Systems

Automated lighting, thermostat control, and voice assistants

Energy savings, ease of use, accessibility

Telehealth Platforms

Virtual doctor consultations are integrated into community services

Convenience, reduced travel for care

Wearable Health Devices

Smartwatches with heart rate, sleep, and fall detection

Continuous health monitoring, early alerts

Community Apps/Portals

Digital platforms for event sign-ups, maintenance requests, and social forums

Enhance engagement and communication

Remote Security Systems

Smart door locks, video doorbells, surveillance cameras

Increase safety and peace of mind

Insights into Regional Migration Patterns, Boomer Lifestyle Preferences, Or Developer Strategies

Category

Insight

Examples

Regional Migration Patterns

Baby Boomers are relocating to states with mild climates, low taxes, and a high quality of life. There is a shift from traditional retiree states to emerging markets closer to family and healthcare.

Florida (The Villages), Arizona (Sun City), North Carolina (Raleigh), Texas (Austin), Tennessee

Boomer Lifestyle Preferences

Boomers value health, wellness, and social connectivity. Desired amenities include fitness centers, pickleball, arts, educational programs, and volunteer opportunities. They prefer active, engaging environments with easy access to healthcare and pet-friendly policies.

Latitude Margaritaville (FL/SC/TN), Del Webb communities with robust lifestyle programming

Developed Strategies

Developers are expanding into non-traditional markets, offering flexible pricing, aging-in-place home designs, and tech-enabled smart homes. Mixed-use developments that offer convenience and community integration are on the rise.

Del Webb (nationwide), Lennar, Toll Brothers; homes with no-step entries, smart tech, wide halls

Source: Grand View Research Analysis

Below are the emerging markets in the U.S. active adult (55+) community sector where developers are seeing increasing demand from Baby Boomers looking for alternatives to traditional retirement states:

Region/State

Why It’s Emerging

Example Communities

North Carolina

Mild climate, relatively low cost of living, strong healthcare systems, and proximity to the East Coast family.

Carolina Arbors by Del Webb (Durham), Brunswick Forest (Leland)

South Carolina

Tax-friendly, coastal access, and growing towns such as Greenville and Charleston offer culture and walkability.

Sun City Hilton Head (Bluffton), Del Webb Charleston

Texas

No state income tax, diverse cities, affordable land, and access to top-tier medical facilities in Austin, Dallas, and San Antonio.

Del Webb Sweetgrass (Richmond), Kissing Tree (San Marcos)

Tennessee

Low taxes, natural beauty (Smoky Mountains), moderate climate, and access to healthcare hubs such as Nashville and Knoxville.

Del Webb Southern Springs (Spring Hill)

Georgia

Warm climate, tax incentives for retirees, and growing metro areas such as Atlanta with strong healthcare infrastructure.

Sun City Peachtree (Griffin), Cresswind at Lake Lanier (Gainesville)

Colorado

Appeals to active, outdoorsy retirees; offers scenic beauty, walkability, and a high quality of life in places such as Fort Collins and Colorado Springs.

Banning Lewis Ranch (Colorado Springs), The Retreat at Banning Lewis

Idaho & Utah

Lower cost of living than West Coast states, access to outdoor recreation, and quieter, low-crime environments.

Valencia Park (Eagle, ID), SpringHouse Village (South Jordan, UT)

Source: Grand View Research Analysis

These regions are attracting developers and senior citizens due to a combination of affordability, lifestyle amenities, and strategic locations. Let me know if you want to focus on any one state’s community profiles or compare the cost of living and taxes across these areas.

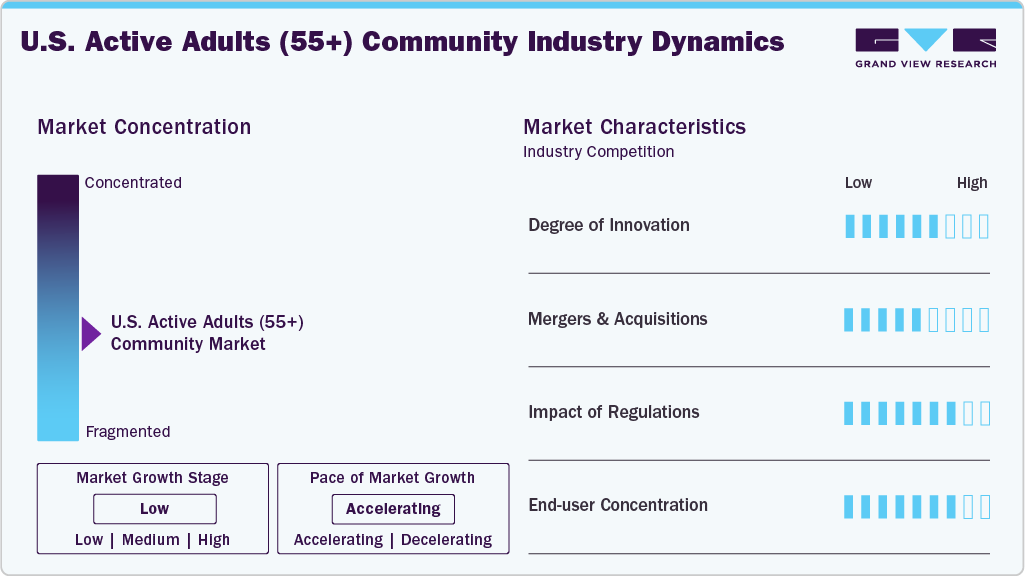

Market Concentration & Characteristics

The chart below represents the relationship between industry concentration, characteristics, and participants. The x-axis shows the level of industry concentration, ranging from low to high. The y-axis represents various market characteristics, such as degree of innovation, impact of regulations, industry competition, service and product expansion, level of partnerships and collaboration activities, and regional expansion. For instance, the industry is fragmented, with many service providers entering the market. There is a high moderate degree of innovation, a moderate level of merger & acquisitions activities, a moderate impact of regulations, and a moderate end user concentration in the industry.

The U.S. active adults 55+ community industry is experiencing a high degree of innovation. Communities such as Laguna Woods Village and Sun City, Texas, offer innovative, lifestyle-focused environments that cater to the evolving expectations of today’s retirees. Instead of simply providing age-restricted housing, these communities emphasize creativity, wellness, sustainability, and experiential living. Many features are unique themes, such as farm-to-table living, where residents can participate in community gardens, or university-based retirement communities (UBRCs) that offer lifelong learning opportunities and access to campus resources.

The market players are leveraging strategies such as collaborations, partnerships, and acquisitions to promote the reach of their offerings and increase their service capabilities. In August 2025, Capital Square acquired an active adult, build-for-rent community near San Antonio, Texas-specifically in Fredericksburg-to launch a new Delaware Statutory Trust (DST) offering under its Section 1031 tax-advantaged investment platform. This investment capitalizes on strong demographic trends, robust rent growth, and high demand in lifestyle-oriented, retirement-appealing markets.

Whitson Huffman, co-chief executive officer and chief investment officer of Capital Square, said:

“The launch of this offering highlights the increasing demand for purpose-built, active adult rental communities in lifestyle-driven markets like Fredericksburg. Fredericksburg offers exceptional regional demographics, rising rent trends and expansive regional growth, and we believe that this property is uniquely positioned to provide high-quality housing and the potential for long-term value to our investors.”

The regulatory framework for the industry involves compliance with industry-specific guidelines and standards to ensure accuracy and consistency. At the federal level, the Housing for Older Persons Act (HOPA, 1995) provides an exemption from the Fair Housing Act, allowing communities to lawfully market themselves as “55+” or “age-restricted” housing, provided that at least 80% of the units are occupied by at least one resident aged 55 or older. Compliance with this rule requires communities to maintain clear age-verification policies and documentation. In addition, regulations influence how amenities, accessibility features, and housing designs meet Americans with Disabilities Act (ADA) standards to support aging residents with mobility or functional needs.

The majority of end users are concentrated in suburban and Sunbelt regions (Florida, Arizona, Texas, Nevada, and the Carolinas), where favorable climates, tax benefits, and established retirement hubs amplify market demand. As a result, developers and operators often tailor their offerings specifically to this concentrated demographic, with product design, pricing, and community features closely aligned to the preferences of active, financially secure older adults. This concentrated demand ensures consistent market growth and increases competition among developers to differentiate their communities through lifestyle, technology, and healthcare integration.

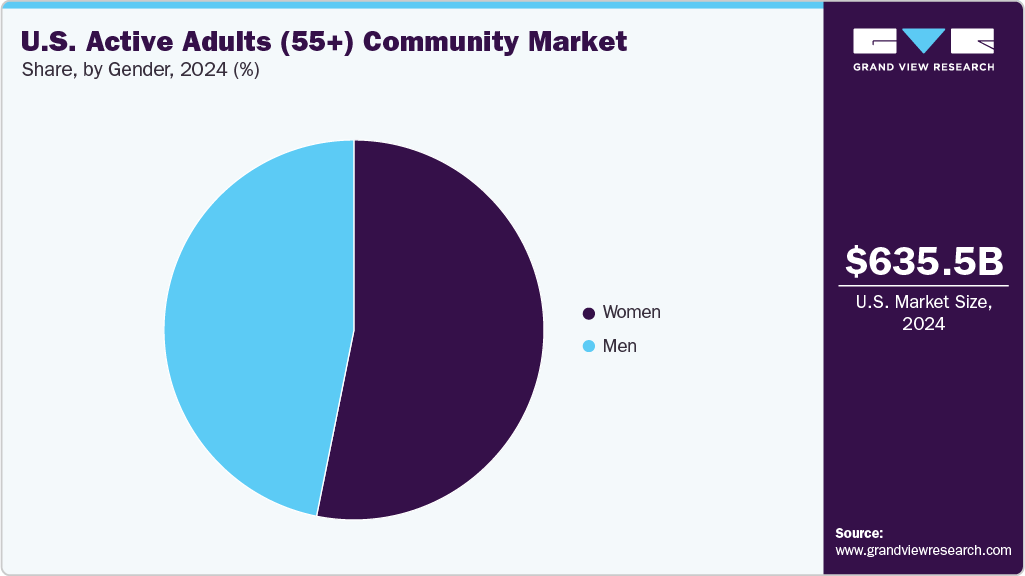

Gender Insights

The women segment dominated the U.S. active adults 55+ community market with a revenue share of 53.2% in 2024. The increase in the number of women is driven by demographic changes, increased longevity, and shifting lifestyle preferences. Women generally have a longer life expectancy than men, around five years more on average, leading to a larger number of single, widowed, or divorced women reaching retirement age who are looking for safe, socially enriching living environments. Many of these women appreciate community, autonomy, and convenience, which makes active adult communities particularly attractive. For instance, locations such as Sun City in Arizona and Del Webb’s developments nationwide commonly offer women-led clubs, wellness programs, and volunteer opportunities that promote strong social connections.

The men segment is expected to register the fastest CAGR during the forecast period, driven by lifestyle, health, and social factors. Many men in the 55+ age group seek environments that promote active living and recreational opportunities, such as golf courses, fitness centres, walking trails, swimming pools, and sports clubs. Unlike traditional retirement models, today’s male active adults prefer communities where they can maintain physical vitality and pursue hobbies such as cycling, fishing, woodworking, or gaming. Health and wellness access is another key driver, as men are increasingly conscious of preventive healthcare, nutrition, and fitness to extend healthy aging. Social connectivity also plays a crucial role as these communities provide structured activities, men’s clubs, and peer groups that help counter isolation, especially for widowers or divorced individuals.

Country Insights

Southeast Active Adults (55+) Community Market Trends

The Southeast region (including Florida, the Carolinas, Georgia, and parts of Tennessee) has emerged as one of the most attractive markets for active adults 55+ communities, due to a combination of climate, affordability, and lifestyle appeal. The region’s warm weather and mild winters make it highly desirable for retirees seeking year-round outdoor activities such as golf, walking, and water recreation. In addition, states such as Florida and Tennessee offer tax advantages, including no state income tax and relatively lower property taxes, which enhance the financial feasibility of relocating. The Southeast also provides a wide range of master-planned communities that feature resort-style amenities, fitness centers, clubhouses, wellness programs, and cultural activities that cater to the active lifestyle preferences of today’s older adults.

Midwest Active Adults (55+) Community Market Trends

The Midwest region is expected to witness substantial growth over the forecast period, driven by a combination of affordability, lifestyle preferences, and demographic shifts. Unlike coastal or Sunbelt states, the Midwest offers lower housing costs and overall cost of living, making it attractive for retirees and downsizers seeking value without compromising quality of life. Many older adults in the Midwest also prefer to “age in place” near family, friends, and familiar cultural settings, rather than relocating to distant retirement hubs. This proximity to social networks is a strong driver of community development in the region. Moreover, the Midwest’s expanding healthcare infrastructure, including large hospital networks and specialty clinics, supports the health and wellness needs of older adults. Developers are responding by creating low-maintenance housing with modern amenities, fitness facilities, walking trails, and community centers tailored to an active lifestyle.

Key U.S. Active Adults (55+) Community Company Insights

The market is fragmented, dominated by a few large players. These companies focus on creating communities that emphasize independent living, social engagement, wellness, and low-maintenance housing tailored to the preferences of the 55+ population. Leading players have established a strong presence through master-planned communities, resort-style amenities, and innovative housing models that appeal to both downsizing retirees and active older adults seeking a vibrant lifestyle. In addition, many companies are expanding into new geographic regions, including the Sunbelt and the Midwest, to capture growing demand.

Key U.S. Active Adults (55+) Community Companies:

- PULTEGROUP, INC

- Holding Company of The Villages, Inc.

- Latitude Margaritaville

- Hot Springs Village

- Rossmoor

- Robson Communities

- Sun Lakes of Arizona

- Green Valley

- Del Webb

- Sun City Center

- Trilogy

- Brookdale Senior Living Inc.

- Oxford Senior Living

Recent Developments

-

In April 2025, Viva Bene, the nation’s first 55+ active adult rental community, opened in Missouri, combining attainably priced housing with preventive healthcare. This community model enables residents to access wellness programs, routine health screenings, and preventive care services within their living environment, effectively promoting healthier aging while reducing the reliance on acute healthcare interventions. By integrating affordable housing with proactive health management, Viva Bene creates a synergistic approach that supports independence, lowers long-term medical costs, and enhances overall quality of life for active adults.

Laurie Schultz, co-founder and principal of Viva Bene and Avenue, said:

"We set out to create a model that empowers residents to live healthier, more fulfilling lives in a community offering opportunities for an engaging lifestyle and convenient access to preventive healthcare -- and to do so at a price point far lower than most retirement communities," "Viva Bene changes the 'senior living' paradigm by incorporating early access to care navigation and chronic care management. It's about proactive prevention and infusing wellness into everyday life so people can thrive."

-

In January 2025, Chicago-based healthcare real estate investment firm Greene Park Capital entered the active adult housing sector with the acquisition of a 225-unit community in the Boston metro area. This marks the firm's inaugural investment in age-restricted, lifestyle-oriented living. The property, branded as Everleigh Cape Cod, offers a range of amenities, including fitness centers, game rooms, and outdoor spaces such as bocce courts and pickleball courts.

Jordyn Berger, partner of the senior housing investment platform at Greene Park Capital, said.

“The institutions are going to want to get into the sector, but there hasn’t been a large enough kind of portfolio trade for them to get into the sector,” “Some of the large private equity, they want to invest at least $100 million of equity, and these deal sizes are just not there. I would say the average one we’re kind of buying is anywhere from $30 million to $75 million.”

U.S. Active Adults (55+) Community Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 661.0 billion

Revenue forecast in 2033

USD 906.6 billion

Growth rate

CAGR of 4.02% from 2025 to 2033

Actual data

2021 - 2024

Forecast data

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Gender, country

Country scope

U.S.

Key companies profiled

PULTEGROUP INC.; Holding Company of The Villages, Inc.; Latitude Margaritaville; Hot Springs Village; Rossmoor; Robson Communities; Sun Lakes of Arizona; Green Valley; Del Webb; Sun City Center; Trilogy; Brookdale Senior Living Inc.; Oxford Senior Living

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Active Adults (55+) Community Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. active adults (55+) community market report based on gender and country:

-

Gender Outlook (Revenue, USD Billion, 2021 - 2033)

-

Women

-

Men

-

-

Country Outlook (Revenue, USD Billion, 2021 - 2033)

-

West

-

Southeast

-

Southwest

-

Midwest

-

Northeast

-

Frequently Asked Questions About This Report

b. The U.S. active adults 55+ community market size is expected to reach USD 906.6 billion by 2033, growing at a CAGR of 4.02% from 2025 to 2033.

b. The U.S. active adult (55+) community market was estimated at USD 635.5 billion in 2024.

b. Some key players operating in the U.S. active adult (55+) community market include PULTEGROUP INC., Holding Company of The Villages, Inc., Latitude Margaritaville, Hot Springs Village, Rossmoor, Robson Communities, Sun Lakes of Arizona, Green Valley, Del Webb, Sun City Center, Trilogy, Brookdale Senior Living Inc., Oxford Senior Living.

b. The rapid growth of the aging population, with baby boomers entering retirement age and seeking vibrant lifestyles beyond traditional senior living are the key factors expected to fuel the U.S. active adult (55+) community market. Furthermore, cultural shifts toward “active aging,” emphasizing socialization, travel, hobbies, and lifelong learning, reinforce demand for these communities.

b. The women segment dominated the market and accounted for a share of 84.12% in 2024 attributed to demographic changes, increased longevity, and shifting lifestyle preferences.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.