- Home

- »

- Advanced Interior Materials

- »

-

U.S. Aluminum Curtain Walls Market Size Report, 2030GVR Report cover

![U.S. Aluminum Curtain Walls Market Size, Share & Trends Report]()

U.S. Aluminum Curtain Walls Market Size, Share & Trends Analysis Report By Wall Type (Stick-built, Semi-unitized & Unitized), By End Use (Commercial & Residential), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-530-4

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Report Overview

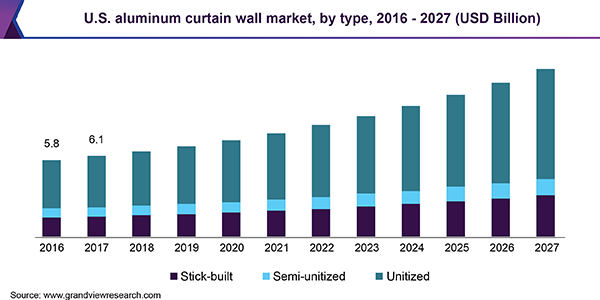

The U.S. aluminum curtain walls market size was valued at USD 6.14 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 7.5% from 2024 to 2030. The increasing construction sector plays a significant role in driving the market's growth. Government is making substantial investments in infrastructure development, which includes building new structures and upgrading existing ones. Technological advancements positively influence the market growth of aluminum curtain walls. The implementation of innovative curtain walls systems with enhanced thermal efficiency, structural integrity, and simplified installation elevates their appeal. Moreover, the integration of smart technologies such as sensors and actuators allows for remote monitoring and control of building applications, enhancing the effectiveness of aluminum curtain walls.

The growing focus on sustainability and green construction methods has raised the need for eco-conscious building materials. Due to its full recyclability, aluminum plays a significant role in promoting sustainable construction. Consequently, companies and real estate developers are acknowledging the profit-making opportunities of environmentally friendly aluminum curtain wall construction. Growing businesses, a rising middle class, and the demand for both commercial and residential properties have led to a rise in real estate investments.

The demand for office spaces, retail outlets, and hospitality facilities is driving construction activity across the country. Rising housing prices and increased population have led to a surge in residential construction projects. Aluminum curtain walls offer a sleek and modern aesthetic that is increasingly popular in contemporary architecture. Aluminum curtain walls can be integrated with smart building technologies to optimize energy use and improve occupant comfort. Advancements in manufacturing techniques and materials have led to the development of more efficient and durable curtain wall systems further driving the market growth.

Wall Type Insights

The unitized segment dominated the market in 2023. Unitized curtain walls are prefabricated wall panels that are assembled off-site and then installed as complete units on the building. This method offers several advantages, including faster installation times, improved quality control, and reduced on-site labor. The increasing demand for unitized curtain walls can be attributed to the desire for efficient construction, enhanced energy efficiency, and the ability to incorporate complex architectural designs.

The stick-built segment is projected to grow significantly over the forecast period. The stick-built method for aluminum curtain walls is typically more economical than unitized systems. This cost-effectiveness comes from various factors, such as decreased material wastage, lower labor expenses from easier installation methods, and reduced reliance on specialized machinery. Due to tightening construction budgets, builders are choosing more options that provide quality and affordability, which is increasing the popularity of stick-built systems.

End Use Insights

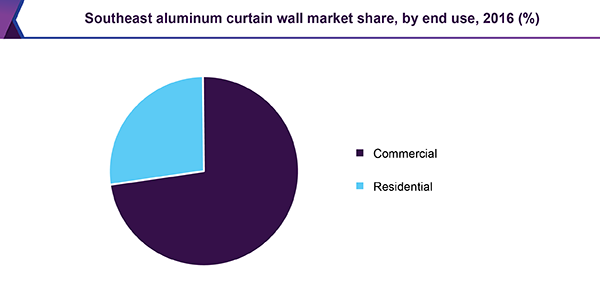

The commercial segment dominated the market accounting for a market revenue share of 72.4% in 2023. The increasing demand for modern and energy-efficient office spaces, retail outlets, and hospitality facilities has driven the adoption of aluminum curtain walls. These walls offer a sleek and contemporary aesthetic, while also providing excellent thermal and acoustic performance. Moreover, the ability to incorporate large expanses of glass into aluminum curtain walls allows for natural light and views, enhancing the overall occupant experience.

The residential segment is projected to grow significantly over the forecast period. The growing trend towards modern and minimalist home designs has fueled the demand for these walls. Aluminum curtain walls offer a clean and contemporary look, while also providing durability and low maintenance. Furthermore, the ability to customize aluminum curtain walls to match specific architectural styles and preferences has made them a desirable choice for discerning homeowners.

Key Companies And Market Share Insights

Some key companies in the U.S. aluminum curtain walls market include Aluflam North America, Alumil Aluminum Industry S.A., EFCO, LLC, Enclos Corp., Kalwall, Kawneer Group Inc. and others. These companies are hugely investing in R&D for introducing eco-friendlier systems.

Key U.S. Aluminum Curtain Walls Companies:

- Aluflam North America

- Alumil Aluminum Industry S.A.

- EFCO, LLC

- Enclos Corp.

- Kalwall

- Kawneer Group Inc.

- National Enclosure Company

- PRL Glass Systems

- TUBELITE

- Trulite

Aluminum Curtain Walls Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.48 billion

Revenue forecast in 2030

USD 10.00 billion

Growth Rate

CAGR of 7.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Wall Type, End Use

Regional scope

U.S.

Country scope

U.S.

Key companies profiled

Alumil; Aluplex; ALUTECH; EFCO, LLC; Enclos Corp.;GUTMANN Group; HansenGroup; heroal; HUECK System GmbH & Co. KG; Josef Gartner GmbH; Kalwall; Kawneer Company, Inc.; National Enclosure Company; Ponzio; Purso; RAICO Bautechnik GmbH; Reynaers; SAPA; Schüco India; Skansa

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Aluminum Curtain Walls Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. aluminum curtain wall market report based on, wall type, application, and region.

-

U.S. Aluminum Curtain Walls Market Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Stick-built

-

Semi-unitized

-

Unitized

-

-

U.S. Aluminum Curtain Walls Market Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Commercial

-

Residential

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."