U.S. Beer And Cider Market Size & Trends

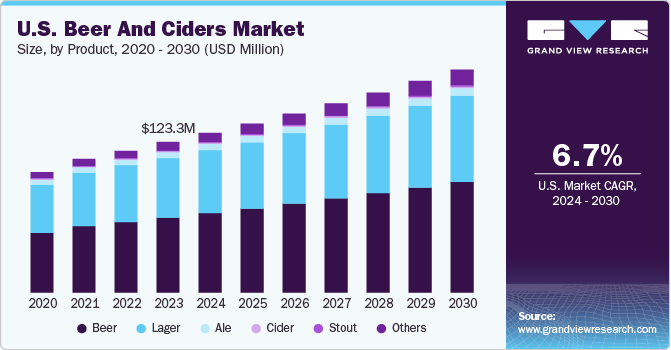

The U.S. beer and cider market was valued at USD 123.27 million in 2023 and is expected to grow at a CAGR of 6.7% from 2024 to 2030. Innovation in flavors and product varieties is driving the growth of beer and cider in the U.S. Brewers and cider makers are continuously experimenting with diverse ingredients to create unique and appealing flavors. This trend is driven by evolving consumer preferences for premium and artisanal beverages that offer distinctive taste experiences.

Craft breweries are at the forefront of this movement, producing small batches of experimental brews that showcase novel ingredients like exotic hops, fruits, spices, and even botanicals. The popularity of barrel-aged beer, sour beer, and experimental cider reflects a growing demand for complex and adventurous flavor profiles among consumers.

The growing popularity of beer across all states in the U.S. is drive the expansion of the U.S. beer and cider market. Overall, beer consumption in the U.S. among adults aged 21 and over averages approximately 28.2 gallons per person per year. This figure underscores the enduring popularity of beer as a favored alcoholic beverage across a diverse range of demographics and occasions.

The expansion of distribution channels, including online platforms and home delivery services, is making it easier for consumers to access a wide range of beers and ciders. This convenience factor is driving market growth, particularly in the post-pandemic era. Effective marketing and branding strategies are crucial in attracting and retaining customers. Engaging marketing campaigns, collaborations with celebrities and influencers, and targeted advertising are enhancing brand visibility and consumer loyalty.

Product Insights

The beer segment held the largest revenue in 2023. The U.S. beer market is significantly driven by the expanding customer preference for craft beer. Craft breweries have established a unique market niche by focusing on high-quality ingredients, inventive brewing methods, and unusual flavors. Craft beers, in contrast to mass-produced beers, are frequently brewed in smaller amounts, which gives brewers the freedom to experiment with a wide range of ingredients. In November 2023, Pinter officially launched in the U.S. market. Pinter offers a revolutionary way for beer enthusiasts to brew high-quality, fresh beer at home with ease and convenience. The system includes a sleek, user-friendly device and a variety of beer kits that allow users to craft a wide range of styles, from lagers and IPAs to stouts and ales. By combining cutting-edge brewing technology with high-quality ingredients, Pinter ensures that homebrewers can enjoy professional-grade beer with minimal effort. The launch in the U.S. taps into the growing trend of homebrewing and DIY experiences, appealing to a market eager for personalized and hands-on approaches to beer making.

The lager segment is expected to grow at the fastest CAGR over the forecast period. Major beer brands and large breweries primarily produce lagers, contributing to their significant presence in the market. These brands invest heavily in marketing and distribution, ensuring widespread availability and recognition of their lager products across the country.

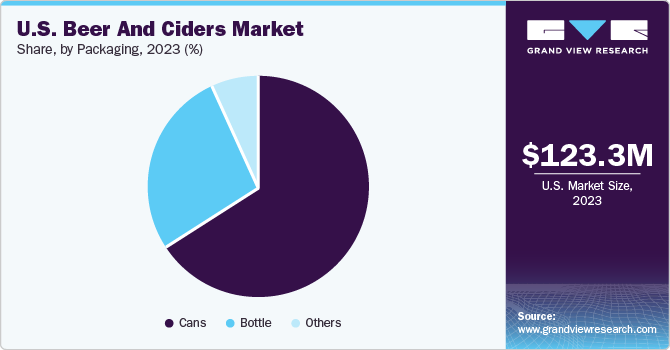

Packaging Insights

Cans held the largest revenue market share in 2023. Cans offer significant cost advantages in the production, transportation, and storage of beer and cider, contributing to their attractiveness in the market. From a production standpoint, cans are typically cheaper to manufacture than glass bottles due to lower material costs and simpler production processes. Their lighter weight reduces transportation costs, as more cans can be shipped for the same freight cost compared to glass bottles, which are heavier and more fragile, hence driving the growth of segment.

The bottle segment is expected to grow at the fastest CAGR over the forecast period. Bottles allow breweries and cideries to offer a wide range of product varieties and sizes, from single-serve bottles to larger format bottles suitable for sharing. This variety caters to different consumer preferences and occasions, enhancing market appeal.

Distribution Channel Insights

The on-trade distribution channel held the largest revenue share in 2023. On-trade venues play an important role in enhancing the overall drinking experience by providing consumers with opportunities to pair beer and cider with dining experiences and social gatherings. This culinary interaction encourages experimentation with different beer styles and flavors. The knowledgeable staff and bartenders often play a crucial role in guiding consumers through their choices, offering recommendations based on preferences and providing insights into the brewing process and beverage origins. On-trade venues serve as hubs for cultural exchange, education, and exploration of the diverse world of beers and ciders.

The online segment is expected to grow at the fastest CAGR over the forecast period. Online platforms offer convenience by allowing consumers to browse and purchase a wide selection of beers and ciders from the comfort of their homes. This accessibility appeals to busy consumers who prefer the convenience of doorstep delivery rather than visiting physical stores.

Key U.S. Beer And Cider Company Insights

Few of the major companies in the U.S. beer and cider market include Anheuser-Busch, InBev, Heineken, Carlsberg Breweries A/S and Molson Coors Beverage Company. The large companies involved in the market are active globally and have a significant market share in different countries. Ultimately, they have launched different beers depending upon the preferences in particular countries.

-

Heineken offers a diverse portfolio of beer products that cater to various consumer preferences and occasions. Heineken's flagship product, Heineken Lager Beer, is renowned for its distinctive flavor and premium quality, appealing to consumers seeking a classic European lager experience. In addition to its iconic lager, Heineken offers a range of other beer brands, including Amstel Light, Dos Equis, Newcastle Brown Ale, and Strongbow Hard Ciders.

-

Carlsberg Breweries A/S offers a range of products that cater to diverse consumer preferences. Its product lineup includes flagship brands such as Carlsberg Pilsner, a classic lager known for its balanced taste and quality ingredients.

Key U.S. Beer And Cider Companies:

- Anheuser-Busch InBev

- Heineken

- Carlsberg Breweries A/S

- Molson Coors Beverage Company

- Asahi Group Holdings, Ltd.

- Diageo

- Sierra Nevada Brewing Co.

- United Breweries Ltd.

- Oettinger Brauerei

- China Resources Beer (Holdings) Company Limited

Recent Developments

-

In March 2023. Heineken launched a new beer in the light lager category in the U.S. with low-carb and low-calorie ingredients, named Heineken Silver. It is produced considering the American market and contains 4 % of alcohol, 95 calories per 12-oz glass. The beer is launched with new aluminum cans in the U.S.

-

In January 2024, Asahi Europe & International (AEI) acquired Octopi Brewing, a Wisconsin-based contract beverage production and co-packing company. This acquisition is a significant milestone in Asahi's growth plan as it will enable the renowned Japanese beer to be brewed in the U.S. for the first time.

U.S. Beer And Cider Market Report Scope

|

Report Attribute

|

Details

|

|

Revenue forecast in 2030

|

USD 191.25 million

|

|

Growth Rate

|

CAGR of 6.7% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2020 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Revenue in USD million and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product, packaging, distribution channel

|

|

Country scope

|

U.S.

|

|

Key companies profiled

|

Anheuser-Busch InBev; Heineken; Carlsberg

Breweries A/S; Molson Coors Beverage Company;

Asahi Group Holdings; Ltd.; Diageo; Sierra Nevada Brewing Company; United Breweries Ltd.; Oettinger Brauerei; China Resources Beer (Holdings) Company Limited

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. Beer And Ciders Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2020 to 2030. For this study, Grand View Research has segmented the U.S. beer and cider market report based on product, packaging, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2020 - 2030)

-

Beer

-

Ale

-

Lager

-

Stout

-

Others

-

Cider

-

Packaging Outlook (Revenue, USD Million, 2020 - 2030)

-

Distribution Channel Outlook (Revenue, USD Million, 2020 - 2030)