U.S. Atherectomy Devices Market Trends

U.S. atherectomy devices market size was valued at USD 671.3 million in 2023 and is projected to grow at a CAGR of 4.9% from 2024 to 2030. The driving factors can be attributed to the altered lifestyle, increased fast-food intake, geriatric population, and rising prevalence rate of peripheral artery disease (PAD) and atherosclerosis. According to the Cleveland Clinic data, in U.S., nearly 6.5 million people aged 40 and above have peripheral artery disease (PAD). Such incidences drive the market growth for its treatment.

The rising geriatric population can be primarily attributed to the growth of atherectomy devices in the U.S. market. According to the census result published in May 2023, the older population is estimated to be 55.8 million, representing 16.8% of the country’s population. The atherectomy procedure is carried out to treat peripheral artery disease occurring in older patients, which drives the market growth of atherectomy devices.

The rise in chronic diseases such as atherosclerosis and peripheral artery disease (PAD) is further driving the market growth. Atherosclerosis is caused by high cholesterol, obesity, and diabetes. According to the Centers for Disease Control and Prevention (CDC) report published in May 2024, approximately 25 million adults suffer from high cholesterol, leading to blockage in arteries. Such rising incidences are expected to drive the market to grow.

The rising prevalence of cardiovascular disease is driving the growth of the market. According to the Centers for Disease Control and Prevention (CDC) published report in May 2024, one in five deaths are caused by heart disease. The main cause of the rising heart disease is obesity. According to a study published by The President and Fellows of Harvard College (Harvard College), approximately 1 billion adults are projected to be obese by 2030. Such health concerns are expected to drive the market growth.

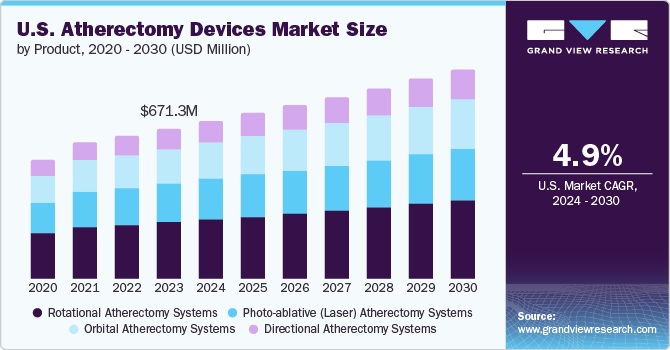

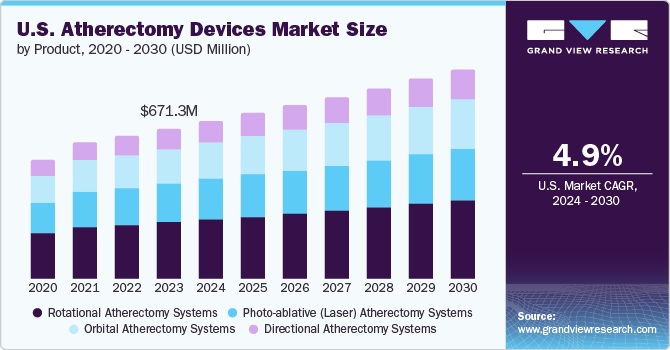

Product Insights

Directional atherectomy systems dominated the market and accounted for a share of 37.2% in 2023. The factors attributing to the segment’s growth are increased efficiency, minimal surgery, and low disease relapse. A study published in April 2023 estimated that nearly 14 million people are affected by peripheral artery disease, and the disease prevalence increases with age. Various companies are involved in technological innovations to discover advanced disease treatments. Companies such as Medtronic provide directional atherectomy systems such as HawkOne directional atherectomy system, TurboHawk Peripheral Plaque Excision System, and SilverHawk for health care professionals. Such involvement from companies is expected to drive market growth.

The photo-ablative (Laser) atherectomy systems segment is expected to register the fastest CAGR of 6.3% during the forecast period. The laser atherectomy is performed on patients who are unable to undergo angioplasty or stenting. Laser atherectomy is suggested for diabetic patients. The rising number of diabetic patients suffering from peripheral artery disease is expected to drive the segment growth. The Centers for Disease Control and Prevention (CDC) estimated that 38.4 million people, accounting for 11.6% of the U.S. population, were diagnosed with diabetes. According to the American Heart Association Inc., people with diabetes are at high risk of developing peripheral artery disease (PAD). To treat diabetic patients who are also suffering from PAD, a laser atherectomy is performed. Laser alternatives provide effective and safe treatment as it emits high-energy light to unblock the artery. Companies that provide photo-ablative (Laser) atherectomy systems such as Koninklijke Philips N.V., Abbott, and AngioDynamics, are expected to drive the market growth.

Application Insights

The peripheral vascular segment accounted for the largest market revenue share of 49.9% in 2023. The rising prevalence of peripheral vascular disease is driving the segment growth for the atherectomy devices market. The common cause of peripheral vascular disease is atherosclerosis, which is nothing but built-up of fats in the artery due to high cholesterol. According to the information published by the American Heart Association, Inc. in June 2021, the prevalence of PAD in the U.S. affects approximately 8.5 million adults in the country.

The neurovascular segment is expected to grow at the fastest CAGR over the forecast period, owing to the development of advanced treatment options and a strong regulatory framework. For instance, the U.S. Food and Drug Administration (FDA) has developed guidelines for manufacturing and commercializing medical devices to ensure safety. Manufacturers are required to submit form 510(k) to ensure the safety and effectiveness of these devices. Such progressions are expected to drive the growth of the market.

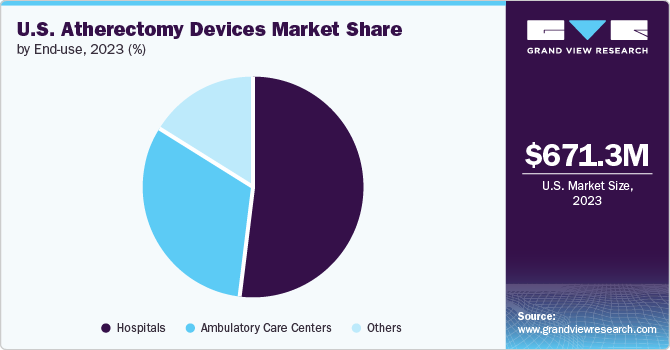

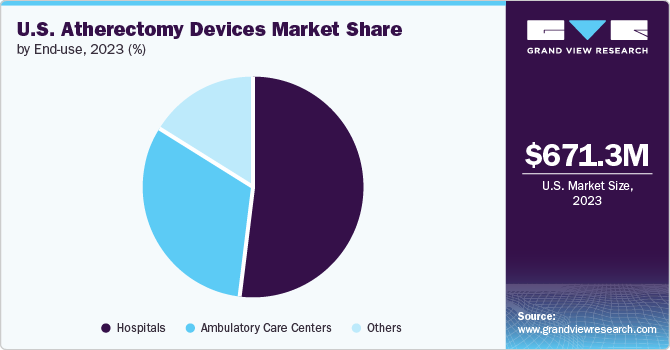

End Use Insights

The hospital segment accounted for the largest market revenue share of 52.2% in 2023. The growing incidences of chronic diseases such as diabetes, atherosclerosis, and peripheral artery diseases are driving the segment’s growth. The rising cases are driving increased adoption of atherectomy and the growing availability of health insurance to cover the atherectomy costs. For instance, American Endovascular & Amputation Prevention ensures insurance coverage for atherectomy procedures. Such instances are expected to drive the segment growth.

Ambulatory care centers are the second fastest-growing segment, significantly growing during the forecast period. The growing number of peripheral artery disease and atherosclerosis cases and the rising adoption of atherectomy procedures are driving the ambulatory care center’s segment growth. Ambulatory care is provided by health professionals in the outpatient settings. According to the National Library of Medicine report published in November 2022, the increasing treatment costs enabled the Centers for Medicaid & Medicare (CMS) to modify physician reimbursement by raising office-based procedure costs and providing incentives to treat peripheral artery disease as an out-patient. Such initiatives are expected to drive the segment’s growth.

Country Insights

The U.S. atherectomy devices market is expected to grow significantly over the forecast period. The rising prevalence of peripheral artery disease caused by factors such as diabetes, obesity, and high cholesterol among U.S. citizens is driving the atherectomy devices growth in the market. Various companies are involved in technological innovations to provide advanced solutions to treat peripheral artery disease, which leads to blocking the arteries. Atherectomy devices are used to unblock the arteries, such as Diamondback 360 Precision Orbital Atherectomy System (OAS), Rotarex S Rotational Excisional Atherectomy System, ROTAPRO rotational atherectomy system, Rotablator rotational atherectomy system, and Phoenix atherectomy system.

Key U.S. Atherectomy Devices Company Insights

Some key companies in the U.S. atherectomy devices market include Abbott, B. Braun SE, Boston Scientific Corporation, Terumo Corporation, and BD. Key companies are involved in strategic initiatives such as in innovating new products, collaborating with institutions and other industries, and establishing partnerships.

-

Abbott is a healthcare company offering innovative medical and health-related devices for cardiovascular health, diabetes, diagnostics, and chronic pain. Through its cardiovascular division, the company offers technological solutions for treating vascular diseases, irregular heartbeat. The company offers atherectomy solutions, such as Diamondback 360 precision orbital atherectomy system.

-

Boston Scientific Corporation is a biomedical and biotechnological company that manufactures invasive medical devices. The company offers a range of atherectomy products such as ROTOPRO, a rotational atherectomy, Jetstream Atherectomy System, and Rotablator Atherectomy System.

Key U.S. Atherectomy Devices Companies:

- Abbott

- B. Braun SE

- Boston Scientific Corporation

- BD

- AngioDynamics

- Biomerics

- Terumo Corporation

- Medtronic

- Koninklijke Philips N.V.

Recent Developments

-

Abbott acquired the medical device company Cardiovascular Systems, Inc. (CSI) in April 2023 to enhance its capabilities to treat patients with peripheral and coronary diseases.

-

Cardio Flow, Inc. received FDA approval for its FreedomFlow Orbital Atherectomy Peripheral Platform in October 2023.

U.S. Atherectomy Devices Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 704.6 million

|

|

Revenue forecast in 2030

|

USD 938.7 million

|

|

Growth Rate

|

CAGR of 4.9% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Revenue in USD million and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product, application, end use, region

|

|

Country scope

|

U.S.

|

|

Key companies profiled

|

Abbott, B. Braun SE, Boston Scientific Corporation, BD, AngioDynamics, Biomerics, Terumo Corporation, Medtronic, and Koninklijke Philips N.V.

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. Atherectomy Devices Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. atherectomy devices market report based on product, application, and end use.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Directional Atherectomy Systems

-

Orbital Atherectomy Systems

-

Photo-ablative (Laser) Atherectomy Systems

-

Rotational Atherectomy Systems

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Peripheral Vascular

-

Neurovascular

-

Cardiovascular

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Care Centers

-

Others