- Home

- »

- Medical Devices

- »

-

U.S. Anti-snoring Devices And Snoring Surgery Market Report, 2030GVR Report cover

![U.S. Anti-snoring Devices And Snoring Surgery Market Size, Share & Trends Report]()

U.S. Anti-snoring Devices And Snoring Surgery Market Size, Share & Trends Analysis Report By Type (Oral Appliances/Mouthpieces, Nasal Devices, Position Control Devices, Chin Straps), By Country, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-025-3

- Number of Report Pages: 74

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

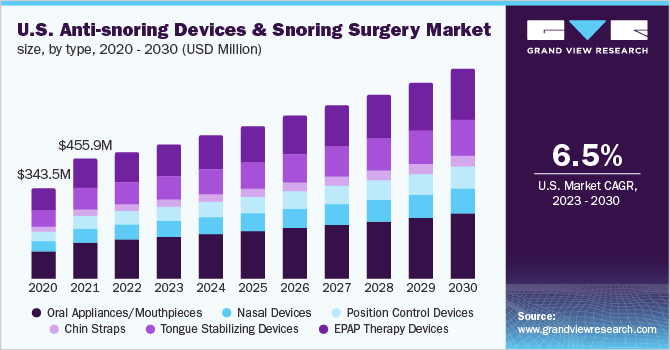

The U.S. anti-snoring devices and snoring surgery market size was valued at USD 483.7 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.5% from 2023 to 2030. The rising prevalence of obesity, the easy availability of products through offline and online channels in the U.S., and the launch of technologically advanced products are the major factors boosting the growth of the U.S. anti-snoring devices and snoring surgery market.

The COVID-19 pandemic had a major impact on the U.S. in every aspect, from healthcare to the economy, everything was severely affected. The pandemic led to a fall in sales of anti-snoring devices due to reduced patient visits to dentists. In addition, the lockdowns and restrictions on movement by the government severely disrupted the demand and supply chain which also contributed to a drop in sales of the devices during the pandemic.

Moreover, the pandemic also led to the postponement or cancellation of elective surgeries in order to avoid the spread of the virus. Many individuals also opted to willingly postpone their surgeries and avoid hospital visits, in order to avoid being infected with the virus. All these factors indicated that the pandemic had far-reaching effects on the industry. However, with the opening of economies and the world returning to normalcy, the market quickly gained traction and managed to recover at a very swift pace post-pandemic. Furthermore, with the launch of new products in the market, it is expected to grow exponentially over the forecast period as well.

Increasing prevalence of obesity is one of the major factors driving the demand for anti-snoring devices and snoring surgery devices. This is due to the increasing consumption of fast-food, and reduced physical activity which represents a growing shift towards a sedentary lifestyle among U.S. citizens. For instance, according to CDC, the U.S. obesity prevalence between the years 2019 to 2020 was 41.9%.

Obesity related problems include stroke, type 2 diabetes, heart disease, and certain types of cancer which are among the leading cause of premature preventable death. Additionally, the incidence of snoring and sleep apnea is also acute among individuals who are obese. In addition, the easy availability of these products in retail stores as well as through online sales is also a factor influencing the growth of the market. Moreover, the rise in the number of customers being inclined towards e-commerce and a wide variety of options on e-commerce sites is also helping the market to grow and will further accelerate over the forecast period.

Type Insights

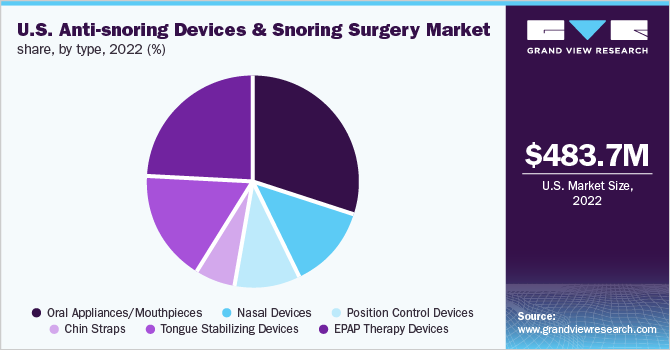

Based on type, oral appliances/mouthpieces dominated the market with the highest market share in 2022. This is due to the growing adoption of these products among dentists and patients as it is the first line of treatment recommended for the treatment of snoring. Moreover, the launch of new products in the market with technologically advanced features is also driving the segment growth and leading to higher adoption of these products compared to other anti-snoring devices.

EPAP therapy devices is the second leading segment in terms of revenue in 2022. One of the main factors driving the growth of this segment is the launch of new products and the manufacturers' efforts to increase their sales by entering into a distribution agreement with strong regional distributors. In addition, the EPAP therapy device has shown tremendous potential in treating patients with snoring issues and obstructive sleep apnea which represents great growth for this segment over the forecast period as well.

Key Companies & Market Share Insights

Key players in the U.S. anti-snoring devices and snoring surgery market are focusing on carrying out various strategic initiatives in order to secure a strong position in the market. Some of the key strategic initiatives carried out include acquisition & mergers, partnership & collaboration, new product launches, etc. For instance, in February 2021, Signifier Medical Technologies launched an innovative anti-snoring device, eXciteOSA, and the device works by producing electrical muscle stimulation through a mouthpiece around the tongue. Some prominent players in the U.S. anti-snoring devices and snoring surgery market include:

-

Ocular Therapeutix Inc.

-

SomnoMed Ltd.

-

Airway Management, Inc.

-

Resmed Inc.

-

Fisher & Paykel Healthcare Corp. Ltd.

-

Koninklijke Philips NV

-

Sleep Well Enjoy Life, Ltd.

-

Tomed Dr. Toussaint GmbH

-

MEDiTAS Ltd.

U.S. Anti-snoring Devices And Snoring Surgery Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 513.2 million

Revenue forecast in 2030

USD 802.9 million

Growth Rate

CAGR of 6.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type

Country scope

U.S.

Key companies profiled

Ocular Therapeutix Inc.; SomnoMed Ltd.; Airway Management, Inc.; Resmed Inc.; Fisher & Paykel Healthcare Corp. Ltd.; Koninklijke Philips NV; Sleep Well Enjoy Life, Ltd.; Tomed Dr. Toussaint GmbH; MEDiTAS Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Anti-snoring Devices and Snoring Surgery Market Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. anti-snoring devices and snoring surgery market report based on type.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral appliances/Mouthpieces

-

Nasal Devices

-

Position Control Devices

-

Chin Straps

-

Tongue Stabilizing Devices

-

EPAP Therapy Devices

-

Frequently Asked Questions About This Report

b. The U.S. anti-snoring devices and snoring surgery market size was estimated at USD 483.7 million in 2022 and is expected to reach USD 513.2 million in 2023

b. The U.S. anti-snoring devices and snoring surgery market is expected to grow at a compound annual growth rate of 6.5% from 2023 to 2030 to reach USD 802.9 million by 2030.

b. Oral appliances/mouthpieces dominated the U.S. anti-snoring devices and snoring surgery market with a share of 29.93% in 2022. This is attributable to the increasing product demand, availability of technologically advanced products and favorable reimbursement scenario.

b. Some key players operating in the U.S. anti-snoring devices and snoring surgery market include Ocular Therapeutix Inc., SomnoMed Ltd., Airway Management, Inc., Resmed Inc., Fisher & Paykel Healthcare Corp. Ltd., Koninklijke Philips NV, Sleep Well Enjoy Life, Ltd.,Tomed Dr.Toussaint GmbH, MEDiTAS Ltd.

b. Key factors that are driving the U.S. anti-snoring devices and snoring surgery market growth include rising prevalence of obesity, easy availability of products through offline and online channels in the U.S. and launch of technologically advanced products.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."