- Home

- »

- Medical Devices

- »

-

U.S. BDSM Sex Toys Market Size And Share Report, 2030GVR Report cover

![U.S. BDSM Sex Toys Market Size, Share & Trends Report]()

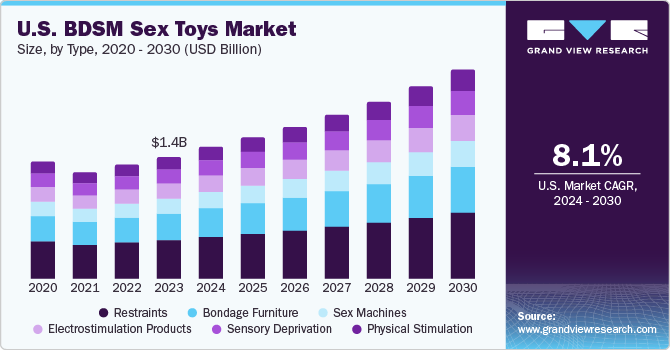

U.S. BDSM Sex Toys Market Size, Share & Trends Analysis Report By Type (Restraints, Bondage Furniture, Sex Machines, Electrostimulation Products, Sensory Deprivation, Physical Stimulation), By Distribution Channel, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-040-2

- Number of Report Pages: 68

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

U.S. BDSM Sex Toys Market Size & Trends

The U.S. BDSM sex toys market size was estimated at USD 1.4 billion in 2023 and is anticipated to grow a compound annual growth rate (CAGR) of 8.13 % from 2024 to 2030. Easy availability of customized bondage products and changing consumer attitudes toward BDSM activities owing to the influence of social media and the entertainment industry are among the factors expected to drive the growth.

COVID-19 pandemic positively impacted the adoption of BDSM products, including growing demand for customized whips and leather handcuffs. According to a study published by Love the Sales, around 83% rise was reported in searches for handcuffs and whips in April 2020 compared to April 2019.

Market Dynamics

The stigma associated with sexual activities & experimenting is reducing due to liberalization and growing acceptance of homosexuality. Sex-positive movements have helped clear stereotypes related to gender, age, and social construct of people. Companies operating in this market are launching various campaigns to raise awareness and break the stigma around sex toys by changing consumer perception. For instance, in August 2021, LoveHoney Group launched a TV advertisement to show lingerie and sex toys under the Love How You Love campaign.

Several studies have suggested that BDSM practices in the U.S. are highly prevalent, with around 50% to 75% of the sexually active population engaging in BDSM practices. The preference differs with the type of products and the prices of the products. According to the Ask Eva survey of October 2020 by Le Wand, around 61.5% of participants in the U.S. use restraint BDSM toys and about 89.4% of individuals are interested in using these products. This can be attributed to the rising consumer awareness regarding these products owing to the growing advertisement campaigns, launch of erotic books, and movies such as 50 Shades of Grey.

Innovative high-tech products have been in massive demand in the U.S., disrupting the traditional BDSM sex toys market. From manufacturers to consumers, everyone wants to harness the potential of technology to enhance sexual pleasure during intercourse. Moreover, customers are shifting toward technologically advanced sex machines from traditional penetrative or extractive sex toys. Hence, companies are launching customizable human-like robots or machines for sexual intercourse. According to a YouGov survey conducted in February 2020, around 22% of the U.S. population was interested in having sexual intercourse with a robot, accounting for a 6% rise in number from 2017.

Type Insights

Based on type, the U.S. BDSM sex toys market is segmented into restraints, bondage furniture, sensory deprivation, physical stimulation, electrostimulation, sex machine, and others. Restraints dominated in 2023 with the largest revenue share of 30.86% and is expected to witness the fastest CAGR from 2024 to 2030. This can be attributed to the increasing product demand from young adults & the LGBTQ+ community and easy product availability in online retail stores.

Factors such as lower cost of products and rising preference for BDSM sex toys among beginners are expected to drive the market growth from 2024 to 2030. Many companies are launching new products to cater to this growing customer pool of restrained BDSM products. For instance, in June 2018, Rihanna launched the Savage Xcessories line on the Savage X Fenty website, with around 11 products, such as fluffy satin restraints and fluffy handcuffs.

Sensory deprivation segment is expected to witness significant growth from 2024 to 2030. This can be attributed to the enhanced sexual intimacy and pleasure during sensory deprivation activities as it amplifies the other senses by restricting one sense. According to a survey of around 2,700 users by Simpatic.us, around 58% of women respondents were interested in being blindfolded during sexual intercourse.

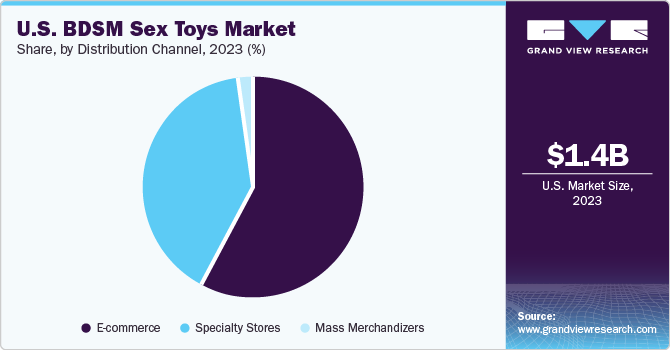

Distribution Channel Insights

Based on distribution channel, the market is divided into e-commerce, mass merchandizers, and specialty stores. E-commerce dominated with the largest revenue share of 58.47% in 2023. This segment is expected to witness the fastest CAGR during the forecast period, owing to the increasing number of customers preferring these channels over traditional options due to discrete delivery of products and customer anonymity.

Specialty stores held a significant revenue share in 2023. Decreasing social stigma regarding sex toys has boosted the appeal of adult toy stores in the U.S. The LGBTQ+ community and younger demographics are showing interest in exploring new sexual experiences, making them major target customers of specialty store owners. In addition, these stores often provide a unique customer experience while shopping, with expert recommendations and a diverse range of products from multiple brands.

Availability of BDSM sex toys has increased in recent years, with mass merchandizers in selling products such as blindfolds and restraints in sexual wellness aisles.

Key Companies & Market Share Insights

The market is highly fragmented with the presence of global and local manufacturers & distributors. These companies have a vast range of products in several categories, including restraints, sex machines, bondage furniture, gags, and muzzles. These products are designed keeping in mind the diverse consumer demands, with variations in each category. Industry players are adopting various strategies to stay competitive, including new product launches and sales & discounts. For instance, in January 2022, Pipedream Products started shipping Body Dock Universal Harness System and King Cock Elite Dual Density Silicone dildos from its distribution center in the Midwest.

Key U.S. BDSM Sex Toys Companies:

- Lovehoney Group Ltd.

- Doc Johnson Enterprises

- Unbound

- PHE, Inc. (Adam & Eve)

- California Exotic Novelties

- Pipedream Products

- Mr. S Leather

- The Stockroom (JTT, Co.)

- Extreme Restraints (XR LLC)

- Kink Store

U.S. BDSM Sex Toys Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.5 billion

Revenue forecast in 2030

USD 2.4 billion

Growth rate

CAGR of 8.13% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel

Country scope

U.S.

Key companies profiled

Lovehoney Group Ltd.; Doc Johnson Enterprises; Unbound; PHE, Inc. (Adam & Eve); California Exotic Novelties; Pipedream Products; Mr. S Leather; The Stockroom (JTT, Co.); Extreme Restraints (XR LLC); Kink Store

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. BDSM Sex Toys Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. BDSM sex toys market report based on type and distribution channel:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Restraints

-

Bondage Furniture

-

Sex Machines

-

Electrostimulation Products

-

Sensory Deprivation

-

Physical Stimulation

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

E-commerce

-

Specialty Stores

-

Mass Merchandizers

-

Frequently Asked Questions About This Report

b. The U.S. BDSM sex toys market size was estimated at USD 1.4 billion in 2023 and is expected to reach USD 1.5 billion in 2024.

b. The U.S. BDSM sex toys market is expected to grow at a compound annual growth rate of 8.13% from 2024 to 2030 to reach USD 2.4 billion by 2030.

b. Restraints dominated the U.S. BDSM sex toys market with a share of 30.9% in 2023. This is attributable to the increasing demand for products from young adults & the LGBTQ+ community and their easy availability in online retail stores in the U.S.

b. Some key players operating in the U.S. BDSM sex toys market include Lovehoney Group Ltd.; Doc Johnson Enterprises; Unbound; PHE, Inc. (Adam & Eve); California Exotic Novelties; Pipedream Products; Mr. S Leather; The Stockroom (JTT, Co.); Extreme Restraints (XR LLC); Kink Store

b. Key factors that are driving the U.S. BDSM sex toys market growth include the easy availability of customized bondage products and changing consumer attitudes toward BDSM activities owing to the influence of social media and the entertainment industry.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."